[Commenting on a story about the re-introduction of heritage apples to the British market through the work of the wildlife charity People’s Trust for Endangered Species.]

If people want little orchards of native (well, you know) apples then people should have little orchards of native apples. As long as, of course, they’re creating and maintaining those little orchards of native apples at their own expense. This is, after all, what liberalism means, that the peeps get to do what the peeps want. And if we’re to add some Burkean conservatism so that it’s the little platoons sorting it out for themselves then all the better.

As long as no one is being forced to pay for this through taxation then what could possibly be the problem?

At another level this is climbing Maslow’s Pyramid again. At one level of income we’ll take fruit in the only way we can, seasonally and in a limited manner. We get richer, technology advances, we can have apples year round – but that does mean trade, commercially sized operations and the inevitable limited selection. We get richer again and now we’ve more than sufficiency, let’s have that variety back again.

After all, it’s not as if we’re not seeing this right across the food chain, is it?

That roast beef of Olde Englande was most certainly better than the bully beef from Argentina or the Fray Bentos pie. As is the best grass fed British beef of today. But we moved through the cycle to get from most not being able to eat any beef, to all being able to have bad beef, to now again thinking more about the quality – we have a more than sufficiency of beef and can be picky about it.

Tim Worstall, “I fully approve of this”, Tim Worstall, 2017-10-22.

October 23, 2019

QotD: Climbing Maslow’s Pyramid again

October 21, 2019

October 5, 2019

Losing our religion

Arthur Chrenkoff found another report on the inverse relationship between development and religious belief:

A few weeks ago I wrote a longish blog post arguing that for many people in the developed world environmentalism has become a religion, filling up the gap in spirituality left by the decline of Christianity. I don’t claim any originality or new insight in this observation; it has been noted many times before, including by my friend, former artilleryman and now man of God, Rev Donald Sensing, and it has made an appearance quite a few times subsequent to my piece, a propos Greta Thunberg’s performance at the United Nations and the reaction it inspired around the (developed) world.

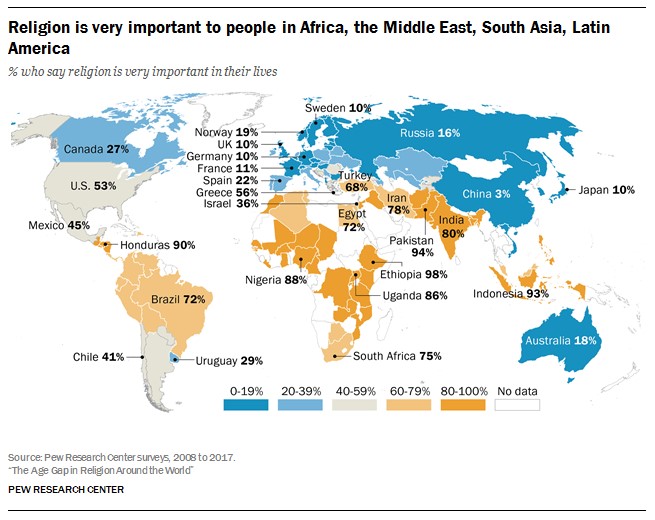

Today, I chanced upon another interesting analysis by Pew Research Center, about religious belief and commitment around the world. Results are not surprising but are nevertheless interesting, including this world map:

Unfortunately, Pew does not provide additional data on those for whom religion might be “important” or “somewhat important” so as to paint a slightly fuller picture of religious sentiment, but the results illustrated above are probably quite indicative. The developed world is well and truly secular now, with the United States and Greece being the only outliers (and by a long mile), while most of the developing world (with the notable exception of China after seven decades of communism) remains extremely religious. Thus, Pew notes that “if current trends continue, countries with high levels of religious affiliation will grow fastest. The same is true for levels of religious commitment: The fastest population growth appears to be occurring in countries where many people say religion is very important in their lives.”

As the main topic of this Pew study is the age gap in religious faith around the world, it should be noted that the younger generations in the developed world are even less religious than their elders, often significantly less, putting the already low rates across the West in an even starker perspective (by contrast, throughout most of the developing world, there is little, if any, gap in religious commitment between the young and the old).

October 4, 2019

“Economics is … the science of not being able to have your cake and eat it”

Philip Booth on Greta Thunberg’s message and its economic over-simplifications:

In many senses, economic problems are more complex than scientific problems and Thunberg is, implicitly at least, pronouncing on economic matters. Whilst knowledge about climate science is uncertain, a judgement has to be and can be made on the balance of evidence. But economic decisions involve trade-offs. Economics is, as Lionel Robbins put it, the science of not being able to have your cake and eat it. We cannot both decrease carbon emissions hugely and enjoy standards of living increasing at the rate that would have been possible if emissions were not reduced.

It is tempting the believe the green rhetoric that we will all have fluffy green jobs and a green standard of living without any hardship from reducing emissions. We cannot. Reducing carbon emissions quickly to zero means that we will have much less of everything else. We might prefer decarbonisation to other goods and services, but it is not a cost-free choice. We considering this, we should remember that the average income in the UK is ten times the average income in the rest of the world. When other people face these trade-offs the sacrifice of decarbonisation is that much greater.

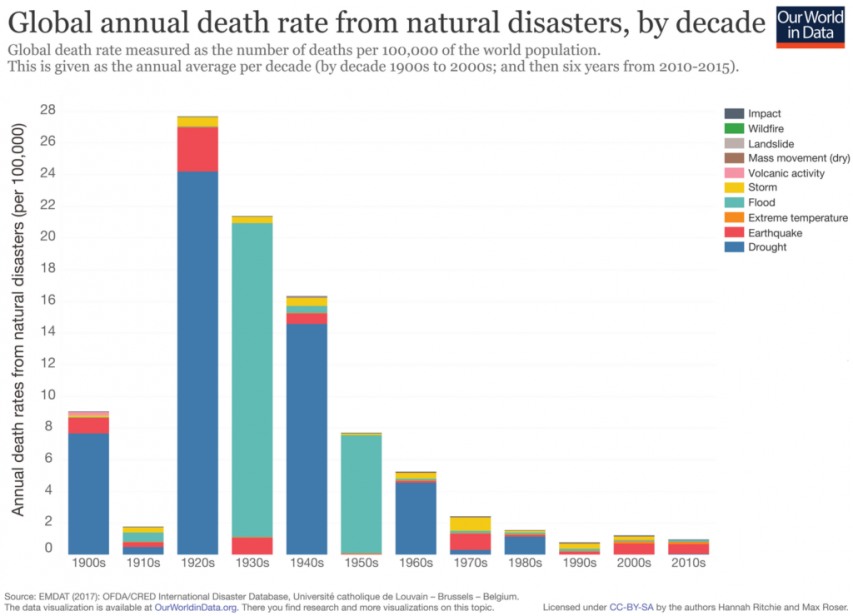

One of the advantages of being richer is that we are more resilient to natural disasters. It follows from this that there is a trade-off between decarbonisation, which might lead to fewer natural disasters, and our ability to cope with them, which might reduce if we become less rich. As we have become richer, deaths from natural disasters have plummeted. The figure shows the fall in deaths in natural disasters over the last century – they have reduced by, perhaps, 90 per cent.

The use of air conditioning illustrates this trade-off in a rather stark way. In a letter on the environment written by Pope Francis in 2015 called Laudato si, the pontiff strongly criticised the adoption of air conditioning in the strongest terms. An academic paper on air conditioning in the US produced such remarkable results that the abstract is worth quoting at length:

“the mortality effect of an extremely hot day declined by about 80% between 1900-1959 and 1960-2004. As a consequence, days with temperatures exceeding 90°F were responsible for about 600 premature fatalities annually in the 1960-2004 period, compared to the approximately 3,600 premature fatalities that would have occurred if the temperature-mortality relationship from before 1960 still prevailed. Second, the adoption of residential air conditioning (AC) explains essentially the entire decline in the temperature-mortality relationship. In contrast, increased access to electricity and health care seem not to affect mortality on extremely hot days.”

Air conditioning leads to higher carbon emissions and, most likely, higher global temperatures. But the increase in resilience arising from air conditioning is astonishing – it has led to an 80 per cent drop in deaths from heat.

September 24, 2019

QotD: Conditions for the rise of tyrants in the Greek city states

The central problem of almost every society before about 1950 has been how to reconcile the great majority to distributions of property in which they are at a disadvantage. Only a minority has even been able to enjoy secure access to abundant food and good clothing and clean water and healthcare and education. Whether actually enslaved or formally free sellers of labour, the majority have always had to look up to a minority of the rich who are often legally privileged. How to keep them quiet?

Force can only ever be part of the answer. The poor have always been the majority, and sometimes the great majority. Armies of mercenaries to protect the rich have not always been available, and they have never by themselves been sufficient to compel obedience on all occasions in every respect.

Force, therefore, has always been joined by religious terrors. In Egypt, the king was a god, and the privileged system of which he was the head was part of a divine order that the common people were enjoined never to challenge. In the other monarchies of the near east, the king might not actually be a god. But all the priests taught that he was part of a divinely ordained order that it was blasphemy to challenge.

In the Greek city states until about a century before the birth of Epicurus, securing the obedience of the poor had not been a serious problem. There had been some class conflict, even in Athens. But most land was occupied by smallholders, and excess population could be decanted into the colonies of Italy and the western Mediterranean. There were rich citizens, but they were usually placed under heavy obligations to contribute to the defence and ornament of their cities.

Then a combination of commercial progress and the disruptions of the war between Athens and Sparta created a steadily widening gulf between rich and poor. There was also a growing problem of how to maintain large but unknown numbers of slaves in peaceful subjection.

The result was a class war that destabilised every Greek state. The sort of democracy seen in Athens could survive in a society where citizens were broadly equal. Once a small class of rich and a much larger class of the poor had emerged, there was a continual tendency for democratic assemblies to be led by demagogues into policies of levelling that could be ended only by the rise of a tyrant, who would secure the wealth of the majority — but who could secure it only so long as the poor could be terrified into submission. Once they could not be terrified by the threat of overwhelming force, they would rise up and dispossess the rich, until a new tyrant could emerge to subdue them again.

Unlike in the monarchies of the near east, no settled order could be maintained in Greece by religious terrors. During the sixth and fifth centuries, the Greek mind had experienced the first enlightenment of which we have record. There had been a growth of philosophy and science that revealed a world governed by laws that could be uncovered and understood by the unaided reason.

Now, enlightenments are always dangerous to an established religion. And the Greek religion was unusually weak as a counterweight to reason. The Greeks had no conception of a single, omnipotent God the Creator. Instead, they had a pantheon of supernatural beings who had not created the world, but were subject to many of its limitations. These were frequently at war with each other, and so they could be set against each other by their human worshippers with timely sacrifices and other bribes. They did not watch continually over human actions, and beyond the occasional punishment and reward to the living, they had no means of compelling observance of any code of human conduct.

And so, when the intellectual disturbance of philosophy and science spilled over into demands for a reconstruction of society in which property would be equalised, there was no religious establishment with the authority to stand by the side of the rich.

Sean Gabb, “Epicurus: Father of the Englightenment”, speaking to the 6/20 Club in London, 2007-09-06.

September 13, 2019

NDP leader Jagmeet Singh gets his tax plans vetted by the Parliamentary Budget Office

A recent innovation for political campaigns is that they can ask the Parliamentary Budget Office to provide an estimate for the impact of any taxation proposals, and NDP leader Jagmeet Singh was the first out of the gate to have his “super-wealth tax” evaluated. The PBO estimates that the levy would net out some $6 billion in the first full year of implementation. Sounds like a lot of money! Colby Cosh explains why it’s not quite what it might seem:

Federal NDP leader Jagmeet Singh taking part in a Pride Parade in June 2017 (during the leadership campaign).

Photo via Wikimedia.

Alas, the bean-counters always swoop in to spoil things. Singh’s wealth-tax scheme is instructive not only because he availed himself of PBO costing, but because it usefully reveals the limits of what the PBO or any other economic modeller can do. Look, in other words, at the fine print.

The PBO’s job was to estimate what you can extract from “an annual net wealth tax on Canadian resident economic families equal to one per cent of net wealth above $20 million.” In the PBO model this is a simple multiplication, but the roughly $6 billion take is arrived at only by reducing the revenue by 35 per cent to correct for “behavioural response” — that is, lawful (and unlawful) tricks employed to avoid the new tax by the rich targets. The net revenue is what’s left after you deduct another two per cent to cover administrative costs.

And, as the PBO immediately insists, “the estimate has high uncertainty” on both counts. This means they’re educated guesses. Jennifer Robson, a social policy prof at Carleton University’s Arthur Kroeger College, pointed out on Twitter that right now we don’t tax economic families per se and we don’t report assets and debts routinely to Revenue Canada. Ideas for pure wealth taxation (which is rare in practice) are predicated on the creation of, essentially, a new tax system — one which would have to detect and perpetually update how much, for example, the furniture in your house costs. The 35 per cent loss from behavioural response is at the high end of historic estimates from real-world examples. Even within our current tax system, Robson observes, we only get two extra dollars for every one we spend on expanding collections and compliance against the existing tax base.

As a practical matter, a wealth tax would mostly be, or would act most efficiently as, a tax on bank balances and investment accounts. Of course, there is always real estate. The super-rich seem to have a lot of that, and it is relatively easy to tax, and the resentment of Torontonians and Vancouverites who don’t own some is, for better or worse, a major reason the NDP is trying to weaponize envy.

But this reminds us that property taxes and taxes on property transfers perform a similar function, although they are not used primarily for income redistribution as such here — and in Canada ours are relatively high. The OECD does a little league table of tax structures, and compared with other industrialized countries Canada’s take from property taxes is about double the average. In a 36-country list we are near the bottom (33rd) in our dependence on taxing goods and services, and about average (12th) in dependence on corporate taxation, but fifth highest in dependence on personal taxation — and third in dependence on property taxes.

August 27, 2019

So much for nil nisi bonum

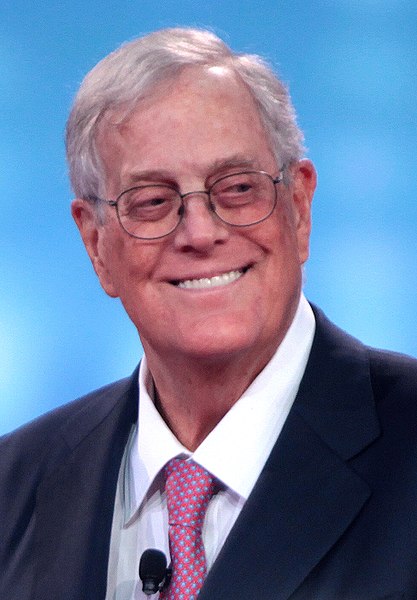

The old Latin phrase De mortuis nihil nisi bonum encourages us to only speak well of the dead. The recent death of libertarian billionaire David Koch has brought forth a torrent of vituperation from many people in media and politics, as James Piereson and Naomi Schafer Riley record:

David Koch speaking at the Defending the American Dream Summit in Columbus, Ohio, 21 August 2015.

Photo by Gage Skidmore via Wikimedia Commons.

“Yesterday David Koch of the zillionaire Koch brothers died … of prostate cancer. I guess I’m going to have to reevaluate my low opinion of prostate cancer.” That was Bill Maher last Friday night, joking before his approving audience. Maher went on to say, “The Amazon is burning up. I’m glad he’s dead.” Maher is not known for his kindness toward those with whom he disagrees. In that sense, he reflects the thinking of a growing number of progressives and leftists who openly despise conservatives and libertarians. David Koch, along with his brother Charles, have for decades been targets of harsh rhetoric from the far Left.

What is it about David Koch that inspired such hatred? “We live in the world that he helped build, and it is on fire,” wrote Sarah Jones in New York, denouncing Koch’s “monstrous legacy.” In Esquire, Charles Pierce writes: “Except for his surviving brother, Charles, no man had a worse effect on American politics since the death of John C. Calhoun. Every malignancy currently afflicting us can be traced in one way or another into their wallets, and that’s not even to mention the lasting damage they’ve done to the planet as a whole.”

This is the kind of language that religious cults reserve for heretics and apostates — and in many ways, David and Charles Koch were blasphemers to the liberal orthodoxy. They believed in smaller government and thus criticized the welfare state, excessive taxation, and a great deal of government regulation. At the same time, they criticized America’s wars abroad, along with high levels of defense spending, and were sympathetic to the causes of gay rights and gay marriage. They were consistent in their views across a range of issues, antagonizing liberals but also vexing conservatives. The claim that David Koch was a reflexive right-winger is a caricature of his beliefs.

The Kochs believed in smaller government. Whether it was gay marriage or land wars in Asia, they consistently argued that less government intervention would produce freer and happier people. Their support for drug legalization and abortion rights irked plenty of conservatives, but it drove few over the edge as their support for lower taxes and greater school choice did for liberals. Perhaps nothing irked liberals more, though, than the Kochs’ fight for less environmental regulation. Blaming Charles and David Koch for singlehandedly destroying the rainforests or raising the temperature of the earth seems to be a common theme among critics — an attribution of immense power beyond the capacity of any man or family or company.

August 26, 2019

QotD: Princesses

[Princesses] think of themselves as Strong, Independent Women, even while saying “I like a man to open doors and pay for everything — and treat me like a princess!” No, dear, if a man opens doors for you he’s treating you like a simpleton and if he pays for everything, he’s treating you like a hooker. (The crossover between the princess look and the hooker look, as the late Barbara Cartland grotesquely illustrated, is considerable.) And it’s a man knowing that you can be bought with a dinner and a pair of shoes which leads to him so frequently mugging you off — royally — in favour of a better bargain. Back on the pink plastic shelf you go!

How do you spot a Princess? She’ll be keen on pampering to an extent which indicates to the casual onlooker that her natural self must be extraordinarily rank if it takes such effort and expense to keep in check. (Princesses shouldn’t be confused with Professional Beauties, most of whom retain a healthy contempt for the business of exchanging physical gifts for fiscal rewards, from Hedy Lamarr saying “Any girl can be glamorous — all you have to do is stand still and look stupid” to the catwalk models who invariably live in jeans and sneakers after shrugging off the stupid clothes which Princesses pine for.)

The Princess believes that retail therapy is the answer to everything, even though the rest of us avert our eyes from this most obvious manifestation of the essential hollowness of a life that an over-enthusiasm for clothes-shopping invariably indicates in anyone out of their teens. They’ll have long nails, ostensibly to show that they’re ladies of leisure, but signalling to the rest of us that they’re very likely parasites with low sex-drives. They like big weddings — and as a liking for big weddings often goes hand in hand with humourlessness, they often have very short marriages. They are in short practitioners of the Violet Elizabeth Bott school of feminism – less about equal rights and fulfilling one’s potential than about stamping your foot till you get what you want.

They dislike men, seeing them not as flesh-and-blood people so much as platinum-and-titanium meal-tickets, and they mistrust women, seeing them as competition. An ageing Princess is more than likely to end up lonely — and with no life of the mind to comfort her, this loneliness may make her mentally addled at a comparatively young age. Once the sheen is off her skin, the Princess has nothing that would make one seek her out; like a lot of people over-keen on spangles and glitter, they are at heart rather drab people — drains not radiators, personality-wise — who never make things happen or drive things forward but rather wait to be rescued. They tend to find themselves eternally in the passenger seat of their life’s journey, stranded on the hard shoulder with their souvenirs, waiting in vain for hunky help to arrive.

Julie Burchill, “The Princess generation needs to grow up”, The Spectator, 2017-07-18.

July 30, 2019

QotD: Business versus economics

There often occurred to me the difference between the Professor of Economics and the business man, as judged by their financial success. The business man may not perhaps be on the same intellectual plane as the professor, but he bases his ideas on real facts and puts the whole power of his will behind their realisation. The professor, on the other hand, often has a false conception of reality and although perhaps having more ideas, is neither able nor anxious to carry them out; the fact that he has them is satisfaction enough. And so the business man has the greater financial success.

Erwin Rommel, edited by B.H. Liddell Hart in The Rommel Papers, 1953.

July 12, 2019

Mark Steyn urges caution when considering the Epstein case

It may make sense to avoid a rush to judgement, as the way the federal justice system works these days does not encourage a belief in its impartiality or, for that matter, its dedication to the concept of “justice”:

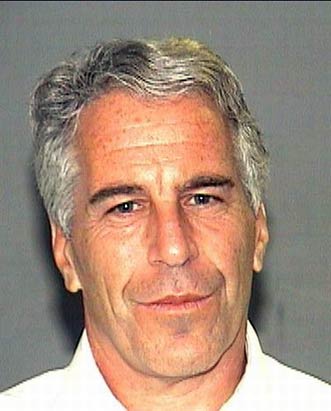

I am wary of saying anything too definitive re the Jeffrey Epstein case, because so much of the reporting is way too trusting of the federal prosecutors’ official narrative. Don’t get me wrong: I take it as read that he’s an industrial-scale pedophile, if only because it seems to be the only thing anybody knows about him – including how he made his billion dollars. He apparently requires three “massages” a day by underage girls. So, upon being informed that Mr Epstein was flying his “Lolita Express” around Africa with Bill Clinton, Kevin Spacey and a softcore porn actress called Chauntae Davies on board, I’m disinclined to accept the official explanation that this was an Aids-relief “humanitarian” mission.

Mug shot of Jeffrey Epstein made available by the Palm Beach County Sheriff’s Department, taken following his indictment for soliciting a prostitute in 2006.

Image via Wikimedia Commons.That said, as longtime readers know, I regard federal justice as appallingly corrupt, and so the sudden revival of Epstein’s prosecution is somewhat more than intriguing. First, and as often with prominent American cases, the details make no sense:

In a memo filed to the court, prosecutors outlined the scope of Epstein’s vast wealth to argue that he has the means to flee the country and escape prosecution, noting that he not only has homes in Manhattan, Palm Beach, New Mexico and Paris — with his Upper East Side townhouse, of which prosecutors are seeking the forfeiture, alone worth $77 million — but also owns a private island in the US Virgin Islands.

He also has three US passports, owns at least 15 vehicles and has access to two private jets, according to the memo.

I can understand how a rich man comes to have fifteen cars, but how pray, does one individual citizen acquire three US passports? And from a government supposedly on “orange alert” these last eighteen years.

Second, Epstein was the beneficiary of a ludicrously lenient federal plea deal a decade ago for exactly the same charges. So this would appear to be “double jeopardy”. Not so fast, say the feds:

It is well-settled in the Second Circuit [appellate court] that a plea agreement in one US Attorney’s office does not bind another unless otherwise stated.

Is that so? Thanks to that litigious loser Cary Katz, I’m more familiar with Second Circuit jurisprudence than I might otherwise wish. But I had no idea of the above. So apparently, when you enter into a plea deal with “the United States” that says things like “the United States, in consultation with and subject to the good faith and approval of Epstein’s counsel, shall select an attorney representative for…” and “if Epstein successfully fulfills all of the terms and conditions of this agreement, the United States also agrees that it will not institute any criminal charges against…”, the words “the United States” only apply to the United States that resides at 27 Ocean View Parkway, Miami Beach and not the United States that resides at 32b Rotting Wharf Lane, The Bronx. So forget double jeopardy; you could have demicentuple jeopardy. Who knew?

One more thing: it seems fairly obvious that Epstein is also a procurer for those whose appetites likewise run to schoolgirls. This is where the manifests of his airplane are at least somewhat inferential. Yet the new indictment is concerned only with “the New York Residence” and “the Palm Beach Residence” — and not the Lolita Express jetting well-heeled buddies to Paedo Island. Is this some cozy arrangement to ensure that Bill Clinton et al are excluded from the case?

July 7, 2019

Cancelling student loans would be a really, really bad economic move

Art Carden explains why cancelling outstanding student loan debt — despite its huge popularity on the campaign trail — would be a very bad idea:

University College, University of Toronto, 31 July, 2008.

Photo by “SurlyDuff” via Wikimedia Commons.

It’s one of the rules of electoral success: advocate policies that concentrate the benefits on an easy-to-identify interest group (preferably one that is sympathetic in the public eye) and disperse the costs onto the entire electorate. It’s how we get Coke sweetened with corn syrup rather than actual sugar. It’s also how we get proposals to cancel student loans. As my AIER colleague Will Luther points out, the fact that two of the Democratic frontrunners have made debt cancellation such an important part of their campaigns suggests that the issue is going to be with us for a while.

But would it be a good idea to cancel student debt? And importantly, how does even the prospect of canceled student debt affect people’s incentives?

Regressive Tax

First, let’s consider the quality of the policy. A lot of commentators are pointing out that it’s fundamentally regressive, meaning that we’re basically taxing the poor to pay the rich. As economist Alexander William Salter puts it in the Dallas Morning News, it’s

a transfer of wealth to those with relatively high levels of expected lifetime income, at the expense of those with relatively lower levels of expected lifetime income.

The idea might have some merit, but it will make wealth and income inequality worse rather than better.

Even saying that the idea might have some merit is perhaps too charitable. In 2011, economist Justin Wolfers called it the “Worst. Idea. Ever.” in a Freakonomics post. Why? First, there’s the distributional effect. If we’re going to have policies that transfer wealth from one group to another, it doesn’t make much sense to transfer wealth from taxpayers generally to high-income college graduates. As Will Luther and so many others have pointed out, a college degree brings spectacular financial returns. As a group, college graduates aren’t “needy” by any reasonable definition.

July 3, 2019

Canada’s “elite”

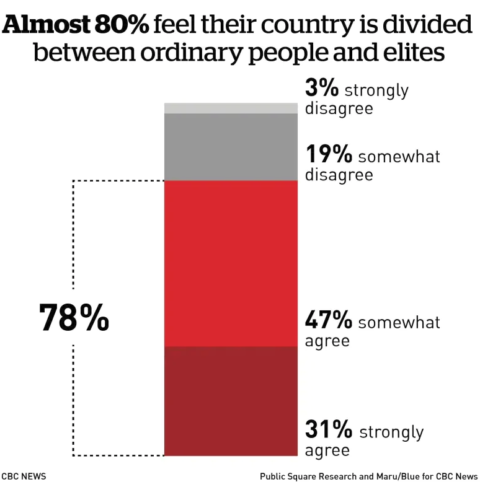

Jay Currie responded to a CBC article on a recent poll that found “nearly 80 per cent of Canadians either strongly or somewhat agree with the statement: ‘My country is divided between ordinary people and elites’.”

The CBC interviewee, Tony Laino, at Fordfest, said describing elites, “Those that think they’re better than me,” he said. “Because I don’t espouse their beliefs.”

Which misses the point. Elites really don’t think of guys like Tony Laino at all. Largely because, as Charles Murray points out in Coming Apart, the new upper class rarely, if ever, meets the Tony Lainos of the world. Murray was writing about white people in America but much the same social bi-furcation is taking place in Canada. Murray looks at education, wealth, marriage, access and what he refers to as the rise of the super-zips, areas where highly educated, well connected, well off people live with others of their class and kind. It is an accelerating phenomenon in the US and it is plainly visible in Canada. Murray quotes Robert Reich as calling this, “the segregation of the successful”.

Inside elite communities “the issues” look very different than they do in the more pedestrian parts of the country. A few pennies extra for gas or heating oil or natural gas to fight the universally acknowledged menace of “climate change” makes perfect sense if your income is in the hundreds of thousands of dollars a year. It is downright terrifying if you are making $50K. Only bigots and racists could be anti-imigration when you, yourself, live in virtually all white, old stock, Canadian enclaves and welcome refugees and migrants who you will never see.

The populist moment has not yet come to Canada and, if Andrew Scheer’s brand of Liberal lite wins in October, there will probably be another decade of elite consolidation before a proper populist movement gets off the ground. Whether it will be right populism a la Trump and Farange, or left populism with a firebrand NDP leader, is hard to say. However, as the Canadian elite grows more insular and disconnected from the ordinary life of Canada and Canadians, that populist moment draws closer.

June 26, 2019

What is the problem that a wealth tax is designed to solve?

Andrew Coyne asks the obvious question about the sudden keen interest in imposing wealth taxes:

“washdc040208-02” by carencey is licensed under CC BY-NC-SA 2.0

It is noteworthy how the debate on inequality has shifted in recent years: from the problem of poverty, whose evils are obvious, to the “problem” of great wealth; from the gap between the poor and the rest of us, to the gap between the rest of us and the rich, or indeed between the rich and the very rich.

But it is not obvious why it is wrong, in itself, that a small number of people should get stinking rich. It is clearly objectionable if they did so by illicit or unethical means — but then it is the means itself, not the wealth, to which we object. And it would be in poor taste, at the least, if they spent it all on themselves. But that is not how the great fortunes are typically disposed of — it’s physically impossible to spend more than a small fraction of it.

Perhaps the argument is less that the rich are too rich than it is that the government is too poor. You can make a case that government should spend more on certain things, especially in America. It doesn’t follow that you need to raise taxes to do so. A lot of good new spending could be funded by cutting bad old spending.

Suppose there were a case for raising taxes. Are wealth taxes the way to go? Wealth is, after all, merely the accumulation of past income — and we already tax income. If rich people are exploiting loopholes to avoid paying tax on their incomes, by all means close the loopholes. But the case for taxing income twice seems obscure.

Yes, we already have a kind of wealth tax, in the form of municipal property taxes — and they’re a notorious mess. They conform to none of the usual principles of good taxation, being neither simple, nor efficient, nor fair.

Why unfair? The bedrock criteria of tax fairness is supposed to be ability to pay. That’s only uncertainly related to wealth. Suppose the value of your house shoots up. Congrats: suddenly you’re wealthy. But your income is unchanged. And it’s income you need, or more accurately cash, to pay your taxes. It’s not clear why you should pay more in tax than someone with the same income, but a cheaper house.

June 5, 2019

QotD: The almost unknown economic good news since 1800

Ordinary people, and some economists, and even a few economic historians, don’t know it. Hans Rosling, the late, great Swedish professor of public health, emphasized how little most people, even very well-informed people, know about the overwhelmingly good news 1800 to the present, or even 1960 to the present (e.g., falling birth rates, falling infant death rates, rising literacy). He surveyed people, in his various audiences to the number of 20,000. They were embarrassingly less accurate on the whole than monkeys would be throwing darts at the multiple choice possibilities. And the human experts, with ordinary citizens, were always biased in a pessimistic, anti-modern direction. Consider Kenneth Pomeranz, in his fine book with Steven Topik, The World That Trade Created. Pomeranz and Topik tell many interesting and accurate stories about the bad side of creative destruction (which comes from any human progress, not as is often said on the left from “neo-liberalism”). But they never acknowledge the gigantic improvements coming from it for ordinary people. Not once.

Dierdre McCloskey, “How Growth Happens: Liberalism, Innovism, and the Great Enrichment (Preliminary version)” [PDF], 2018-11-29.