Lawrence W. Reed discusses the life and career of Publius Rutilius Rufus, Roman consul and historian, who suffered the revenge of corrupt tax farmers (publicani) after attempting to protect taxpayers from extortion in the province of Asia:

In the last decades of the Roman Republic, as its liberties crumbled and the dictatorship of the subsequent Empire loomed, honesty decayed with each successive generation—an omen we should think long and hard about today. Among the lessons of the Roman experience is this: Liberty is ultimately incompatible with widespread indifference to truth. A society of liars succumbs to the tyrant who brings “order” to its chaos and corruption.

In a book I strongly recommend, The Lives of the Stoics: The Art of Living from Zeno to Marcus Aurelius, authors Ryan Holiday and Stephen Hanselman tell us about a man named Publius Rutilius Rufus (158 B.C.-78 B.C.). They regard him as “the last honest man” of the dying Republic. Though that description surely contains ample hyperbole to emphasize a point, Rufus’s exceptional honesty was indeed notable in his day because it was no longer the rule in a decadent age. As Mark Twain would note many centuries later, “an honest man in politics shines more than he would elsewhere”.

Rufus, the great-uncle of Julius Caesar (his sister Rutilia was Caesar’s maternal grandmother), built an illustrious career in the Roman military. Those under his command were known as “the best trained, the most disciplined, and the bravest” of the legions. He garnered enormous respect because of his Stoic virtues — courage, temperance, wisdom, and justice. In 105 B.C., he served in the highest political post in the Republic, the consulship. He was incorruptible, which meant he was a target of those who weren’t.

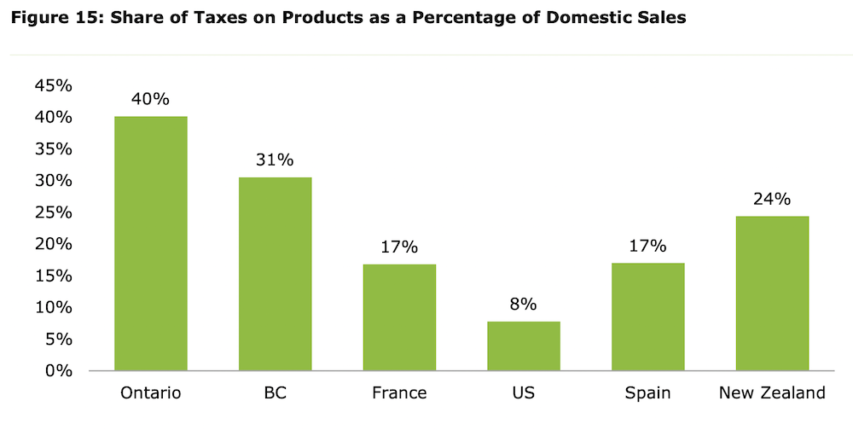

It had become a common practice in the late Republic for the government to hire private contractors to collect taxes. These “publicani” often extorted more from their victims than the taxes required because that’s the way the contracts were written. The government didn’t care what the publicani kept for themselves if it got its expected revenues. When Rufus attempted to stop the injustices this arrangement created, the publicani and their allies in the Roman Senate fought back. They arranged a sham trial with a pre-ordained verdict and charged Rufus with the very thing of which they themselves were guilty: extortion and corruption.

Historian Tom Holland in Rubicon: The Last Years of the Roman Republic writes that Rufus’s conviction was “the most notorious scandal in Roman legal history” and “an object lesson in how dangerous it could be to uphold ancient values against the predatory greed of corrupt officials”. With utterly no evidence and all credible testimony to the contrary, the accusers claimed Rufus had extorted money from Smyrna in the Roman province of Asia (what is now western Turkey).

Another historian, Mike Duncan, notes, “The charges were ludicrous as Rutilius [Rufus] was a model of probity and would later be cited by Cicero as the perfect model of a Roman administrator”.

As punishment for his trumped-up offense, Rufus was sent into exile but in deference to his past service, the court gave him the option of choosing where that would be. He chose Smyrna, the place he was charged with victimizing. When he arrived there, he was celebrated as the man who had tried to end the very practices of which he was wrongly convicted. Ryan Holiday and Stephen Hanselman describe what happened to Rufus as “a very old trick”:

Accuse the honest man of precisely the opposite of what they’re doing, of the sin you yourself are doing. Use their reputation against them. Muddy the waters. Stain them with lies. Run them out of town by holding them to a standard that if equally applied would mean the corrupt but entrenched interests would never survive … Smyrna, grateful for the reforms and scrupulous honesty of the man who had once governed them, welcomed [Rufus] with open arms … Cicero would visit there in 78 B.C. and call him “a pattern of virtue, of old-time honor, and of wisdom”.