A discussion at the amusingly named Handwaving Freakoutery on the ongoing wave of tariff activity under the Trump II administration, characterizing them as “woke” tariffs:

The great argument playing out in the media right now about the relative value and ethical implications of reciprocal tariffs is not relevant. It is not relevant because these tariffs are not reciprocal tariffs in any measurable way. They aren’t reciprocal, they aren’t sensible, and the justification for them is Woke in every sense of the word. Let’s take a close look at what we might call Critical Trade Theory, back our way into an understanding of what a woke tariff is and how this is definitely that, and close with a quick word about how political realignments portend doom for the left even though the right is really screwing this up. Then we’ll all buy mop handle futures.

Awokening

The Great Awokening of the prior decade was founded in part on the False Cause Fallacy. Our major institutions for the better part of the last ten years were operated by wokerists, who used an Intersectional Matrix of Culturally Encouraged Race and Gender Prejudice to counteract what they viewed as hidden unmeasurable forces such as “systemic racism”. They couldn’t point to the systemic racism, but they knew it must be there because of the imbalance in socioeconomic metrics, and they denied any other possible explanation for the imbalance. Once the False Cause was in place, the devout wokerist was forced to fight the hidden prejudice with overt reverse prejudice, because they couldn’t conceive any other cause.

For example, if black folks have a hard time getting into Harvard or UNC, it must be because society is systemically racist against black people, and no other reason, therefore we should redirect admission slots from Asians who earned them to blacks who didn’t, for race balancing.

Harvard did exactly that, for exactly that reason, and admitted it, and it was sent to the Supreme Court, and the Supreme Court banned it, and then Harvard kept doing it and is still doing it using different words.

Some of our other institutions are still running this wokery program, although the Trump Administration purged much of it from the halls of federal power this year under their DEI ban, and many other institutions used Trump as cover to independently purge it from theirs. But this same smooth-brained thinking wiggled its way right into Trump’s tariff plan last week, through an equation that looks fancy but is something my middle school son could figure out.

[…]

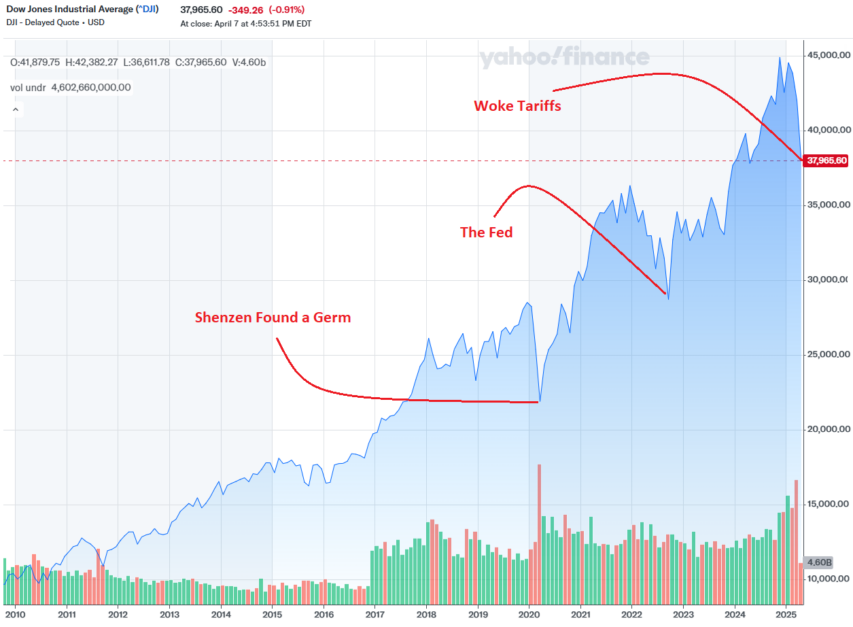

The media thinks these woke tariffs are going to bomb the economy back to the stone age, but when I make the abhorrent choice to read the graphs myself it looks more like January 2024. A 20% tariff on Chinese goods is rough. Adding 34% more to it is rougher. But a 54% tariff on Chinese goods is nothing compared to Shenzhen closing its entire manufacturing sector down because they found a germ, and probably not significantly worse than the Fed turning off the free money spigot in 2022.

These tariffs are going to do goofy shit to the economy. I don’t like the goofy shit they’re likely to do. I think that trade balancing through tariffs is an idea so stupid that only Rust Belt union workers could come up with it, which is why they probably did come up with it, and also probably why Trump won the election by flipping the Rust Belt.