PragerU

Published 16 Jun 2022Are we heading toward an all-renewable energy future, spearheaded by wind and solar? Or are those energy sources wholly inadequate for the task? Mark Mills, Senior Fellow at the Manhattan Institute and author of The Cloud Revolution, compares the energy dream to the energy reality.

(more…)

October 25, 2022

A Multi-Trillion Dollar Pipe Dream

September 8, 2022

Surprise! Liz Truss can successfully locate Canada on a map!

In UnHerd, Marshall Auerback details some of the Canadian connections of Britain’s new PM:

Faced with soaring costs of living, increased collateral damage from the war in Ukraine, and widening national inequality, Liz Truss seemed curiously optimistic in her first speech as Prime Minister. What could possibly be driving such bullishness? Absent any sign of a coherent plan of action, we might find her motivation in an Instagram post from 2018, where Truss cited the time she spent in Canada as a teenager as “the year that changed my outlook on life … #pioneercounty #optimism #maplespirit”.

As profound an impact as that year might have had on Truss’s optimistic psyche, she would do well to look more closely at Canada’s faltering “success story” in recent years. Today, the country is no longer the land of milk and honey (even if it does still produce a fair amount of maple syrup), but suffers many of the same problems as the UK, and a number that are significantly worse: rising inflation, profound income inequality, the challenges posed by climate change, and an increasing host of social problems — not least the mass stabbing spree last weekend in Saskatchewan that left 10 people dead.

However, to the extent that the Trudeau Administration has attempted to remedy some of these problems, there are clear lessons for Truss. Unlike in the UK, many of Canada’s energy problems are largely self-inflicted, a result of a progressive government ignoring its comparatively resource-rich environment, even as its European allies (including the UK) suffer severe consequences of being cut off from Russian gas supplies and the corresponding rise in energy prices.

A few weeks ago, German Chancellor Olaf Scholz visited Canada to secure more gas for his country. This being Canada, the German Chancellor was treated politely, but the underlying plea for Ottawa to increase liquefied natural gas (LNG) production to offset the loss of Russian gas was given short shrift. The Canadian government, one of the biggest producers of natural gas in the world, has misgivings about whether becoming an even bigger producer and exporter would actually be profitable.

Leaving aside the broader debate as to whether the dangers of man-made climate change have been confounded with natural weather and climate variability, natural gas, although a fossil fuel, emits roughly half the amount of carbon dioxide when combusted in a new, efficient natural gas power plant. This would suggest that Canada’s absolutist stance is not only a major geopolitical mistake, but also an economic own goal. The country is foregoing a major growth opportunity, which would both alleviate global inflationary pressures by increasing the supply of natural gas to the global markets, while simultaneously enhancing the prospect for a plethora of new high-paying jobs that would buttress Canada’s declining middle class.

Canada is also home to substantial supplies of copper, nickel, lithium, and cobalt — all of which will be essential to producing the infrastructure required to transition from fossil fuels to greener sources of energy, such as wind and solar. But mining itself remains a “brown” industry, one that creates substantial carbon emissions and environmental degradation. It seems conceivable, then, that the Trudeau government’s green energy purity could soon discourage the increased mining activity needed to facilitate this energy transition.

[…]

Yet in many respects, Canada’s problems are more easily resolved, given that so many are self-inflicted. And not only are there ample natural resources to offset the current energy crisis, but also broad institutional mechanisms to alleviate regional inequalities. Canada, then, cannot provide all the solutions that Truss needs. For all her boosterism, Britain remains a country fatigued by her party’s ongoing political churn and the non-stop travails still emanating from Brexit. If she is to succeed, Truss must begin by removing her rose-tinted view of Canada. The Great White North can certainly serve as an inspiration — but that is all. Canada may have changed Truss’s “outlook on life”. But if Britain is to “ride out the storm”, as she suggested yesterday, an entirely new approach is needed.

April 19, 2022

May 17, 2021

History Summarized: Africa

Overly Sarcastic Productions

Published 7 Jul 2017THE DANGER OF A SINGLE STORY: https://youtu.be/D9Ihs241zeg

It’s been brought to my attention that I made two mistakes: 1) Yes, I disappear at 18:26. Not sure how that happened. 2) At 12:25 I use a map of Africa that with some weird borders. That’s my bad. But if you look at a legit map of Africa, you’ll see the same straight lines in the places that I marked them.

(Remember: making mistakes is ok, so long as we learn from them)The Epic of Mwindo sure was cool, huh? This video is here to show you all about the lovely continent that it came from: Africa! And BOY are there a lot of misconceptions about it.

This video was produced with assistance from the Boston University Undergraduate Research Opportunities Program.

PATREON: www.patreon.com/user?u=4664797

MERCH LINKS:

Shirts – https://overlysarcasticproducts.threa…

All the other stuff – http://www.cafepress.com/OverlySarcas…Find us on Twitter @OSPYouTube!

April 8, 2021

Fallen Flag — the Duluth, Missabe & Iron Range Railway

The Merritt family of Minnesota (known as the “Seven Iron Brothers“) discovered a large iron ore deposit in the Mesabi Range and created the largest iron ore mine in the world (as of the 1890s) and tried to persuade the DMN to build a 70-mile rail connection to get their ore to harbour and out to the iron and steel foundries around the Great Lakes. The DMN was unwilling to commit, so the Merritt family borrowed money to build the line from, among other financiers, John D. Rockefeller. The line — called the Duluth, Missabe and Northern — got built and began operations in 1892, but the Merritts expanded too quickly at the wrong moment — the financial panic of 1893 — losing financial control and leaving ownership of both the mine and the railway in Rockefeller’s hands by 1894.

Charlemagne Tower sold the Duluth & Iron Range to Illinois Steel in 1887, which was succeeded by Federal Steel, then U.S. Steel. By 1901, both the D&IR and DM&N were under U.S. Steel control. USS upgraded both railroads with heavy rail and double track, ordered bigger locomotives and larger cars, and built sizeable shops and roundhouses at Proctor and Two Harbors.

In 1915 DM&N leased the Spirit Lake Transfer Railway, a link between DM&N at Adolph, near Proctor, and the Interstate Transfer Railway at Oliver, Wis., across from Steelton, Minn. The Interstate Transfer ran from Oliver to Itasca, in eastern Superior, giving the DM&N connections with large railroads including Northern Pacific, Chicago & North Western’s “Omaha Road”, and three members of the Canadian Pacific family: Minneapolis, St. Paul & Sault Ste. Marie (“Soo Line”); Wisconsin Central; and Duluth, South Shore & Atlantic.

DM&N and D&IR remained separate until January 1, 1930, when the DM&N leased the D&IR and consolidated operations. Then on July 1, 1937, the DM&N merged with the Spirit Lake Transfer to form the Duluth, Missabe & Iron Range Railway. DM&IR then acquired ownership of D&IR and Interstate Transfer, and they became part of the new corporation on March 22, 1938. Reminders of the two big predecessors remained in the DM&IR’s two operating divisions, named Iron Range and Missabe, made up primarily of the predecessors’ tracks.

The Great Depression drastically reduced ore traffic. In 1932, not a single all-ore train was run — the small amount of ore that had to be shipped was carried in mixed freights. World War II reversed the road’s fortunes, of course, and the postwar boom resulted in an even higher demand for ore, with an all-time tonnage record being set in 1953.

Missabe had minimal passenger service. Into the 1950s, handsome Pacifics pulled heavyweight steel RPOs and coaches, two with solarium observation sections. At the end of World War II, the Missabe still provided service between Duluth and Ely (Winton), and Duluth and Hibbing, with the Hibbing train connecting with one from Iron Junction to Virginia.

Duluth, Missabe & Iron Range M-3 locomotive no. 227.

Photo by “GavinTheGazelle” via Wikimedia Commons.

U.S. Steel spun off the DM&IR and its other ore railroads and shipping companies to subsidiary Transtar in 1988, selling majority control to the Blackstone Group. In 2001, DM&IR and other holdings were moved from Transtar to Great Lakes Transportation, fully owned by Blackstone, so for the first time in a century, DM&IR was no longer associated with U.S. Steel. On October 20, 2003, Canadian National announced it would buy Great Lakes Transportation, which also owned Bessemer & Lake Erie, Pittsburgh & Conneaut Dock Co. in Ohio, and Great Lakes Fleet, Inc. The purchase was finalized on May 10, 2004, and the independent Missabe Road vanished.

CN retired all but 10 of the SD40-3s, most of the SD38s, and all the rebuilt SD9s and 18s. Major locomotive work shifted from Proctor to other shops, and train dispatchers moved to Wisconsin, then Illinois. CN invested in new ore cars for the Missabe, gradually replacing those that dated to when steam still ruled the railroad. DM&IR existed on paper until December 31, 2011, when CN merged subsidiaries DM&IR and Duluth, Winnipeg & Pacific into Wisconsin Central.

November 7, 2020

Misunderstanding what is meant by “mineral reserves”

It seems to happen almost as regularly as Old Faithful, as someone blows a virtual gasket over the reserves of this or that mineral “running out” in x number of years. Tim Worstall explains why this is a silly misunderstanding of what the term “mineral reserves” actually means:

“Aerial view of a small mine near Mt Isa Queensland.” by denisbin is licensed under CC BY-ND 2.0

It’s not exactly unusual to see some environmental type running around screaming because mineral reserves are about to run out. The Club of Rome report, the EU’s “circular economy” ideas, Blueprint for Survival, they’re all based upon the idea that said reserves are going to run out.

They look at the usual listing (USGS, here) and note that at the current rate of usage reserves will run out in 30 to 50 years. Entirely correct they are too. It’s the next step which is such drivelling idiocy. For the claim then becomes that we will run out of those metals, those minerals, when the reserves do. This being idiot bollocks.

For a mineral reserve is, as best colloquial language can put it, the stuff we’ve prepared for use in the next few decades. Like, say, 30 to 50 years. That we’re going to run out of what we’ve got prepared isn’t a problem. For we’ve an entire industry, mining, whose job to to go prepare some more for us to use.

[…] A mineral reserve is something created by the mining company. Created by measuring, testing, test extracting and proving that the mineral can be processed, using current technology, at current prices, and produce a profit. Proving that this is not just dirt but is in fact ore.

Mineral reserves are things we humans make, not things that exist.

August 28, 2020

George Stephenson: The Father of the Railways

Biographics

Published 6 Feb 2020Check out Squarespace: http://squarespace.com/biographics for 10% off on your first purchase.

This video is #sponsored by Squarespace.

TopTenz Properties

Our companion website for more: http://biographics.orgCredits:

Host – Simon Whistler

Author – Radu Alexander

Producer – Jennifer Da Silva

Executive Producer – Shell HarrisBusiness inquiries to biographics.email@gmail.com

July 29, 2020

How Freight Trains Connect the World

Wendover Productions

Published 5 Mar 2019Support Wendover Productions on Patreon: https://www.patreon.com/wendoverprodu…

Instagram: http://Instagram.com/sam.from.wendover

Twitter: http://www.Twitter.com/WendoverPro

Email: sam@wendover.productions

Reddit: http://Reddit.com/r/WendoverProductionsAnimation by Josh Sherrington

Sound by Graham Haerther (http://www.Haerther.net)

Thumbnail by Simon BuckmasterSpecial thanks to Patreon supporters Alec M Watson, Andrew J Thom, Arkadiy Kulev, Chris Allen, Chris Barker, Connor J Smith, Daddy Donald, Etienne Dechamps, Eyal Matsliah, Hank Green, Harrison Wiener, James Hughes, James McIntosh, John & Becki Johnston, Keith Bopp, Kelly J Knight, Ken Lee, Kyle, KyQuan Phong, Manoj Kasyap Govindaraju, MyNameIsKir, Plinio Correa, Qui Le, Sheldon Zhao, Simen Nerleir, and Tim Robinson

Music by http://epidemicsound.com

Select footage courtesy the AP Archive

Select footage courtesy Bigstock: http://bit.ly/bigstock-videofreetrialBNSF train clip courtesy Scott Hiddelston

July 25, 2020

Did Jerónimo de Ayanz y Beaumont invent the steam engine a century before Newcomen?

In his latest Age of Invention newsletter, Anton Howes investigates Spanish claims that Jerónimo de Ayanz y Beaumont beat Newcomen by a hundred years in the quest to harness steam power:

Screenshot from “Savery’s Miners Friend – 1698”, a YouTube video by Guy Janssen (https://www.youtube.com/watch?v=Dt5VvrEIj8w)

The Spanish claimant in question is one Jerónimo de Ayanz y Beaumont, a late-sixteenth-century aristocrat and military engineer from Navarre, who from 1597 served as the administrator of the royal mines, and who invented a whole host of devices, from diving equipment and mine ventilation systems, to various improvements to mills, pumps, and furnaces. Thanks to the work of historian and engineer Nicolás García Tapia, whose biography of Ayanz came out in 2010, we now know quite a bit about this interesting inventor. The work was published in Spanish, and quite understandably was widely covered in the Spanish press. So although Ayanz has not quite become a household name in Spain just yet, he does now seem to be fairly well-known by the local “well actually” brigade (a shadowy international movement of which I am, to most people’s annoyance, a long-serving member). “Thomas Newcomen/Thomas Savery invented the steam engine you say? Well actually, I think you’ll find it was Ayanz a century earlier” — I had a quick google and discovered there were hundreds of comments to this effect.

But, actually, the story is a bit more complicated than that. The devil, as always, is in the detail, and unfortunately the press claims about the technology have become widely and erroneously repeated, apparently ignoring Tapia’s careful historical work. I even spotted a recently-published encyclopaedia of inventions that repeated the errors.

So what, exactly, did Ayanz invent? The key fact is that in 1606 he obtained a 20-year monopoly from the king of Spain for the use of over fifty different inventions, including two steam-related devices. One of these was related to getting rid of deadly mine gases, which had killed one of his friends and collaborators, and had almost killed Ayanz too. His solution was a steam injector — essentially, a steam boiler with a narrowing pipe sticking out of it, which would inject the steam into a larger air pipe. The pressurised steam, upon flowing up into the air pipe, created a powerful sucking effect behind it, thus rapidly drawing deadly gases out of the mine. (A bit like at the start of this video).

It was the second steam-powered device, however, that has become famous as Ayanz’s steam engine. Just like the inventions of Thomas Savery and Thomas Newcomen about a century later, it was designed to pump the water out of mines. Ayanz formed a partnership in 1608-11 to reopen the silver mines of Guadalcanal in Spain, which had been abandoned due to flooding, and seems to have tried to implement the engine there: he obtained rights to cut down nearby trees for firewood, for example, and exploited nearby copper, which would have been essential for making boilers and pipes. As for whether he actually got it to work, we don’t know for sure. Sadly, he died only a few years after starting the project.

But the devilish detail is in how his engine worked. Specifically, all the multiplying errors seem to have arisen from a misinterpretation, by the press, of Tapia’s statement that the engine was “very similar” to that of Thomas Savery. There are, certainly, some important similarities. Both engines, for example, exploited the expansionary force of steam. In both, steam from a boiler was piped into a water tank, forcing that water up a narrow pipe — what we might call a pushing effect. And both engines used two tanks, which alternated so that the engine would pump continuously. While one tank and was being refilled with mine water, the other would be have the steam pushing the water out, and then vice versa. So far so good. Indeed, due to the two water tanks, drawings of Ayanz’s and Savery’s devices look very similar side by side.

July 23, 2020

QotD: Herbert Hoover in Australia and China

Hoover graduates Stanford in 1895 with a Geology degree. He plans to work for the US Geological Survey, but the Panic of 1895 devastates government finances and his job is cancelled. Hoover hikes up and down the Sierra Nevadas looking for work as a mining engineer. When none materializes, he takes a job an ordinary miner, hoping to work his way up from the bottom […]

After a few months, he finds a position as a clerk at a top Bay Area mining firm. One year later, he is a senior mining engineer. He is moving up rapidly – but not rapidly enough for his purposes. An opportunity arises: London company Berwick Moreing is looking for someone to supervise their mines in the Australian Outback. Their only requirement is that he be at least 35 years old, experienced, and an engineer. Hoover (22 years old, <1 year experience, geology degree only) travels to Britain, strides into their office, and declares himself their man. The executives “professed astonishment at Americans’ ability to maintain their youthful appearance” (Hoover had told them he was 36), but hire him and send him on an ocean liner to Australia.

[…]

After a year, Hoover is the most hated person in Australia, and also doing amazing. His mines are producing more ore than ever before, at phenomenally low prices. He scouts out a run-down out-of-the-way gold mine, realized its potential before anyone else, bought it for a song, and raked in cash when it ended up the richest mine in Australia. He received promotion after promotion.

Success goes to his head and makes him paranoid. He starts plotting against his immediate boss, Berwick Moreing’s Australia chief Ernest Williams. Though Williams didn’t originally bear him any ill will, all the plotting eventually gets to him, and he arranges for Hoover to be transferred to China. Hoover is on board with this, since China is a lucrative market and the transfer feels like a promotion. He travels first back to Stanford – where he marries his college sweetheart Lou Henry – and then the two of them head to China.

China is Australia 2.0. Hoover hates everyone in the country and they hate him back […] The same conflicts are playing itself out on the world stage, as Chinese resentment at their would-be-colonizers boils over into the Boxer Rebellion. A cult with a great name – “Society Of Righteous And Harmonious Fists” – takes over the government and encourages angry mobs to go around killing Westerners. Thousands of Europeans, including Herbert and Lou, barricade themselves in the partly-Europeanized city of Tientsin to make a final last stand.

In between dodging artillery shells, Hoover furiously negotiates property deals with his fellow besiegees. He argues that if any of them survive, it will probably because Western powers invade China to save them. That means they will soon be operating under Western law, and people who had already sold their mines to Western companies would be ahead of the game and avoid involuntary confiscation. Somehow, everything comes up exactly how Hoover predicts. US Marines arrived in Tientsin to liberate the city (Hoover marches with them as their local guide) and he is ready to collect his winnings.

Problem: it turns out that “Whatever, sure, you can have my gold mine, we’re all going to die anyway” is not legally ironclad. Hoover, enraged as he watches apparently done deals slip through his fingers, reaches new levels of moral turpitude. He offers the Chinese great verbal deals, then gives them contracts with terrible deals, saying that this is some kind of quaint foreign custom and if they just sign the contract then the verbal deal will be the legally binding one (this is totally false). At one point, he literally holds up a property office with a gun to get the deed to a mine he wants. Somehow, after consecutively scamming half the population of China, he ends up with the rights to millions of dollars worth of mines. Berwick Moreing congratulates him and promotes him to managing director. He and Lou sail for London to live the lives of British corporate bigshots.

As you might also predict, Hoover manages to offend everyone in Britain. Soon he is signing off on a “mutually agreeable”, “amicable” dismissal from Berwick Moreing. They agree to let him go on the condition that he does not compete with them – a promise he breaks basically instantly. He goes into banking, and his “bank” funds mining operations in a way indistinguishable from being a mining conglomerate. Eventually he abandons even this fig leaf, and just does the mining directly.

In other ways, his tens of millions of dollars are mellowing him out. Over his years in London, he develops hobbies besides making money and crushing people. He starts a family; he and Lou have two sons, Herbert Jr and Allen. He even hosts dinner parties, very gradually working on the skill of getting through an entire meal without mortally offending any guest…

Scott Alexander, “Book Review: Hoover”, Slate Star Codex, 2020-03-17.

July 4, 2020

The birth of the steam age

In the latest installment of his Age of Invention newsletter, Anton Howes explores the very early steam age in England:

Why was the steam engine invented in England? An awful lot hinges on this question, because the answer often depends on our broader theories of what caused the British Industrial Revolution as a whole. And while I never tire of saying that Britain’s acceleration of innovation was about much, much more than just the “poster boy” industries of cotton, iron, and coal, the economy’s transition to burning fossil fuels was still an unprecedented and remarkable event. Before the rise of coal, land traditionally had to be devoted to either fuel, food, or clothing: typically forest for firewood, fields for grain, and pastures for wool-bearing sheep. By 1800, however, English coal was providing fuel each year equivalent to 11 million acres of forest — an area that would have taken up a third of the country’s entire surface area, and which was many times larger than its actual forest. By digging downward for coal, Britain effectively increased its breadth.

And coal found new uses, too. It had traditionally just been one among many different fuels that could be used to heat homes, alongside turf, gorse, firewood, charcoal, and even cow dung. When such fuels were used for industry, they were generally confined to the direct application of heat, such as in baking bricks, evaporating seawater to extract salt, firing the forges for blacksmiths, and heating the furnaces for glass-makers. Over the course of the seventeenth century, however, coal had increasingly become the fuel of choice for both heating homes and for industry. Despite its drawbacks — it was sooty, smelly, and unhealthy — in places like London it remained cheap while the price of other fuels like firewood steadily increased. More and more industries were adapted to burning it. It took decades of tinkering and experimentation, for example, to reliable use coal in the smelting of iron.

Yet with the invention of the steam engine, the industrial uses of coal multiplied further. Although the earliest steam engines generally just sucked the water out of flooded mines, by the 1780s they were turning machinery too. By the 1830s, steam engines were having a noticeable impact on British economic growth, and had been applied to locomotion. Steam boats, steam carriages, steam trains, and steam ships proliferated and began to shrink the world. Rather than just a source of heat, coal became a substitute for the motive power of water, wind, and muscle.

So where did this revolutionary invention come from? There were, of course, ancient forms of steam-powered devices, such as the “aeolipile”. Described by Hero of Alexandria in the 1st century, the aeolipile consisted of a hollow ball with nozzles, configured in such a way that the steam passing into the ball and exiting through the nozzles would cause the ball to spin. But this was more like a steam turbine than a steam engine. It could not do a whole lot of lifting. The key breakthroughs came later, in the late seventeenth and early eighteenth centuries, and instead exploited vacuums. In a steam engine the main force was applied, not by the steam itself pushing a piston, but by the steam within the cylinder being doused in cold water, causing it to rapidly condense. The resulting partial vacuum meant that the weight of the air — the atmospheric pressure — did the real lifting work. The steam was not there to push, but to be condensed and thus pull. It saw its first practical applications in the 1700s thanks to the work of a Devon ironmonger, Thomas Newcomen.

Science was important here. Newcomen’s engine could never have been conceived had it not been for the basic and not at all obvious observation that the air weighed something. It then required decades of experimentation with air pumps, barometers, and even gunpowder, before it was realised that a vacuum could rapidly be created through the condensation of steam rather than by trying to suck the air out with a pump. And it was still more decades before this observation was reliably applied to exerting force. An important factor in the creation of the steam engine was thus that there was a sufficiently large and well-organised group of people experimenting with the very nature of air, sharing their observations with one another and publishing — a group of people who, in England, formalised their socialising and correspondence in the early 1660s with the creation of the Royal Society.

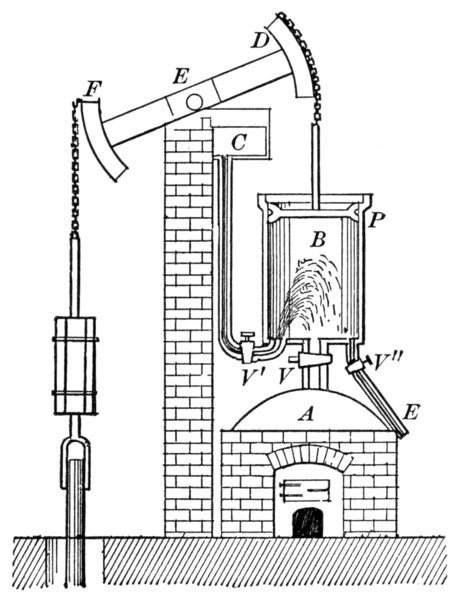

Newcomen’s Atmospheric Steam Engine. The steam was generated in the boiler A. The piston P moved in a cylinder B. When the valve V was opened, the steam pushed up the piston. At the top of the stroke, the valve was closed, the valve V’ was opened, and a jet of cold water from the tank C was injected into the cylinder, thus condensing the steam and reducing the pressure under the piston. The atmospheric pressure above then pushed the piston down again.

Original illustration from Practical Physics for Secondary Schools. Fundamental principles and applications to daily life, by Newton Henry Black and Harvey Nathaniel Davis, 1913, via Wikimedia Commons.

February 29, 2020

The metallic nickname of Henry VIII

In the most recent Age of Invention newsletter, Anton Howes outlines the rocky investment history for German mining firms in England during the Tudor period:

Cropped image of a Hans Holbein the Younger portrait of King Henry VIII at Petworth House.

Photo by Hans Bernhard via Wikimedia Commons.

It’s an especially interesting case of England’s technological backwardness, given that copper was a material of major strategic importance: a necessary ingredient for the casting of bronze cannon. And it was useful for other industries, especially when mixed with zinc to form brass. Brass was the material of choice for accurate navigational instruments, as well as for ordinary pots and kettles. Most importantly, brass wire was needed for wool cards, used to straighten the fibres ready for spinning into thread. A cheaper and more secure supply of copper might thus potentially make England’s principal export, woollen cloth, even more competitive — if only the English could also work out how to produce brass.

The opportunity to introduce a copper industry appeared in 1560, when German bankers became involved in restoring the gold and silver content of England’s currency. The expensive wars of Henry VIII and Edward VI in the 1540s had prompted debasements of the coinage, to the short-term benefit of the crown, but to the long-term cost of both crown and country. By the end of Henry VIII’s reign, the ostensibly silver coins were actually mostly made of copper (as the coins were used, Henry’s nose on the faces of the coins wore down, revealing the base metal underneath and earning him the nickname Old Coppernose). The debased money continued to circulate for over a decade, driving the good money out of circulation. People preferred to hoard the higher-value currency, to send it abroad to pay for imports, or even to melt it down for the bullion. The weakness of the pound was an especial problem for Thomas Gresham, Queen Elizabeth’s financier, in that government loans from bankers in London and Antwerp had to be repaid in currency that was assessed for its gold and silver content, rather than its face value. Ever short of cash, the government was constantly resorting to such loans, made more expensive by the lack of bullion.

Restoring the currency — calling in the debased coins, melting them down, and then re-minting them at a higher fineness — required expertise that the English did not have. From France, the mint hired Eloy Mestrelle to strike the new coins by machine rather than by hand. (He was likely available because the French authorities suspected him of counterfeiting — the first mention of him in English records is a pardon for forgery, a habit that apparently died hard as he was eventually hanged for the offence). And to do the refining, Gresham hired German metallurgists: Johannes Loner and Daniel Ulstätt got the job, taking payment in the form of the copper they extracted from the debased coinage (along with a little of the silver). It turned out to be a dangerous assignment: some of the copper may have been mixed with arsenic, which was released in fumes during the refining process, thus poisoning the workers. They were prescribed milk, to be drunk from human skulls, for which the government even gave permission to use the traitors’ heads that were displayed on spikes on London Bridge — but to little avail, unfortunately, as some of them still died.

Loner and Ulstätt’s payment in copper appears to be no accident. They were agents of the Augsburg banking firm of Haug, Langnauer and Company, who controlled the major copper mines in Tirol. Having obtained the English government as a client, they now proposed the creation of English copper mines. They saw a chance to use England as a source of cheap copper, with which they could supply the German brass industry. It turns out that the tale of the multinational firm seeking to take advantage of a developing country for its raw materials is an extremely old one: in the 1560s, the developing country was England.

Yet the investment did not quite go according to plan. Although the Germans possessed all of the metallurgical expertise, the English insisted that the endeavour be organised on their own terms: the Company of Mines Royal. Only a third of the company’s twenty-four shares were to be held by the Germans, with the rest purchased by England’s political and mercantile elite: people like William Cecil (the Secretary of State) and the Earl of Leicester, Robert Dudley (the Queen’s crush). It was an attractive investment, protected from competition by a patent monopoly for mines of gold, silver, copper, and mercury in many of the relevant counties, as well as a life-time exemption for the investors from all taxes raised by parliament (in those days, parliament was pretty much only assembled to legitimise the raising of new taxes).

February 16, 2020

Diamonds vs. Self Determination – South West Africa and the League of Nations I THE GREAT WAR 1920

The Great War

Published 15 Feb 2020Sign up for Curiosity Stream and Nebula: https://curiositystream.com/thegreatwar

Woodrow Wilson’s 14 Points and their idea of self-determination didn’t go unnoticed in the former German colonies like German Southwest Africa. But especially South Africa had other ideas at the Paris Peace Conference and lobbied to take control over future Namibia and its lucrative diamond mines.

» SUPPORT THE CHANNEL

Patreon: https://www.patreon.com/thegreatwar

Merchandise: https://shop.spreadshirt.de/thegreatwar/» SOURCES

Emmett, Tony. 1999. Popular Resistance and the Roots of Nationalism in Namibia, 1915-1966. Basel, Switzerland: P. Schlettwein Publishing.

Olusoga, David, and Casper W. Erichsen. 2011. The Kaiser’s Holocaust: Germany’s Forgotten Genocide and the Colonial Roots of Nazism. London, UK: Faber and Faber.

Onselen, Charles van. 1980. Chibaro: African mine labour in Southern Rhodesia 1900-1933. London, UK: Pluto Pr.

Pirio, Gregory. 1988. “The Role of Garveyism in the Making of Namibian Nationalism.” In Namibia 1884-1984: Readings on Namibia’s History and Society: Selected Papers and Proceedings of the International Conference on “Namibia 1884-1984: 100 Years of Foreign Occupation; 100 Years of Struggle”, London 10-13 September, 1984, Organised by the Namibia Support Committee in Co-Operation with the SWAPO Department of Information and Publicity, edited by International Conference on “Namibia 1884-1984: 100 Years of Foreign Occupation; 100 Years of Struggle,” Brian Wood, Namibia Support Committee, United Nations Institute for Namibia, SWAPO, and Department of Information and Publicity. London: The Committee in cooperation with United Nations Institute for Namibia.

“Report on the Natives of South-West Africa and Their Treatment by Germany.” 1918. 1918. https://ufdc.ufl.edu/UF00072665/00001/1j.

Silvester, Jeremy, and Jan-Bart Gewald, eds. 2003. Words Cannot Be Found: German Colonial Rule in Namibia: An Annotated Reprint of the 1918 Blue Book. Sources for African History, v. 1. Leiden, NL ; Boston, USA: Brill.

Smith, Iain R. 1999. “Jan Smuts and the South African War.” South African Historical Journal 41 (1): 172–95. https://doi.org/10.1080/0258247990867….

Vinson, Robert Trent. 2012. Americans Are Coming! Dreams of African American Liberation in Segregationist South Africa. Athens: Ohio University Press. http://public.eblib.com/choice/public….

Wallace, Marion, and John Kinahan. 2013. A History of Namibia from the Beginning to 1990. Oxford, UK: Oxford University Press.

William Blakemore Lyon. 2015. “The South West Africa Company and Anglo-German Relations, 1892-1914.” Master’s thesis, Cambridge University.

Zimmerer, Jürgen, and Joachim Zeller. 2008. Genocide in German South-West Africa. Monmouth, UK: Merlin Press.

Michell, Lewis (1910). The Life and Times of the Right Honourable Cecil John Rhodes 1853-1902, Volume 2. New York and London: Mitchell Kennerly

Rhodes, Cecil, (1902) “The Last Will and Testament of Cecil John Rhodes: With Elucidatory Notes to Which Are Added Some Chapters Describing the Political and Religious Ideas of the Testator”, London: “Review of Reviews” Office

Cecil Rhodes, “Confession of Faith”, 1877 https://pages.uoregon.edu/kimball/Rho…» SOCIAL MEDIA

Instagram: https://instagram.com/the_great_war

Twitter: https://twitter.com/WW1_Series

Reddit: https://reddit.com/r/TheGreatWarChannel»CREDITS

Presented by: Jesse Alexander

Written by: Jesse Alexander

Director: Toni Steller & Florian Wittig

Director of Photography: Toni Steller

Sound: Toni Steller

Editing: Toni Steller

Mixing, Mastering & Sound Design: http://above-zero.com

Maps: Daniel Kogosov (https://www.patreon.com/Zalezsky)

Research by: Jesse Alexander

Fact checking: Florian WittigChannel Design: Alexander Clark

Original Logo: David van StepholdA Mediakraft Networks Original Channel

Contains licensed material by getty images

All rights reserved – Real Time History GmbH 2020

December 31, 2019

A lump of coal minus a canary – December 30th – TimeGhost of Christmas Past – Day 7

TimeGhost History

Published 30 Dec 2019The last day of work of the year for many people is the harbinger of exciting new change. For British coal miners in 1986, it meant the redundancy of the canary in the coal mine.

Join us on Patreon: https://www.patreon.com/TimeGhostHistory

Hosted by: Indy Neidell

Written by: Tom Maeden and Spartacus Olsson

Directed by: Spartacus Olsson and Astrid Deinhard

Executive Producers: Bodo Rittenauer, Astrid Deinhard, Indy Neidell, Spartacus Olsson

Creative Producer: Joram Appel

Post-Production Director: Wieke Kapteijns

Research by: Tom Maeden

Edited by: Mikołaj Cackowski

Sound design: Marek KamińskiSoundtracks from Epidemic Sound:

Howard Harper-Barnes – “A Sleigh Into Town”

Farrell Wooten – “Blunt Object”

Johannes Bornlöf – “The Inspector 4”

Jo Wandrini – “Dawn of Civilization”A TimeGhost chronological documentary produced by OnLion Entertainment GmbH.

From the comments:

TimeGhost History

2 hours ago

So, the year is almost over… it’s a Monday, so many of you might be at work. How was 2019 and how do you hope that 2020 is going to be? For us at TimeGhost it has been a very exciting year indeed. WW2 grew both in scope and viewership, Between 2 Wars is almost completed and we welcomed close to 2,000 new recruits to the TimeGhost Army https://www.patreon.com/TimeGhostHistoryAnd all of us, you guys included need to thank them for all the content we were able to bring to you in 2019. Because like nations depend on their defense forces to maintain their independence, we depend on the TimeGhost Army to keep fighting the good fight of education and entertainment. Thank you from the bottom of our hearts. We look forward to take all of this even further in 2020 as WW2 grows ever more complex, Between 2 Wats concludes, and we come out with new exciting series here on the TimeGhost channel.

December 5, 2019

Fallen flag – the Denver & Rio Grande Western

The origins of the Denver & Rio Grande Western by Mark Hemphill for Trains magazine:

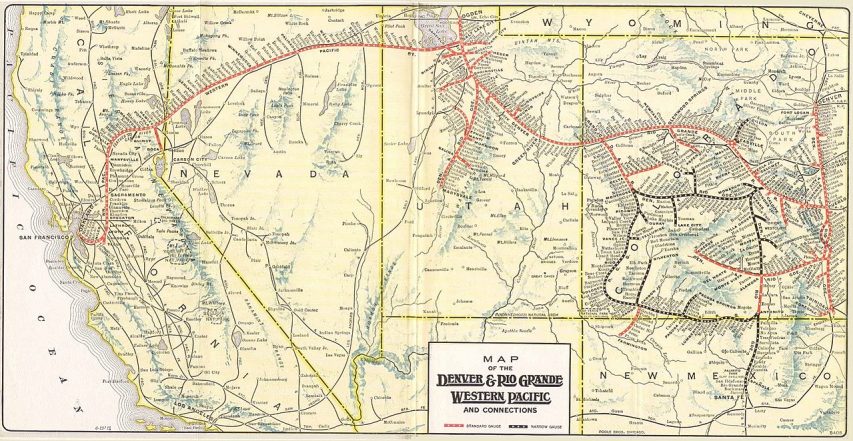

1914 route map of the Denver & Rio Grande Western and Western Pacific railroads.

Map via Wikimedia Commons

In the American tradition, a railroad is conceived by noble men for noble purposes: to develop a nation, or to connect small villages to the big city. The Denver & Rio Grande of 1870 was not that railroad. Much later, however, it came to serve an admirable public purpose, earn the appreciation of its shippers and passengers, and return a substantial profit.

The Rio Grande was conceived by former Union Brig. Gen. William Jackson Palmer. As surveyor of the Kansas Pacific (later in Union Pacific’s realm), Palmer saw the profit possibilities if you got there first and tied up the real estate. Palmer, apparently connecting dots on a map to appeal to British and Dutch investors, proposed the Denver & Rio Grande Railway to run south from Denver via El Paso, Texas, to Mexico City. There was no trade, nor prospect for such, between the two end points, but the proposal did attract sufficient capital to finish the first 75 miles to Colorado Springs in 1871.

William Jackson Palmer 1836-1909, founder of Colorado Springs, Colorado, builder of several railroads including the D&RGW.

Photograph circa 1870, photographer unknown, via Wikimedia Commons.Narrow-gauge origins

Palmer chose 3-foot gauge to save money, assessing that the real value lay in the real estate, not in railroad operation. At each new terminal, Palmer’s men corralled the land, then located the depot, profiting through a side company on land sales. Construction continued fitfully to Trinidad, Colo., 210 miles from Denver, by 1878. Above Trinidad, on the ascent to Raton Pass, Palmer’s engineers collided with the Santa Fe’s, who were building toward California. Realizing that a roundabout narrow-gauge competing with a point-to-point standard-gauge would serve neither the fare box nor the next prospectus, Palmer changed course, making D&RG a supply line to the gold and silver bonanzas blossoming all over Colorado and Utah. Thus the Rio Grande would look west, not south, and would plumb so many canyons in search of mineral wealth that it was a surprise to find one without its rails.Turning west at Pueblo, Colo., and outfighting the Santa Fe for the Royal Gorge of the Arkansas River — where there truly was room for only one track — D&RG entered Leadville, Colorado’s first world-class mining bonanza, in 1880. Three years later, it completed a Denver–Salt Lake City main line west from Salida, Colo., via Marshall Pass and the Black Canyon of the Gunnison River. The last-spike ceremony in the desert west of Green River, Utah, was low-key, lest anyone closely examine this rough, circuitous, and glacially slow “transcontinental.” Almost as an afterthought, D&RG added a third, standard-gauge rail from Denver to Pueblo, acknowledgment that once paralleled by a standard-gauge competitor, narrow-gauge was a death sentence.

New owners, new purpose

Palmer then began to exit. The company went bust, twice, in rapid succession. The new investors repurposed the railroad again. Instead of transient gold and silver, the new salvation would be coal. Thick bituminous seams in the Walsenburg-Trinidad field fed beehive coke ovens of a new steel mill near Pueblo and heated much of eastern Colorado and western Kansas and Nebraska.