You may be feeling the pinch from Bidenflation, election year stresses, and political lawfare, but at least you’re not up in America’s hat:

It’s late February, a time of year when many Americans contemplate stacks of documents and receipts, dreading the moment when they’ll have to square accounts with government extortionists. That this comes as the state grows increasingly intrusive and coercive adds insult to injury, since we pay the bill for this mistreatment. But it could be worse; we could be Canadian!

Same Inquisition, Different Dollar

“As tax season ramps into high gear in Canada, the average citizen is facing an unholy ream of paperwork so daunting that even the Canada Revenue Agency isn’t entirely sure how it all works,” Tristin Hopper wrote this week for the National Post. “An infamous 2017 Auditor General report found that CRA call centres ‘gave wrong information to callers almost 30 per cent of the time’.”

Oh, OK. That doesn’t sound much different from the experience here in the U.S., where the IRS hands out the wrong information maybe a quarter of the time. (Or more. Who knows?) But Canadians pay a high price tag for the privilege of spelling “call centre” with the “r” in front of the “e”.

But a Higher Tax Bill North of the Border

“In December 2015, Canada’s new Liberal government introduced changes to Canada’s personal income tax system,” Canada’s Fraser Institute, a free-market think tank, noted in 2020. “Even before the changes, the country’s combined federal and provincial top marginal tax rates compared unfavourably to those in the United States and other industrialized countries. … Nine Canadian provinces occupy the list of 10 jurisdictions with the highest top combined marginal income tax rates and all provinces are in the top 13 [across the U.S. and Canada].”

Umm. Ouch.

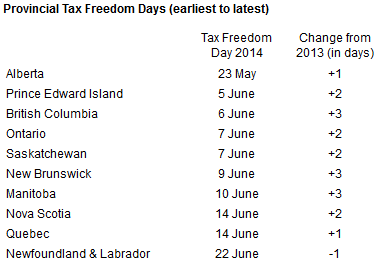

In truth, comparing tax burdens requires a deep dive because of differences in how taxes are applied, income brackets, deductions, and the like. Fans of big government always want to balance costs against “benefits” of government services, as if being mugged to support a state monopoly should be welcomed by those who’d rather shop among competitors or entirely forgo some services. Suffice it to say that comparisons of provincial and state tax burdens generally reveal a lighter touch south of the border.

Worse, though, the think tank finds overall economic freedom slipping across Canada.

Higher Taxes Reflect Less Freedom

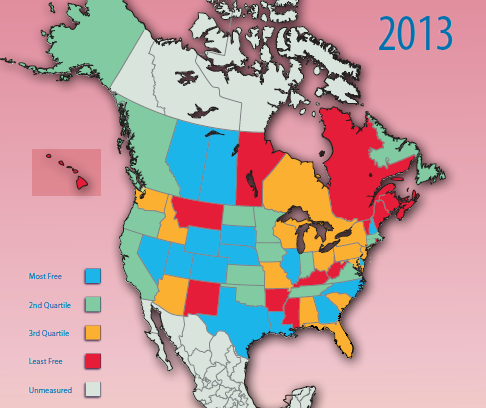

“For the first time, every Canadian province ranks in the bottom half of jurisdictions in our annual rankings of economic freedom in North America,” Fraser announced of its Economic Freedom of North America 2023 report. “Alberta in the all-government index is once again the highest-ranking Canadian province but it has declined substantially. In the all-government index, Alberta is now tied for 31st place out of 50 U.S. states, 32 Mexican states, 10 Canadian provinces, and the US territory of Puerto Rico.”

Economic freedom is defined as you’d expect, with economic activity involving “minimal government interference”. As the report adds, “an index of economic freedom should measure the extent to which rightly acquired property is protected and individuals are engaged in voluntary transactions”.

Fraser compares the states and provinces to each other within their countries, and also across Canada, Mexico, and the United States. For the purpose of comparing jurisdictions across three nations, the report looks at six areas of economic activity: government spending; taxes; labor market freedom; legal systems and property rights; sound money; and freedom to trade internationally.

The highest ranked jurisdiction is New Hampshire, followed in the first quartile by Florida and 20 other U.S. states. Alberta ranks at 31, between Missouri and Connecticut. British Columbia comes in at 45, with Ontario at 50 and Manitoba at 54. The last-ranked U.S. state is Delaware, at 53, though the territory of Puerto Rico ranks at 61. Quebec brings up the rear for Canada, at 56.