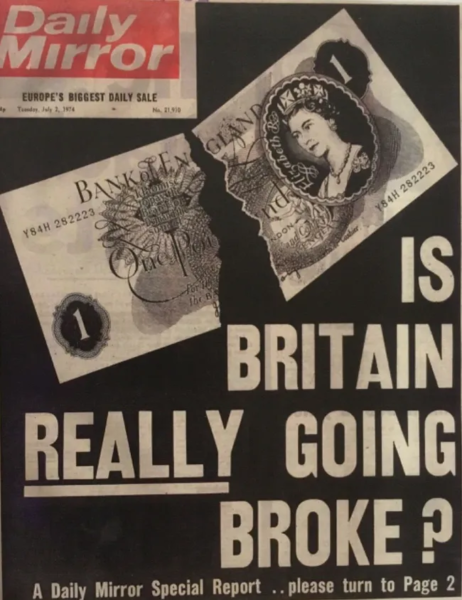

In the second part of Ed West‘s appreciation of Dominic Sandbrook’s Seasons in the Sun, Britain was described as “sliding, sinking, shabby, dirty, lazy, inefficient, dangerous, in its death throes, worn out, clapped out, occasionally lashing out” by Margaret Drabble in her 1977 novel The Ice Age, and it certainly seems to fit the bill quite well:

The Times reported in October of that year that London’s West End was in a “sorry state”, with parts of Shaftesbury Avenue and Charing Cross Road “in the sort of condition that, in Birmingham or Manchester, would qualify them for wholesale slum clearance”.

Journalist Clive Irving wrote that London had become “a semi-derelict slum”, a city blighted by “tacky porno shops, skin movies, pinball arcades, and toxic hamburger joints” while “behind neon facades the buildings are flaking and unkempt”.

The capital had lost a million and a half people since its peak in 1939, and would continue its decline for another decade. Whitehall Mandarin Ronald McIntosh declared that “London is evidently losing population quite heavily [and] services are steadily deteriorating, and nobody seems to have the least idea of how to deal with it”.

The country as a whole was haemorrhaging people, and in 1975 its population fell for the first time since records began. In the spring of 1974 applications for emigration to Canada went up 65 per cent, while New Zealand even felt compelled to put restrictions on people fleeing the old country.

Doctors in particular were leaving in droves, and recruitment agency Robert Lee International estimated that the number of professionals wanting to move abroad rose by 35% in just six months, from January and July 1975. Interest was keenest among engineers, accountants, scientists and teachers.

Many high earners were fleeing excessive tax rates, so punitive that even the Bond producer Albert R Broccoli left to make the iconic British movies elsewhere, and Moonraker would be filmed in France.

Gone were the days of the Swinging Sixties; instead, the London of George Smiley was “the city of the Sex Pistols and The Sweeney, not the Beatles and The Avengers; a city of tramps and hooligans, hustlers and muggers, the downtrodden and the disappointed, haunted by the deadly figure of the IRA bomber”.

Britain’s second city was in an even worse state. During Wilson’s first term Birmingham had been hailed as “the most go-ahead city in Europe”. Now the Times admitted it looked like a “large and chaotic building site”.

Travel writer Jonathan Raban described Southampton’s Millbrook estate as “a vast, cheap storage unit for nearly 20,000 people”. The country’s increasing problem with crime, hooliganism, graffiti and drug addiction meant that residents wouldn’t even hang their clothes in communal areas, for fear of theft.

The great architectural feats of the post-war era were beginning to look like a miserable failure, and none more so than the utopian social housing schemes, which had often entailed destroying closely-knit and organic communities in overcrowded and run-down – but rescuable – terraced housing.

Christopher Brooker visited Keeling House in Bethnal Green and found “its concrete cracked and discolouring, the metal reinforcement rusting through the surface, every available inch covered with graffiti”. Here was the story of modern Britain, “the bright, anticipated dream followed by a seedy, nightmarish reality”.

The National Theatre’s Peter Hall visited the New York Juilliard School and upon return home “found it depressing to compare it with our own already run-down, ill-maintained South Bank building”.

“The English apparently no longer care enough about material surroundings,” he wrote: “They even seem to take a positive pleasure in defiling them.”