Sean Gabb explains why even libertarians need to consider the non-state power in the hands of corporations that can — and does — force people out of their jobs, their homes, and even deprive them of the ability to communicate or to access financial services merely for expressing unpopular opinions. As I said in a different venue, it’s a short step from “no fly lists” to “no eat lists”, especially when the enforcing entity is a nominally private organization:

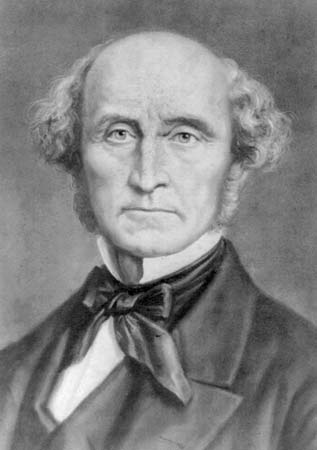

The old pressures to conform were wrong. So are the new. And they are wrong simply because they are pressures to conform. I find myself at last appreciating a part of Mill’s essay On Liberty for which I never used to have much time. Until recently, I would insist that the only real oppression was by the State: all else was the working of private choice. If the authorities fined a man £5 for having sex with another man, that was outrageous tyranny. If his tastes became public knowledge, and he was unable to find work, that was merely unfortunate. This is, I still believe, essentially true. Indeed, I could argue that, without a State having centralised and corporatised powers of discrimination that ought to be widely distributed, there would be no problem — or there would be a problem that was bearable. But these powers were centralised and corporatised a long time ago. They are now being used to achieve a uniformity of opinion outside the home in which the formal organs of compulsion have no obvious part. This is not the “tyranny of the majority” that worried Mill. I find it inconceivable that anything close to a majority could believe the insane drivel pouring from the regime media. Neither, though, is it the kind of oppression against which liberal bills of rights have traditionally been written. Because of this —

when society is itself the tyrant …, its means of tyrannising are not restricted to the acts which it may do by the hands of its political functionaries. Society can and does execute its own mandates: and if it issues wrong mandates instead of right, or any mandates at all in things with which it ought not to meddle, it practises a social tyranny more formidable than many kinds of political oppression, since, though not usually upheld by such extreme penalties, it leaves fewer means of escape, penetrating much more deeply into the details of life, and enslaving the soul itself. Protection, therefore, against the tyranny of the magistrate is not enough: there needs protection also against the tyranny of the prevailing opinion and feeling; against the tendency of society to impose, by other means than civil penalties, its own ideas and practices as rules of conduct on those who dissent from them …

(J.S. Mill On Liberty, 1859, “Introductory“)

We need protection indeed. But the protection we need is not yet another law telling the police to leave dissidents alone. We already have a stack of these, and they are protections against a threat that largely does not exist. The answer, I suggest, is an amendment to the anti-discrimination laws to outlaw discrimination on the grounds of what may be loosely called political opinion.

I say hardly anyone read my original essay. Sadly, most of those who did read it stand in the more wooden reaches of the libertarian movement, and these set up a cry that I had become a Communist. I was suggesting that private organisations should be coerced in their choices of whom and whom not to employ, and even in their choices of customer and supplier. I had abandoned the non-aggression principle. Here, briefly expressed, is my answer to these claims.

I run the Centre for Ancient Studies. This provides a range of tuition services in Greek and Latin. It is a sole tradership. As such, I reserve the unconditional right to decide what services I offer and to whom. If I dislike the colour of your face, or the status of your foreskin, or your tastes in love, or anything else that I may think relevant, it should be my right not to do business with you. It may be that only a fool turns away customers with money to spend, and I am not that sort of a fool. Even so, I do claim at least the theoretical right, and I ground it on my right to do as I please with my own. But I claim these rights as a human individual. A limited company is not a human individual. Whatever entrepreneurship may exist in them, these companies are artificial persons and creatures of the State. Their owners have the privilege of limited liability. That is, they have the right, in the event of insolvency, not to pay the debts of a company if these are greater than the assets of the company. If this were not a valuable right, there would not be so many limited companies. There are almost no large companies, and none lasting more than a single generation, that do not have limited liability.

This being so, limited companies benefit from a grant of privilege from the State, and are legitimate subjects of regulation by the State for as long as they are receipt of this privilege. No doubt, some forms of state regulation are bad in their objects, or bad as regards the means to their objects. But regulation is not in itself an aggression by the State. It follows that, whether or not we can get it, libertarians should not feel barred from demanding laws to prevent limited companies from discriminating against their employees on the grounds of political opinion, and to require them to do business with customers and suppliers regardless of political opinion.

I appreciate that I am asking for more than the regulation of limited companies. The anti-discrimination laws we have make no distinction between incorporated and unincorporated associations. Even so, the extension of these laws to cover political opinion would mainly affect only the larger limited companies. At the same time, there is an obvious and overriding public interest in the protection of political opinion. People are now scared to speak their minds. Whether intended or just revealed, this is part of the strategy. The reason why the collapse of both freedom and tradition is gathering pace is because no one dares stand up and protest. In the absence of protest, everything will carry on as it is. Given a restored right of protest, there is a chance of stopping the collapse. The only way to lift the blanket of fear that now lies over all but approved opinion is somehow or other to get a law making it clear that no one who speaks his mind can be loaded with shadow punishments.

“Somehow or other!” In a sense, I am making a fool of myself. I am asking the politicians to make a law against what they themselves may not be doing, but that has no effect on their main reason for being in politics, which is to fill their pockets. I am asking them to take on the entire mass of the non-elected Establishment. I am asking a lot of these people. On the other hand, the politicians still need to be elected, and that was the weak point in the Establishment’s plan to stay in the European Union. We had to spend four years voting and revoting, but we did eventually get what we wanted. It is conceivable that, if enough of us call loudly enough for protection, some kind of protection will be granted.

Short of that, we are lost.