At Reason, Liz Wolfe shows her worldly sophistication and disdain for her inferiors as she takes on the emotional labour of thinking about Canada for a brief moment:

US President-elect Donald Trump successfully trolled Justin Trudeau about Canada becoming the 51st state of the union.

I cannot believe I am being forced to care about Canada right now. They call their cops Mounties you know. Absurd people facing an absurd political crisis. Let’s dig in.

Prime Minister Justin Trudeau has, over his nine-year reign, become terribly unpopular. He resigned yesterday. This was semiexpected because all relevant opposition parties had vowed to mount challenges to his leadership come late January/early February, and because Trudeau’s finance minister quit last month after the two clashed.

Canadians are pissed off, like so many others around the world, with the high cost of living, which they attribute to Trudeau. Earlier in his term, he prioritized climate change–related initiatives (like a costly carbon tax) and catering to Indigenous groups. He’s prioritized letting in lots of immigrants, which many Canadians have soured on. When the pandemic hit, provincial governments imposed economically ruinous lockdowns, and Trudeau himself imposed a vaccine mandate for all those entering the country, as well as the entire federal work force. The vaccine mandate for all border-crossers, which was in place from October 2021 to October 2022, spurred the Canadian trucker convoy, an occupation of Ottawa that attempted to protest the government to change this freedom-trampling policy. Trudeau’s response was to freeze the bank accounts of people involved, in an attempt to suppress the peaceful dissent.

When he first came to power in 2015, the nepo baby (son of another former prime minister) was widely admired due to his purported good looks and charm. When Donald Trump took office in the U.S. in January 2017, Trudeau quickly positioned himself as a foil to Trump, earning adoration from America’s #Resistance left. Now, those people’s opinions don’t really matter (if they ever did at all), and normal Canadians have seen first-hand the impacts of Trudeau’s policies. He sees the writing on the wall and is attempting to minimize the damage to his party.

“This country deserves a real choice in the next election and it has become clear to me that if I’m having to fight internal battles, I cannot be the best option in that election,” he said in a press conference yesterday. In order to do that, he’s prorogued Parliament — suspending it without dissolving it.

“To allow his party’s thousands of members to choose his successor, a lengthy process that will involve campaigning, Mr. Trudeau suspended Parliament until March 24. A general election is expected to follow,” reports The New York Times. “Holding a party leadership election before a general one is par for the course in countries with parliamentary systems like Canada’s. Suspending Parliament to hold such an election is far less common. By doing so, Mr. Trudeau wards off the likely collapse of his minority government and gives the Liberals time to choose a leader unburdened by his dismal poll numbers.” In other words: Suspending Parliament is a political ploy to stop the bleeding and help his allies stay in power.

This final act seems par for the course for a man who prefers playing politics to crafting sound policy. It’s possible someone more freedom-appreciating will replace him (though I’m pretty sure 90 percent of the population qualifies as more freedom-appreciating than Trudeau). But this comes at a difficult time for Canada, as Trump mulls slapping 25 percent tariffs on all Canadian goods, partially blaming our northern neighbors for an influx of migrants and fentanyl. It remains to be seen whether Trudeau will be replaced with someone better and whether Canadians can dig themselves out of this terrible economic hole that’s been wrought by seemingly endless government spending.

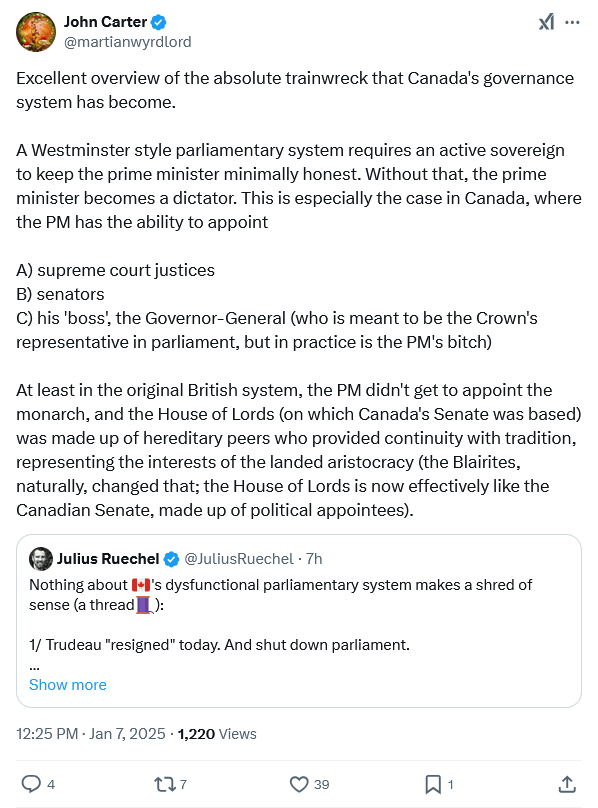

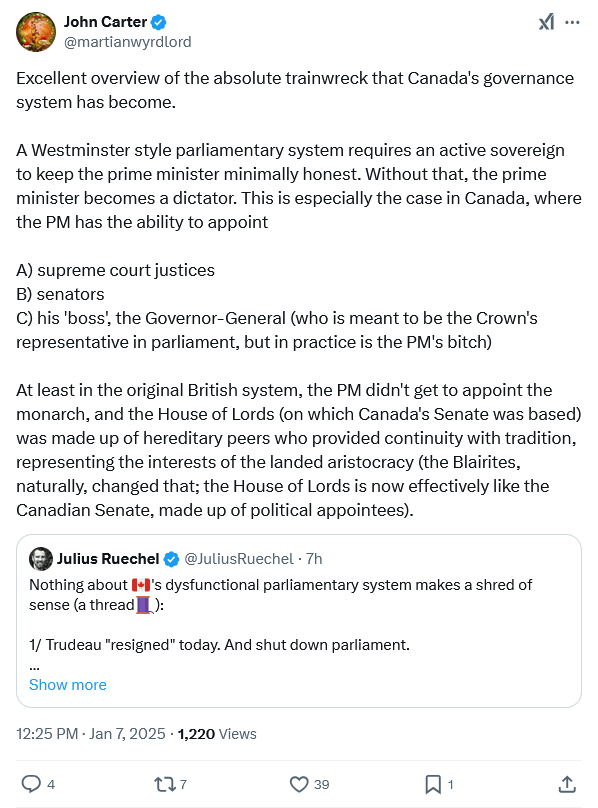

On the social media platform formerly known as Twitter, John Carter links to a thread by Julius Ruechel on the Canadian system of governance:

What Julius Ruechel said:

Nothing about [Canada’s] dysfunctional parliamentary system makes a shred of sense (a thread🧵):

1/ Trudeau “resigned” today. And shut down parliament.

So, now we effectively have a kind of custodial govt for the next few months. Run by Trudeau.

2/ Only now, with parliament shut down, Trudeau and his cabinet continues to run the govt, issue govt contracts, control the treasury, and negotiate on the world stage on Canada’s behalf … but without any parliamentary oversight.

How do you hold a govt to account without a parliament? The police won’t do it — they’ve more than proven that over 9 years of rampant govt corruption and abuse.

3/ The Governor General (who is supposed to ensure that Canada has a functioning government) gave Trudeau the green light to shut down (prorogue) parliament without triggering an election. Even as the country continues to unravel and as Canada’s finances continue to spiral towards an inflationary debt and currency crisis … “go ahead, get your party in order, Canada can wait (paraphrasing)”

4/ What a lovely gift from the Governor General … all so that the same party that could have ousted Trudeau for 9 disastrous years, but didn’t, has time to pick a new leader to continue to govern us.

Remember, Trudeau’s resignation does not automatically trigger an election, only a leadership race within the Liberal Party (lasting a minimum of 3 months during which Trudeau still remains as Prime Minister). The winner of that race emerges to govern the country without having to face a general election open to all Canadians.

Throughout all of this fiasco, there has not been a non-confidence vote to trigger the fall of the govt. The Liberal Party retains its mandate to govern Canada (despite their leadership race) because the other left-wing parties (NDP, Greens, and Bloc Quebecois) continue to prop up Trudeau’s Liberal govt.

And now, with parliament prorogued, the other parties couldn’t trigger a non-confidence vote even if they wanted to. Parliament would need to sit again before that can happen.

5/ In other words, the Governor General (the only one who currently has the power to trigger an election) is keeping Canada in crisis in order to accomodate a political party that has lost all its legitimacy to govern.

But guess who appointed the Governor General … yup, Trudeau.

It gets worse …

6/ Voting in the Liberal leadership race is open to children as young as 14. And to foreign nationals living in Canada that don’t even have citizenship or residency. How is that even legal? What could possibly go wrong?

7/ By shutting down parliament, Trudeau has also effectively shut down the ongoing parliamentary investigation into foreign interference. Based on a govt report, there are at least 11 MPs (plus multiple support staff) who have been compromised yet continue to work in our govt. But, the Liberals have refused to release their names. Or to fire them.

And now, thanks to Trudeau’s prorogation stunt, we won’t know their names ahead of the next election.

8/ The Conservative party is likely to challenge the proroguation of parliament to try to trigger an immediate election. But 7 of Canada’s 9 Supreme Court judges were appointed by … you guessed it again … Trudeau.

9/ And if the Conservatives come to power under Pierre Poilievre when we finally do get another election, the legislation they want to pass requires the Senate to sign off on it.

But 90 of Canada’s 105 senators are appointed by Trudeau, with another 8 open seats that will likely also be filled by Trudeau during this “transition” period. Yes, he still has the power to do that … without parliamentary oversight.

10/ At the 1:15:50 mark of his January 2nd YouTube interview with Jordan Peterson, Pierre Poilievre even openly admitted that (because of the Liberal bias in the Senate) the Conservatives need Canadians to help him pass legislation by becoming much more politically active — specifically he needs them to put pressure on their senators to “motivate” them to support his economic reforms.

That might work in the US where senators are elected. But how do Canadians “put pressure on senators” when Canadian senators are appointed by the Prime Minister and serve for life (until age 75)?

11/ Nonetheless, at the 24:35 mark of the same interview with Jordan Peterson (https://youtu.be/Dck8eZCpglc?si=y268pZaYSBG0gPKR&t=1475), the leader of Canada’s official opposition party, Pierre Poilievre, proudly proclaimed that :

“we have … the best system of govt in the history of the world — the parliamentary system. Not the best govt, but the best system of govt.”

How reassuring … 🤦♂️

In the National Post, Carson Jerema argues for the abolition of the Liberal Party of Canada, the self-imagined “National Governing Party”:

The corrupting influence of the Liberal party has become all encompassing. When this or that cabinet minister gets uppity about being responsible with public money (Bill Morneau), or about interfering in criminal prosecutions (Jody Wilson-Raybould), they are simply replaced with someone more pliant, until that replacement is no longer useful, and is then kicked to the curb (David lametti, Chrystia Freeland). Ministers who had distinguished, or at least not humiliating, careers before politics, say a Bill Blair or a Marc Garneau, have been reduced to the role of yelping sycophant.

The illness radiates outward turning anything even remotely connected to government into a client or an arm of the Liberal party.

The explosion in the size of the federal bureaucracy, the vast expansion of corporate welfare into preferred Liberal businesses (read, green), Ottawa’s aggressive invasion into what’s left of provincial jurisdiction (dental care, pharmacare, energy and natural resources), has all been conducted for the benefit of the party.

Nothing happens in this country unless it benefits the Liberals. No one is hired, no cavity is filled, no money is invested and no child is educated, without partisan approval. And, it is only approved, if there is some electoral gain, however narrow. The rapid increase in immigration over the past decade could, as it has in the past, create a longterm base of Liberal voters. It is hard to believe the Liberals being as enthusiastic about immigration, if it didn’t have this prospect.

As government grows and grows and grows, it isn’t meeting any sort of public service need, or any ideological end, it is simply patronage on a grand scale. The entire state, and everyone in it has been turned into a beneficiary of the Liberals, all of us, part of the machine. Even Sir John A. Macdonald, fresh off the Pacific Scandal, would be embarrassed by this state of affairs.

All governments advance policies for electoral advantage, but there is something otherworldly about what the Liberals have done. Moreover, when what they do is plainly indefensible, such as dismissing Chinese election interference, or subordinating foreign policy to the preferences of Jew hating-pro-Hamas protesters, they can’t understand why anyone would ever question them. Large segments of the news media are always happy to comply and help the government gaslight the electorate.