The History Guy: History Deserves to Be Remembered

Published 1 Feb 2019During the gilded age ruthless businessmen fought for control of railway lines. The Albany and Susquehanna railroad was another battlefield in the “Railroad wars.” In this episode, The History Guy remembers “the Battle of the Tunnel”.

This is original content based on research by The History Guy. Images in the Public Domain are carefully selected and provide illustration. As images of actual events are sometimes not available, images of similar objects and events are used for illustration.

All events are portrayed in historical context and for educational purposes. No images or content are primarily intended to shock and disgust. Those who do not learn from history are doomed to repeat it. Non censuram.

Patreon: https://www.patreon.com/TheHistoryGuy

The History Guy: History Deserves to Be Remembered is the place to find short snippets of forgotten history from five to fifteen minutes long. If you like history too, this is the channel for you.

Awesome The History Guy merchandise is available at:

teespring.com/stores/the-history-guyScript by THG

#newyork #thehistoryguy #ushistory

April 28, 2020

Robber Barons and the Battle of the Tunnel

February 29, 2020

The metallic nickname of Henry VIII

In the most recent Age of Invention newsletter, Anton Howes outlines the rocky investment history for German mining firms in England during the Tudor period:

Cropped image of a Hans Holbein the Younger portrait of King Henry VIII at Petworth House.

Photo by Hans Bernhard via Wikimedia Commons.

It’s an especially interesting case of England’s technological backwardness, given that copper was a material of major strategic importance: a necessary ingredient for the casting of bronze cannon. And it was useful for other industries, especially when mixed with zinc to form brass. Brass was the material of choice for accurate navigational instruments, as well as for ordinary pots and kettles. Most importantly, brass wire was needed for wool cards, used to straighten the fibres ready for spinning into thread. A cheaper and more secure supply of copper might thus potentially make England’s principal export, woollen cloth, even more competitive — if only the English could also work out how to produce brass.

The opportunity to introduce a copper industry appeared in 1560, when German bankers became involved in restoring the gold and silver content of England’s currency. The expensive wars of Henry VIII and Edward VI in the 1540s had prompted debasements of the coinage, to the short-term benefit of the crown, but to the long-term cost of both crown and country. By the end of Henry VIII’s reign, the ostensibly silver coins were actually mostly made of copper (as the coins were used, Henry’s nose on the faces of the coins wore down, revealing the base metal underneath and earning him the nickname Old Coppernose). The debased money continued to circulate for over a decade, driving the good money out of circulation. People preferred to hoard the higher-value currency, to send it abroad to pay for imports, or even to melt it down for the bullion. The weakness of the pound was an especial problem for Thomas Gresham, Queen Elizabeth’s financier, in that government loans from bankers in London and Antwerp had to be repaid in currency that was assessed for its gold and silver content, rather than its face value. Ever short of cash, the government was constantly resorting to such loans, made more expensive by the lack of bullion.

Restoring the currency — calling in the debased coins, melting them down, and then re-minting them at a higher fineness — required expertise that the English did not have. From France, the mint hired Eloy Mestrelle to strike the new coins by machine rather than by hand. (He was likely available because the French authorities suspected him of counterfeiting — the first mention of him in English records is a pardon for forgery, a habit that apparently died hard as he was eventually hanged for the offence). And to do the refining, Gresham hired German metallurgists: Johannes Loner and Daniel Ulstätt got the job, taking payment in the form of the copper they extracted from the debased coinage (along with a little of the silver). It turned out to be a dangerous assignment: some of the copper may have been mixed with arsenic, which was released in fumes during the refining process, thus poisoning the workers. They were prescribed milk, to be drunk from human skulls, for which the government even gave permission to use the traitors’ heads that were displayed on spikes on London Bridge — but to little avail, unfortunately, as some of them still died.

Loner and Ulstätt’s payment in copper appears to be no accident. They were agents of the Augsburg banking firm of Haug, Langnauer and Company, who controlled the major copper mines in Tirol. Having obtained the English government as a client, they now proposed the creation of English copper mines. They saw a chance to use England as a source of cheap copper, with which they could supply the German brass industry. It turns out that the tale of the multinational firm seeking to take advantage of a developing country for its raw materials is an extremely old one: in the 1560s, the developing country was England.

Yet the investment did not quite go according to plan. Although the Germans possessed all of the metallurgical expertise, the English insisted that the endeavour be organised on their own terms: the Company of Mines Royal. Only a third of the company’s twenty-four shares were to be held by the Germans, with the rest purchased by England’s political and mercantile elite: people like William Cecil (the Secretary of State) and the Earl of Leicester, Robert Dudley (the Queen’s crush). It was an attractive investment, protected from competition by a patent monopoly for mines of gold, silver, copper, and mercury in many of the relevant counties, as well as a life-time exemption for the investors from all taxes raised by parliament (in those days, parliament was pretty much only assembled to legitimise the raising of new taxes).

February 2, 2020

Boeing and the kitchen sink

In the Continental Telegraph, Tim Worstall looks at the mess the new Boeing management has inherited and what they may need to do to be seen to be fixing it:

“Boeing 521 427”by pmbell64 is licensed under CC BY-SA 2.0

Which brings us to another piece of stock market wisdom, about trying to catch a falling knife. A dangerous occupation and the reference is to trying to call the bottom on some stock that has just had a disaster. At some point, surely, the tumble in price will stop and there will be a bounce. Well, yes, or perhaps maybe, for we must not forget that that proper bottom is that end of life – the bankruptcy – price of nothing. For everything that isn’t about to go bust then yes, there’s a price at which buying in the face of everyone else’s panic can be highly profitable. The question being, well, what is about to go bust? Toys R Us did, after all. Actually, so have quite a lot of retailers just recently. There was no above zero price at which it was sensible to buy in.

So, some stock crashes in price, should we buy in? After all, there is that phenomenon known as the dead cat bounce – anything will bounce at least once if you drop it from high enough. The question becomes one of, well, is this crash a result of something that can be reversed, or perhaps something that’s not going to be terminal for the organisation? Or is this just the start of that realisation process that the organisation is coming to the end of its life and going to that final resting place of a zero dollar valuation?

[…]

So, Boeing and the 737 Max. The changes in airframe had the unfortunate consequence of diving a couple of the planes into the ground. We’ve had a drip of stories about how the development process wasn’t all we would wish it to be. The FAA isn’t going to let it back up into the air until the summer at earliest. The Dreamliner seems to be having demand problems and, well, things aren’t looking good.

But is this the start of some spiral to zero? No, don’t be daft. Partly because the American government simply would not allow that. Boeing’s too much part of the backdrop of the US economy for that to be left to happen. The military business is also of significant value whatever happens to the civil aviation side. And of course the numbers we’re talking about here could be painful to stock holders – they are already in part of course – but at the very worst we’re looking at some tens of billions of problem here. That’s just not enough to drive a company Boeing’s size down to zero. Not in this decade at least, given that the only reasonable competition is Airbus. Global duopolies don’t end that way.

So, at this point there’s an argument to say that trying to catch that falling knife of the Boeing stock price might be worthwhile. So, when might that be? At which point another idea, kitchen sinking. This is when a new management team decides to make themselves look good by declaring how bad things had got under the previous one. Absolutely anything and everything that looks like, it might even smell of a problem in the future is taken out and declared. Provisions are made for this problem on this contract, for that problem that might occur over there, add a bit more and then heck, why not, double it! This has, assuming the company survives this balance sheet massacre, the obvious effect of making the new management team look good over the years. Not just because everything starts from this new low place. But also because many of those provisions – those over-provisions – won’t be needed and can be written back from reserves into the P&L.

December 12, 2019

QotD: Economic sophistication in ancient Greece

Let us take the case of Thales of Miletus (c620-c546 BC), one of the earliest of Greek philosophers. This story is told of him by Aristotle:

There is the anecdote of Thales the Milesian and his financial device, which involves a principle of universal application, but is attributed to him on account of his reputation for wisdom. He was reproached for his poverty, which was supposed to show that philosophy was of no use. According to the story, he knew by his skill in the stars while it was yet winter that there would be a great harvest of olives in the coming year; so, having a little money, he gave deposits for the use of all the olive-presses in Chios and Miletus, which he hired at a low price because no one bid against him. When the harvest-time came, and many were wanted all at once and of a sudden, he let them out at any rate which he pleased, and made a quantity of money.

Whether this is a true story about Thales, or even of market conditions in Miletus, is of no importance. What is important is the unvoiced background to the story. It cannot easily be taken as an instance of the predatory capitalism that Polanyi and Finley are willing to grant to the ancient world. Thales decided that there would be a good olive crop. He did not buy olive presses. Instead, he took out options on them. He and those who dealt with him, seem to have understood the nature of the deal made. When it turned out that Thales had predicted right, he seems to have had no trouble enforcing his contracts. This assumes a familiarity of the courts with such contracts, and a commercial state of mind either among the peoples of Chios and Miletus, or — assuming the story is apocryphal — among Aristotle’s Athenian audience.

Many of the Greek city states were considerable trading centres. They lack any detailed commercial histories. Certainly, no ancient writer thought it consistent with the dignity of history to describe their economic structure and the causes of their commercial greatness. But this casual anecdote must stand in place of the unwritten histories as evidence for thriving and sophisticated financial economies.

Sean Gabb, “Market Behaviour in the Ancient World: An Overview of the Debate”, 2008-05.

December 5, 2019

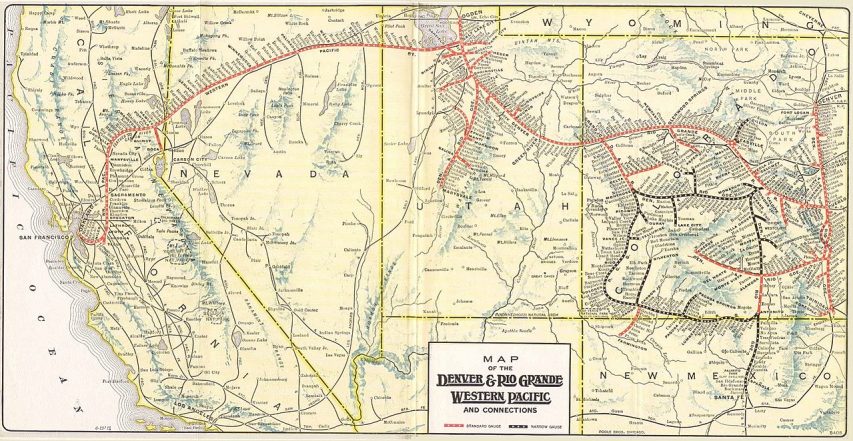

Fallen flag – the Denver & Rio Grande Western

The origins of the Denver & Rio Grande Western by Mark Hemphill for Trains magazine:

1914 route map of the Denver & Rio Grande Western and Western Pacific railroads.

Map via Wikimedia Commons

In the American tradition, a railroad is conceived by noble men for noble purposes: to develop a nation, or to connect small villages to the big city. The Denver & Rio Grande of 1870 was not that railroad. Much later, however, it came to serve an admirable public purpose, earn the appreciation of its shippers and passengers, and return a substantial profit.

The Rio Grande was conceived by former Union Brig. Gen. William Jackson Palmer. As surveyor of the Kansas Pacific (later in Union Pacific’s realm), Palmer saw the profit possibilities if you got there first and tied up the real estate. Palmer, apparently connecting dots on a map to appeal to British and Dutch investors, proposed the Denver & Rio Grande Railway to run south from Denver via El Paso, Texas, to Mexico City. There was no trade, nor prospect for such, between the two end points, but the proposal did attract sufficient capital to finish the first 75 miles to Colorado Springs in 1871.

William Jackson Palmer 1836-1909, founder of Colorado Springs, Colorado, builder of several railroads including the D&RGW.

Photograph circa 1870, photographer unknown, via Wikimedia Commons.Narrow-gauge origins

Palmer chose 3-foot gauge to save money, assessing that the real value lay in the real estate, not in railroad operation. At each new terminal, Palmer’s men corralled the land, then located the depot, profiting through a side company on land sales. Construction continued fitfully to Trinidad, Colo., 210 miles from Denver, by 1878. Above Trinidad, on the ascent to Raton Pass, Palmer’s engineers collided with the Santa Fe’s, who were building toward California. Realizing that a roundabout narrow-gauge competing with a point-to-point standard-gauge would serve neither the fare box nor the next prospectus, Palmer changed course, making D&RG a supply line to the gold and silver bonanzas blossoming all over Colorado and Utah. Thus the Rio Grande would look west, not south, and would plumb so many canyons in search of mineral wealth that it was a surprise to find one without its rails.Turning west at Pueblo, Colo., and outfighting the Santa Fe for the Royal Gorge of the Arkansas River — where there truly was room for only one track — D&RG entered Leadville, Colorado’s first world-class mining bonanza, in 1880. Three years later, it completed a Denver–Salt Lake City main line west from Salida, Colo., via Marshall Pass and the Black Canyon of the Gunnison River. The last-spike ceremony in the desert west of Green River, Utah, was low-key, lest anyone closely examine this rough, circuitous, and glacially slow “transcontinental.” Almost as an afterthought, D&RG added a third, standard-gauge rail from Denver to Pueblo, acknowledgment that once paralleled by a standard-gauge competitor, narrow-gauge was a death sentence.

New owners, new purpose

Palmer then began to exit. The company went bust, twice, in rapid succession. The new investors repurposed the railroad again. Instead of transient gold and silver, the new salvation would be coal. Thick bituminous seams in the Walsenburg-Trinidad field fed beehive coke ovens of a new steel mill near Pueblo and heated much of eastern Colorado and western Kansas and Nebraska.

July 27, 2019

The US Economy is About to Crash Hard | Between 2 Wars | 1929 Part 1 of 3

TimeGhost History

Published on 25 Jul 2019In 1929 it’s been nothing but growth for the US economy for years, at least if you judge by the New York Stock Exchange. But all that glitters is not gold, and when the gilding comes off this bubble it sinks like a lead ballon.

Join us on Patreon: https://www.patreon.com/TimeGhostHistory

Hosted by: Indy Neidell

Written by: Francis van Berkel

Produced and directed by: Spartacus Olsson and Astrid Deinhard

Executive Producers: Bodo Rittenauer, Astrid Deinhard, Indy Neidell, Spartacus Olsson

Creative Producer: Joram Appel

Post Production Director: Wieke Kapteijns

Edited by: Daniel Weiss

Sound Mix by: Iryna DulkaArchive by: Reuters/Screenocean http://www.screenocean.com

A TimeGhost chronological documentary produced by OnLion Entertainment GmbH

From the comments:

TimeGhost History

3 hours ago (edited)

Now… ladies and gents – this is not a video about 2019 and we are not making any political statements. We know that some of you love making parallels between the present day and historical events. Although we can learn from history, try to remember that the circumstances were very different. Others among you feel it appropriate to extend partisan conflicts backwards and make out our videos, or events in the videos as partisan statements or issues. First of all we simply don’t do that, we just relate the events and the circumstances as factually as possible with the best possible sources. Second of all it is pointless to look for the 2019 partisan left/right divide according to party lines in events that happened 90 years ago. There’s just no comparison as both reality, and political parties have gone through so much change that the members of the same party, from today and then would probably disagree so vehemently on so many points the they would not even understand each other. So please, try your best to not go off on partisan rants, as it distracts form the actual historical issues at hand

July 8, 2019

Bitcoin and its successors lack one thing that Libra has

Andrew Coyne on cryptocurrencies:

“Bitcoin – from WSJ”by MarkGregory007 is licensed under CC BY-NC-SA 2.0

Sign of the times: the convenience store in my block of mid-town Toronto has installed, in addition to the usual fare of milk, cigarettes and magazines, an ATM dispensing bitcoins. Customers insert their debit cards and buy bitcoin, which they can then use to … to …

To do what, exactly, that they could not do with regular money? Bitcoin, the original cryptocurrency — there are now dozens of competitors — has always struck me as a solution in search of a problem. Its chief selling point, the anonymity made possible by its system of ultra-encrypted peer-to-peer transactions, unmediated by the banking system and beyond reach of the regulators, would seem of most appeal to two groups: crooks and cranks.

Oh, and a third: speculators. The price of cryptocurrencies has tended to fluctuate wildly — having fallen to a third of its peak against the U.S. dollar last year, Bitcoin has tripled in value so far in 2019. Cryptocurrencies are unlikely to achieve widespread use as mediums of exchange so long as they fail to fulfil one of money’s other primary functions, as stores of value.

The Wild West reputation the privately issued currencies have acquired — one of the most popular, Dogecoin, was invented by a 26-year-old Australian in 2013 as a joke — will be one of the early hurdles confronting Facebook’s recent entry into the field. The company hopes its 2.4 billion users will soon be buying goods and services from each other with Libra, as the proposed digital currency is called, wherever on earth either party may happen to be.

And yet Libra differs from Bitcoin and its ilk in several important ways. One, while it makes use of the same blockchain encryption technology as Bitcoin to ensure the security of payments, it is not based on the same anarchic premise.

In contrast to Bitcoin’s unsupervised, massively distributed, “permissionless” network, Libra will operate, at least initially, via Facebook’s Messenger and WhatsApp platforms, which are very much subject to its control. The company, and the others it has recruited as partners — names like Visa, Mastercard, and PayPal — are likewise highly visible targets of regulatory oversight, and indeed have signalled they intend to work with national banking regulators.

July 3, 2019

QotD: Elon Musk as a modern-day Ferdinand DeLesseps

I used to love Elon like everyone else. I still think that having four or five billionaires in a space race against each other is finally the world I thought I was going to get growing up reading Heinlein. The Tesla Model S was probably one of the most revolutionary cars of the last 50 years. But he lost me when he committed outright fraud in the Solar City – Tesla deal and since then have only become more skeptical about he and Tesla.

I sort of laugh when folks tell me that really smart successful rich people believe in Tesla. You mean like James Murdoch, on the board of Tesla and who also was lost his entire investment in Theranos? Or like Larry Ellison, an adviser and fan of Elizabeth Holmes who invested $1 billion in Tesla just 6 months ago and has already lost 40% of it? The window on this is probably closing, but over the last 10 years if you wanted to get Silicon Valley investors to throw a lot of money at you, find a traditional bricks and mortar business and devise a story in which you take that industry and convert its economics to that of the networked software world (see: Uber, WeWork, Tesla, and even Theranos in some of its strategic pivots).

Or how about true millennials and Elon Musk? Name a wealthy millennial supporter of Elon Musk and Tesla and I can bet you any amount of money they have not looked at Tesla’s balance sheet or cash flow or the details of its global demand trends. They have not thought about its dealership strategy or manufacturing strategy and the cash flow implications of these. They just like what Elon says. It sounds big and visionary. They buy into Elon’s formulation that he is saving the environment and everyone opposed to him is in a cabal with big oil (ignoring the fact that Elon routinely uses his Gulfstream VI to commute distances less than 60 miles). So saying that rich millenials adore Elon is effectively saying that they want to be associated with the same things Elon says he is for — the environment and space travel et al.

Elon Musk is Ferdinand DeLesseps. He is PT Barnum. He is Elizabeth Holmes. He is the pied piper. He is fabulous at spinning visions and making them sound science-y. But he is not Tony Stark. There is a phenomenon with Elon Musk that everyone thinks he is brilliant until they hear him speak about something about which they have domain knowledge, and then they realize he is full of sh*t. For example, no one who knows anything about transportation or physics or basic engineering has thought his Boring Company and Hyperloop make any sense at all. His ideas would have been great cover stories for Popular Mechanics in the 1970’s, wowing 13-year-old boys like me with pictures of mile-long cargo blimps and flying RV’s. He is like a Marvel movie that spouts science that is just believable-enough sounding that it moves the plot along but does not stand up to any scrutiny.

All of this would be harmless if he was not running a public company. I don’t really care about the rich folks who were duped by Elizabeth Holmes, but hundreds of thousands of small millenial investors who have totally bought into the Elon hype are literally putting their last dollar into Tesla, and sometimes borrowing more. Tesla shorts often laugh at these folks on Twitter, calling them “bagholders,” but it is a tragedy. Unless Tesla finds a sugar daddy sucker, and the odds of that are getting longer, I think it is going to end badly for many of these investors.

As a disclosure, I have been short Tesla via puts for a while now. It you really want to understand Elon, the best book I can recommend is The Path Between The Seas about the building of the Panama Canal. First, it is a great book you should read no matter what. And second, Ferdinand DeLesseps is the best analog I can find for Musk.

Warren Meyer, “People Who Express Opinions Outside of their Domain Seldom Have Really Looked into it Much”, Coyote Blog, 2019-05-28.

June 21, 2019

Making America Great Again | Between 2 Wars | 1927 Part 1 of 2

TimeGhost History

Published on 20 Jun 2019In 1927 the US is finally back to its pre-WWI economic greatness, at least measured by the stock market. But all is not well with the finances in the land of the free and home of the brave.

Join us on Patreon: https://www.patreon.com/TimeGhostHistory

Hosted by: Indy Neidell

Written by: Francis van Berkel and Spartacus Olsson

Research by: Francis van Berkel

Directed and Produced by: Spartacus Olsson and Astrid Deinhard

Executive Producers: Bodo Rittenauer, Astrid Deinhard, Indy Neidell, Spartacus Olsson

Creative Producer: Joram Appel

Post Production Director: Wieke Kapteijns

Edited by: Wieke KapteijnsArchive by Reuters/Screenocean http://www.screenocean.com

A TimeGhost chronological documentary produced by OnLion Entertainment GmbH

From the comments:

TimeGhost History

1 day ago (edited)

So… before you all go and get your panties in a bunch about the title. 1. This video is literally abut the effort to make America great again in the 1920s. 2. Although Donald Trump appropriated that expression in 2016, it has been used by two Presidents before him; Ronald Reagan and Bill Clinton. 3. It has even been used in other political contexts both liberal and conservative as early as in the 1940s. So, as a historical reference to US history, not a political value comment, it is highly relevant to this episode. On that note, our heartfelt thanks to our TimeGhost Army that keeps the wheels attached to the TimeGhost vehicle and keeps us rolling forward into the past. If you’re not already a member, you can join here: https://www.patreon.com/TimeGhostHistory or here: https://timeghost.tv

April 9, 2019

Blue’s Dumb History Tales

Overly Sarcastic Productions

Published on 8 Mar 2019Please check out That Works for the best blacksmithing on YouTube: https://goo.gl/vXsuFt

What do you get when you cross a month that has 5 Fridays with a historian who can’t do math? This nonsense, apparently.

PATREON: https://www.patreon.com/OSP

March 22, 2019

Understanding the Great Depression

Marginal Revolution University

Published on 23 May 2017In this video, we examine the causes behind the Great Depression with the help of the aggregate demand-aggregate supply model.

In 1929, the stock market crashed and an air of pessimism swept across America — making bank depositors nervous. What would you do if you thought your money might not be safe with the bank? You’d probably want it back in your own hands. What happened next? A run on the banks.

Along with the Stock Market Crash of 1929, it’s one of the iconic moments of the early days of Great Depression. However, the Great Depression was an incredibly complex downturn in which the economy experienced a series of aggregate demand shocks. By the end of this video, you’ll walk away with a better understanding of the many factors behind the Great Depression and how to apply the AD-AS model to a real-world scenario.

January 27, 2019

Some reasons to be bearish on Tesla’s future

At Coyote Blog, Warren Meyer climbs back onto one of his favourite hobby horses:

Yes, I am like an addict on Tesla but I find the company absolutely fascinating. Books and HBS case studies will be written on this saga some day (a couple are being written right now but seem to be headed for Musk hagiography rather than a real accounting ala business classics like Barbarians at the Gate or Bad Blood).

I still stand by my past thoughts here, where I predicted in advance of results that 3Q2018 was probably going to be Tesla’s high water mark, and explained the reasons why. I won’t go into them all. There are more than one. But I do want to give an update on one of them, which is the growth and investment story.

First, I want to explain that I have nothing against electric vehicles. I actually have solar panels on my roof and a deposit down on an EV, though it is months away from being available. What Tesla bulls don’t really understand about the short position on Tesla is that most of us don’t hate on the concept — I respect them for really bootstrapping the mass EV market into existence. If they were valued in the market at five or even ten billion dollars, you would not hear a peep out of me. But they are valued (depending on the day, it is a volatile stock) between $55 to $65 billion.

The difference in valuation is entirely due to the charisma and relentless promotion by the 21st century’s PT Barnum — Elon Musk. I used to get super excited by Musk as well, until two things happened. One, he committed what I consider outright fraud in bailing out friends and family by getting Tesla to buy out SolarCity when SolarCity was days or weeks from falling apart. And two, he started talking about things I know about and I realized he was totally full of sh*t. That is a common reaction from people I read about Musk — “I found him totally spellbinding until he was discussing something I am an expert in, and I then realized he was a fraud.”

Elon Musk spins great technology visions. Like Popular Mechanics magazine covers from the sixties and seventies (e.g. a flying RV! a mile long blimp will change logging!) he spins exciting visions that geeky males in particular resonate with. Long time readers will know I identify as one of this tribe — my most lamented two lost products in the marketplace are Omni Magazine and the Firefly TV series. So I see his appeal, but I have also seen his BS — something I think a lot more people have caught on to after his embarrassing Boring Company tunnel reveal.

December 2, 2018

QotD: There’s investment and then there’s “public investment”

In 2003, the Organisation for Economic Cooperation and Development published a paper on the ‘sources of economic growth in OECD countries’ between 1971 and 1998 and found, to its surprise, that whereas privately funded research and development stimulated economic growth, publicly funded research had no economic impact whatsoever. None. This earthshaking result has never been challenged or debunked. It is so inconvenient to the argument that science needs public funding that it is ignored.

November 30, 2018

England: South Sea Bubble – Lies – Extra History

Extra Credits

Published on 9 May 2015Support us on Patreon! http://bit.ly/EHPatreon

____________No historian is perfect, so it’s important we acknowledge our mistakes where we find them (with the help of our viewers, no less)! After we clear up some discrepancies that emerged during the South Sea Bubble series, we turn to answering some common questions that came up during this series on economic history. In a period where financial masterminds like John Blunt engaged in trickery meant to confuse other people and hide his real activities, it’s no wonder that many viewers had questions about what insider trading is and how Blunt could endlessly inflate stock prices for his unprofitable company. This is a history show, but we do our best to explain! As a bonus, James also reads Robert Knight’s letter to Parliament on the eve of his illegal flight and tells some cool stories about Robert “It was Me” Walpole.

September 27, 2018

Revising the accredited investor rules

Alex Tabarrok summarizes a suggestion from Matt Levine on how to improve the rules for accredited investors:

Matt Levine has an excellent piece on accredited investor rules and his alternative:

- Anyone can also invest in any other dumb investment; you just have to go to the local office of the SEC and get a Certificate of Dumb Investment. (Anyone who sells dumb non-approved investments without requiring this certificate from buyers goes to prison.)

- To get that certificate, you sign a form. The form is one page with a lot of white space. It says in very large letters: “I want to buy a dumb investment. I understand that the person selling it will almost certainly steal all my money and that I would almost certainly be better off just buying index funds, but I want to do this dumb thing, anyway. I agree that I will never, under any circumstances, complain to anyone when this investment inevitably goes wrong. I understand that violating this agreement is a felony.”

- Then you take the form to an SEC employee, who slaps you hard across the face and says “Really???” And if you reply “Yes, really,” then she gives you the certificate.

- Then you bring the certificate to the seller and you can buy whatever dumb thing he is selling.