Michael Shellenberger on the breathtaking hypocrisy of first world nations’ rhetoric toward developing countries’ attempts to improve their domestic energy production:

What’s worse, global elites are demanding that poor nations in the global south forgo fossil fuels, including natural gas, the cleanest fossil fuel, at a time of the worst energy crisis in modern history. None of this has stopped European nations from seeking natural gas to import from Africa for their own use.

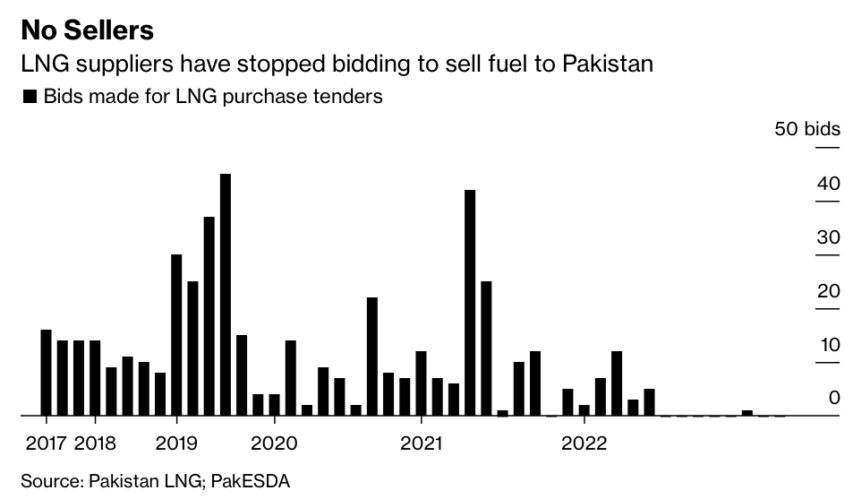

Rich nations have for years demanded that India and Pakistan not burn coal. But now, Europe is bidding up the global price of liquified natural gas (LNG), leaving Pakistan forced to ration limited natural gas supplies this winter because Europeans — the same ones demanding Pakistan not burn coal — have bid up the price of natural gas, making it unaffordable.

At last year’s climate talks, 20 nations promised to stop all funding for fossil fuel projects abroad. Germany paid South Africa $800 million to promise not to burn coal. Since then, Germany’s imports of coal have increased eight-fold. As for India, it will need to build 10 to 20 full-sized (28 gigawatts) coal-fired power plants over the next eight years to meet a doubling of electricity demand.

This is climate imperialism. Rich nations are only agreeing to help poor nations so long as they use energy sources that cannot lift themselves out of poverty.

Consider the case of Norway, Europe’s second-largest gas supplier after Russia. Last year it agreed to increase natural gas exports by 2 billion cubic meters, in order to alleviate energy shortages. At the same time, Norway is working to prevent the world’s poorest nations from producing their own natural gas by lobbying the World Bank to end its financing of natural gas projects in Africa.

The IMF wants to hold hostage $50 billion as part of a “Resilience and Sustainability Trust” that will demand nations give up fossil fuels and thus their chance at developing. Such efforts are working. On Thursday, South Africa received $600 million in “climate loans” from French and German development banks that can only be used for renewables. The Europeans hope to shift the $7.6 billion currently being invested by South Africa in electricity infrastructure away from coal and into renewables.

Celebrities and global leaders say they care about the poor. In 2019, the Duchess of Sussex, Meghan Markle, Prince Harry’s wife, told a group of African women, “I am here with you, and I am here FOR you … as a woman of color.” Why, then, are they demanding climate action on their backs?