Of such sorts are the wizards who now run the country. Here is the perfect pattern of a professional world-saver. His whole life has been devoted to the art and science of spending other people’s money. He has saved millions of the down-trodden from starvation, pestilence, cannibalism, and worse – always at someone else’s expense, and usually at the taxpayer’s. He has been going at it over and over again at Washington. And now, with $4,800,000,000 of your money and mine in his hands, he is preparing to save fresh multitudes, that they may be fat and optimistic on the Tuesday following the first Monday in November, 1936, and so mark their ballots in the right box.

H.L Mencken, “The New Deal”, Baltimore Sun, 1935-05-27.

January 25, 2018

QotD: The New Deal

October 29, 2017

QotD: Mencken’s revised view of Coolidge

In what manner he would have performed himself if the holy angels had shoved the Depression forward a couple of years — this we can only guess, and one man’s hazard is as good as another’s. My own is that he would have responded to bad times precisely as he responded to good ones — that is, by pulling down the blinds, stretching his legs upon his desk, and snoozing away the lazy afternoons…. He slept more than any other President, whether by day or by night. Nero fiddled, but Coolidge only snored…. Counting out Harding as a cipher only, Dr. Coolidge was preceded by one World Saver and followed by two more. What enlightened American, having to choose between any of them and another Coolidge, would hesitate for an instant? There were no thrills while he reigned, but neither were there any headaches. He had no ideas, and he was not a nuisance.

H.L. Mencken, The American Mercury, 1933-04.

January 22, 2017

The media’s Great Depression nostalgia

Ed Driscoll on the recurring media nostalgia for a long-ago, much-worse-than-today time:

The month after Obama won the election in 2008, Virginia Postrel noted that a lot of journalists (read: Democrat operatives with bylines) had heavily invested in the notion that it was the 1930s all over again, and had a major case of what Virginia dubbed “Depression Lust,” and were busy cranking out “Depression Porn” in service to the Office of the President-Elect. Not least of which was Time magazine’s infamous cover of Obama Photoshopped into the second coming of FDR and the headline “The New, New Deal,” thinking it was a compliment, and not an ominous prediction of an economy as similarly atrophied as Roosevelt’s. Pretending that Trump is Hitler allows you, oh brave foot-soldier in the DNC-MSM, to pose as the new Dietrich Bonhoeffer. It’s simply the funhouse mirror image version of the same sclerotic meme.

For the modern left, if the economy is relatively good*, and the incoming president has a (D) after his name, he’s the second coming of JFK (see: Clinton, Bill); if the economy is bad, and he has a (D) after his name, he’s FDR — and no matter what the shape of the economy, if the president has an (R) after his name, he’s Hitler (QED: Nixon, Reagan, Bush #43, and Trump).

* And it was, despite Clinton’s rhetoric. Would Time magazine lie to you? Well yes, of course. But look what they admitted in December of 1992.

December 8, 2016

The History of Paper Money – VI: The Gold Standard – Extra History

Published on Nov 5, 2016

Even as the use of paper money grew, ties to the gold standard remained… and remained challenging. From the First Opium War to the Great Depression, events around the world stretched the capacity of bullion based economics. So what – and who – finally abandoned it?

August 25, 2016

RMS Queen Mary “was one of the epic government bailout boondoggles of the 20th century”

At Reason, Glenn Garvin looks at the role government subsidies had in the survival of the Cunard Line and the building of the RMS Queen Mary:

The most interesting thing about the Queen Mary, which for several decades was the largest passenger ship ever built, is not the 20-foot propellers so perfectly balanced that they could be spun with a flick of the wrist; or the 35,000 tons of metal that went into its construction; or the 10 million rivets that hold the whole thing together. It’s not even the still-mysterious question of how the ship became the springboard for the very first cheap-shot joke about Joan Collins. (Q. What’s the difference between Joan Collins and the Queen Mary? A. It takes a few tugs to get the Queen Mary out of her slip.)

No, the really special thing about the Queen Mary is that it was one of the epic government bailout boondoggles of the 20th century. In 1931, barely a year into the ship’s construction, the Cunard line went broke. The British dutifully forked over a loan of a staggering 9.5 million pounds — that’s $684 million in 2016 dollars — to keep the company afloat (dreadful pun not intended until I actually typed it). Which, as the documentary Mighty Ship at War: The Queen Mary notes, saved a whopping 2,000 jobs — at $342,000 a pop, I can only conclude that shipping lines employ a lot more neurosurgeons than I was aware — and, more importantly, England’s image: “Great Britain was at risk of losing its reputation as the world’s leading maritime nation.”

Its wide-eyed admiration of pork-slinging statecraft aside, Mighty Ship at War is a peppy and quite watchable little documentary about an oddball chapter in maritime history: the conversion of luxury liners into troop transports during World War II. When war broke out in Europe in 1939, unleashing German submarine wolfpacks on commercial shipping in the Atlantic, the cruise ships were drafted just like able-bodied men. They even got the maritime equivalent of a GI haircut, repainted a dull naval gray while their posh staterooms were ripped out to make way for towering stacks of bunks.

Even before its military makeover, Mighty Ship at War relates, the Queen Mary had found its business model remade by Europe’s gathering war clouds. Because the ship’s London-to-New York route included a stop in Cherbourg, France, it became the escape route of choice for many Jews fleeing Europe. Even families of modest means often traveled in plutocratic splendor, blowing their life savings on first-class tickets, because the Germans would confiscate any money or valuables the refugees tried to carry with them. “Give the money to the Brits, not the damn Nazis,” one refugee who made the crossing as a small child remembers his parents saying. By early 1939, every London departure of the Queen Mary was sold out.

June 6, 2016

QotD: What really ended the Great Depression in the United States?

The Great Depression was the worst economic crisis in U.S. history. From 1931 to 1940 unemployment was always in double digits. In April 1939, almost ten years after the crisis began, more than one in five Americans still could not find work.

On the surface, World War II seems to mark the end of the Great Depression. During the war more than 12 million Americans were sent into the military, and a similar number toiled in defense-related jobs. Those war jobs seemingly took care of the 17 million unemployed in 1939. Most historians have therefore cited the massive spending during wartime as the event that ended the Great Depression.

Some economists — especially Robert Higgs […] challenged that conclusion. Let’s be blunt. If the recipe for economic recovery is putting tens of millions of people in defense plants or military marches, then having them make or drop bombs on our enemies overseas, the value of world peace is called into question. In truth, building tanks and feeding soldiers — necessary as it was to winning the war — became a crushing financial burden. We merely traded debt for unemployment. The expense of funding World War II hiked the national debt from $49 billion in 1941 to almost $260 billion in 1945. In other words, the war had only postponed the issue of recovery.

Even President Roosevelt and his New Dealers sensed that war spending was not the ultimate solution; they feared that the Great Depression — with more unemployment than ever — would resume after Hitler and Hirohito surrendered. Yet FDR’s team was blindly wedded to the federal spending that (as I argue in my 2009 book New Deal or Raw Deal?) had perpetuated the Great Depression during the 1930s.

FDR had halted many of his New Deal programs during the war — and he allowed Congress to kill the WPA, the CCC, the NYA, and others — because winning the war came first. In 1944, however, as it became apparent that the Allies would prevail, he and his New Dealers prepared the country for his New Deal revival by promising a second bill of rights. Included in the President’s package of new entitlements was the right to “adequate medical care,” a “decent home,” and a “useful and remunerative job.” These rights (unlike free speech and freedom of religion) imposed obligations on other Americans to pay taxes for eyeglasses, “decent” houses, and “useful” jobs, but FDR believed his second bill of rights was an advance in thinking from what the Founders had conceived.

Burton Folsom, “If FDR’s New Deal Didn’t End the Depression, Then It Was World War II that Did”, The Freeman, 2014-12-26.

March 28, 2016

QotD: Black Thursday, 1929

One of the most thorough and meticulously documented accounts of the Fed’s inflationary actions prior to 1929 is America’s Great Depression by the late Murray Rothbard. Using a broad measure that includes currency, demand and time deposits, and other ingredients, Rothbard estimated that the Federal Reserve expanded the money supply by more than 60 percent from mid-1921 to mid-1929. The flood of easy money drove interest rates down, pushed the stock market to dizzy heights, and gave birth to the “Roaring Twenties.” Some economists miss this because they look at measures of the “price level,” which didn’t change much. But easy money distorts relative prices, which in turn fosters unsustainable conditions in certain sectors.

By early 1929, the Federal Reserve was taking the punch away from the party. It choked off the money supply, raised interest rates, and for the next three years presided over a money supply that shrank by 30 percent. This deflation following the inflation wrenched the economy from tremendous boom to colossal bust.

The “smart” money — the Bernard Baruchs and the Joseph Kennedys who watched things like money supply — saw that the party was coming to an end before most other Americans did. Baruch actually began selling stocks and buying bonds and gold as early as 1928; Kennedy did likewise, commenting, “only a fool holds out for the top dollar.”

When the masses of investors eventually sensed the change in Fed policy, the stampede was underway. The stock market, after nearly two months of moderate decline, plunged on “Black Thursday” — October 24, 1929 — as the pessimistic view of large and knowledgeable investors spread.

The stock market crash was only a symptom — not the cause — of the Great Depression: the market rose and fell in near synchronization with what the Fed was doing. If this crash had been like previous ones, the subsequent hard times might have ended in a year or two. But unprecedented political bungling instead prolonged the misery for twelve long years.

Lawrence W. Reed, “The Great Depression was a Calamity of Unfettered Capitalism”, The Freeman, 2014-11-28.

March 16, 2016

QotD: The Great Depression

How bad was the Great Depression? Over the four years from 1929 to 1933, production at the nation’s factories, mines, and utilities fell by more than half. People’s real disposable incomes dropped 28 percent. Stock prices collapsed to one-tenth of their pre-crash height. The number of unemployed Americans rose from 1.6 million in 1929 to 12.8 million in 1933. One of every four workers was out of a job at the Depression’s nadir, and ugly rumors of revolt simmered for the first time since the Civil War.

Old myths never die; they just keep showing up in college economics and political science textbooks. Students today are frequently taught that unfettered free enterprise collapsed of its own weight in 1929, paving the way for a decade-long economic depression full of hardship and misery. President Herbert Hoover is presented as an advocate of “hands-off,” or laissez-faire, economic policy, while his successor, Franklin Roosevelt, is the economic savior whose policies brought us recovery. This popular account of the Depression belongs in a book of fairy tales and not in a serious discussion of economic history, as a review of the facts demonstrates.

To properly understand the events of the time, it is appropriate to view the Great Depression as not one, but four consecutive depressions rolled into one. The late economist Hans F. Sennholz labeled these four “phases” as follows: the business cycle; the disintegration of the world economy; the New Deal; and the Wagner Act. The first phase explains why the crash of 1929 happened in the first place; the other three show how government intervention kept the economy in a stupor for over a decade.

The Great Depression was not the country’s first depression, though it proved to be the longest. The common thread woven through the several earlier debacles was disastrous manipulation of the money supply by government. For various reasons, government policies were adopted that ballooned the quantity of money and credit. A boom resulted, followed later by a painful day of reckoning. None of America’s depressions prior to 1929, however, lasted more than four years and most of them were over in two. The Great Depression lasted for a dozen years because the government compounded its monetary errors with a series of harmful interventions.

Lawrence W. Reed, “The Great Depression was a Calamity of Unfettered Capitalism”, The Freeman, 2014-11-28.

March 8, 2016

QotD: The Civil Works Administration, the Works Progress Administration and the Wagner Act

Roosevelt created the Civil Works Administration in November 1933 and ended it in March 1934, though the unfinished projects were transferred to the Federal Emergency Relief Administration. Roosevelt had assured Congress in his State of the Union message that any new such program would be abolished within a year. “The federal government,” said the President, “must and shall quit this business of relief. I am not willing that the vitality of our people be further stopped by the giving of cash, of market baskets, of a few bits of weekly work cutting grass, raking leaves, or picking up papers in the public parks.”

But in 1935 the Works Progress Administration came along. It is known today as the very government program that gave rise to the new term, “boondoggle,” because it “produced” a lot more than the 77,000 bridges and 116,000 buildings to which its advocates loved to point as evidence of its efficacy. The stupefying roster of wasteful spending generated by these jobs programs represented a diversion of valuable resources to politically motivated and economically counterproductive purposes.

The American economy was soon relieved of the burden of some of the New Deal’s excesses when the Supreme Court outlawed the NRA in 1935 and the AAA in 1936, earning Roosevelt’s eternal wrath and derision. Recognizing much of what Roosevelt did as unconstitutional, the “nine old men” of the Court also threw out other, more minor acts and programs which hindered recovery.

Freed from the worst of the New Deal, the economy showed some signs of life. Unemployment dropped to 18 percent in 1935, 14 percent in 1936, and even lower in 1937. But by 1938, it was back up to 20 percent as the economy slumped again. The stock market crashed nearly 50 percent between August 1937 and March 1938. The “economic stimulus” of Franklin Roosevelt’s New Deal had achieved a real “first”: a depression within a depression!

The stage was set for the 1937–38 collapse with the passage of the National Labor Relations Act in 1935 — better known as the Wagner Act and organized labor’s “Magna Carta.” To quote Hans Sennholz again:

This law revolutionized American labor relations. It took labor disputes out of the courts of law and brought them under a newly created Federal agency, the National Labor Relations Board, which became prosecutor, judge, and jury, all in one. Labor union sympathizers on the Board further perverted this law, which already afforded legal immunities and privileges to labor unions. The U.S. thereby abandoned a great achievement of Western civilization, equality under the law.

Armed with these sweeping new powers, labor unions went on a militant organizing frenzy. Threats, boycotts, strikes, seizures of plants, and widespread violence pushed productivity down sharply and unemployment up dramatically. Membership in the nation’s labor unions soared; by 1941 there were two and a half times as many Americans in unions as in 1935.

From the White House on the heels of the Wagner Act came a thunderous barrage of insults against business. Businessmen, Roosevelt fumed, were obstacles on the road to recovery. New strictures on the stock market were imposed. A tax on corporate retained earnings, called the “undistributed profits tax,” was levied. “These soak-the-rich efforts,” writes economist Robert Higgs, “left little doubt that the president and his administration intended to push through Congress everything they could to extract wealth from the high-income earners responsible for making the bulk of the nation’s decisions about private investment.”

Higgs draws a close connection between the level of private investment and the course of the American economy in the 1930s. The relentless assaults of the Roosevelt administration — in both word and deed — against business, property, and free enterprise guaranteed that the capital needed to jumpstart the economy was either taxed away or forced into hiding. When Roosevelt took America to war in 1941, he eased up on his anti-business agenda, but a great deal of the nation’s capital was diverted into the war effort instead of into plant expansion or consumer goods. Not until both Roosevelt and the war were gone did investors feel confident enough to “set in motion the postwar investment boom that powered the economy’s return to sustained prosperity.”

Lawrence W. Reed, “The Great Depression was a Calamity of Unfettered Capitalism”, The Freeman, 2014-11-28.

February 18, 2016

QotD: FDR’s New Deal

Franklin Delano Roosevelt won the 1932 presidential election in a landslide, collecting 472 electoral votes to just 59 for the incumbent Herbert Hoover. The platform of the Democratic Party whose ticket Roosevelt headed declared, “We believe that a party platform is a covenant with the people to be faithfully kept by the party entrusted with power.” It called for a 25 percent reduction in federal spending, a balanced federal budget, a sound gold currency “to be preserved at all hazards,” the removal of government from areas that belonged more appropriately to private enterprise, and an end to the “extravagance” of Hoover’s farm programs. This is what candidate Roosevelt promised, but it bears no resemblance to what President Roosevelt actually delivered.

In the first year of the New Deal, Roosevelt proposed spending $10 billion while revenues were only $3 billion. Between 1933 and 1936, government expenditures rose by more than 83 percent. Federal debt skyrocketed by 73 percent.

Roosevelt secured passage of the Agricultural Adjustment Act (AAA), which levied a new tax on agricultural processors and used the revenue to supervise the wholesale destruction of valuable crops and cattle. Federal agents oversaw the ugly spectacle of perfectly good fields of cotton, wheat, and corn being plowed under. Healthy cattle, sheep, and pigs by the millions were slaughtered and buried in mass graves.

Even if the AAA had helped farmers by curtailing supplies and raising prices, it could have done so only by hurting millions of others who had to pay those prices or make do with less to eat.

Perhaps the most radical aspect of the New Deal was the National Industrial Recovery Act (NIRA), passed in June 1933, which set up the National Recovery Administration (NRA). Under the NIRA, most manufacturing industries were suddenly forced into government-mandated cartels. Codes that regulated prices and terms of sale briefly transformed much of the American economy into a fascist-style arrangement, while the NRA was financed by new taxes on the very industries it controlled. Some economists have estimated that the NRA boosted the cost of doing business by an average of 40 percent — not something a depressed economy needed for recovery.

Like Hoover before him, Roosevelt signed into law steep income tax rate increases for the high brackets and introduced a 5 percent withholding tax on corporate dividends. In fact, tax hikes became a favorite policy of the president’s for the next ten years, culminating in a top income tax rate of 94 percent during the last year of World War II.

Lawrence W. Reed, “The Great Depression was a Calamity of Unfettered Capitalism”, The Freeman, 2014-11-28.

February 14, 2016

QotD: President Herbert Hoover’s lasting economic legacy

Until March 1933, these were the years of President Herbert Hoover — the man that anti-capitalists depict as a champion of non-interventionist, laissez-faire economics.

Did Hoover really subscribe to a “hands off the economy,” free-market philosophy? His opponent in the 1932 election, Franklin Roosevelt, didn’t think so. During the campaign, Roosevelt blasted Hoover for spending and taxing too much, boosting the national debt, choking off trade, and putting millions of people on the dole. He accused the president of “reckless and extravagant” spending, of thinking “that we ought to center control of everything in Washington as rapidly as possible,” and of presiding over “the greatest spending administration in peacetime in all of history.” Roosevelt’s running mate, John Nance Garner, charged that Hoover was “leading the country down the path of socialism.” Contrary to the modern myth about Hoover, Roosevelt and Garner were absolutely right.

The crowning folly of the Hoover administration was the Smoot-Hawley Tariff, passed in June 1930. It came on top of the Fordney-McCumber Tariff of 1922, which had already put American agriculture in a tailspin during the preceding decade. The most protectionist legislation in U.S. history, Smoot-Hawley virtually closed the borders to foreign goods and ignited a vicious international trade war.

Officials in the administration and in Congress believed that raising trade barriers would force Americans to buy more goods made at home, which would solve the nagging unemployment problem. They ignored an important principle of international commerce: trade is ultimately a two-way street; if foreigners cannot sell their goods here, then they cannot earn the dollars they need to buy here.

Foreign companies and their workers were flattened by Smoot-Hawley’s steep tariff rates, and foreign governments soon retaliated with trade barriers of their own. With their ability to sell in the American market severely hampered, they curtailed their purchases of American goods. American agriculture was particularly hard hit. With a stroke of the presidential pen, farmers in this country lost nearly a third of their markets. Farm prices plummeted and tens of thousands of farmers went bankrupt. With the collapse of agriculture, rural banks failed in record numbers, dragging down hundreds of thousands of their customers.

Hoover dramatically increased government spending for subsidy and relief schemes. In the space of one year alone, from 1930 to 1931, the federal government’s share of GNP increased by about one-third.

Hoover’s agricultural bureaucracy doled out hundreds of millions of dollars to wheat and cotton farmers even as the new tariffs wiped out their markets. His Reconstruction Finance Corporation ladled out billions more in business subsidies. Commenting decades later on Hoover’s administration, Rexford Guy Tugwell, one of the architects of Franklin Roosevelt’s policies of the 1930s, explained, “We didn’t admit it at the time, but practically the whole New Deal was extrapolated from programs that Hoover started.”

To compound the folly of high tariffs and huge subsidies, Congress then passed and Hoover signed the Revenue Act of 1932. It doubled the income tax for most Americans; the top bracket more than doubled, going from 24 percent to 63 percent. Exemptions were lowered; the earned income credit was abolished; corporate and estate taxes were raised; new gift, gasoline, and auto taxes were imposed; and postal rates were sharply hiked.

Can any serious scholar observe the Hoover administration’s massive economic intervention and, with a straight face, pronounce the inevitably deleterious effects as the fault of free markets?

Lawrence W. Reed, “The Great Depression was a Calamity of Unfettered Capitalism”, The Freeman, 2014-11-28.

August 26, 2015

July 6, 2015

May 25, 2015

QotD: Deflation

Deflation occurs when there is not enough currency in circulation to meet the needs of the economy. Here again, the classical definition focuses on falling prices rather than an insufficient currency stock, but deflation is primarily a monetary phenomenon.

It is the economic version of anemia: too little blood is reaching the body. Each unit of the currency goes up in value relative to the goods and services available, but because the stock of currency isn’t growing fast enough, it starves the economy of investment capital. There isn’t enough money to build out existing business, to create new ones, or to hire new workers. (This is in part what happened during the Great Depression of the 1930’s.) Inventories shrink, but new goods aren’t being produced due to the lack of investment capital. Eventually the economy grinds to a halt as production withers away.

Specie currencies are more prone to deflation than fiat currencies for the simple reason that fiat currencies are not based on scarce (and thus valuable) resources like gold, silver, or what have you. There’s only so much gold and silver to go around, and sometimes the supply of bullion can be interrupted for long periods. (Sometimes this is even done deliberately by rival nations or speculators.) Also, because the value of gold and silver is set outside the control of government or authority issuing the currency, it limits the kinds of monetary policy the sovereign can conduct, especially during times of crisis.

Monty, “Inflation, Deflation, and Monetary Policy”, Ace of Spades HQ, 2014-07-11.

November 18, 2014

Finland’s Great(est) Depression

Lars Christensen explains why — economically speaking — Finland is suffering through an economic phenomena even worse than the Great Depression:

In my post from Friday — Italy’s Greater Depression — Eerie memories of the 1930s — I inspired by the recent political unrest in Italy compared the development in real GDP in Italy during the recent crisis with the development in the 1920s and 1930s.The graph in that blog post showed two things. First, Italy’s real GDP lose in the recent crisis has been bigger than during 1930s and second that monetary easing (a 41% devaluation) brought Italy out of the crisis in 1936.

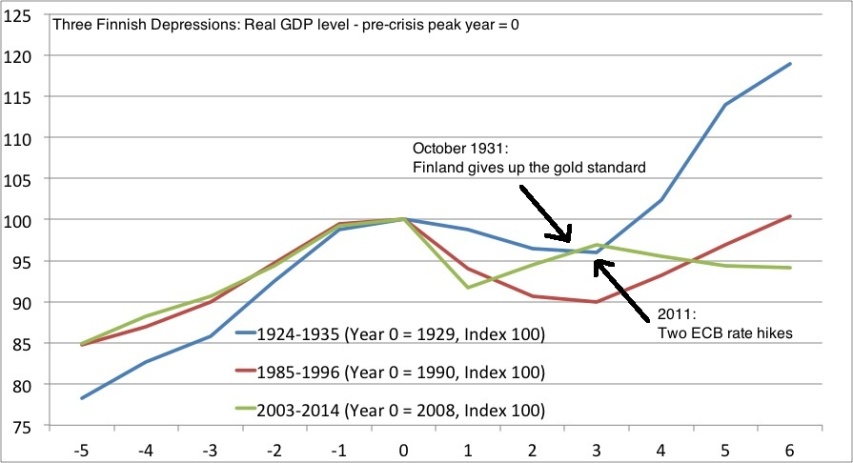

I have been asked if I could do a similar graph on Finland. I have done so — but I have also added the a third Finnish “Depression” and that is the crisis in the early 1990s related to the collapse of the Soviet Union and the Nordic banking crisis. The graph below shows the three periods.

[…]

The most interesting story in the graph undoubtedly is the difference in the monetary response during the 1930s and during the present crisis.

In October 1931 the Finnish government decided to follow the example of the other Nordic countries and the UK and give up (or officially suspend) the gold standard.

The economic impact was significant and is very clearly illustrate in the graph (look at the blue line from year 2-3).

We have nearly imitate take off. I am not claiming the devaluation was the only driver of this economic recovery, but it surely looks like monetary easing played a very significant part in the Finnish economic recovery from 1931-32.