Christopher Snowden asks whether we should believe the consistent claims of public health advocates on how much things they disapprove of (smoking, drinking, etc.) “cost” the taxpayer:

If smoking costs the taxpayers £173 billion, then how much does widespread forced feeding of office pastries cost?

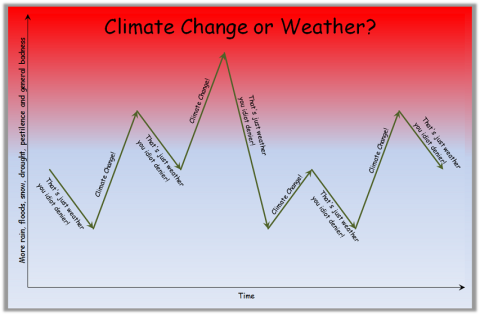

If you say that a certain activity costs society £10 billion a year, most people would assume that if that activity disappears, society will save £10 billion a year.

They might have different ideas of what “society” means. Some will assume that the £10 billion is a cost to taxpayers while others will assume that some of the cost is borne by private individuals and businesses. But the majority will, quite reasonably, assume that the cost is to other people, i.e. those who do not participate in the activity.

And nearly everyone will assume that the £10 billion is money in the conventional sense of cash that can be exchanged for goods and services.

But when it comes to estimates from “public health” campaigners about the cost of drinking/smoking/obesity, all these assumptions would be wrong. Most of the “costs” are to the people engaged in the activity and they are not financial costs. Taxpayers would not pay less tax if they disappeared. In general, they would pay more.

Last month I mentioned an estimate of the “cost” of gambling in the UK and said:

These studies have no merit as economic research. They are purely driven by advocacy. The hope is that the average person will wrongly assume that the costs are to taxpayers and agitate for change.

The main aim of these Big Numbers is to convince the public that heavily-taxed activities place a burden on society that exceeds the tax revenue, thereby justifying yet more taxes and prohibitions.

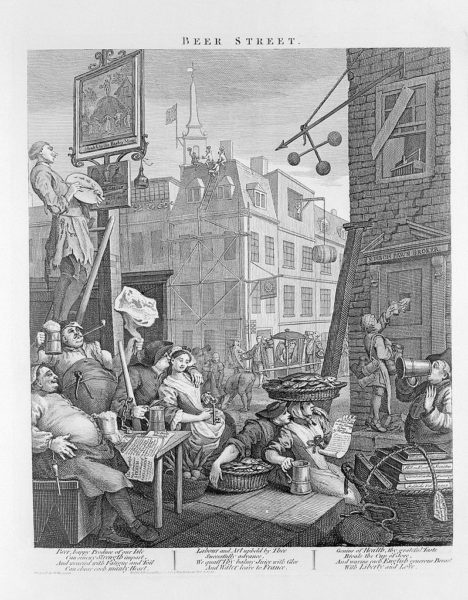

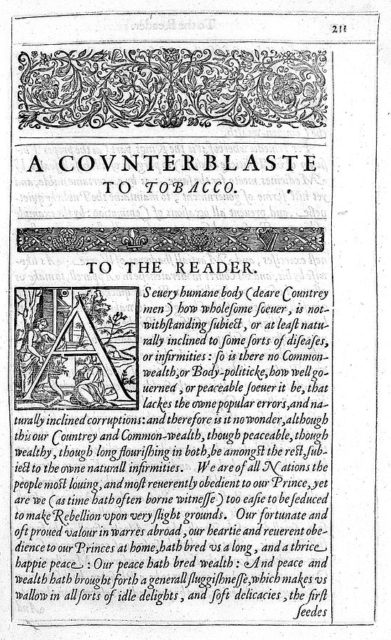

In the case of smoking, this has become more and more difficult. Smoking has been a net gain for the Treasury ever since King James I started taxing it heavily in the 1600s. Today, as the smoking rate dwindles and tobacco duty rises ever higher, anti-smoking campaigners have got their work cut out duping non-smokers into thinking otherwise.

Tobacco duty brings in about £12 billion a year. For years, groups like Action on Smoking and Health (ASH) used a figure of £13.74 billion as the “cost of smoking”. This came from a flimsy Policy Exchange report which included £5.4 billion as the cost of smoking breaks and £4.8 billion as the cost of lost productivity due to premature mortality. Neither of these are costs to the taxpayer. They are not even external costs, i.e. costs to non-smokers.

Last year, in a review commissioned by the Department of Health, Javed Khan came up with a figure of “around £17 billion” as the “societal cost” of smoking. This included “reduced employment levels” (£5.69 billion) and “reduced wages for smokers” (£6.04 billion). Again, these costs fall on smokers themselves and are not external costs. They are, in other words, none of the government’s business.

Last week, a report commissioned by Action on Smoking and Health (ASH) pulled out all the stops and announced that the cost of smoking to Britain was now — wait for it! — £173 billion. Go big or go home, eh?