PauliosVids

Published 15 Dec 2018From the British Motor Corporation Ltd (BMC).

October 21, 2023

October 18, 2023

Why the Canadian Surface Combatant (CSC) program will cost so much more than equivalent US or British ships

In The Line, Philippe Lagassé outlines the Canadian Surface Combatant (CSC) program — the next-generation front-line combat ships for the Royal Canadian Navy intended to replace the current Halifax-class frigates and the already retired Iroquois-class destroyers:

Building warships is an expensive business, especially if you’re getting back into it after a few decades. Take the Canadian Surface Combatant (CSC). Fifteen CSCs will be built at Halifax’s Irving Shipbuilding to replace Canada’s current frigates and decommissioned destroyers. According to a 2022 study by the Parliamentary Budget Officer (PBO), the CSC acquisition will cost $80.2 billion. Given that defence inflation is well above regular inflation, and that regular inflation is running hot, that number isn’t going to go down.

Canada’s CSC will be a variant of the Type 26 Global Combat Ship originally designed for the Royal Navy. The Canadian variant includes significant changes to the original Type 26 design, notably to the combat systems. With the estimated per unit cost of each ship topping $5.6 billion, the National Post‘s John Ivison warns that the CSC is out of control. Ivison notes that the United States Navy (USN) acquired its Constellation-class frigates for $1.66 billion. Why, he understandably asks, is Canada paying so much for the CSC, and to what end?

The Canadian government always views major military purchases for the Canadian Armed Forces primarily as regional economic development projects and always attempts to get all or at least a major part of the construction done in Canada. To most people this sounds sensible: big military equipment acquisitions mean a lot of money being spent, so why shouldn’t most of that money be spent inside Canada? The answer, in almost every case, is that it will be significantly more expensive because Canadian industry doesn’t regularly produce these ships/planes/helicopters/tanks, so a lot of money will need to be spent to construct the factories or shipyards, import the specialized equipment, hire and train the workforce, etc., and no rational private industry will spend that kind of money unless they’re guaranteed to be repaid (plus profit).

Ordinary items for the Canadian military like clothing, food, non-specialized vehicles (cars, trucks, etc.) may carry a small extra margin over run-of-the-mill stuff, but it will generally be competitive with imported equivalents. Highly specialized items generally won’t be competitively priced exactly because of those specialized qualities. The bigger and more unusual the item to be purchased, the less economic sense it makes to buy domestically.

There are also the conflicting desires of the elected government (who generally want to target the spending to electoral districts or regions that benefit “their” voters), the permanent bureaucracy (who want to ensure that programs last a long time to ensure jobs within the civil service), and the military procurement teams (who have a tendency to over-optimistically estimate up-front and long-term costs because they want to get the procurement process underway … it’s tougher to stop something already in-process than one that still needs formal approval).

Once there’s a budget and capabilities are identified, the requirements for individual projects are prepared. It’s here that the comparison with lower cost, off-the-shelf alternatives runs into difficultly. The USN has lots of different types of ships that do lots of specific things. The above-mentioned Constellation-class is one of many different types of warships that the USN will sail, each with specific mission sets and roles. The Canadian military has only been directed to acquire fifteen CSCs, but the government expects the CAF to do a variety of missions at sea — not as many as the USN, of course, but still a good number. Canada has other military ships, including the Arctic Offshore Patrol Vessels (AOPS) also being built by Irving, but the CSC will be Royal Canadian Navy (RCN)’s primary expeditionary platform. Canadian defence planners, therefore, need those 15 ships to be capable of undertaking various missions and roles. Compounding this challenge are technological changes and the ever-evolving threat. The requirements for the CSC need to be continuously updated, and in some cases expanded, to keep pace with these developments, too.

An artist’s rendition of BAE’s Type 26 Global Combat Ship, which was selected as the Canadian Surface Combatant design in 2019, the most recent “largest single expenditure in Canadian government history” (as all major weapon systems purchases tend to be).

(BAE Systems, via Flickr)

On purely economic grounds, it would often make sense to add Canada’s order on to existing US, British, or other allied military orders to benefit from the economies of scale … but pure economic benefits don’t rank highly on the overall scale of importance. There’s also the understandable desire of the government to buy fewer items with wider capabilities as the government’s requirements for the military change with time and circumstance.

Were Canadian defence planners too cavalier in their requirements and design modifications? Maybe. Looking at it from their perspective, though, we should appreciate that they thinking about capabilities for a ship that Canada will use until the 2100s.

Doubts about the CSC are going to keep multiplying. The per unit costs can only increase so much before people start seriously discussing reducing how many of them will be built. You can be sure that some within government are already asking “Why 15? Why not 12?” Serious concerns are also being raised about whether the defence budget can afford to maintain CSC and keep them technologically up to date after the fleet is introduced. Given the CAF’s personnel recruitment troubles, moreover, it’s unclear if the RCN will have enough sailors to operate the full fleet. The first CSC that hits the water, furthermore, will have all sorts of kinks and problems that will need to be sorted out. That’s standard for first ships off the line, but you can be sure that every failing will be met with handwringing and charges of incompetence.

To address these concerns, the government must let DND/CAF better explain what the CSC is designed to do and why it needs to do it. Simply telling Canadians that it’s the right ship isn’t enough when it’s easy to point to lower-cost alternatives. As well, the government needs to be far more transparent about estimates of costs and what’s driving them. Political and public support for the CSC shouldn’t be taken for granted, and growing concerns about the program can’t be simply brushed away.

October 14, 2023

A Jacobite spy for Bonnie Prince Charlie

In the latest Age of Invention newsletter, Anton Howes talks about the career of John Holker of Manchester, cloth manufacturer, who joined the army of Prince Charles Edward Stewart in 1745, and eventually became an expert in industrial espionage:

Prince Charles Edward Stuart, 1720 – 1788. Eldest Son of Prince James Francis Edward Stuart.

Portrait by Allan Ramsay, National Galleries Scotland via Wikimedia Commons.

I’ve lately been reading about one of history’s greatest spies — not a James Bond-like agent with licence to kill, but a master of industrial espionage, John Holker.1

Holker was originally from Manchester, in Lancashire, where he was a skilled cloth manufacturer in the early eighteenth century, his specialty being calendering — a finishing process to give cloth a kind of sheen or glazed effect. But Holker was also a Catholic and a Jacobite — a believer in the claim of the Catholic descendants of the deposed king James II to be the rightful rulers of Great Britain, instead of the Hanoverian George I and George II who had only succeeded to the throne because they were Protestants. In 1745 James II’s grandson Charles, also known as Bonnie Prince Charlie — likely the “Bonnie” who lies over the ocean in the famous song — landed in the Scottish Highlands and raised the royal standard. Charles’s uprising defeated the British troops stationed in Scotland, captured Edinburgh, and then marched down the west coast of England, capturing Carlisle and entering Lancashire.

To Holker, who had been born in the same year as the last Jacobite rebellion in 1719, the arrival of Charles in Manchester must have seemed like a once-in-a-generation opportunity. He and his business partner instantly joined Charles’s troops and he was appointed a lieutenant. But Manchester was the last place to provide many eager volunteers for the uprising, and when Charles reached Derby he lost heart and turned around. Holker and his business partner ended up being left to garrison Carlisle as Charles and his force retreated into Scotland to hunker down, and they were soon captured by the British troops sent to quash the uprising. They were then, as officers, sent to Newgate prison in London to sit with their legs bound in irons and await trial and certain execution.

But they never made it to trial. In the first demonstration of Holker’s extraordinary talent for espionage, they escaped. Holker had been allowed visitors in prison, so had drawn on London’s crypto-Jacobite circle to smuggle in files, ropes, and information about the prison and its surroundings. They managed to file through the leg-irons and window bars, climbed up the gutters onto the prison roof, and then used planks from the cell’s tabletop to cross onto the roof of a nearby house. In the event, they disturbed a dog guarding the house, and so Holker hid in a water-butt and became separated from the others. He eventually found refuge at a crypto-Jacobite’s house, then escaped into the countryside before managing to make his way to France.

In France, Holker joined his fellow veterans of the failed uprising of ‘45, becoming a lieutenant in a Jacobite regiment of the French army. He fought for the French in the Austrian Netherlands — present-day Belgium — against the Hapsburgs, the Hanoverians, the Dutch, and the British. Even more extraordinary, however, was that when Bonnie Prince Charlie wanted to go in secret to England in 1750, it was Holker who went with him as his sole companion and guide. Although Charles failed to persuade his supporters in England to rise up in rebellion on their own, Holker managed to get the prince secretly and safely to London and back.

By the time Holker reached his early thirties he had been an industrialist, rebel, prisoner, fugitive, soldier, undercover agent, and even spy-catcher: he successfully identified a spy for the British in Charles’s circle, even if Charles failed to heed his warning. But in 1751 Holker’s career took yet another turn when he was recruited by the French government as an industrial spymaster.

Holker’s chief task was to steal British textile technologies.

1. Unless otherwise stated, I’ve drawn much of my information on Holker and the industries that the French attempted to copy from John R. Harris, Industrial Espionage and Technology Transfer: Britain and France in the 18th Century (Taylor & Francis, 2017), particularly chapter 3.

September 24, 2023

A sliver of hope for Indigo?

In the latest SHuSH newsletter, Ken Whyte relays some new-ish rumours in the book business that may provide a bit of help for the struggling Indigo chain:

“Indigo Books and Music” by Open Grid Scheduler / Grid Engine is licensed under CC0 1.0

So what do we make of Heather Reisman’s return as CEO of the Indigo bookselling chain after her unceremonious removal from that role just two months ago?

The short answer is I have no idea, but SHuSH has never shied away from delivering irresponsible speculation on happenings at Indigo. I heard this week from a reasonably reliable source that Indigo is in discussions with Elliott Management Corp., owners of Barnes & Noble and the world’s only buyer of distressed bookselling chains.

This conflicts with some chatter I reported last spring suggesting that Elliott Management was uninterested in Indigo. If what I’m now hearing is true, it’s great news.

I have to emphasize, I have no idea. But if a deal were imminent, it would make sense to bring Heather back to see it through. Indigo wouldn’t want the bother of recruiting a new leader simply to effect the handover, and who would want the job on those terms?

And another thing …

In last week’s piece about Indigo, I noted that the company’s staff, “with exceptions, were young, inexpert, and disinterested”. Amal, clearly one of the exceptions, left an interesting comment:

No. We became disinterested simply because a) we were all book lovers and had zero interest in selling crap and b) just like the author of this piece, head office and management were beyond dismissive of our knowledge, our book expertise, our genuine love of the written word. I worked at Chapters/Indigo starting in 2006 all the way until 2019, a couple of days a week, simply for my love of books. I am incredibly proud of my time there — especially when I was able to introduce new authors or genres to readers. My staff picks would sell out because I would hand sell them to people with my joy. It certainly wasn’t for the stellar pay or the people who treat retail employees like we are “inexpert”. Fun fact: you were asked in the job interview what your favourite books/genres were.

September 23, 2023

QotD: In which we discover why they’re called antimacassars

“Antimacassar” is such a lovely Victorianism. We still have antimacassars — they’re those pieces of protective fabric you see at the top of your train or plane seat — but do you know why antimacassars are so called? Because in the nineteenth century Rowland’s Macassar Oil became such a popular unguent for gentlemen’s coiffures that the land was full of oily-haired chaps who, upon entering your drawing room, would settle back in your favorite chair — and uh-oh, there goes the fabric. Hence, the vital deployment of the antimacassar. Rowland’s Macassar Oil was one of the first products to be marketed nationally (and, indeed, internationally), and so universally known that Lewis Carroll put it in Alice Through the Looking-Glass:

His accents mild took up the tale:

He said ‘I go my ways,

And when I find a mountain-rill,

I set it in a blaze;

And thence they make a stuff they call

Rowlands’ Macassar-Oil –

Yet twopence-halfpenny is all

They give me for my toil.’Better yet, in Don Juan Lord Byron managed to rhyme it:

In virtue, nothing earthly could surpass her

Save thine ‘incomparable oil’, Macassar!Mark Steyn, “Self-Knitting Antimacassars”, Steyn Online, 2019-08-02.

September 21, 2023

This is York

Jago Hazzard

Published 28 May 2023“Make all the railways come to York!”

(more…)

September 20, 2023

How the feds could lower grocery prices without browbeating CEOs

Jesse Kline has some advice for Prime Minister Jagmeet Singh Justin Trudeau on things his government could easily do to lower retail prices Canadians face on their trips to the grocery store:

CBC report on federal scapegoating of grocery chain CEOs.

https://www.cbc.ca/news/politics/government-grocery-store-meeting-ottawa-food-prices-1.6967978

What exactly the grocery executives are supposed to do to bring down prices that are largely out of their control is anyone’s guess. Do they decrease their profit margins even further, thereby driving independent retailers out of business and shedding jobs by increasing their reliance on automation? Do they stop selling high-priced name-brand products, thus decreasing their average prices while driving up profits through the sale of house-brand products?

If the government were serious about working with grocers, rather than casting them as villains in a piece of performative policy theatre, here are a number of policies the supermarket CEOs should propose that would have a meaningful effect on food prices throughout the country.

End supply management

Why do Canadians pay an average of $2.81 for a litre of milk — among the highest in the world — when our neighbours to the south can fill their cereal bowls for half the cost? Because a government-mandated cartel controls the production of dairy products in this country, while the state limits foreign competition through exorbitantly high tariffs on imports.The same, of course, is true of our egg and poultry industries. Altogether, it’s estimated that supply managements adds between $426 and $697 a year to the average Canadian household’s grocery bill. It’s not a direct cause of inflation, but it’s a policy that, if done away with, could save Canadians up to $700 a year in fairly short order.

Yet not only have politicians been unwilling to address it, they have been fighting some of our closest trading partners to ensure that foreign food products don’t enter the Canadian market and drive down prices. Ditching supply management would be a no-brainer, if anyone in Ottawa was willing to use their brain.

Reduce regulations

The best way to decrease prices in any market is to foster competition. As the Competition Bureau noted in a report released in June, “Canada’s grocery industry is concentrated” and “tough to break into”. Worse still, “In recent years, industry concentration has increased”.So why don’t more foreign discount grocery chains set up shop here? Perhaps it’s because they know our national policy encourages Canadian-owned oligopolies. While grocery retailers don’t face the same foreign-ownership restrictions as airlines or telecoms, the products they sell are heavily regulated, which acts as a barrier to bringing in cheaper goods from other countries.

Although it wasn’t the primary reason for the lack of foreign competition, the Competition Bureau did note that, “Laws requiring bilingual labels on packaged foods can be a difficult additional cost for international grocers to take on”.

Other ways the federal government could help Canadians afford their grocery bills include:

- Jail thieves

- Stop port strikes

- Don’t tax beer

- Axe the carbon tax

Don’t hold your breath for any of these ideas to be taken up by Trudeau’s Liberals.

September 18, 2023

It turns out that buying up the rights to old rock songs wasn’t a good investment after all

Ted Gioia enjoys a little bit of schadenfreude here because he was highly skeptical of the investments in the first place, although the geriatric rockers who “sold out” seem to have generally made out like bandits this time around:

Back in 2021, investors spent more than $5 billion buying the rights to old songs. Never before in history had musicians over the age of 75 received such big paydays.

I watched in amazement as artists who would never sell out actually sold out. And they made this the sale of a lifetime, like a WalMart in El Paso on Black Friday.

Bob Dylan sold out his entire song catalog ($400 million — ka-ching!). Paul Simon sold out ($250 million). Neil Young sold out ($150 million). Stevie Nicks sold out ($100 million). Dozens of others sold out.

As a result, rock songs have now entered their Madison Avenue stage of life.

Twisted Sister once sang “We’re Not Gonna Take It”. But even they took it — a very large payout, to be specific. A few months ago, the song showed up in a commercial for Discover Card.

Bob Dylan’s song “Shelter from the Storm” got turned into a theme for Airbnb. Neil Young’s “Old Man” was rejuvenated as a marketing jingle for the NFL (touting old man quarterback Tom Brady).

Fans mocked this move. Even Neil Young, now officially a grumpy old man himself, expressed irritation at the move. After all, the head of the Hipgnosis, the leading song investment fund, had promised that the rock star’s “Heart of Gold” would never get turned into “Burger of Gold”.

That hasn’t happened (yet). But where do you draw the line?

I was skeptical of these song buyouts from the start — but not just as a curmudgeonly purist. My view was much simpler. I didn’t think old songs were a good investment. […] But even I didn’t anticipate how badly these deals would turn out.

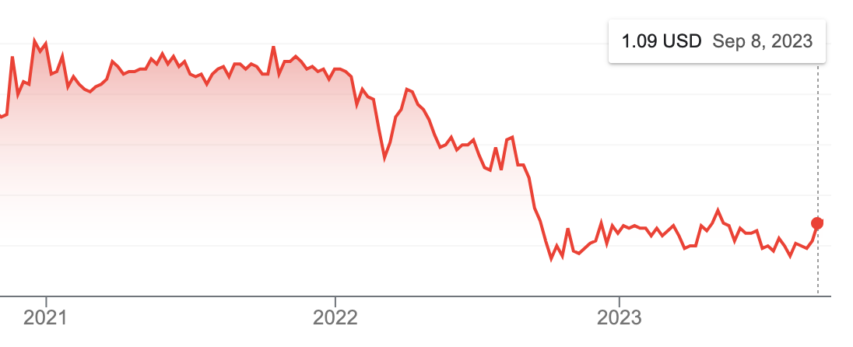

The more songs Hipgnosis bought, the more its share price dropped. The stock is currently down almost 40% from where it was at the start of 2021.

Things have gotten so bad, that the company is now selling songs.

On Thursday, Hipgnosis announced a plan to sell almost a half billion dollars of its song portfolio. They need to do this to pay down debt. That’s an ominous sign, because the songs Hipgnosis bought were supposed to generate lots of cash. Why can’t they handle their debt load with that cash flow?

But there was even worse news. Hipgnosis admitted that they sold these songs at 17.5% below their estimated “fair market value”. This added to the already widespread suspicion that current claims of song value are inflated.

September 17, 2023

Why Indigo’s struggles are far from over

Following up from last week, in this week’s SHuSH newsletter Ken Whyte explains why Indigo went in the direction it chose and why it seemed like the thing to do at that time:

“Indigo Books and Music” by Open Grid Scheduler / Grid Engine is licensed under CC0 1.0

Bookselling is a difficult business and it’s been especially difficult over the last twenty years. The Internet captured a lot of the used book business and shifted it online. Amazon captured a lot of the new book business and shifted it online (and bought Abebooks.com, one of the largest used book sites).

Former Indigo CEO Heather Reisman tried and failed to convince the federal government to keep Amazon south of the border back around 2002. She went so far as to sue the feds on the grounds that Amazon, as a cultural entity, was not majority-owned by Canadians and therefore operating in contravention of the Investment Canada Act. The suit went nowhere because Amazon then had no physical presence in Canada; it operated primarily through Canada Post. By the time Amazon did announce its intention to build a warehouse north of the border, early in 2010, the government had given up enforcing the Investment Canada Act. It was happy to have Amazon create new jobs.

It was when Amazon opened its Canadian warehouse that Heather began backing Indigo out of the book business. She cursed Amazon for its anticompetitive practices, not least its habit of selling books below cost to destroy competitors, and adopted the term “cultural department store” as a pivot from bookstores.

I’ve made it clear in newsletter after newsletter that I don’t like the direction Heather took Indigo but it’s only fair to look back at prevailing circumstances in 2010 and wonder if she really had a choice.

I’m sure she had stacks of research and hordes of people telling her that abandoning books was the only move. Attempting to compete with Amazon’s enormous scale and superior logistics would have struck many as a fool’s errand. Amazon would always have the largest selection, the best price, and the fastest delivery.

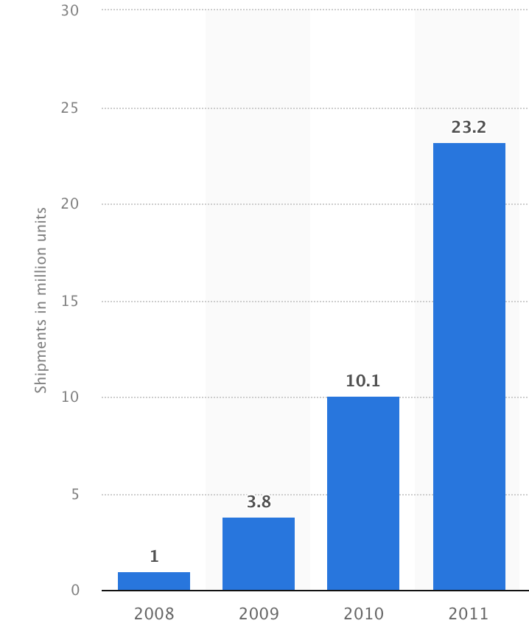

There was also a widespread belief that print was dead. E-books, e-readers, and tablets were the future, along with the “one very, very, very large single text“. Global e-reader sales were growing like this:

They were expected to keep growing. So were sales of e-books. In 2012, the Financial Post quoted data from Indigo predicting that e-books would capture 50 percent of the market in five years.

So, having played the Canadian Nationalist card and discovering that the government was willing to bluster but not to meaningfully act, Heather Reisman took the advice of her consultants and diversified away from books and into all the utter crap that currently befoul at least half of the retail space in every Indigo store. After all, the big box bookstores in the United States were clearly failing in the face of Amazon, with Borders filing for bankruptcy and Barnes & Noble staggering in the same direction. From 1999 to 2019, fully half of all the bookstores in the country disappeared.

The story isn’t as bleak as it looked in 2019, as Barnes & Noble is staging quite a comeback by concentrating on the book business. It’s a radical move, but Indigo could do far worse than cooking up a maple-flavoured version of the Barnes & Noble strategy. It might fail, but they’ll definitely fail if they keep on pretending to be a department gift store that also has a few books.

September 16, 2023

The many, MANY failed VW Beetle Reboots!

Big Car

Published 22 Oct 2021I recently made a video on the many, many times British Leyland tried to update the Mini. The lack of an update helped to make the original Mini an iconic shape. The same has happened to many other iconic cars, and the Volkswagen Type 1 or Beetle falls into the same camp. Why did it take 36 years until the Beetle would get a replacement, and how did a car made as a Nazi show of strength end up in a Disney film?

(more…)

September 14, 2023

Scott Alexander reviews the (old) Elon Musk biography

It’s okay, he makes it clear from the start that he’s talking about Ashlee Vance’s earlier work, not the one that just hit the shelves this year:

This isn’t the new Musk biography everyone’s talking about. This is the 2015 Musk biography by Ashlee Vance. I started reading it in July, before I knew there was a new one. It’s fine: Musk never changes. He’s always been exactly the same person he is now.1

I read the book to try to figure out who that was. Musk is a paradox. He spearheaded the creation of the world’s most advanced rockets, which suggests that he is smart. He’s the richest man on Earth, which suggests that he makes good business decisions. But we constantly see this smart, good-business-decision-making person make seemingly stupid business decisions. He picks unnecessary fights with regulators. Files junk lawsuits he can’t possibly win. Abuses indispensable employees. Renames one of the most recognizable brands ever.

Musk creates cognitive dissonance: how can someone be so smart and so dumb at the same time? To reduce the dissonance, people have spawned a whole industry of Musk-bashing, trying to explain away each of his accomplishments: Peter Thiel gets all the credit for PayPal, Martin Eberhard gets all the credit for Tesla, NASA cash keeps SpaceX afloat, something something blood emeralds. Others try to come up with reasons he’s wholly smart – a 4D chessmaster whose apparent drunken stumbles lead inexorably to victory.

Elon Musk: Tesla, SpaceX, And The Quest For A Fantastic Future delights in its refusal to resolve the dissonance. Musk has always been exactly the same person he is now, and exactly what he looks like. He is without deception, without subtlety, without unexpected depths.

The main answer to the paradox of “how does he succeed while making so many bad decisions?” is that he’s the most focused person in the world. When he decides to do something, he comes up with an absurdly optimistic timeline for how quickly it can happen if everything goes as well as the laws of physics allow. He – I think the book provides ample evidence for this – genuinely believes this timeline,2 or at least half-believingly wills for it to be true. Then, when things go less quickly than that, it’s like red-hot knives stabbing his brain. He gets obsessed, screams at everyone involved, puts in twenty hour days for months on end trying to try to get the project “back on track”. He comes up with absurd shortcuts nobody else would ever consider, trying to win back a few days or weeks. If a specific person stands in his way, he fires that person (if they are an employee), unleashes nonstop verbal abuse on them3 (if they will listen) or sues them (if they’re anyone else). The end result never quite reaches the original goal, but still happens faster than anyone except Elon thought possible. A Tesla employee described his style as demanding a car go from LA to NYC on a single charge, which is impossible, but he puts in such a strong effort that the car makes it to New Mexico.

This is the Musk Strategy For Business Success; the rest is just commentary.

1. Vance starts with the story of the biography itself. When Musk learned he was being profiled, he called Vance, threatened that he could “make [his] life very difficult”, and demanded the right to include footnotes wherever he wanted telling his side of the story. When Vance said that wasn’t how things worked, Elon invited him to dinner to talk about it. Elon arrived late, and spent the first few courses talking about the risk of artificial superintelligence. When Vance tried to redirect the conversation to the biography, Elon abruptly agreed, gave him unprecedented access to everyone, and won him over so thoroughly that the book ends with a prediction that Musk will succeed at everything and become the richest man in the world (a bold claim back in 2015).

I like this story but find myself dwelling on Musk’s request — why shouldn’t he be allowed to read his own biography before publication and include footnotes giving his side of the story where he disagrees? That sounds like it should be standard practice! If I ever write a post about any of you and you disagree with it, feel free to ask me to add a footnote giving your side of the story (or realistically I’ll put it in an Open Thread).

2. The book gives several examples of times Musk almost went bankrupt by underestimating how long a project would take, then got saved by an amazing stroke of luck at the last second. When Vance asked him about his original plan to get the Falcon 1 done in a year, he said:

“Reminded about the initial 2003 target date to fly the Falcon 1, Musk acted shocked. ‘Are you serious?’ he said. ‘We said that? Okay, that’s ridiculous. I think I just didn’t know what the hell I was talking about. The only thing I had prior experience in was software, and, yeah, you can write a bunch of software and launch a website in a year. No problem. This isn’t like software. It doesn’t work that way with rockets.”

But also, the employees who Vance interviewed admit that whenever Musk asks how long something will take, they give him a super-optimistic timeline, because otherwise he will yell at them.

3. I wondered whether Elon was self-aware. The answer seems to be yes. Here’s an email he wrote a friend:

“I am by nature obsessive compulsive. In terms of being an asshole or screwing up, I’m personally as guilty of that as anyone, and am somewhat thick-skinned in this regard due to large amounts of scar tissue. What matters to me is winning, and not in a small way. God knows why … it’s probably [rooted] in some very disturbing psychoanalytical black hole or neural short circuit.”

QotD: Going to “the mall”

“How was the mall?” Mom would ask when you got home.

“Eh, it was dead,” you might say.

“What did you do?”

“Nothing.”

Neither was true. Every trip to the mall had a routine. You’d swing by the sausage and cheese store for samples. You’d go to the record store to leaf through the sheaves of albums, nodding at the rock gods’ pictures on the wall, content in the cocoon of your generation’s culture. Head over to Chess King to see if there was something stylish you could wear on a date, if you ever had one; saunter casually into Spencer Gifts to look at the posters in the back, snicker at the naughty gifts, marvel at some electronic thing that cast colored patterns on the wall. Then you’d find a place, maybe by the fountain in the center, and watch the world go past in that agreeably tranquilized state of mall shopping.

Dead? Hardly. Okay, maybe it was the afternoon, low traffic. No movie you really wanted to see, the same stuff in the stores you saw last week. Of course you’d go back tomorrow, because that’s what you did with your friends. You went to the mall.

A dead mall is something else today: a vast dark cavern strewn with trash, stripped of its glitter, its escalators frozen, waiting for the claws to take it apart. The internet abounds with photos taken by surreptitious spelunkers, documenting the last days of once-prosperous malls. We look at these pictures with fascination and sadness. No one said they’d last forever. But there wasn’t any reason to think they wouldn’t. Hanging out as teens, we never thought we’d outlive the mall.

James Lileks, “The Allure of Ruins”, Discourse, 2023-06-12.

September 11, 2023

The DOJ versus SpaceX

I was a bit boggled when the US Justice Department announced it was going after Elon Musk’s SpaceX for alleged discriminatory hiring practices:

The Justice Department recently filed a lawsuit against SpaceX, the California-based spacecraft manufacturer and satellite communications company founded by Elon Musk.

In its lawsuit, the DOJ accused SpaceX of only hiring U.S. citizens and green-card holders, thereby discriminating against asylees and refugees in hiring, an alleged violation of the Immigration and Nationality Act.

Musk denied the allegations and accused the government of weaponizing “the DOJ for political purposes”.

“SpaceX was told repeatedly that hiring anyone who was not a permanent resident of the United States would violate international arms trafficking law, which would be a criminal offense,” Musk wrote on X, formerly known as Twitter.

It’s uncertain if the DOJ is actually targeting SpaceX (more on that in a minute), but George Mason University economist Alex Tabarrok quickly found a problem with the DOJ’s allegations.

“Do you know who else advertises that only US citizens can apply for a job?” Tabarrok asked. “The DOJ.”

Tabarrok even brought the receipts: a screenshot of the DOJ job website that explicitly states, “U.S. Citizenship is Required.”

So, if Musk is discriminating against non-U.S. citizens in his hiring practices, so is the DOJ.

This makes the lawsuit prima facie absurd on one level. However, one could also argue that there could be good reasons to discriminate in hiring. And as is usually the case, for better or worse, the government gets to decide when it’s OK to discriminate and when it’s not OK.

And that’s where things get hazy.

Musk and others claim that companies such as SpaceX are legally required to hire U.S. citizens because of International Traffic in Arms Regulations, a federal regulatory framework designed to safeguard military-related technologies.

The DOJ disagrees. So who is right? It’s difficult to say, Tabarrok pointed out.

“The distinction, as I understand it, rests on the difference between US Persons and US Citizens,” he wrote on Marginal Revolution, “but [SpaceX is] 100% correct that the DoD frowns on non-citizens working for military related ventures.”

In other words, SpaceX appears to have been trying to comply with Department of Defense regulations by not using non-citizens in military-related work, and in doing so, it may have run afoul of the DOJ.

September 10, 2023

Time for NFL running backs to set up their own union?

It’s been known for a few years, but has been brought into clear focus during this NFL offseason that the position of running back — historically one of the most important positions on the field after the quarterback — has been steadily devalued by NFL teams. Superbowl-hopeful teams no longer centre their game plan around a workhorse running back, with more and more plays being passes to wide receivers and tight ends rather than running the ball. During the 2023 offseason, several big-name running backs went public with their frustrations over new contracts. The NFL Players Association, the union for players to negotiate with the NFL’s owners, has not been as proactive for running back concerns so a break-away RB union is back under discussion:

… running backs — whose job includes receiving handoffs from the quarterback, catching passes, and blocking — are getting pummeled like never before by bigger, stronger, faster NFL players. Which means that when their contracts are up, running backs are more damaged than they used to be.

What’s more, the drama has shifted: running backs used to score a lot, but now the action revolves around quarterbacks and wide receivers.

That explains why team owners are increasingly hiring rookies to be their running backs and, instead of investing in them long-term, replacing those rookies with other rookies at the end of their first contract.

So, running backs — having suffered tons of concussions, ankle sprains, and other injuries — never see the big, second-contract payday other NFL players land. Like the Kansas City Chiefs’ quarterback Patrick Mahomes’ $450 million contract or the $120 million deal wide receiver Tyreek Hill signed with the Miami Dolphins.

All of which explains how Harris has become a leading advocate for a running-backs-only union — and the unlikely face of the new American labor movement.

“I agree with my running back brothers around the NFL — history will show that you need running backs to win — we set the tone every game and run through walls for our team,” Harris tweeted in July, after three of his fellow running backs failed to secure long-term deals with their teams.

The new union, which would be separate from the NFL Players Association, was first proposed in 2019, when the International Brotherhood of Professional Running Backs filed a petition with the National Labor Relations Board.

When Harris was asked in June what he thought of the idea, he said: “I’m open to it.”

He is joined by Tennessee Titans running back Derrick Henry, 29. Known as King Henry, he tweeted in July: “At this point, just take the RB position out the game then. The ones that want to be great & work as hard as they can to give their all to an organization, just seems like it don’t even matter. I’m with every RB that’s fighting to get what they deserve.”

Granted, professional running backs, with an average salary of $1.8 million, make a lot more than nurses, pilots, public school teachers, and everyone else in a union, but the money is declining, and they increasingly feel as though they’re being exploited by management at the same time the NFL is seeing record success. In 2023, the NFL secured $130 billion in new media deals. Of the top 100 network television broadcasts in the country last year, the league accounted for 82, and that figure is going up. On top of all that, game attendance is nearing an all-time high.

Indigo today … Indigone tomorrow?

In the latest SHuSH newsletter, Ken Whyte discusses the financial woes of Canada’s quasi-monopoly book chain, Indigo after a series of misfortunes:

“Indigo Books and Music” by Open Grid Scheduler / Grid Engine is licensed under CC0 1.0

As we reported in SHuSH 197 and SHuSH 203, Indigo posted a ruinous 2023 (its fiscal year ends March 30), losing $50 million. That came on the heels of more than $270 million in losses the previous four years. The company’s share price, as high as $20 in 2018, has been floating around $1.30 this summer.

That dismal performance spelled the end of founding CEO Heather Reisman’s leadership at the chain. In June, her husband, Onex billionaire Gerry Schwartz, who has been Indigo’s controlling shareholder and chief financial backstop since the company’s launch in 1997, took the reins and elbowed Heather into the ditch along with almost every member of the board of directors who wasn’t beholden to Gerry personally.

The only non-Gerry director to survive was CEO Peter Ruis.

As I said at the time, Peter Ruis, “a career fashion retailer who landed in this jackpot from England two years ago”, is either “polishing his resume as we speak or negotiating a massive retention bonus to stick around and wield an axe on Gerry’s behalf. My money is on polishing.”

[…]

Meanwhile, I’m hearing that everyone in the publishing industry is being slammed with returns. Publishers usually get a lot of books back from retailers in the first quarter of the year as stores send back unsold inventory from the holiday season. This year, the returns were slower to start, probably because of Indigo’s cyberattack last fall, but they have kept coming right through the second and third quarters. This is coupled with lighter than usual buying for the fall.

The firm’s releases continue to claim that Indigo will keep books at its core, even as it loads its shelves with brass cutlery, dildos, and pizza ovens. According to Google, the core of an apple represents 25 percent of its weight. Books are now less than 50% of Indigone, suggesting more returns and light orders to come.

One final note. I corresponded this morning with a giant of Canadian businessman who has no special insight into the Indigo situation although he’s kept up with the news and, like everyone in Toronto commercial circles, he’s familiar with the Schwartz-Reismans.

He wonders just how involved Gerry is with Indigo these days. Apparently his health is not good. And while he’s still the lead shareholder at Onex, he’s no longer CEO and may not have access to the hordes of ultra-bright hirelings and menials that have long surrounded him.

My friend writes: “My guess is that suppliers are going to start to halt shipping and that a financial crisis is imminent, despite [Gerry’s] line of credit. But I don’t know anything.”