There are really only three management books anyone ever needs to read (soon forthcoming, the fourth, my own precis of those three!) and we can use all of them in explaining this.

The Peter Principle tells us that everyone gets promoted to their own level of incompetence. So, that explains why the people actually running HR departments are incompetent. The second is Parkinson’s Law, which everyone usually takes to be about work expanding to fill the time available etc. In reality the book as a whole is about how bureaucracy will eat an organisation from the inside. Like one of those parasitic wasps where the pupae eat the spider from the inside out. The lesson of this is that proper management of any organisation is a constant battle against the growth of the bureaucracy. Proper managers should — must — spend significant amounts of their time turning a blowtorch on that internal bureaucracy. Real slash and burn, proper Carthaginian Solution on their arses.

The third has the most direct and exact relevance here. Up the Organisation. In which we are told that the personnel department (what we had before Human Resources) should be the secretary of the line manager. Someone wants to hire someone? Sure. The person who decides who to hire is the person doing the hiring. He needs an assistant only in so far as someone should phone up the local rag to put the job ad in.

Now, it is necessary to have someone making sure the details for the paycheque are right, that they enrolled in the company equity scheme, health care is sorted. But that’s some beancounter preferably hundreds of miles away from any actual influence upon anything.

All of which — from that distillation of the finest ponderings upon corporate management civilisation has so far achieved — tells us what to do with Human Resources.

Turn the blowtorches on the power skirts. Possibly even the full Carthaginian. Tho’ who we’ll find to buy as drabs and doxies the usual inhabitants of HR is another matter. Dunno, might be worth ploughing them into the fields and selling the salt instead.

Tim Worstall, “The Invasion Of The Power Skirts”, It’s all obvious or trivial except …, 2024-12-06.

March 9, 2025

QotD: HR metastasized

December 10, 2024

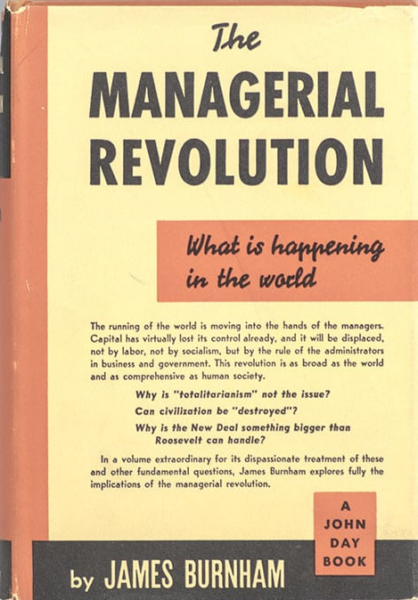

Countering the “Managerial Revolution”

Tim Worstall discusses the rise of the managerial class — described in 1941’s Managerial Revolution by James Burnham — and how detrimental to individual enterprises and the wider economy managerialism has been:

This, rather joyously, explains a lot about the modern world. We could go back to the mid-1980s and the bloke who ran the ‘baccy company written up in Barbarians at the Gates. In which he, as CEO, had a fleet of private planes, the company paid for his 11 country club memberships and so on. His salary was decent, sure, but the corporation rented him all the trappings of a Gatsbyesque — and successful — capitalist. Until the actual capitalists — the barbarians — turned up at those gates and started demanding shareholder returns.

Or we can think of the bureaucratic classes in the UK in more recent decades. Moving effortlessly between this NGO, that quasi-governmental body and a little light sitting on the right government inquiry. All at £1500 a day and a damn good pension to follow.

Or, you know, adapt the base idea to taste. There really is a bureaucratic and managerial class that gains the incomes and power of the capitalists of the past without having to do anything quite so grubby as either risk their own money or, actually, do anything. They, umm, administer, and the entire class is wholly and absolutely convinced that everything must be administered and they’re the right people to be doing that.

You know, basically David Cameron. Met him once, when he was just down from uni. At a political meeting – drinkies for the Tory activists in a particular council ward, possibly a little wider than that. Hated him on sight which I agree has saved me much time over the decades. And I was right too. There is nothing to Cameroonism other than that the right sort of people should be administering — the managerial revolution.

Sure, sure, we used to have the aristocracy which assumed the same thing but we did used to insist that they could chop someone’s head off first — show they had the capability. Also, they didn’t complain nor demand a pension when we did that to them if they lost office.

But the bit that really strikes me. France — and thereby the European Union — seems to me to be where this Managerial Revolution has gone furthest. Get through the right training (the “enarques“) and you’re the right guy to be a Minister, run a political party, manage the oil company, sort out the railways etc. You don’t have to succeed or fail at any of them, you’re one of the gilded class that runs the place. Because, you know, everything needs to be run and one of this class should do so.

The divergence or even active conflict of interests between the owners and the non-owning managers is part of the larger Principal-Agent Problem.

December 9, 2024

QotD: The downfall of Boeing

Boeing was once a young startup, founded by the eccentric heir to a timber fortune. Through a mixture of luck, derring-do, and frequent cash injections from its wealthy patron, it managed to avoid bankruptcy long enough for World War II to begin, at which point the military contracts started rolling in. Along the way, it developed an engineer-dominated, technically perfectionist, highly deliberative corporate culture. At one time, you could have summed it up by saying it was the Google of its time, but alas there are problems with that analogy these days. Maybe we should say it was the “circa 2005 Google” of its time.

There’s a lot to love about an engineer-dominated corporate culture. For starters, it has a tendency to overengineer things, and when those things are metal coffins with hundreds of thousands of interacting components, filled with people and screaming through the air at hundreds of miles an hour, maybe overengineering isn’t so bad. These cultures also tend to be pretty innovative, and sure enough Boeing invented the modern jet airliner and then revolutionized it several times.

But there are also downsides. As any Googler will tell you, these companies usually have a lot of fat to trim. Some of what looks like economic inefficiency is actually vital seed corn for the innovations of the future, but some of it is also just inefficiency, because nobody looks at the books, because it isn’t that kind of company. Likewise, being highly deliberative about everything can lead to some really smart decision making and avoidance of group think, but it can also be a cover for laziness or for an odium theologicum that ensures nothing ever gets done. Smart managers steeped in this sort of culture can usually do a decent job of sorting the good from the bad, but only if they can last, because you see there’s a third problem, which is that almost everybody involved is a quokka.

Engineers, being a subspecies of nerds, are bad at politics. In 1996, Boeing did something very stupid and acquired a company that was good at politics. McDonnell Douglas, another airplane maker, wasn’t the best at making airplanes, but was very good at lobbying congress and at impressing Wall Street analysts. Boeing took over the company, but pretty much everybody agrees that when the dust had settled it was actually McDonnell Douglas that had taken over Boeing. One senior Boeing leader lamented that the McDonnell Douglas executives were like “hunter killer assassins”. No, sorry bro, I don’t think they were actually that scary, you were just a quokka.

Anyway, the hunter killer assassins ran amok: purging rivals, selling off assets, pushing through stock buybacks, and outsourcing or subcontracting everything that wasn’t nailed down. They had a fanaticism for capital efficiency that rose to the level of a monomania,1 which maybe wasn’t the best fit for an airplane manufacturer. And slowly but surely, everything went off the rails. Innovation stopped, the culture withered, and eventually planes started falling out of the sky. And now the big question, the question Robison just can’t figure out. Why?

John Psmith, “REVIEW: Flying Blind by Peter Robison”, Mr. and Mrs. Psmith’s Bookshelf, 2023-02-06.

1. This is how you know this story took place in an era of high interest rates!

October 24, 2024

It’s called “piercing the corporate veil” and it’s a terrible idea

Tim Worstall explains why the EU’s latest brain fart is not just a bad idea in its own right, but a truly horrific precedent for the future:

… But now, this, now this is even more important than that. We can deal with free speech by the judicious use of lampposts. This is worse:

The European Union has warned X that it may calculate fines against the social-media platform by including revenue from Elon Musk’s other businesses, including Space Exploration Technologies Corp. and Neuralink Corp., an approach that would significantly increase the potential penalties for violating content moderation rules.

Under the EU’s Digital Services Act, the bloc can slap online platforms with fines of as much as 6% of their yearly global revenue for failing to tackle illegal content and disinformation or follow transparency rules.

In English law that’s known as “piercing the corporate veil”. It’s also something we don’t do. Because that corporate veil is the very thing, the only thing, that makes large scale economic activity possible.

It has actually been said — and not just by me — that the invention of the limited company is the third grand invention of all time. Agriculture, the scientific method, the limited company.

Before the limited co everything was done through partnerships. Every individual involved in the ownership of something was liable for all of the debts of that thing. Which, when you’ve got 5 or 10 blokes trading isn’t that bad an incentive upon them to be honest.

Now think of large scale activity. We want a blast furnace — plenty of folk say Britain should have one after all. £3 to £5 billion these days. OK. No one’s got that much. So, we need to mobilise the savings of many thousands of people to go build it. But without limited liability that means all of those thousands are liable for all the debts — off into the future — of that blast furnace.

“Invest £500 in the new, new British Steel. And if we fuck up then in 10 years’ time they’ll come and take your house.”

Err, yes.

Large scale economic activity depends upon being able to separate the debts of one specific activity from the general economic life of all its backers. If this is not true then no one will invest in large scale economic activity. Therefore we won’t have large scale economic activity. Which would, you know, be bad.

September 17, 2024

QotD: “Megacorporations” in history and fiction

I think it is worth stressing here, even in our age of massive mergers and (at least, before the pandemic) huge corporate profits, just how vast the gap in resources is between large states and the largest companies. The largest company by raw revenue in the world is Walmart; its gross revenue (before expenses) is around $525bn. Which sounds like a lot! Except that the tax revenue of its parent country, the United States, was $3.46 trillion (in 2019). Moreover, companies have to go through all sorts of expenses to generate that revenue (states, of course, have to go about collecting taxes, but that’s far cheaper; the IRS’s operating budget is $11.3bn, generating a staggering 300-fold return on investment); Walmart’s net income after the expenses of making that money is “only” $14.88bn. If Walmart focused every last penny of those returns into building a private army then after a few years of build-up, it might be able to retain a military force roughly on par with … the Netherlands ($12.1bn); the military behemoth that is Canada ($22.2bn US) would still be solidly out of reach. And that’s the largest company in the world!

And that data point brings us to our last point – and the one I think is most relevantly applicable for speculative fiction megacorporations – historical megacorporations (by which I mean “true” megacorps that took on major state functions over considerable territory, which is almost always what is meant in speculative fiction) are products of imperialism, produced by imperial states with limited state capacity “outsourcing” key functions of imperial rule to private entities. And that explains why it seems that, historically, megacorporations don’t dominate the states that spawn them: they are almost always products and administrative arms of those states and thus still strongly subordinate to them.

I think that incorporating that historical reality might actually create storytelling opportunities if authors are willing to break out of the (I think quite less plausible) paradigm of megacorporations dominating the largest and most powerful communities that appear so often in science fiction. What if, instead of a corporate-dominated Earth (or even a corp-dominated Near-Future USA), you set a story in a near-future developing country which finds itself under the heel of a megacorporation that is essentially an arm of a foreign government, much like the EIC and VOC? Of course that would mean leavening the anti-capitalist message implicit in the dystopian megacorporation with an equally skeptical take about the utility of state power (it has always struck me that while speculative fiction has spent decades warning about the dangers of capitalist-corporate-power, the destructive potential of state power continues to utterly dwarf the damage companies do. Which is not to say that corporations do no damage of course, only that they have orders of magnitude less capability – and proven track record – to do damage compared to strong states).

(And as an aside, I know you can make an argument that Cyberpunk 2077 does actually adopt this megacorporation-as-colonialism framing, but that’s simply not how the characters in the game world think about or describe Arasoka – the biggest megacorp – which, in any event, appears to have effectively absorbed its home-state anyway. Arasoka isn’t an agent of the Japanese government, it is rather a global state in its own right and according to the lore has effectively controlled its home government for almost a century by the time of the game.)

In any event, it seems worth noting that the megacorporation is not some strange entity that might emerge in the far future with some sort of odd and unpredictable structure, but instead is a historical model of imperial governance that has existed in the past and (one may quibble here with definitions) continues to exist in the present. And, frankly, the historical version of this unusual institution is both quite different from the dystopian warnings of speculative fiction, but also – I think – rather more interesting.

Bret Devereaux, “Fireside Friday: January 1, 2021”, A Collection of Unmitigated Pedantry, 2021-01-01.

September 5, 2024

Is the DEI tide finally receding from corporate boardrooms?

At the Foundation for Economic Education, Jon Miltimore explains why many major US corporations are reconsidering their earlier “all in” approach to lecturing their customers about progressive causes:

Bud Light’s brand ambassador, Dylan Mulvaney, whose antics triggered a consumer boycott that cost the company over a billion in lost revenue.

DEI is just one form of corporate social activism, which comes in various forms and includes its cousin Environmental, Social, and Governance (ESG). Both ideas fall under, to some degree, Corporate Social Responsibility (CSR), the idea that corporations have a duty to take social and environmental actions into consideration in their business models.

If you’re wondering why Burger King has commercials on climate change and cow farts, and why Bud Light’s commercials went from featuring Rodney Dangerfield and Bob Uecker to trans activist Dylan Mulvaney, it’s because of CSR.

The idea that corporations should fight for social causes has skyrocketed in recent years to such an extent that activism is inhibiting companies in their primary mission: generating profits by serving customers.

“Firms leveraging situations and social issues is not new, but showcasing their moral authority despite a disinterested consumer base is,” Kimberlee Josephson, an Associate Professor of Business at Lebanon Valley College in Annville, Pennsylvania, has observed.

Bud Light’s decision to feature Mulvaney cost them an estimated $1.4 billion in sales, and it revealed the danger of corporations leaning into social activism, particularly campaigns and policies that alienate their own consumer bases.

Not very long ago, companies like Chick-fil-A faced backlash from progressive activists for supporting traditional marriage. Culture war advocates on the right have responded in similar fashion.

Conservative influencers have made a point of raising awareness around “woke” corporate initiatives — white privilege campaigns, climate change goals, LGBTQ events, etc. The most successful ones, such as Robby Starbuck who pioneered the campaign against Tractor Supply and John Deere, made a point of targeting corporations with conservative consumer bases.

“If I started a boycott against Starbucks right now, I know that it wouldn’t get anywhere near the same result,” Starbuck recently told the Wall Street Journal.

One can support Robby Starbuck’s tactics or oppose them. What’s clear is that corporations increasingly face risks for participating in social activism campaigns, and the threats now come from both sides of the political aisle.

Respectful neutrality on cultural issues used to be the default way for companies to avoid insulting the general public and potentially alienating customers. Under the influence of DEI/ESG/CSR advocates, corporations were persuaded that they could offend half of the population without suffering any meaningful financial losses. That turned out to be untrue.

July 16, 2024

Real world economic experiment to test Card & Krueger’s minimum wage theory

Tim Worstall points out that the California state government is — intentionally or not — running an interesting economic validation of the Card & Krueger study in New Jersey that seemed to show raising minimum wages didn’t have a negative impact on overall employment:

“Fast food” by Daniel Barcelona is licensed under CC BY 3.0 .

For think back to that New Jersey minimum wage study, Card and Krueger. That showed that acshully, employment in fast food joints rose when the minimum wage went up. Now, I’ve been saying for a long time now that I think there’s a fallacy of composition there.

“Fast food” isn’t “fast food”. There are — at least — two sectors here. There’re those big national chains, lots of advertising, franchisees, MaccyD’s and the like. Then there’s a vast hinterland of Mom and Pop places. The financial structures are entirely different. The chains are capital intensive. I think I’ve seen that buns for burgers come in pre-cut. Salad definitely arrives in bags, already shredded. There’s no prep – not even prep areas in those kitchens. Mom and Pop run differently. One reason I know is because I’ve owned and run one. There’s an awful lot of labour that goes into turning blocks of stuff into those sandwiches. Stuff is sliced, diced, soups are cooked on site, from identifiable ingredients, bread is sliced and on and on.

No, this isn’t to try and riff off The Bear. But there is a difference in economic structure between those who are large corporates vending fast food and not-large corporates vending fast food.

And I think — think, me, I do — that the problem with the Card and Krueger study was that it didn’t account for this. A change in the general labour rate might push people to the capital intensive end of this market. Certainly could do, it would be possible to model it that way. Which means that using only the data from the fast food chains, as C&K did, would pick up only part, perhaps half, of the reaction. The Mom and Pops shed labour, the capital intensive chains modestly pick it up, the net effect is — well, the net effect could be anywhere actually.

Which is what makes this CA minimum wage change so interesting. Because the $20 an hour applies only to those working for the big national chains — or their franchisees.

Mom and Pop have to pay the normal CA minimum wage, not the $20. So, the labour intensive part of the overall system has just been handed a competitive advantage against the capital intensive end of it. We would expect, could possibly measure, that the overall employment outcome is positive.

No, really. I’d be willing to defend the idea that it could be, certainly. Note that “could”. So, we’ve two sectors, capital intensive, labour intensive. We’ve just said that the capital using guys now have to pay more — much more — for their labour than the labour intensive guys. The capital intensive guys can only respond by higher prices or worse service (ie, fewer labour hours). The labour intensive sector might end up picking up so much of the traffic that they expand employment — expand employment so much as to actually increase overall fast food sector employment. By shifting from the capital to the labour intensive sectors.

This should be studied, right? Now, my actual economic skills — rather than ruminations — are zero so it’s not going to be me checking this out. But I recommend it as something for someone looking for a PhD subject to think about. Possibly even someone more senior than that looking for a point upon which to make their bones.

Does a higher minimum wage that only — only — applies to the capital intensive portion of an economic sector like fast food actually increase employment? By shifting the sector over to the more labour intensive sector not subject to that higher minimum wage?

Logically, it could, significant empirical work would be necessary to show it though.

July 2, 2024

The Chevron decision

On his substack, Glenn “Instapundit” Reynolds discusses the recent US Supreme Court decision on “Chevron deference” and how it is going to impact the administrative state (and their business victims) going forward:

Goodbye, Chevron deference. Larry Tribe is already mourning the Supreme Court’s overturning of NRDC v. Chevron, in the Loper Bright and Relentless cases, as a national catastrophe:

Oh, the humanity!

Well, speaking as a professor of Administrative Law, I think I’ll bear up just fine. I’ve spent the last several years telling my students that Chevron was likely to be reversed soon, and I’m capable of revising my syllabus without too much trauma. It’s on a word processor, you know. As for those academics who have built their careers around the intricacies of Chevron deference, well, now they’ll be able to write about what comes next. And if they’re not up to that task, then it was a bad idea to build a career around a single Supreme Court doctrine.

And that wasn’t the only important Supreme Court decision targeting the administrative state, a situation that has pundit Norm Ornstein, predictable voice of the ruling class’s least thoughtful and most reflexive cohort, making Larry Tribe sound calm.

Sure, Norm, whatever you say.

But how about let’s look at what the Court actually did in Chevron, and in the Loper Bright and Relentless cases that overturned it, and in SEC v Jarkesy, where the Court held that agencies can’t replace trial by jury with their own administrative procedures, and in Garland. v. Cargill, where the Court held that agencies can’t rewrite statutes via their own regulations. I don’t think you’ll find the sort of Russian style power grab that Ornstein describes, but rather a return to constitutional government of the sort that he ought to favor.

At root, Chevron v. Natural Resources Defense Council is about deference. Deference is a partial abdication of decisionmaking in favor of someone else. So, for example, when we go out to dinner, I often order what my son-in-law orders, even if something else on the menu sounds appealing. I’ve learned that somehow he always seems to pick the best thing.

Deference doesn’t mean “I’ve heard your argument and I’m persuaded by it”, (though something like that is misleadingly called “Skidmore deference”, but isn’t actually deference at all). Deference means “even if I would have decided this question differently, I’m going to go with your judgment instead”.

Under Chevron deference, when an agency interprets a statute it administers (e.g., the EPA and the Clean Air Act), a court will uphold its interpretation so long as it is (generously assessed) a reasonable one, even if it is not the interpretation the court would have come up with on its own. As you might imagine, this, at least potentially, gives agencies a lot more leeway, particularly when, as is often the case, Congress has drafted the statute ambiguously.

With Chevron overturned, courts will now apply their own judgment instead of deferring to agencies. Of course, this isn’t as big a deal as Larry and Norm seem to think, because Chevron has been dying the death of a thousand cuts for a while. Under the “major questions doctrine”, courts already decline to defer to agency interpretations where the issue has major social or economic ramifications.

July 1, 2024

The Anglosphere “imported American racial progressivism, and then commenced to import American-style racial problems. Thanks, America.”

At Postcards From Barsoom, John Carter discusses meritocratic racial quotas in employment and higher education as a “Universally Disagreeable Compromise”:

The race question has been a fault line in American society from its inception. In the aftermath of the hypermigration of the early twenty-first century, it has only become more complicated and divisive, not only in America, but throughout the Anglospheric world. The rest of us imported American racial progressivism, and then commenced to import American-style racial problems. Thanks, America.

The question seems to ultimately revolve around who shall receive the economic spoils. The “equity” that is endlessly referenced by diversity commissars is literally the home equity held by the white middle class, which the diverse and their champions openly intend to expropriate and redistribute.

The most contentious battlegrounds are in academic admissions and corporate hiring, in which the imperative is to minimize the number of White men, and maximize everything that isn’t White men. How the everything else is maximized is of no particular account. A team composed entirely of black men is just as “diverse” as a team which also features Black lesbians, Arab homosexuals, and Thai ladyboys. It is the presence of White men that makes organizations less diverse: a team composed entirely of Black men, with the exception of a solitary White male token, is less diverse than the all-Black team.

For generations now we have suffered under the affirmative action regulations imposed under the banner of Civil Rights. For proponents, Civil Rights are a civic religion, and they guard the advantages won by adherence to their faith jealously. For the victims of affirmative action – which includes both those rejected from employment or university, as well as those subjected to the incompetency of affirmative action admits and hires – affirmative action is a hateful absurdity.

The underlying problem, which to this day only Internet edgelords will openly discuss, is human biodiversity. The various ancestral groups are, in fact, different, in ways that go beyond the merely cosmetic, to include general levels of cognitive aptitude, along with specific behavioural proclivities. To a certain degree this is due to upbringing, but only to a certain degree; upbringing can bring a child as close to his genetic potential as possible, but cannot push him beyond it. The best that nurture can do is to allow nature to flower; it cannot change nature. The natural outcome of this is that, under a purely race-blind, meritocratic dispensation, there will be noticeable and ineradicable differences in the representation of various races within any given profession.

Whether or not one supports a purely meritocratic approach to admissions and hiring then tends to depend a lot on whether one belongs to a group that is likely to do well, or poorly, under such a system. East Asians tend to support a more meritocratic approach, because their high test scores, good study habits, and strong work ethic mean that they will be extremely competitive. Blacks, on the other extreme, are far more skeptical of meritocracy, intuiting that a ruthlessly meritocratic approach would tend to see them pushed out of the professions at the expense [or rather, to the benefit] of Whites, Asians, and Indians.

The current system is practically the worst possible system. The official narrative is built upon the foundational lie that we are all the same under the skin, and that any difference in group-level socioeconomic outcome can only be the result of bigotry, racism, systemic racism, implicit bias, and the historical consequences of slavery or colonialism. This lie has driven our society quite insane, leading in particular to the demonization of Whites – a large fraction of whom buy into the narrative of ethnomasochistic guilt with religious zeal, and another large fraction of whom reject this framing of their racial character as sick and ugly. To a large degree the culture wars are driven by this very division. In the American context, this division maps quite closely to Constitutionalists vs Civil Rights adherents, i.e. it is a holy war between the two dominant civic religions. It is not accidental that this also maps to Republican (i.e. those who wish to preserve the Old Republic built by the Constitution) vs Democrat (i.e. those who wish to complete the transformation of the Republic into something [like] the Our Democracy they’ve been growing in the soil of Civil Rights).

As William M Briggs has pointed out ad nauseum, the prohibition of “disparate impact” and “discrimination” under the Civil Rights regime is an absolute nightmare for corporate America. On the one hand, to discriminate on the basis of race (or any other identity) is plainly illegal; on the other, to not discriminate is invariably to open oneself to charges of discrimination, as the various statistical differences between racial groups work themselves out in aptitude tests, SATs, grade point averages, or job performance. This places employers in the Kafkaesque position of being required to discriminate without being seen to discriminate. They must put their thumbs on the scale to ensure equal outcomes, without being caught doing so.

For Whites especially, this has been a very bad deal. Because no organization will ever be sued for taking on too many officially victimized minorities, there is no upper limit to the number of diversity hires; but if the student body or corporate org chart falls below a given group’s fraction of the population, lawsuits are almost guaranteed. This then produces an inevitable ratchet effect which systematically excludes White people from their own society, with corrosive effects on competence, morale, and confidence in institutions. It doesn’t help that, because we are still officially meritocratic, the leadership classes subject us all to constant gaslighting: we are discriminated against openly by people who brag about discriminating against us while insisting in the same breath that there is no discrimination. It is not surprising that many of us are ready to burn these people at the stake.

June 21, 2024

“Neoliberal ideology is antidemocratic at its very core. Its aim is to give free-reign over our societies to corporations, not citizens”

Tim Worstall responds to a recent Medium essay by Julia Steinberger which illustrates that “neoliberal” has joined “fascist” as a generic term to indicate strong disapproval of a person, organization, or idea:

The idea that an adult woman can believe these things is just amazeballs. But here we are. A tweet from Julia Steinberger leads to her Medium essay about what’s wrong with the world.

An upheaval in 10 chapters:

1. The cause. We know the climate crisis is brought to us by highly unequal and undemocratic economic systems.

Err, no? Emissions are emissions. 100 people emitting one tonne each is exactly the same as 1 person emitting 100 tonnes. Sure, it’s true that a more unequal society will have more people emitting those 100 tonne personal amounts. But a more equal society will have more people able to emit another 1 tonne each. For, more equality is by definition the movement of some of those assets of the richer to those poorer — the economic assets which either allow or do the emitting. Sure, Jim Ratcliffe’s £50,000 private jet flight emits more than my £100 Easyjet one. But if we take the £50k off Jim and give it to 500 folk like me then all 500 of us might spend the marginal income on an Easyjet flight each — which would be more emissions than Jim’s spending of the money.

It simply is not true that economic inequality is the heart, the core or the cause of climate change. It’s idiocy to think it is too.

Of course, we know what’s happening here. Climate Change is Bad, M’Kay? Which it is, obviously. Economic inequality is Bad, M’Kay? Well, there the evidence is a great deal more mixed but whatever. But in the minds of the stupid all bad things have the same cause. So, if inequality is bad, climate change is bad, then they must be the same thing because they’re Bad, M’Kay?

2. The rise. The recent history of these economic systems, in the Americas and Eurasia, is dominated by the ascendance of neoliberal ideology.

Oh, that is good. Given that I am a neoliberal — a fully paid up one, Senior Fellow at the Adam Smith Institute and all — that’s very good. Given HS2, looming wealth taxation, the increased bite of idiot regulation and all that I can’t say that I see neoliberalism as winning right now but that might depend upon your starting point. If you’re a socialist — or an idiot but I repeat myself — you might well regard the plenitude of bananas in the supermarket as neoliberal. After all, that is something that socialism never did achieve.

3. The threat. Neoliberal ideology is antidemocratic at its very core. Its aim is to give free-reign over our societies to corporations, not citizens.

And, well, you know, bollocks. The very beating heart of neoliberalism is that corporations need to be controlled and they’re best controlled by the citizens. In the form of free markets rather than voting on which bureaucrats get the gold plated pension, true. But neoliberals are between indifferent and actually against capitalist power. The whole nub of the idea is that markets do the job of controlling capitalists better than bureaucrats, politicians or, obviously, capitalists.

There’s not really any way for her thesis to survive after getting so much of the basics wrong, is there?

But just one more tidbit:

Hayek and his neoliberal colleagues now needed another, antidemocratic way, to organise society. They didn’t want democracy, but they wanted some kind of self-maintaining organisation — by which they meant hierarchy. Organisation was supposed to be supplied by the market, and hierarchy by competition within markets. (It’s worth noting that neoliberals in the 1950s did not, although they should have, predict that unfettered markets lead to concentrations in monopolies or cartels. They would arguably disapprove of the vast corporations running our current economies, even though their market-above-democracy policies predictably brought them into being.)

Well, that wasn’t actually the last tidbit. But the idea that Friedman, Mises, Menger, Hayek and the rest didn’t worry about monopolies? Jesu C is really bouncin’ on that pogo stick right now. And then the idea that democracy will be better bulwark against monopolies than markets? Can you actually do backflips on a pogo stick?

June 20, 2024

The “Idiot Nephew Theory” of show business management

Ted Gioia recalls his hopes of getting into the entertainment industry after graduation:

The story of how I became a strategy consultant is shameful.

I was a student at Stanford’s Graduate School of Business, and needed a job after graduation. I wanted to work in the music or entertainment industries — but I soon learned this was an impossible dream.

They didn’t want me. And they didn’t want my classmates either.

Hundreds of companies came to our business school to recruit talent, and they included most of the leading US corporations. So I talked with everybody — Coca Cola, Morgan Stanley, Atari, Procter & Gamble, you name it.

But no record label or movie studio ever showed up. They didn’t even send job listings.

Can you guess why?

I asked around on campus and was told the following (off the record):

Come on, Ted. You will never see the entertainment business recruit here. Those folks are not looking for business talent.

They give the choice jobs to their family members — the idiot nephew gets hired, not an MBA. Even better if it’s an idiot son.

And if there are other openings? Well … You’ve heard about the casting couch, haven’t you? Let me give you a hint — that couch isn’t just for auditioning the cast.

But you wouldn’t want a job there even if they gave you one. When time comes for a promotion, the drooling idiot nephew moves up — not you.

I’ve never shared that story before — because I know how people inside the music business hate hearing it.

And maybe it’s not a fair story.

All I can say is that I found this advice very helpful. I stopped planning on a career in the music business. And I also developed a very useful theory to explain why record labels are so bad at making strategic decisions.

I call it the “Idiot Nephew Theory”:

THE IDIOT NEPHEW THEORY: Whenever a record label makes a strategic decision, it picks the option that the boss’s idiot nephew thinks is best.

And what does the idiot nephew decide? That’s easy — they always do whatever the company lawyer recommends.

Maybe this theory is wrong. All I can say is that it helps me predict events in the entertainment industry with a surprising degree of accuracy.

I always operate on the assumption that there’s no business strategy in the music or movie business — only legal maneuvering.

Years later, when the music business got totally reamed by tech companies — a phase we’re still living through, by the way — I wasn’t surprised in the least. The record labels respond to every new music technology by litigating, but whenever they encounter a company with more legal clout than them (Apple or Google/YouTube, for example), they simply gave up.

In the future, you can test this theory yourself. You will see that it possesses great explanatory power.

June 15, 2024

W.H.O. the hell do they think they are?

Christopher Snowden on what he calls a “new low” for the World Health Organization (WHO) in a report issued earlier this week that sounds like Karl Marx was one of the writers:

The WHO European Region published a new report today, written mostly by British ‘public health’ academics. It is quite revealing. For example …

This requires, at a minimum, that governments recognize that the primary interest of all major corporations is profit and, hence, regardless of the product they sell, their interests do not align with either public health or the broader public interest. Any policy that could impact their sales and profits is therefore a threat, and they should play no role in the development of that policy. Similarly, governments must also recognize the now overwhelming evidence (see also chapters 4, 6 and 7) that HHIs [“health-harming industries”] engage in the same political and scientific practices as tobacco companies and that voluntary or multistakeholder partnership approaches do not work where conflicts of interest exist. Instead, they must regulate other HHIs [“health-harming industries”], their products and practices, as they do tobacco.

That’s just one paragraph, but there’s a lot it in.

Firstly, they are clearly not just opposed to “health-harming industries” but to private industry and the free market in general.

Secondly, they want to exclude all industries from the policy-making process, as already happens with the tobacco industry.

Thirdly, they want to regulate all “health-harming industries” in the same way as they regulate tobacco. These industries include alcohol, food and fossil fuels, but the report also mentions pharmaceuticals, infant formula, gambling, firearms, healthcare (!) and sugary drinks. As the quote above makes clear, they think that all private industry damages health in some way.

This is all there in black and white and there is much more of the same in the report. This is not scaremongering or the slippery slope fallacy. It is in an official WHO document.

When people show you who they are, believe them.

I have written about this for The Critic …

If this sounds to you like Bolshie talk, you might be onto something. It is further confirmation that the modern “public health” movement is an arm of the hard left presented as an arm of medicine. It would be tempting to tell the authors to stay in their lane, but anti-capitalist nanny statism is their lane. For over a decade, such academics, mostly from Britain and Australia, have been pumping out studies about the “commercial determinants of health” and the “corporate political activity” of “unhealthy commodity industries”. The new WHO report is a sort of greatest hits collection. Last year they published a whole series of articles in the Lancet in which they claimed that there is “growing evidence that neoliberalism has been damaging to health” and called for “a normative shift away from harmful consumptogenic systems”.

Half-baked Marxist rhetoric has been rife in the social sciences for decades, but these people have a vaguely coherent point to make and are pursuing a serious, if terrifying, agenda. Since they do not believe in human agency, they assume that people only make “unhealthy choices”, such as eating processed ham, because the system that controls them has been rigged by big corporations. They say in today’s report that “consumers do not have capacity (time or resources) to make the ‘right’ choice”. Fortunately, public health academics know what the right choice is and could impose it on a grateful population if it were not for the pesky free market. Hence their rage against capitalism, which extends to suspicion of intellectual property, international trade, share buybacks, impact assessments (because they allow businesses to engage with policy-makers) and even the EU single market.

Further to what I say in the article, I’d add that it is to the UK’s shame that so many of the authors of this report are British. They include quackademics that I have been making fun of for years, such as Anna Gilmore, Mark Petticrew and May van Schalkwyk. Between them, they constitute a small clique of talentless, fanatics and/or grifting social scientists who have constructed a world of unreality for themselves by publishing endless low quality journal articles which they and their colleagues then reference and self-reference. It is profoundly depressing that they are now dangling the corpse of the WHO — which was once a great institution — on pieces of string.

June 14, 2024

QotD: European “megacorporations” in the east

The great (and terrible) chartered trading companies offer a more promising historical parallel for the megacorporation, with much larger scope. The largest of these were the British East India Company (EIC, 1600-1874) and the Dutch East India Company (the Vereenigde Oostindische Compagnie or VOC, 1594-1800). The EIC at one point accounted for something close to half of the the world’s trade and the VOC at points had total or near-total monopolies on the trade of important and valuable spices. Both companies were absolutely massive and exercised direct, state-like authority over territory and people.

And the structure of these massive trading companies mirrors some of the elements of a megacorp. While both companies were, in theory, shipping companies, in practice they were massive vertically integrated conglomerates. Conquering the production areas (particularly India for the EIC and Java for the VOC), they essentially controlled the production chain from start to finish. That complete vertical integration meant that the companies also had to supply employees and colonial subjects, which in turn meant controlling trade and production in everything from food and clothes to weapons. Both companies had their own armies and fleets (the EIC boasted more than 25,000 company soldiers at its height, the VOC more than 10,000) and controlled and administered territory.

In short, they were the colonial Dutch and British governments for many millions of colonial subjects. For the people living in territory dominated by these companies, they really would have resembled the megacorps of speculative fiction, operating with effectively impunity and using their vast profits to field armies and navies capable of defeating local states and compelling them to follow the interests of the company (which remained profit-oriented).

(I feel the need to stop and note that “company rule” in India and even more so in the Dutch East Indies was brutally exploitative, living up to – and in many cases quite surpassing – the normal dystopian billing of science fiction megacorporations. At the same time, it seems equally worth noting that the shift to direct colonial rule by the state was not always much better.)

So in one sense, the speculative fiction megacorp has already existed, but in the other, the limits of these historical entities are informative too. First, it seems relevant that none of these companies were creatures of the markets, rather, they were created by state action – they were chartered companies, state monopolies, or both. These massive imperial trading companies (of which the EIC and VOC were the most successful, but not the only ones) were all created by their respective governments, armed with substantial privileges and typically given exclusive rights to certain trade – they were state-sanctioned monopolies (echoes of this also in the Japanese Zaibatsu state-sanctioned vertical monopolies; note that the Roman publicani [tax-farming “companies” of the middle and late Republic] were also state-sanctioned monopolies) whose monopolies were backed by state power to the point that their states (that is, Britain, the Dutch Republic, France and so on) would and did go to war to protect the trading rights of their monopoly trading companies.

Second, these megacorporations, far from being in a position to usurp the states that formed them (as fictional megacorporations often do), turn out to be extremely vulnerable to those states. The EIC was effectively nationalized by an act of parliament in 1858 (after the Indian Mutiny of 1857 discredited company rule in the eyes of the British government) and disbanded in 1874. The VOC was likewise nationalized by its parent government in 1796 and then dissolved in 1799. No effort was made by either company to resist being disbanded with any sort of force; it would have been a pointless gesture in any case. While the resources of the EIC were vast, the military capabilities of the British Empire were far greater. Moreover, the companies simply didn’t have the legitimacy to operate absent their state backing.

This is of course also true for the not-quite-megacorporations, like the great trusts of America’s gilded age (Standard Oil, U.S. Steel, etc.), or the Japanese zaibatsu or even modern super-sized corporate entities. Of the 10 largest companies in the world, four are straight up state-owned enterprises. Even for the private modern massive company, by and large when they try to fight their “home” state, they lose, or at least are badly damaged without seriously inconveniencing the far greater power of the state (just ask AT&T or Microsoft).

Bret Devereaux, “Fireside Friday: January 1, 2021”, A Collection of Unmitigated Pedantry, 2021-01-01.

April 28, 2024

QotD: “I love Big Brother!”

I suppose my defeatist attitude is precisely what they — they being governments and corporations — are trying to cultivate with all of this oppression.

I don’t relish the Winston Smith role. I’ll just pass on the rats in Room 101 and skip right to the mindless, thoughtless bliss of Big Brotherly love without having to have it beaten into me.

Actually, it seems that Orwell was mistaken. Oppression does not have to mean dismal living conditions, horrible food, telescreen propaganda and rusty rationed razor blades. Big government can control people far more effectively by giving them a small slice of comfort and domesticity. Allow them a modest home. Encourage them to accumulate trinkets and toys and the occasional status symbol. Allow commercial marketing to develop the propaganda that shapes opinion and mood and sets people on the desired path.

Commercial marketing is far more effective than state propaganda — “Drivers Wanted” has recruited more people than any poster featuring a stern and serious Uncle Sam. Keep them somewhat comfortable, keep them acquisitive rather than inquisitive, keep them entertained rather than informed — and no-one will be seriously tempted to pursue an alternative.

Jonathan Piasecki, private e-mail, 1999-07-07 (originally published, with permission, on the old blog, 2005-06-24).

April 15, 2024

Simon & Schuster, founded 1924

In the latest SHuSH newsletter, Ken Whyte provides a thumbnail history of the American publishing house Simon & Schuster:

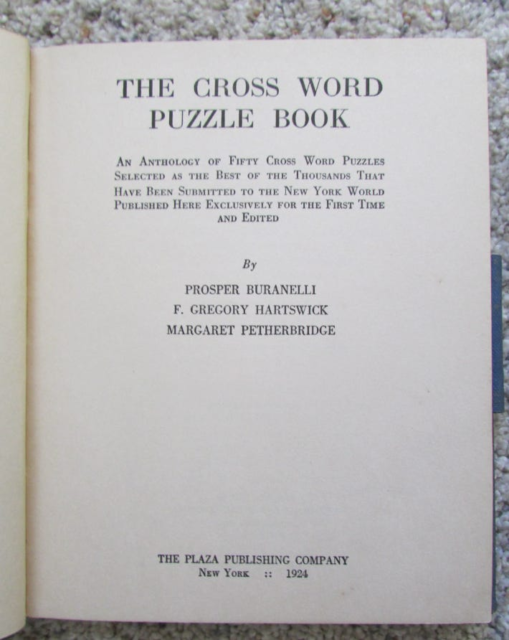

The firm was started by Richard Leo Simon, a Great War veteran and piano salesman, and his partner, Max Lincoln Schuster, an auto magazine editor. They had met when Simon failed to sell Schuster a piano. They scraped together $8,000 in savings and loans from friends, family, and a telephone operator, and launched their first title in 1924: The Cross Word Puzzle Book, a collection compiled by the editors of the New York World, which was reputed to have the best crossword of the day. Each copy of the book came with a pencil and an eraser.

Messrs. Simon and Schuster initially called themselves The Plaza Publishing Company (something S&S doesn’t mention on its history webpage). They didn’t want to be personally associated with a novelty publishing project.

The novelty project sold 40,000 copies in three months and just under half a million in its first year, earning the boys a profit of $100,000, which has to be the fastest start ever for a book publisher. The Cross Word Puzzle Book was a cash cow for decades to come — there were at least fifty-six more editions, the vast majority published as S&S books. Its proceeds funded many better quality publishing initiatives.

Will Durant’s The Story of Philosophy was published in 1926 to critical success and impressive sales. Hervey Allen’s Anthony Adverse won the Pulitzer in 1934, as did Thomas Wolfe’s You Can’t Go Home Again in 1940. Will and Ariel Durant’s eleven-volume The Story of Civilization, which started publishing in 1935 and would take forty years to complete, also won a Pulitzer and was another huge seller.

By the time S&S acquired the paperback rights to Margaret Mitchell’s Gone with the Wind in 1942 and Fitzgerald’s The Great Gatsby in 1945, it was already the leading publisher in America. To make sure everyone knew it, the boys moved into a stunning new headquarters at one of the most expensive addresses in the world, 1230 Avenue of the Americas, part of Rockefeller Center.

While it was winning its share of literary awards and publishing some great books, Simon & Schuster never forgot its roots in commercial projects. In mid-life it was famous as the how-to publisher: How to Read a Book, How to Improve your Memory, How to Raise a Dog, How to Think Straight, How to Play Winning Checkers, and the bestselling granddaddy of them all, Dale Carnegie’s How to Win Friends and Influence People, which has sold a staggering thirty million copies and still routinely shows up on bestseller lists.

Interestingly, the operational brains behind S&S was an unnamed partner, Leonard Shimkin, who joined the company as business manager at age seventeen. It was largely at Shimkin’s initiative that S&S launched Pocket Books in 1939, establishing the concept of inexpensive paperbacks, which broadened the reading public and opened the door to the expansion of genre fiction. He was also the one who walked Dale Carnegie into S&S.

The boys sold the company to Marshall Field, owner of the Chicago Sun, in 1944 but continued to work at it. They bought it back when Field died in 1956, this time with Shimkin taking an equity position. Simon retired in 1957 and Schuster not long after, eventually leaving Shimkin with sole ownership.

Meanwhile, the hits kept coming. Joseph Heller’s Catch-22 in 1961, Rachel Carson’s Silent Spring in 1962, Capote’s In Cold Blood in 1966, Alex Haley’s Roots in 1976, Larry McMurtry’s Lonesome Dove in 1985, Stephen Hawking’s A Brief History of Time in 1988, and so on.

In 1975, Shimkin sold S&S to Gulf + Western, the first in a depressing series of corporate foster homes, none of which has known anything about or cared anything for books. G+W became Paramount in 1989, which was acquired by Viacom in 1994, which split into two companies in 2005, with Simon & Schuster becoming part of CBS Corporation, which in 2019 was merged back with Viacom, which in 2022 changed its name to Paramount Global and, after failing to unload S&S to Penguin Random House that same year, landed it with KKR the next. More on why all the corporate shuffling is far from over here.

Simon & Schuster and its subsidiary, Scribner, are the last great American-owned monuments to the golden age of American book publishing, which runs from about 1920 through to … I don’t know, the 1970s? All the others — Random House, Knopf, HarperCollins, Little, Brown & Co. — are owned by foreign conglomerates (HC’s owner, News Corp, is technically American but its controlling family, the Murdochs, are culturally British when they’re not being Australian).