… (related: Scott examined some of the same data about Holocaust survival rates as Eichmann In Jerusalem, but made them make a lot more sense: the greater the legibility of the state, the worse for the Jews. One reason Jewish survival in the Netherlands was so low was because the Netherlands had a very accurate census of how many Jews there were and where they lived; sometimes officials saved Jews by literally burning census records).

Centralized government projects promoting legibility have always been a two-steps-forward, one-step back sort of thing. The government very gradually expands its reach near the capital where its power is strongest, to peasants whom it knows will try to thwart it as soon as its back is turned, and then if its decrees survive it pushes outward toward the hinterlands.

Scott describes the spread of surnames. Peasants didn’t like permanent surnames. Their own system was quite reasonable for them: John the baker was John Baker, John the blacksmith was John Smith, John who lived under the hill was John Underhill, John who was really short was John Short. The same person might be John Smith and John Underhill in different contexts, where his status as a blacksmith or place of origin was more important.

But the government insisted on giving everyone a single permanent name, unique for the village, and tracking who was in the same family as whom. Resistance was intense:

What evidence we have suggests that second names of any kind became rare as distance from the state’s fiscal reach increased. Whereas one-third of the housholds in Florence declared a second name, the proportion dropped to one-fifth for secondary towns and to one-tenth in the countryside. It was not until the seventeenth century that family names crystallized in the most remote and poorest areas of Tuscany – the areas that would have had the least contact with officialdom. […]

State naming practices, like state mapping practices, were inevitably associated with taxes (labor, military service, grain, revenue) and hence aroused popular resistance. The great English peasant rising of 1381 (often called the Wat Tyler Rebellion) is attributed to an unprecedented decade of registration and assessments of poll taxes. For English as well as for Tuscan peasants, a census of all adult males could not but appear ominous, if not ruinous.

Scott Alexander, “Book Review: Seeing Like a State”, Slate Star Codex, 2017-03-16.

March 10, 2019

QotD: Surnames and taxes

February 25, 2019

February 18, 2019

Mis-measuring inequality

Tim Worstall explains why any protest in a western country about “inequality” is probably bogus from the get-go:

Their opening line, their justification:

We live in an age of astonishing inequality.

No, we don’t. We live in an age of astonishing and increasing equality. Thus any set of policies, any series of analysis, that flows from this misunderstanding of reality is going to be wrong.

And that’s all we really need to know about it all.

The problem is that their measurements – the ones they’re paying attention to – of inequality just aren’t the useful ones, the ones we’re interested in. They’re usually pre-tax, pre-benefits. They’re always pre-government supplied services. And they never, ever, look at the thing we’re actually interested in, inequality of living standards.

To give an example, the Trades Union Congress did a calculation a few years back looking at top 10% households in the UK and bottom 10%. They took the average of each decile – so, the average of the top 10% households, the average of the bottom. Then they looked at the ratio between them.

The top 10% gain some 12 times the market income of the bottom 10%. Now take account of taxes and benefits. Then add in the effects of the NHS, free education for all children and so on. Government services. We end up with a ratio of 4 to 1. Life as it’s actually lived gives the top 10% four times the final income – income being defined by consumption of course – of the bottom 10%.

That’s not a high level of inequality.

February 13, 2019

The origins of the word “loot”

William Dalrymple wrote about the Honourable East India Company for the Guardian a few years back, including the way the word “loot” entered common English usage:

The Mughal emperor Shah Alam hands a scroll to Robert Clive, the governor of Bengal, which transferred tax collecting rights in Bengal, Bihar and Orissa to the East India Company, August 1765.

Oil painting by Benjamin West (1738-1820) via Wikimedia Commons.

One of the very first Indian words to enter the English language was the Hindustani slang for plunder: “loot”. According to the Oxford English Dictionary, this word was rarely heard outside the plains of north India until the late 18th century, when it suddenly became a common term across Britain. To understand how and why it took root and flourished in so distant a landscape, one need only visit Powis Castle.

The last hereditary Welsh prince, Owain Gruffydd ap Gwenwynwyn, built Powis castle as a craggy fort in the 13th century; the estate was his reward for abandoning Wales to the rule of the English monarchy. But its most spectacular treasures date from a much later period of English conquest and appropriation: Powis is simply awash with loot from India, room after room of imperial plunder, extracted by the East India Company in the 18th century.

There are more Mughal artefacts stacked in this private house in the Welsh countryside than are on display at any one place in India – even the National Museum in Delhi. The riches include hookahs of burnished gold inlaid with empurpled ebony; superbly inscribed spinels and jewelled daggers; gleaming rubies the colour of pigeon’s blood and scatterings of lizard-green emeralds. There are talwars set with yellow topaz, ornaments of jade and ivory; silken hangings, statues of Hindu gods and coats of elephant armour.

Such is the dazzle of these treasures that, as a visitor last summer, I nearly missed the huge framed canvas that explains how they came to be here. The picture hangs in the shadows at the top of a dark, oak-panelled staircase. It is not a masterpiece, but it does repay close study. An effete Indian prince, wearing cloth of gold, sits high on his throne under a silken canopy. On his left stand scimitar and spear carrying officers from his own army; to his right, a group of powdered and periwigged Georgian gentlemen. The prince is eagerly thrusting a scroll into the hands of a statesmanlike, slightly overweight Englishman in a red frock coat.

The painting shows a scene from August 1765, when the young Mughal emperor Shah Alam, exiled from Delhi and defeated by East India Company troops, was forced into what we would now call an act of involuntary privatisation. The scroll is an order to dismiss his own Mughal revenue officials in Bengal, Bihar and Orissa, and replace them with a set of English traders appointed by Robert Clive – the new governor of Bengal – and the directors of the EIC, who the document describes as “the high and mighty, the noblest of exalted nobles, the chief of illustrious warriors, our faithful servants and sincere well-wishers, worthy of our royal favours, the English Company”. The collecting of Mughal taxes was henceforth subcontracted to a powerful multinational corporation – whose revenue-collecting operations were protected by its own private army.

It was at this moment that the East India Company (EIC) ceased to be a conventional corporation, trading and silks and spices, and became something much more unusual. Within a few years, 250 company clerks backed by the military force of 20,000 locally recruited Indian soldiers had become the effective rulers of Bengal. An international corporation was transforming itself into an aggressive colonial power.

Using its rapidly growing security force – its army had grown to 260,000 men by 1803 – it swiftly subdued and seized an entire subcontinent. Astonishingly, this took less than half a century. The first serious territorial conquests began in Bengal in 1756; 47 years later, the company’s reach extended as far north as the Mughal capital of Delhi, and almost all of India south of that city was by then effectively ruled from a boardroom in the City of London. “What honour is left to us?” asked a Mughal official named Narayan Singh, shortly after 1765, “when we have to take orders from a handful of traders who have not yet learned to wash their bottoms?”

February 9, 2019

QotD: The global utility of a national carbon tax

James Griffin [of] Texas A&M’s Bush School of Government […] is a carbon-tax advocate who begins by acknowledging what everyone knows but hardly anyone says: that, absent subsidies and mandates, renewables and so-called green energy could not begin to compete with oil and coal, and the market would be entirely dominated by fossil fuels.

The carbon tax is one of those policy ideas that is largely sound in theory but runs up hard upon the shoals of reality. I am not convinced that a national carbon tax would change U.S. consumer behavior to such an extent that it would have positive effects on what is after all a global phenomenon, nor am I convinced that the U.S. government would use the revenue from a carbon tax to invest in real climate-change mitigation. That makes the carbon tax a very expensive way of demonstrating good intentions, which does not seem to me like a very fruitful way to work. And compared to more direct programs, such as clearing the way for the development of new, modern, nuclear-power facilities, a carbon tax is even less attractive.

Kevin D. Williamson, “The Case for a Carbon Tax”, National Review, 2017-03-08.

February 5, 2019

December 1, 2018

CAFE killed the North American passenger car

The move by GM to close many of its remaining car manufacturing facilities in Canada and the US is a belated rational response — not to the market, but to the ways government action has distorted the market. In the Financial Post, Lawrence Solomon explains how, step-by-step, the CAFE rules have shifted drivers out of sedans and wagons and into minivans, pickup trucks, and SUVs:

Before the U.S. government introduced Corporate Average Fuel Economy (CAFE) standards to increase the distance cars could travel per gallon of gas, sedans and full-size station wagons were popular and SUVs were unknown. CAFE, which effectively governed the entire North American market thanks to the Canada-U.S. Auto Pact, incented manufacturers to artificially raise the cost of large passenger cars in order to favour smaller, more fuel-efficient vehicles. It soon claimed its first victim: the full-size station wagon, whose flexible interior accommodated both passenger and cargo needs, and which, at its peak, came in 62 models to satisfy different tastes.

But, although CAFE priced the station wagon out of the market, the market still demanded a vehicle that offered its flexibility. Enter Lee Iacocca, the chairman of Chrysler, who helped develop the minivan and convinced the U.S. government to deem it a truck rather than a passenger vehicle, thus exempting it from the strict CAFE standards that killed the station wagon. The minivan took off — the first 1984 model, built in Windsor, sold 209,000 its first year — followed by the SUV, which also was deemed a truck rather than a passenger vehicle. By 2000, the passenger car had less than half the market. Today it accounts for only about a third.

CAFE standards didn’t only claim certain car models as victims, they also made the whole industry a victim by making it dependent on government whims and then handouts. CAFE also distorted the market by creating credits for ethanol and electric vehicles and by creating a lobbyist’s dream through ever-changing regulations that led car manufacturers to continually game the system to favour their own vehicles over those of competitors.

Perversely, by improving mileage, CAFE also increased distances travelled and emissions of pollutants such as carbon monoxide and nitrogen oxides. The 2025 CAFE targets (since cancelled by President Trump) ran to almost 2,000 pages and were estimated to add an average of US$1,946 to the cost of a vehicle. Tax loopholes also helped accelerate SUV sales — like all light trucks, they were exempted from the gas-guzzler’s excise tax and also given preferential tax treatment as business vehicles.

November 24, 2018

November 22, 2018

This is why tax cuts are always criticized for benefitting the rich

Rebecca Zeines and Jon Miltimore explain why newspaper headlines and TV anchors always seem to decry any tax cut as being disproportionally beneficial to the wealthy:

But crucial facts are often missing in these articles. As a recent Bloomberg piece explained, two key points tend to be overlooked in articles written by media outlets and progressive tax proponents:

- The top 1 percent paid a greater share of individual income taxes (37.3 percent) than the bottom 90 percent combined (30.5 percent).

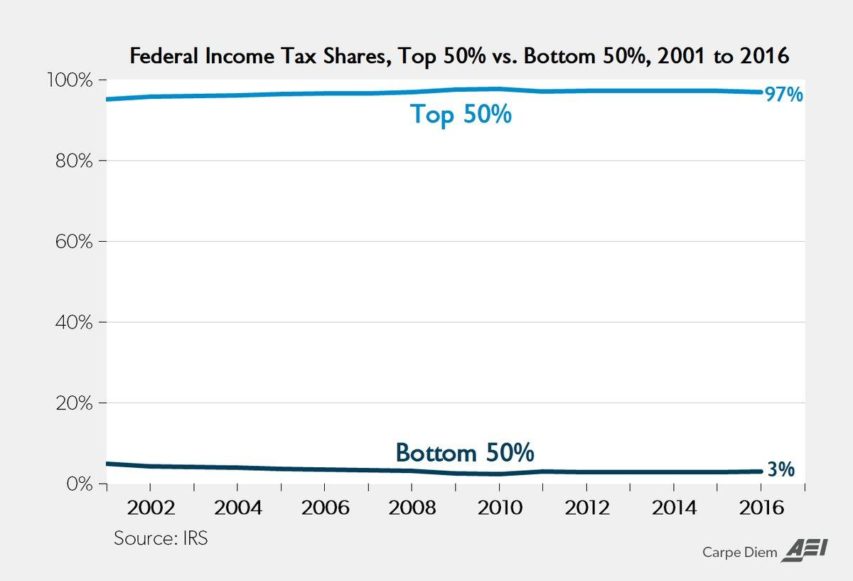

- The top 50 percent of all taxpayers paid 97 percent of total individual income taxes.

These numbers date back to 2016 but remain applicable in 2018.

These data show that the bottom 50 percent of US taxpayers paid just 3 percent of total income taxes in 2016, while the top 50 percent accounted for 97 percent.

Here is a wonderful visual representation of this dynamic, courtesy of Mark Perry of the American Enterprise Institute:

There is a clear correlation between economic freedom and prosperity, and tax climate is a key component of economic freedom.

Economist Dan Mitchell explains it best: Heavy taxation destroys entrepreneurship. The more money is taxed out of the private sector, the less is available for investment, development, and worker compensation (recall that after Trump’s tax bill was enacted, many businesses raised workers’ wages and offered bonuses).

Efforts to improve America’s tax climate are consistently and predictably derided as tax cuts for “the rich.” But, as the above diagram shows, it’s quite impossible to offer people a comparatively huge tax cut when they’re paying a comparatively tiny percentage of income taxes.

November 16, 2018

The political wrangles ahead over the federal carbon tax

Andrew Coyne — for once not beating the drum for electoral reform — discusses the challenge facing the federal government in the wake of provincial resistance to their carbon tax plans:

But the real test, of course, is yet to come. The provinces cannot stop the tax on their own. The court challenges are likely to fail. Provinces that refuse to implement carbon pricing will simply find the federal “backstop” tax imposed in its place. It is the election that will decide the issue, not duelling governments. Or so Conservatives hope.

Certainly there are abundant grounds to doubt the political wisdom of the Liberal plan. A tax, or anything that resembles it, would be a hard enough sell on its own. But a tax in aid of a vast international plan to save the earth from a scourge that remains imperceptible to most voters, to which Canada has contributed little and against which Canada can have little impact, while countries whose actions would be decisive remain inert? Good luck.

What seems clear is that voters’ support for carbon pricing is shallow and tentative. The Conservative strategist who chortled to the National Post that the Liberals are asking Canadians “to vote with their hearts, not their wallets” — an impossibility, he meant — was correctly cynical. Just because people want to save the planet doesn’t mean they want to pay for it.

The best way to read the public’s mood is in the positions of the political parties, who are in their various ways each trying to assure them that it won’t cost them a dime. The Liberal version of this is to promise to rebate the extra cost of the federal tax to consumers — indeed, they pledge, 70 per cent of households will make a profit on the exchange.

The Conservatives have been less forthcoming, but it would appear their plan is to hide the cost, substituting regulations, whose effects are largely invisible to consumers, for the all-too-visible tax at the pump. Here, too, I suspect they may have a better (i.e. more cynical) read on popular opinion. The public often prefer to have the costs of government hidden from them, even if they know they are paying them — even if they know they are paying more this way, as indeed they are in this case. Do what you want to us, they seem to say, just don’t rub our faces in it.

So I would be skeptical about polls showing majority support for the federal plan: 54 per cent, according to Angus Reid, while Abacus finds 75 per cent would either support or at least accept it (versus 24 per cent opposed). These were taken shortly after the announcement of the federal rebates. Yet it is far from evident the rebates will still register with people a year from now. Indeed, the Conservatives barely paused to acknowledge them as inadequate before going on to pretend they had never been mentioned.

November 15, 2018

Amazon’s HQ$2Bn decision

If you had any doubt that the Amazon HQ2 competition was about anything other than trolling for economic bribes, this should banish the thought:

Amazon is getting some prime real estate.

In exchange for more than $2 billion in economic incentives, the online shopping giant will locate a pair of new corporate headquarters just across the Potomac River from Washington, D.C., and just across the East River from Manhattan. Tuesday’s much-anticipated announcement of the locations for Amazon’s “HQ2” also included details — which had previously been kept from the public — about the economic incentives that successfully lured the Seattle-based firm to the east coast’s political and economic hubs.

Amazon says it will invest $5 billion and create more than 50,000 jobs across the two new locations, with at least 25,000 employees at each of its new corporate campuses, to be located in Virginia’s Crystal City and New York’s Long Island City. Nashville wins a consolation prize: a new supply chain and logistics center that promises 5,000 jobs in exchange for $102 million in economic incentives.

In New York, Amazon will receive $1.2 billion in refundable tax credits through a state-level economic development program and a cash grant of $325 million that’s tied to the construction of new buildings at the Long Island City location over the next 10 years. In Virginia, the state is ponying up $573 million in tax breaks tied to the creation of 25,000 jobs, and the city of Arlington will provide a cash grant of $23 million over 15 years funded by an existing tax on hotel rooms.

Yes, the numbers are staggering — New York state’s pledge of $1.52 billion for 25,000 jobs works out to more than $60,000 in taxpayer support per new job created — but Amazon appears to have selected New York and the D.C. area based on more than just how many zeroes local officials agreed to put on the giant cardboard check.

After all, New Jersey offered Amazon $5 billion (with another $2 billion from Newark), and Maryland offered $8.5 billion. Yet Amazon passed them both over to pick their neighbors.

October 26, 2018

Economist Jack Mintz dis-claims credit for the Liberals’ carbon tax scheme

Everybody likes to be recognized for their work, but Jack Mintz wants to delineate where his original plan and the actual carbon tax scheme implemented by the federal government diverge:

I continue to maintain, as I have all these years, that the best way to implement carbon taxes is to use the revenues to reduce harmful corporate and personal taxes (I’ve since added land-transfer taxes to the original list). This includes removing anti-competitive levies while also providing support for low-income households to cope with higher electricity, heating and transportation costs.

However, what was unveiled Tuesday by the federal Liberal government in its carbon-pricing plan fails to achieve what I would have argued to be an ideal carbon policy. What is being advertised as a climate plan for provinces that fail to follow Ottawa’s carbon-tax directives — currently New Brunswick, Ontario, Manitoba and Saskatchewan, but they’ll likely be joined by others — instead comes across as a grand redistribution scheme administered by an expanding government bureaucracy.

While the federal carbon tax is almost uniform (electricity is not yet included), it provides special exemptions for certain sectors such as farmers, fishers, aviation, power producers in the North and greenhouse operators, although not the ones growing recreational cannabis.

But the departure from uniformity is marginal and not nearly as concerning as the Trudeau government’s continuing commitment to existing and even new regulations and subsidies to promote “clean energy,” each with their implicit carbon price. While economists repeatedly argue for a carbon tax precisely because it means we can forgo these high-cost interventions, somehow that has all been lost. While plenty of the economists behind the carbon-tax lobby were cheering Prime Minister Justin Trudeau’s new plan yesterday, I somehow missed their demands that we now must eliminate clean fuel and renewable electricity standards, subsidies for electric vehicles and ethanol — all of which have carbon costs well in excess of the $50-a-tonne carbon tax planned for 2022.

Another failure of the federal plan is to pass on carbon taxes in the form of Justin Bucks — or, to use the more laborious official name for these tax rebates: Climate Action Incentive Payments. So, rather than include carbon taxation as part of a comprehensive tax reform to make the tax system simpler, less distorting and fair, these Justin Bucks will be paid to households, small businesses, municipalities, universities, colleges, hospitals, non-profit and Indigenous populations.

A fatal flaw in federal pricing plan is a major shift in taxes from individuals to businesses. The average per household rebate — $1,161 in Saskatchewan in 2022 for example — is more than the cost per household of $946 (not including GST or HST on any energy bills). Even though the document states that business taxes are fully shifted forward to households, something is amiss here. How can household rebates average more than costs?

October 25, 2018

It’s not a “bribe” … it’s an “incentive”!

Terence Corcoran explains why the federal government’s promised “incentive” isn’t in any way, shape, or form any kind of bribe:

Step right up, ladies and gentlemen. Welcome aboard the all-new Canadian Cynical Circular Carbon Circus, the amazing Liberal climate control spectacle that will send you on a great environmental ride into the future.

Come on in! We will pay you to not consume fossil fuels — as individuals and as industries. It’s an economic revolution that takes us beyond blockchain and cryptocurrencies and cannabis into a brave new universe in which money goes round and round and everybody wins. We will pay Canadians with their own money — more than $20 billion over five years in carbon taxes that will raise the price of gasoline by 11 cents a litre by 2022, and ever higher thereafter if not sooner. Everybody pays and everybody wins, except for those who don’t. And some people win more than they pay. It’s better than a lottery!

For the people of Ontario, Saskatchewan, Manitoba and New Brunswick, the federal carbon circus cash comes via a new “Climate Action Incentive Payment.” An Ontario family of four will receive $307 for this year, the amount to be claimed on 2018 income tax returns. A Saskatchewan family will get a Climate Action Incentive Payment of $609.

What’s the Climate Action Incentive Payment for? The Liberal plan unveiled by Prime Minister Justin Trudeau and Environment Minister Catherine McKenna Tuesday doesn’t specify. What are taxpayers in the four provinces being incented to do, exactly, with this new wad of free cash? There is only one explanation: Vote Liberal in 2019!

The payments are based on a 2019 carbon price of $20 a tonne, rising to $50 by 2022. As the carbon tax goes up, Ontario families will receive $718 in 2022 and Saskatchewan families $1,459. And there will be more to come, presumably, since the latest doomsday scenario from the UN Intergovernmental Panel on Climate Change — the font of all speculation and data manipulation on climate issues — warned that by 2030 (only 12 years from now) a carbon price of somewhere between $135 to $5,500 per tonne would be needed to keep global warming below 1.5 degrees Celsius.

October 21, 2018

This is why Keynesianism doesn’t work in practice – the politicians flub the hard part

Tim Worstall explains the fatal flaw in Keynes’ economic theory … not so much in the theory part, but in the practical application by flesh-and-blood human beings:

We’re told that government borrowing is falling, the deficit closing. This therefore means that it’s possible to relax austerity, to start spending more upon sweeties for the voters. This being exactly and precisely why Keynesianism as a practical matter doesn’t work. For politicians will follow the fun bit and not the difficult part. Thus as an overall theory it simply is, to use a governmental phrase, no longer operative.

[…]

Think of what that basic Keynesian idea is. When the economy’s in the doldrums we should blow out the deficit in order to increase demand and thus boost the economy. But when we’re running at the resource limit then any such attempts will just turn up as inflation. So, we should stop doing that. Also, as Keynes himself pointed out, when the Sun shines is the time to repair the roof. Perhaps pay down some of that national debt so that the next time we need to blow that deficit out we’ve got space to do so.

Do note that this basic set up is also entirely consistent with modern monetary theory. When the economy is running at its limits then we should be taxing more of that created money back to prevent inflation. That is, running a smaller budget deficit, possibly even a surplus.

So, what happens to kill either theory in reality? Well, here we are. Unemployment at its lowest since the early 1970s. Employment to population ratio at its highest since then. And what are people talking about? Blowing out the deficit again to buy sweeties for voters. That is, the political imperatives just don’t militate in favour of anyone using these theories as they’re supposed to work.

In the meantime, of course, we’ve effectively changed the meaning of the word “austerity“:

Austerity is a political-economic term referring to policies that aim to reduce government budget deficits through spending cuts, tax increases, or a combination of both. Austerity measures are used by governments that find it difficult to pay their debts. The measures are meant to reduce the budget deficit by bringing government revenues closer to expenditures, which is assumed to make the payment of debt easier. Austerity measures also demonstrate a government’s fiscal discipline to creditors and credit rating agencies.

To a modern politician — or political activist — “austerity” now means something more like “only spending a bit more this year than you did last year”. British commentators have been accusing the government’s “austerity” measures for all kinds of negative effects, yet there have been no large scale austerity measures brought in.

September 25, 2018

QotD: The Laffer Curve

Around a certain sort of leftist mention of the Laffer Curve just brings a derisive snort. The sadness of that reaction being that it’s just an obvious mathematical truth. Tax rates of 0 % and 100 % bring in no revenue. Somewhere in between maximises the moolah. Note what isn’t being said, that all tax cuts always pay for themselves, nor even that lower tax rates are necessarily a good thing. Only that there’s some optimal level with regard to revenue collection.

All the arguments about the optimal level of government are over in the Wagner Curve and such others.

The Laffer Curve is also made up of two components, the income and substitution. Some people will work just to make their nut. Observational studies have shown that many taxi drivers do. So, increase their tax rates and they’ll work more. The substitution effect is, well, what’s that net wage worth to me? What’s the value of not working? When going fishing is worth more than working then people will go fishing. The curve as a whole is the interplay of these two effects.

Each tax in each society has its own such curve. A transactions tax of 0.01% can reduce revenue collection, as the EU’s study of a financial transactions tax shows us. Taxes upon income of 20% are below that Laffer Curve peak.

But where, exactly, is that peak for taxes upon income? The best study we’ve got, Saez and Diamond, says between 54% and 80% dependent upon other structures in the tax system. The Tory part of the UK Treasury says around 40 to 45% for income tax, plus national insurance, so at the bottom end of that S&D range. Many lefties want to say it’s higher so we can tax “the rich” more.

Tim Worstall, “How Lovely To Spot The Laffer Curve In The Wild – Doctors’ Pensions Edition”, Continental Telegraph, 2018-09-05.