seangabb

Published 12 Sept 2024Part seven in a series on Everyday Life in the Roman Empire, this lecture discusses demography and life chances during the Imperial period. Here is what it covers:

Introduction – 00:00:00

Our Statistical Civilisation – 00:00:24

Ancient “Statistics” – 00:08:05

How Many Roman Citizens? – 00:18:04

Population of the Empire – 00:21:36

City Populations – 00:27:45

Average Incomes – 00:36:27

Life Expectancy – 00:35:37

Country Life – 00:52:06

Population of Rome – 00:54:39

Feeding Rome – 00:57:40

Roman Water Supply – 01:00:44

Bathing and Sanitation – 01:04:16

Hygienic Value – 01:04:16

Bibliography – 01:06:17

(more…)

March 20, 2025

Everyday Life in the Roman Empire – Demography, Income, Life Expectancy

February 21, 2025

QotD: Why does it cost so much to build modern infrastructure?

Now, obviously, there are reasons why building infrastructure is expensive. One is that politicians have taken unto themselves the power to decide what infrastructure should be built how and where. Therefore infrastructure is built by fuckwits, obvious, innit? We’ve also allowed far too many people to dip their ladle in the gravy — that £300 million planning inquiry into a tunnel under the Thames. And did I say fuckwits already — that £100 million bat tunnel.

But one reason all these things are so expensive is because we’re not doing them on terra nullius. If we start with a bare field a ground source heat pump might well not be that bad an idea. Communal heating systems into an entirely new development, maybe.

But putting ground heat pumps into central London? Can’t do that ‘ere mate, someone’s already built central London right where you want to dig up. HS2 goes right through some of the most expensive — and inhabited by the highly vocal — countryside in the nation. Edinburgh, minor though it is, still has that central London problem.

This also explains why Mercury Comms employed the ferrets. The tubes already existed and fibreoptic could be stuffed down them. They didn’t have to dig up central London, see?

Agreed, this isn’t one of the world’s truly great insights but it is something to keep in mind. The reason building the infrastructure for the next level of civilisation costs so much is because we already have a civilisation. The existence of which gets in the way of the building men …

Tim Worstall, “Why Is Infrastructure So Damn F’n Expensive?”, It’s all obvious or trivial except …, 2024-11-18.

February 13, 2025

From Ruins to Recovery: The Fight to Rebuild – W2W 004

TimeGhost History

Published 12 Feb 2025In 1946, the world is struggling to rebuild from the devastation of WWII. Cities lie in ruins, economies are shattered, and millions are displaced. As the old powers of Britain and France weaken, the rising superpowers — the U.S. and USSR — compete to shape the new world order. Will reconstruction lead to stability, or is the world heading for another conflict?

(more…)

January 31, 2025

I Spent Over 12 Hours on an Amtrak Train (on purpose)

Not Just Bikes

Published 6 Oct 2024Chapters

0:00 Intro

1:24 Leaving New York

3:04 On the train

4:03 The views

4:38 Freight trains & delays

5:37 The train is so much more comfortable

7:09 The border crossing

8:17 The Canadian side

9:24 Should you take this train?

10:20 Comparisons to Europe & Japan

11:20 We need more high-speed rail

12:02 VIA Rail is bad … and getting worse

12:58 VIA Rail is expensive!

14:11 The new VIA Rail baggage policy

15:49 Better train service is important!

17:14 Concluding thoughts

(more…)

January 26, 2025

QotD: The map is not the territory, state bureaucrat style

… most bureaucrats aren’t evil, just ignorant … and as Scott shows, this ignorance isn’t really their fault. They don’t know what they don’t know, because they can’t know. Very few bureaucratic cock-ups are as blatant as Chandigarh, where all anyone has to do is look at pictures for five minutes to conclude “you couldn’t pay me enough to move there”. For instance, here’s the cover of Scott’s book:

That’s part of the state highway system in North Dakota or someplace, and though again my recall is fuzzy, the reason for this is something like: The planners back in Bismarck (or wherever) decreed that the roads should follow county lines … which, on a map, are perfectly flat. In reality, of course, the earth is a globe, which means that in order to comply with the law, the engineers had to put in those huge zigzags every couple of miles.

No evil schemes, just bureaucrats not mentally converting 2D to 3D, and if it happens to cost a shitload more and cause a whole bunch of other inconvenience to the taxpayers, well, these things happen … and besides, by the time the bureaucrat who wrote the regulation finds out about it — which, of course, he never will, but let’s suppose — he has long since moved on to a different part of the bureaucracy. He couldn’t fix it if he wanted to … which he doesn’t, because who wants to admit to that obvious (and costly!) a fuckup?

Add to this the fact that most bureaucrats have been bureaucrats all their lives — indeed, the whole “educational” system we have in place is designed explicitly to produce spreadsheet boys and powerpoint girls, kids who do nothing else, because they know nothing else. Oh, I’m sure the spreadsheet boys and powerpoint girls know, as a factual matter, that the earth is round — we haven’t yet declared it rayciss to know it. But they only “know” it as choice B on the standardized test. It means nothing to them in practical terms, so it would never occur to them that the map they’re looking at is an oversimplification — a necessary one, no doubt, but not real. As the Zen masters used to say, the finger pointing at the moon is not, itself, the moon.

Severian, “The Finger is Not the Moon”, Rotten Chestnuts, 2021-09-14.

January 18, 2025

Is the World Really Running Out of Sand?

Practical Engineering

Published 1 Oct 2024Sand: a treatise …

There’s a lot changing in the construction industry, and a lot of growth in the need for materials like sand and gravel. But I don’t think it’s fair to say the world is running out of those materials. We’re just more aware of all the costs involved in procuring them, and hopefully taking more account for how they affect our future and the environment.

(more…)

October 9, 2024

Dangling the old “high speed rail between Toronto and Montreal” proposal again

In what seems like an annual ritual, the attractive-to-many (but economically non-viable) idea of putting in a high speed rail line between Toronto and Montreal is getting another airing:

The closest active model to the proposed VIA “High Frequency Rail” proposal is the Brightline service in Florida.

“BrightLine – The Return of FEC passenger service” by BBT609 is licensed under CC BY 2.0

In 2021, the Government of Canada confirmed its plans to significantly upgrade VIA Rail’s passenger rail service between the Windsor and Quebec City corridor into a high-frequency rail service.

As the name suggests, this new high-frequency rail service would offer significantly higher frequencies and reduce travel times on the route linking Toronto, Ottawa, and Montreal by 25 per cent.

With dedicated passenger rail tracks separate from freight operations, which greatly contribute to current service delays, this new train service would more consistently operate at increased speeds of up to 177 km/h to 200 km/h, and reliability would improve to an on-time performance by over 95 per cent.

This is quite true … the existing rail network between Toronto, Montreal and Ottawa was designed and built to carry freight traffic first and passengers only as a secondary goal — in many cases to attract government subsidies for the construction of the lines. Passenger services are, at best, marginally profitable but generally passenger service is a dead loss for the railways and only maintained thanks to ongoing government subsidies, grants, and tax breaks.

Freight trains — the profitable part of the railway network — have gotten longer and heavier over time as technology has improved (and train crews have gotten smaller, reducing labour costs) and the signal systems are optimized for freight traffic: long, slow-moving trains that take a lot of time and energy to speed up and slow down. Passenger trains travel faster (well, theoretically anyway) and make frequent stops to pick up and drop off passengers … signalling systems (which are critical to safe operations) need to be designed to optimize the usage pattern of the majority of the trains which in practice means freight with some modifications in high-population areas to accommodate passenger traffic.

This high-frequency rail service would use VIA Rail’s new and growing fleet of modern Siemens Venture trains operating on the Windsor-Quebec City corridor.

But as it turns out, the federal government is also contemplating a new service that is even better than high-frequency rail — the potential for a high-speed rail service, which would be the first of its kind in Canada.

Currently, the federal government is engaged in the Request For Proposal (RFP) process for the project. In July 2023, it shortlisted three private consortiums to participate in the RFP’s detailed bidding process, attracting international interest from major investors and some of the world’s largest passenger rail service operators.

This includes the consortium named Cadence, entailing CDPQ Infrastructure, AtkinsRealis (formerly known as SNC-Lavalin), Systra Canada, Keolis Canada, SNCF Voyageurs, and national flag carrier Air Canada.

The inclusion of Air Canada in the consortium is … interesting … as one of the goals of an actual high speed system would be to drain off a proportion of the short-haul passenger traffic that currently goes by air. A cynic might wonder if Air Canada’s interest in the project is to help or hinder.

According to a report in Toronto Star last week, each of the three consortiums was directed to create two detailed proposals, including one concept with trains that travel under 200 km/h and another concept with trains that travel faster than 200 km/h.

High-speed rail is generally defined as a train service that operates at speeds of at least 200 km/h.

It was further stated in the report that the new service could result in travel times of only three hours between Toronto and Montreal, as opposed to the current travel times of over five hours on existing VIA Rail services.

For further comparison, the travel time between Toronto and Montreal on flight services such as Air Canada is about 1.5 hours, which does not include the time spent at airports, while the driving time over this distance of over 1,000 km is about 5.5 hours — similar to VIA Rail’s existing services.

The potential holds for VIA Rail’s new service to operate at speeds over 200 km/h along select segments of the corridor.

The required costs to implement 200km/h speeds will be in eliminating as many grade crossings as possible and reconstructing some tight curves to allow the higher speed trains … and, as mentioned earlier, retrofitting the signal system for the faster passenger trains. Even those measures, which don’t really produce a true “high speed” system will be very expensive.

October 4, 2024

You know the jig is up for “renewables” when even Silicon Valley techbros turn against it

JoNova on the remarkably quick change of opinion among the big tech companies on the whole renewable energy question:

Google, Oracle, Microsoft were all raving fans of renewable energy, but all of them have given up trying to reach “net zero” with wind and solar power. In the rush to feed the baby AI gargoyle, instead of lining the streets with wind turbines and battery packs, they’re all suddenly buying, building and talking about nuclear power. For some reason, when running $100 billion dollar data centres, no one seems to want to use random electricity and turn them on and off when the wind stops. Probably because without electricity AI is a dumb rock.

In a sense, AI is a form of energy. The guy with the biggest gigawatts has a head start, and the guy with unreliable generators isn’t in the race.

It’s all turned on a dime. It was only in May that Microsoft was making the “biggest ever renewable energy agreement” in order to power AI and be carbon neutral. Ten minutes later and it’s resurrecting the old Three Mile Island nuclear plant. Lucky Americans don’t blow up their old power plants.

Oracle is building the world’s largest datacentre and wants to power it with three small modular reactors. Amazon Web Services has bought a data centre next to a nuclear plant, and is running job ads for a nuclear engineer. Recently, Alphabet CEO Sundar Pichai, spoke about small modular reactors. The chief of Open AI also happens to chair the boards of two nuclear start-ups.

October 1, 2024

Devastation in the Carolinas

My oldest friend moved to the United States many years ago, moving around the country as his job dictated, but a few years back he and his wife found their perfect house near Asheville, NC. We had emailed to see how they were doing, but got no answer. Yesterday, I got a call from my friend’s cell phone to say that he and his wife were fine and they’d taken in an elderly neighbour until things get back to normal, but they currently don’t have electricity, land line telephone, or municipal water, but they’re otherwise fine. Their house is well above flood level, and he has sufficient camping supplies to keep them going for a while. He loaned his chainsaw to another neighbour who was trying to organize work parties to cut away fallen trees and branches and get more of the local roads open again (my friend recently had lyme disease and doesn’t want to trust his hands doing something as risky as running a chainsaw). We kept the call as short as possible, as he’ll have to manually recharge his phone until power is restored.

Virginia Postrel is originally from that same area of western North Carolina and northwestern South Carolina and reports on how her family in the area is doing in the aftermath of Hurricane Helene:

One of the many examples of the “horizontal forest” on nearly every road in Greenville, SC.

Photo by Virginia’s brother Sam M. Inman IV.

If you read my autobiographical reminiscences, you may have realized that I have family in Upstate South Carolina and western North Carolina, which have been hit hard by the unexpected ferocity of Hurricane Helene. Power has been out in Greenville, SC, for days and roads are nearly impassable because of downed trees on nearly every block.

My brother Sam, who went out in a truck on Friday to buy gasoline for his generator, said only about half the stations that had working pumps and were running out of gas quickly. “Lines of cars around the block … reminiscent of the 1970s”, he texted. He went out again today and found a stark difference between local QuikTrip stations and others. At QT, the lines were longer but flowed faster because stations had closed all but a single entrance and exit. Elsewhere, stations were chaotic traffic jams. At one point, he found himself unable to exit after fueling up because the cars behind and in front of him left no to maneuver room. (He persuaded the one behind him to ease away from his bumper.)

The assisted living place where my mother lives has a generator and at first continued to operate its kitchen and elevators. By today, however, the generator had become unreliable, the lights were flickering, few employees could get to work, and the kitchen was offering dry Cheerios for breakfast. Sam brought our mom to his house, which has no power. He later realized that he needed to return to get her medicine, which usually is delivered daily. I can only imagine how residents who don’t have local family — or who are in the memory care wing! — are managing.

Even people who were prepared with generators, many bought after a blizzard 20 years ago, needed gasoline to power them and, they soon realized, adapters to connect them to household appliances. The adapter aisle at Home Depot was quickly depleted.

The good news is that food is available. Grocery stores are operating more or less as normal, assuming you can get to them. When you sell frozen food, you apparently install large, reliable generators.

Meanwhile, my cousin in Asheville finally got weak cell signal back today. We’d been unable to communicate with her before now. With her husband, pets, and 95-year-old mother, she’s evacuating to Winston-Salem through the weekend, hoping Duke Power will live up to promises that power will be restored by Friday but preparing in case it takes a few days longer.

Although terrible in some areas, the flooding isn’t as bad as it might be, thanks to the region’s many man-made lakes. They absorbed water that otherwise would have flowed into populated towns.

September 29, 2024

The “Foundations” essay could apply equally to Canada’s doldrums as it does to Britain

Earlier this week, I linked to the “Foundations” essay by Ben Southwood, Samuel Hughes, and Sam Bowman and it struck me that so much of what they discuss about Britain’s stagnation applied at least as well to Canada. In the National Post, John Ivison concurs:

The “Foundations” essay pointed to moribund GDP per capita growth, among other data points, to make the argument that Britain is standing still economically. (Britain’s economy grew 0.7 per cent a year between 2002 and 2022, Canada’s increased 0.6 per cent a year in the same period, while U.S. output swelled 1.16 per cent a year.)

In relative terms, both countries are getting poorer: in 2002, Canada’s GDP per person was 81 per cent of the U.S.; in 2022, it was 72 per cent. The same figures for the U.K. against the U.S. are 78 per cent in 2002 and, 70 per cent in 2022.

The reason for Britain’s stagnation, the authors argue, is that it has effectively banned investment in transportation, energy and housing — “the foundations it needs to grow.”

Sound familiar?

“The most important economic fact about modern Britain is that it is difficult to build almost anything, anywhere. This prevents investment, increases energy costs and makes it harder for productive economic clusters to expand,” the authors write, saying the result is lower productivity, incomes and tax revenues.

They argued that Britain needs a program of reform with the scale and ambition of the liberalization of the 1980s that focused on cutting taxes, curbing union power and privatizing state-run industries.

“This time we must focus on making it easier to invest in homes, labs, railways, roads, bridges, interconnectors and nuclear reactors,” they write.

That’s a difficult proposition for politicians who are able to resist anything except the temptation to use resources for immediate electoral gratification, rather than investing for a time after they have left office.

Both Canada and Britain are laggards when it comes to investment in infrastructure. While China spent more than five per cent of its GDP on roads, bridges and other infrastructure in 2021, Canada invested just 0.5 per cent (down from 1.3 per cent in 2010) and the U.K. 0.9 per cent.

But the lack of dynamism is not simply political expediency. Rather, it is motivated by an indifference, even a hostility, toward building critical infrastructure.

The Foundations report noted that Britain has not built a reservoir for 30 years, yet faces chronic water shortages in the east of England. Its environmental agency has blocked new development on the basis that it could only be supplied with water by draining environmentally valuable chalk streams. The result is that England’s innovation hub, Cambridge, is barred from expanding, which threatens to strangle the country’s life-sciences industry.

Similar impulses are at work in Canada. Federal Environment Minister Steven Guilbeault said in February that Ottawa would stop investing in new road infrastructure — a position he later clarified to say meant the federal government would not fund large projects like a highway tunnel connecting Quebec City and Levis, Que.

That same sentiment is reflected in the federal Liberal government’s Impact Assessment Act, passed in 2019, which slowed the pace and increased the cost of major project approvals.

On the housing front, a generation of activists emerged who were intent on preventing urban sprawl yet were also opposed to building mid-rise buildings of the kind that eased housing pressures in continental Europe. Constraints on approval are a major contributor to the 3.5-million-unit housing gap because supply has not kept pace with demand.

The consequence of Canada’s regulatory sclerosis is what business veteran Paul Deegan and former clerk of the Privy Council Kevin Lynch in an FP Comment article earlier this year referred to as “an insidious stealth tax on Canadian jobs and growth“.

Taking each of the “foundations” in turn, the depth of the problem becomes clearer — but so do the solutions.

September 24, 2024

British stagnation – “at some point it becomes impossible to grow when investment is banned”

Ed West reviews a new essay by Ben Southwood, Samuel Hughes, and Sam Bowman which tries to identify the underlying reasons for British economic stagnation:

The theme running through the essay is that the British system makes it very hard to invest and extremely expensive and legally difficult to build, making housing and energy costs prohibitive.

While we all know we have fallen in status, “most popular explanations for this are misguided. The Labour manifesto blamed slow British growth on a lack of “strategy” from the Government, by which it means not enough targeted investment winner picking, and too much inequality. Some economists say that the UK’s economic model of private capital ownership is flawed, and that limits on state capital expenditure are the fundamental problem. They also point to more state spending as the solution, but ignore that this investment would face the same barriers and high costs that existing infrastructure projects face, and that deters private investment.”

The problem is that “all of these explanations take the biggest obstacles to growth for granted: at some point it becomes impossible to grow when investment is banned”.

Even before the Russian invasion of Ukraine, the industrial price of energy had tripled in under 20 years. Per capita electricity generation in Britain is only two-thirds that of France, and a third of the US, making us closer to developing countries like Brazil and South Africa than other G7 states. Transport projects are absurdly expensive, mired by planning rules, and all of this helps explain why annual real wages for the median full-time worker are 6.9 per cent lower than in 2008.

In one of the most notorious examples, the authors note that “the planning documentation for the Lower Thames Crossing, a proposed tunnel under the Thames connecting Kent and Essex, runs to 360,000 pages, and the application process alone has cost £297 million. That is more than twice as much as it cost in Norway to actually build the longest road tunnel in the world.”

Britain’s political elites have failed, they argue, because they do not understand the problems, so “they tinker ineffectually, mesmerised by the uncomprehended disaster rising up before them”.

Even “before the pandemic, Americans were 34 percent richer than us in terms of GDP per capita adjusted for purchasing power, and 17 percent more productive per hour … The gap has only widened since then: productivity growth between 2019 and 2023 was 7.6 percent in the United States, and 1.5 percent in Britain … the French and Germans are 15 percent and 18 percent more productive than us respectively.” The gap continues to widen, and on current trends, Poland will be richer than the United Kingdom by the end of the decade.

Britain began to fall behind after the War, but after decades of relative stagnation, its GDP per capita had converged with the US, Germany and France in the 1980s, and our relative wealth peaked in the early Blair years. (Personally, I wonder if one reason for the great Oasis nostalgia is simply that we were rich back then.) If Britain had continued growing in line with its 1979-2008 trends, average income today would be £41,800 instead of £33,500 — a huge difference.

France is the most natural comparison point to Britain, a country “notoriously heavily regulated and dominated by labour unions”. This is sometimes comical to British sensibilities, so that “French workers have been known to strike by kidnapping their chief executives – a practice that the public there reportedly supports – and strikes are so common that French unions have designed special barbecues that fit in tram tracks so they can grill sausages while they march.” Only in France.

It is also heavily taxed, especially in the realm of employment, and yet despite this, French workers are significantly more productive. The reason is that France “does a good job building the things that Britain blocks: housing, infrastructure and energy supply”.

With a slightly smaller population, France has 37 million homes compared to our 30 million. “Those homes are newer, and are more concentrated in the places people want to live: its prosperous cities and holiday regions. The overall geographic extent of Paris’s metropolitan area roughly tripled between 1945 and today, whereas London’s has grown only a few percent.” One quality-of-life indicator is that “800,000 British families have second homes compared to 3.4 million French families“.

They also do transport far better, with 29 tram networks compared to seven in Britain, and six underground metro systems against our three. “Since 1980, France has opened 1,740 miles of high speed rail, compared to just 67 miles in Britain. France has nearly 12,000 kilometres of motorways versus around 4,000 kilometres here … In the last 25 years alone, the French built more miles of motorway than the entire UK motorway network. They are even allowed to drive around 10 miles per hour faster on them.”

August 23, 2024

August 9, 2024

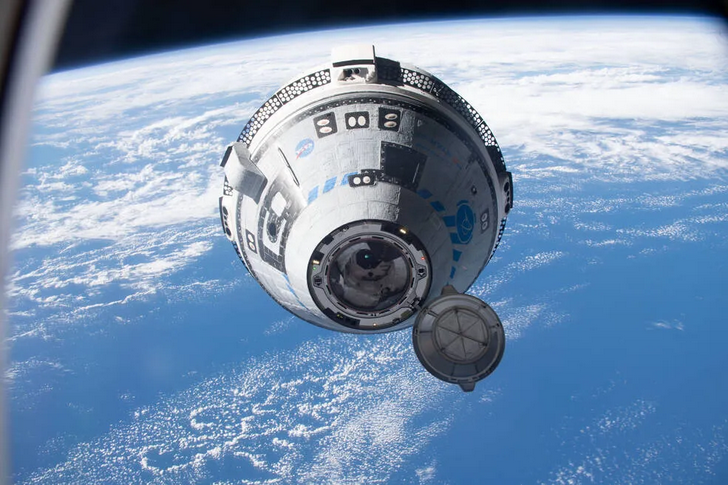

A crisis of competence

Glenn “Instapundit” Reynolds on one of the biggest yet least recognized issues of most modern nations — our overall declining institutional competence:

Almost everywhere you look, we are in a crisis of institutional competence.

The Secret Service, whose failures in securing Trump’s Butler, PA speech are legendary and frankly hard to believe at this point, is one example. (Nor is the Butler event the Secret Service’s first embarrassment.)

The Navy, whose ships keep colliding and catching fire.

Major software vendor Crowdstrike, whose botched update shut down major computer systems around the world.

The United States government, which built entire floating harbors to support the D-Day invasion in Europe, but couldn’t build a workable floating pier in Gaza.

And of course, Boeing, whose Starliner spacecraft is stuck, apparently indefinitely, at the International Space Station. (Its crew’s six-day mission, now extended perhaps into 2025, is giving off real Gilligan’s Island energy.) At present, Starliner is clogging up a necessary docking point at the ISS, and they can’t even send Starliner back to Earth on its own because it lacks the necessary software to operate unmanned – even though an earlier build of Starliner did just that.

Then there are all the problems with Boeing’s airliners, literally too numerous to list here.

Roads and bridges take forever to be built or repaired, new airports are nearly unknown, and the Covid response was extraordinary for its combination of arrogant self-assurance and evident ineptitude.

These are not the only examples, of course, and readers can no doubt provide more (feel free to do so in the comments) but the question is, Why? Why are our institutions suffering from such widespread incompetence? Americans used to be known for “know how,” for a “can-do spirit”, for “Yankee ingenuity” and the like. Now? Not so much.

Americans in the old days were hardly perfect, of course. Once the Transcontinental Railroad was finished and the golden spike driven in Promontory, Utah, large parts of it had to be reconstructed for poor grading, defective track, etc. Transport planes full of American paratroopers were shot down during the invasion of Sicily by American ships, whose gunners somehow confused them for German bombers. But those were failures along the way to big successes, which is not so much the case today.

But if our ancestors mostly did better, it’s probably because they operated closer to the bone. One characteristic of most of our recent failures is that nobody gets fired. (Secret Service Director Kim Cheatle did resign, eventually, but nobody fired her, and I think heads should have rolled on down the line).

May 31, 2024

How To Install a Pipeline Under a Railroad

Practical Engineering

Published Feb 20, 2024I’m on location to document the installation of a water transmission line below two railroad tracks.

Huge thanks to our project partners!

Owner: Crystal Clear Special Utility District

General Contractor: ACP

(more…)

April 26, 2024

Economic inefficiencies in the water market? Don’t worry, here’s the government to make it much worse

Tim Worstall discusses the economics of water markets in the US … that Senator Elizabeth Warren and Representative Ro Khanna seem determined to make far less efficient if their plans come to fruition:

Senator Elizabeth Warren speaking at the Iowa Democrats Hall of Fame Celebration in Cedar Rapids, Iowa, on 9 June, 2019.

Photo by Lorie Shaull via Wikimedia Commons.

Aficionados for truly stupid political interventions into matters economic will already be aware of the idiocies perpetrated by Senator Elizabeth Warren and Representative Ro Khanna. The two seem to end up as if someone rolled together the ideas of Professor Richard J Murphy and The Guardian opinion page then removed all the insight, subtlety and sensibility. True, not an arduous task removing those three but …

The basic water problem out in the Western US is that the wrong people currently own the water rights. We would therefore like to see more trade in those rights. Warren and Khanna are insisting upon further limitations upon the trade in those rights. This is rampant idiocy.

To set the scene, as folk moved out there they realised that water was not one of those things in great surplus in the area. So, those who got there first made sure that the property rights to the water were assigned to them. Nothing odd about this and rights to a scarce resource do need to be allocated. Otherwise we just end up with the commons problem and the resource is exhausted.

OK. And, y’know, quite a lot of things have changed in the century, century and a half since that Wild West was properly populated. But the descendants of those original farmers still own near all the water rights. Hmm, bit of a problem.

That’s OK, we’ve Coase to advise us here:

Ronald Coase (1960), “The Problem of Social Cost”

In the absence of transaction costs, if property rights are well-defined and tradable, voluntary negotiations will lead to efficiency.

It doesn’t matter how rights are allocated initially …

… because if they’re allocated inefficiently at first, they can always be sold/traded …

so the allocation will end up efficient anyway

Now, the distribution — who gets the cash from all of that — is dependent upon that first distribution. But that’s a minor problem compared to the efficient use of water.

So, we want lots of buying and selling. The idiots using $300 of irrigation water to grow $100 worth of alfalfa (pretty much my first English-world piece was on exactly this subject, near 30 years back) can instead sell that same acre-foot to a city, where the two households will happily each pay $500 a year for the half an acre-foot they require.

The asset — the water — has moved from a lower valued (actually, value destructive) use to a higher, the world is richer in aggregate. It doesn’t matter that the farmers get the money because Grandpappy shot all the Injuns. Even without the who gets the money we’re all richer — we’re getting $1k not $100 from the same acre-foot of water.

Coolio!

Enter Warren and Khanna:

With private investors poised to profit from water scarcity in the west, US senator Elizabeth Warren and representative Ro Khanna are pursuing a bill to prohibit the trading of water as a commodity.

Idiots. Damn fools. Politicians, but I repeat myself triply.

Now, do note they’re not trying to insist that water cannot be bought and sold — not because they don’t want to, they do, but because as Federal politicians they’ve no power whatever over within state markets. However, as Federal politicians they can claim power over commodity markets — the speculators will come from around the country, over state lines and interstate commerce is Federal.

So, as with onion futures, they want to ban water futures.