World War Two and Spartacus Olsson

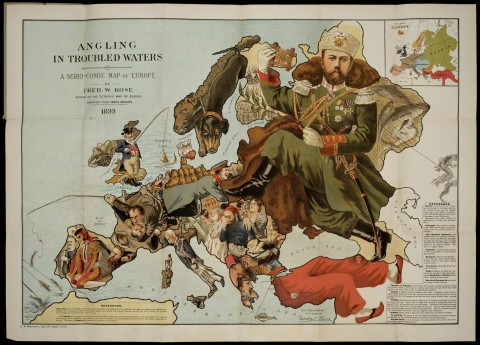

Published 21 Feb 2026In Q4 1933 Hitler pivots Nazi Germany from internal takeover to outward defiance. The London Economic Conference collapses and the tariff truce unravels, Hitler withdraws from the Disarmament Conference and the League of Nations — then stages the November 12 plebiscite and one‑party Reichstag election to claim the nation stands behind him. As Goebbels tightens propaganda and press control through the Editors’ Law (Schriftleitergesetz) and daily directives, the Winter Relief campaign turns “charity” into social pressure and Volksgemeinschaft theater. In December, Reichsbank president Hjalmar Schacht hardens the transfer moratorium to conserve foreign currency for raw materials and rearmament. Using contemporary voices, this episode shows how isolation, manipulation, and “unity” accelerate Europe toward a pre‑war era.

(more…)

February 22, 2026

How to Use a Tariff War to Disrupt the World – Death of Democracy 04 – Q4 1933

February 9, 2026

Jamil Jivani on his trip to Washington DC

If you depend on the CBC, the Toronto Star or other legacy Canadian media, if you heard anything at all about Bowmanville-Oshawa North MP Jamil Jivani’s visit to key American leaders in Washington DC, you probably got the story framed as Liberals tut-tutting and disapproving of Jivani, his initiative to make the trip, and how he should leave everything to the government. If nothing else, it further proved that Prime Minister Carney doesn’t actually want better relations with the US, as his entire campaign was based on opposition to Trump and its success in riling up Canadian boomers with the moronic eLbOwS uP nonsense.

In the National Post Jivani discusses the trip and what he’s learned from it:

It was a whirlwind of a trip, full of excellent conversations. I had meetings with the White House and State Department, including conversations with President Donald Trump, Vice-President JD Vance, and Secretary of State Marco Rubio. Senators from Montana, Ohio, and Wisconsin, as well as the United States Trade Representative, each sat down with me to share their priorities. Businesses and industries employing thousands of Canadians shared their insights with me on where Canada-U.S. trade fits into their vision for economic growth.

Doors were open for dialogue about how Canada and the U.S. can work together at a time when pessimism gets most of the media attention. Certainly, my 15-year friendship with the vice-president played a key role in opening those doors. But what I found across the board was optimism about how we can move trade negotiations forward. I was particularly happy to hear key insights on how we can make progress on specific sectoral priorities, and the importance of strategic diplomacy. I offered my perspective on why CUSMA is so important to communities like mine in Bowmanville—Oshawa North, and I expressed my hope that CUSMA will continue to ensure Canada and the U.S. both benefit from a special economic and security relationship.

There is only so much I can share without first having the chance to speak with Prime Minister Mark Carney and Minister Dominic LeBlanc. Out of respect for their unique responsibilities in negotiating trade with the United States, it’s important that I debrief them before saying too much publicly and see how we can work together moving forward as Conservatives and Liberals.

However, I do want to point out a key observation related to the need for strategic diplomacy. Mexico — the third partner in our trilateral trade agreement with the U.S. — is further ahead in its engagement with the U.S. than Canada is. On Jan. 28, 2026, Mexico and the U.S. announced formal talks on CUSMA reforms. A week later, Mexico and the U.S. announced a joint action plan for critical minerals. Neither of these announcements included Canada.

Observers of this news would be right to worry that the current Canadian government may be making similar mistakes as were made under Prime Minister Justin Trudeau during the 2017 CUSMA negotiations. At that time, Mexico advanced its negotiations with the U.S. while Canada was largely left out of the process. It was only at the last minute, when a bilateral agreement between Mexico and the US was a real possibility, that Canada was included and our unique trilateral arrangement continued.

It would be a mistake to relive 2017 all over again, if for no other reason than Canadian workers and businesses deserve to have full representation in a process that has such a significant impact on our economy. The workers at the GM plant in Oshawa deserve to know that their government did everything possible to protect their jobs and encourage investment in their industry. All Canadians deserve to know that their elected officials are making the best effort possible to advance our national interests.

Full disclosure: Jamil Jivani is my Member of Parliament, and I fully support his decision to go and I hope that it actually does help make for improved trade relations between Canada and the United States. Bitterness and uncertainty only benefit the Liberal Party and Mark Carney, not ordinary Canadians. Attacking and criticizing Donald Trump plays well in our deranged and sycophantic media, but it makes Trump less willing to deal fairly with Canada on trade or other issues of critical importance to both nations.

January 18, 2026

Mark Carney’s actual jobs before becoming Prime Minister

On the social media site formerly known as Twitter, Ezra Levant explains the various jobs Mark Carney has held compared to what many Canadians think he’s done:

Laura Stone @l_stone

Unifor President Lana Payne calls China EV deal “a self-inflicted wound to an already injured Canadian auto industry”. Says providing a foothold to cheap Chinese EVs “puts Canadian auto jobs at risk while rewarding, labour violations and unfair trade practices”. #onpoliI think there’s a misconception amongst Canada’s chattering classes that Mark Carney is an experienced and successful businessman and executive.

He wasn’t. He wasn’t CEO of Brookfield. He was its chairman, overseeing quarterly board meetings and spending the rest of his time flying around to different globalist conferences at the UN or WEF.

He was more of a mascot, a symbol, an ambassador of Brookfield. He didn’t negotiate deals or turn around companies. He did photo-ops.

Before that, he worked at the Bank of England, and before that, the Bank of Canada.

No Googling: can you name a single actual duty of that job? Can you tell me what Carney actually achieved?

He wafted up from fake job to fake job — like Justin Trudeau did, but instead of being a surf instructor and a substitute teacher, he had meaningless executive jobs.

And now when it’s time to shine … he doesn’t know what to do.

It’s been a year, and he has no deal with Trump, despite saying that was his chief focus.

What exactly did he achieve in Beijing? The tariffs against Saskatchewan were lifted — so that merely brings us back to the status quo ten months ago. Nothing else. No investments in Canada, which was the pretext of the trip. Just a capitulations, to allow the dumping of 49,000 Chinese EV cars, with their spyware and malware.

But he looks good in a suit and says ponderous words like “catalyze” and “transformative”. And that’s enough to impress the Parliamentary Press Gallery. Not that they needed much impressing — they’re all on his payroll already, through his massive journalism subsidies. They’re too busy holding the opposition to account to take notice of this latest disaster.

But the regime media shouldn’t feel too bad about being conned. Carney tricked Doug Ford pretty good, didn’t he?

January 9, 2026

Mark Carney’s play-acting on the international stage

There is no way that Canada can make itself economically independent of the United States, no matter how much wishcasting power is exerted to persuade anti-American boomers who habitually vote Liberal. Our entire economy is oriented to serve the vast market to our south, and we’ve been freeloading on our own military because the Americans have been willing to take up the slack and — until recently — not castigate our leaders for their fecklessness. It was bad under Justin Trudeau, but it’s actually gotten worse under Mark Carney’s leadership. Trudeau was performative and loved to play to the world media, but Carney seems to actually believe that he can reverse the entire direction of the Canadian economy by jetting around the world and bad-talking Donald Trump. The Canadian economy has been stalled for ten years now, and if Trump finally loses patience with our idiotic elites, it’ll go into free-fall.

On the social media site formerly known as Twitter, James E. Thorne points out just how few cards Carney actually has in his hand:

Mark Carney’s and Canada’s Dangerous Refusal to Face Reality.

Mark Carney and most Canadians are behaving as if Canada is an independent pole in a multipolar order, when the world he actually inhabits is a hierarchy being brutally clarified by Washington. Trump’s revamped National Security Strategy and the “Trump Corollary” — asserted through the seizure of Nicolás Maduro and open threats toward Cuba and Colombia, make plain that the United States now treats the Western Hemisphere as an American security estate, not a debating society among equals.

In that framework, Canada is not a co-author of the rules. It is a dependency inside the U.S. sphere, structurally lashed to American markets, finance and supply chains. AND after decades without a serious sovereign industrial or energy strategy, Canada is at best a weak Middle Power, that has for decades squandered its competitive advantage through proformative politics and virtue signalling.

In this era, the Western Hemisphere is now a “secure production platform” for American industry and technology, defined not by territorial control but by ownership, access and compliance. The Trump doctrine logic is clear and blunt yet internally coherent: if the Western Hemispheres natural resources and supply chains are secured, the economic and geopolitical dividends will follow.

Carney’s answer to the Trump Doctrine, however, remains the same “City-of-London” orthodoxy that produced him: more proformative political grandstanding, more process, more declarations, more meetings, and more boondoggles.

The Greenland consulate, rhetorical red lines over annexation, the flying around the world, and ritual protests against U.S. action in Venezuela all presume that we still live in the post WWII rules based order. We do not! Will live in the era of the Trump Doctrine, and no we can’t wait it out. And in this era, Greenland will not be allowed to be under the influence of Russia or China.

Thucydides warned that “the strong do what they can and the weak suffer what they must”. Carney’s tragedy is that he quotes the rules-based order while presiding over a country whose economic structure is colonial and whose security ultimately depends on the very power he is theatrically chastising. Posturing without power is not prudence. It is provocation without a plan. And yes it’s dangerous.

The irony is that Carney understands all of this perfectly well, which only sharpens the question: what, exactly, is he doing by posturing as a rules-based equal in a hierarchy where he knows Canada lacks the hard power to back his stance?

December 30, 2025

Tariffs are an economic burden, even when you claim they’re paid by foreigners

At the Foundation for Economic Education, David Hebert responds to a recent pro-tariff puff piece from financial columnist, Matthew Lynn:

As Lynn acknowledges, “the tariffs are a tax”. Because they are a tax, they are going to be paid by someone in some form. You can’t have money flowing into the Treasury without someone paying that extra money in some way. Broadly speaking, we can divide the potential payors of American-imposed tariffs into three camps: American consumers, American importers, and foreigners.

One of the oft-cited effects of a tariff is to reduce the amount of imports coming into America. This makes sense and is in fact one of the numerous goals administration officials have pointed to. Insofar as American consumers and importers end up paying the tariff, they will buy less of the now-more-expensive foreign products. We’re already seeing this happen in the US, which Lynn alludes to throughout his article.

If foreigners pay the tariff, they’ll sell less of the now-tariffed goods to the US. This will, as President Trump and others have correctly identified, hurt their bottom line. To offset at least some of this, these countries will try to sell more of their products to their domestic consumers or consumers in countries other than the US. This is exactly what we have seen and what we are seeing, as other countries around the world are securing new trade deals with one another and deliberately excluding the United States from said deals.

So, Lynn is correct to point out that foreign corporations have incurred costs because of the Trump tariffs. However, despite his repeated implication to the contrary, this is not money that goes to the US Treasury. Volkswagen, for example, has raised the price of its 2026 models by up to 6.5 percent, largely due to tariffs, and has indicated that this is just the beginning. That’s more money coming out of American consumers’ pockets. At these higher prices, American consumers are purchasing fewer Volkswagens than last year. Volkswagen’s losses from the tariffs include an almost 30 percent decline in profits from auto sales. Importantly, sales that do not happen count toward the reduced profit that Volkswagen reported but generate no tariff revenue for the Treasury to collect. That Lynn, a financial commentator, does not understand this distinction is deeply troubling.

Who Really Pays the Tariff?

Lynn’s central argument rests on a fundamental confusion between what economists refer to as the “legal incidence” and the “economic incidence” of a tax. Legally, because tariffs are a tax on imports, it is the US importers who must write the check to Customs and Border Protection. But this says nothing about who actually pays the tariff.

For example, when landlords’ property taxes go up, who pays? The landlord will obviously write the check to the county assessor, but unless Lynn thinks that landlords are running charities, that cost gets passed on to tenants in the form of higher rent, less frequent maintenance, or fewer included benefits (utilities or access to designated parking, for example). The legal incidence falls on the landlord, but the economic incidence falls disproportionately on renters, i.e., young Americans already besieged by high housing costs.

Tariffs work the same way. US Customs and Border Protection bills the American importer directly, which is the legal incidence of the tariff. But the economic burden gets distributed among American consumers, American importers, and foreign exporters, depending on the particulars of the individual markets.

Lynn cites the Harvard Pricing Lab finding an approximately 20 percent “pass-through rate,” meaning that American consumers are only paying about one-fifth of the tariff costs. He treats this as a permanent feature of the tariff regime and as proof that foreigners are footing the bill. But the question isn’t who writes the check today, it’s who bears the cost over time. And here, the evidence directly contradicts Lynn’s fables.

As we have seen, pass-through rates are not static, but evolve over time as markets adjust. And every piece of evidence suggests that the pass-through rate has been and is continuing to rise rapidly. Goldman Sachs and the Council on Foreign Relations tracked the evolution over just this administration. Their findings are stunning: In June, US businesses absorbed about 64 percent of the tariff costs, American consumers about 22 percent, and foreign exporters about 14 percent in the form of reduced profits. Just four months later, American businesses absorbed just 27 percent, while American consumers absorbed 55 percent and exporters absorbed 18 percent. Projections for 2026 continue the trend with consumers absorbing 67 percent, exporters 25 percent, and importers just 8 percent.

The logic behind this is simple and has been echoed by President Trump and Scott Bessent themselves. In the initial months following Liberation Day, American importers could not quickly shift to alternative suppliers, giving them little leverage to demand price cuts from existing foreign vendors. Many American importers also believed (or hoped?) that the tariffs were simply a negotiating tool that would be bargained away. Having built up inventories before April, they were able to avoid raising consumer prices, with the belief that the “temporary pains would be worth the long term gains.”

That’s no longer the case. As the BLS notes in its latest import price index report, the price of imports has barely changed. This matters because US importers, not foreign sellers, are legally required to write the tariff check. American buyers pay the foreign company’s price, then pay the tariff on top of it. If foreigners were truly absorbing the tariffs, they’d have to lower their prices to compensate, and we would see a decrease in the import price index. We haven’t. The index is flat, which is evidence that the burden of the tariff is, as economists warned, being paid disproportionately by Americans in one form or another. As the Council on Foreign Relations analysis points out, by October, importers have “had time to seek alternative suppliers, giving them a bit more negotiating leverage.” More importantly, the “trade deals” that the administration has inked have made it clear that substantially higher tariffs are here to stay. All of this gives importers and retailers good reason to continue passing more of the costs along to consumers.

We are already seeing evidence of this happening. The Federal Reserve Bank of Boston’s survey of small and medium-sized businesses, for example, confirms this dynamic. Firms expecting tariffs to persist for a year or longer plan to pass through three times more of their cost increases to consumers than firms expecting short-lived tariffs. As of August, over 45 percent of affected businesses expected their costs to be impacted for longer than a year.

But how does all of this compare to the pass-through rate felt during the 2018–2019 tariffs? The Harvard Pricing Lab — the same data that Lynn cites — actually undermines his entire argument. After just six months, the 2025 tariff pass-through rate is indeed around 20 percent. But if we compare this to the 2018 tariffs, the difference is night and day. After Trump’s first-term tariffs, the pass-through rate stayed under 5 percent after a full year. This isn’t evidence that these tariffs are working. It’s evidence that these tariffs are hitting consumers harder and faster than the previous round.

November 22, 2025

Ottawa is working hard … to keep beef prices high for consumers

It’s not your imagination, beef is still much more expensive than it used to be (we no longer buy any “good” cuts of meat, settling for ground beef and “stewing beef” when we do the shopping). But rest assured, the feds are working diligently … to prevent beef prices from falling:

We recently received information from a reliable industry source about how the federal government is administering beef import permits. If accurate, it raises serious concerns about whether Ottawa is knowingly sustaining an outdated and opaque system that keeps beef prices unnecessarily high. At a time when many families are struggling with food costs, this is more than a bureaucratic issue — it directly affects affordability.

Canada’s beef import rules operate under a tariff-rate quota system. A limited volume of beef can enter the country at a low tariff, but anything beyond that is slapped with a steep import charge. When supply tightens or when specialty products are required, supplemental import permits are meant to provide flexibility and help stabilize the market. For years, the system worked reasonably well.

But the structure behind the process has not kept pace with today’s realities. The committee originally created to provide guidance — the Beef and Veal Tariff Rate Quota Advisory Committee — has not met since 2015. For a decade, no formal mechanism has existed for importers, retailers, or independent distributors to participate in discussions with government about how permits are allocated. Instead, decisions have shifted informally toward a small group of influential players, including major domestic processors who have a vested interest in limiting imports. The transparency and balance once built into the system have eroded.

Adding to this complexity is the broader concentration of market power in the sector. Beef packing and processing in Canada is dominated by two foreign-owned private companies: Cargill, based in the United States, and JBS, headquartered in Brazil. Together, they control the overwhelming majority of beef slaughter and processing in this country. When a sector is this concentrated, and when a federal system restricts competition through import controls, the beneficiaries are obvious. Any policy that tightens import access — intentionally or not — further entrenches the dominance of these two multinational giants.

The consequences are no longer theoretical. Our source described a case where a long-established importer has beef sitting in bonded storage in Canada. The product is legally imported and properly documented. The importer applied for a supplemental permit to release it into the market at the regular tariff rate. The application was refused. The justification offered — that the beef had been purchased abroad at a price “too low” compared with U.S. prices — makes little economic sense. The product did not come from the U.S., and competitive pricing has never been grounds for rejecting a permit. With no permit, the importer must wait until the next quota year or pay the full over-quota tariff. Ironically, the only reason paying the tariff is even possible now is because beef prices have climbed so sharply. The federal government, of course, collects that tariff revenue.

Cases like this raise an uncomfortable question: does Ottawa actually want to keep beef prices high? If the goal were genuinely affordability, the government could issue supplemental permits when supply conditions justify them. It could restore a functioning advisory committee to ensure balanced input. It could provide clear and transparent criteria for permit decisions. Instead, legitimate requests are rejected, supply is restricted even when product is physically present in the country, and both processors and Ottawa benefit from elevated prices.

November 17, 2025

The US Supreme Court considers whether Trump’s tariffs are legal

Thanks to the staggering incompetence (and/or deliberate provocation for domestic political advantage) of the Carney government’s dealings with President Donald Trump, the current case before the Supreme Court is of significant interest to those of us on the north side of the US-Canadian border. On his Substack, David Friedman discusses the issues before the court:

There are three things wrong with Trump’s tariffs. The first is that they cannot be expected to provide the benefits claimed, can be expected to make both the US and its trading partners poorer; the arguments offered for them depend on not understanding the economics of trade. For an explanation of why that is true, see an earlier post.

The fact that the tariffs make us poorer may be the most important thing wrong with them but it is irrelevant to the Supreme Court; nothing in the Constitution requires the president to do his job well. The questions relevant to the Court are whether what Trump is doing was authorized by past Congressional legislation and whether it was constitutional for Congress to authorize it.

What Counts As An Emergency?

Tariffs are under the authority of Congress, not the president.1 Trump’s justification for setting them himself is congressional legislation, the International Emergency Economic Powers Act.

(a) Any authority granted to the President by section 1702 of this title may be exercised to deal with any unusual and extraordinary threat, which has its source in whole or substantial part outside the United States, to the national security, foreign policy, or economy of the United States, if the President declares a national emergency with respect to such threat.

(b) The authorities granted to the President by section 1702 of this title may only be exercised to deal with an unusual and extraordinary threat with respect to which a national emergency has been declared for purposes of this chapter and may not be exercised for any other purpose. (IEEPA, 50 U.S. Code § 1701, emphasis mine)

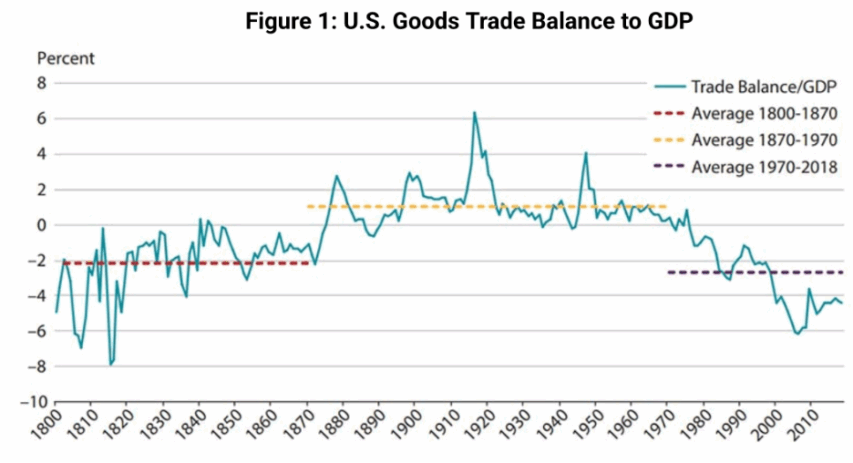

Trump declared that his Worldwide Reciprocal Tariffs were intended to deal with the US trade deficit.2 Whether the deficit is a threat and whether tariffs are a good way to deal with it are questions for economists3 but whether it is unusual is relevant to judges, since if it is not the IEEPA does not apply.

[…]

The Court on Trial

Delegating to the president the power to impose tariffs, a power explicitly given to Congress in the Constitution, is a major question. Under doctrine proclaimed by this court that means that the legislation claimed to delegate that power must be read narrowly. On a narrow reading, on anything but a very broad reading, the legislation fails to apply to President Trump’s tariffs for two independent reasons:

It only grants power in an emergency, which under the language of the Act neither the trade deficit nor the illegal drug problem is; the deficit has existed since 1970, the War on Drugs was proclaimed in 1971.

The powers granted to the president in the Act do not include the power to impose tariffs.

If the six conservative justices believe in the principles they claim, the administration will lose the case 9-0.

- The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises … To regulate Commerce with foreign Nations … (U.S Constitution, Article I, Section 8).

- “I found that conditions reflected in large and persistent annual U.S. goods trade deficits constitute an unusual and extraordinary threat to the national security and economy of the United States that has its source in whole or substantial part outside the United States. I declared a national emergency with respect to that threat, and to deal with that threat, I imposed additional ad valorem duties that I deemed necessary and appropriate.” (Executive Order July 31, 2025).

- The answers are no and no.

October 27, 2025

Trump versus Carney (and Ford, his court jester)

Another week, another set of bleak headlines about the trade relationship (or lack thereof) between Canada and the United States. For some, this is the story of how Trump Derangement Syndrome has consumed all levels of Canadian leadership, while for others it’s proof that you can’t deal with Trump as a rational adult and instead need to consider him an overgrown toddler with a nuclear arsenal at his disposal. Or perhaps it’s a little from column A and a bit from column B:

At the risk of overstating my own influence, it’s like the President of the United States read my piece saying he was acting like a toddler and decided, “oh yeah? I’ll show what ‘acting like a toddler’ means!” and did this, presumably once Bluey was over:

U.S. President Donald Trump says he is raising tariffs on Canadian goods by 10 per cent, after accusing Canada of airing what he called a “fraudulent” advertisement that misrepresented former president Ronald Reagan’s stance on tariffs.

In a post published on Truth Social at 4:30 p.m. Saturday, Trump wrote, “I am increasing the Tariff on Canada by 10% over and above what they are paying now.”

Trump’s post cited his frustration over an advertisement produced by the Ontario government that used clips of Reagan warning about the dangers of protectionism and praising free trade.

“Canada was caught, red handed, putting up a fraudulent advertisement on Ronald Reagan’s Speech on Tariffs,” he wrote.

Earlier this week, Trump had cut off trade negotiations with Ottawa, explaining it was due to the “hostile” nature of the ad campaign.

“Their Advertisement was to be taken down, IMMEDIATELY, but they let it run last night during the World Series, knowing that it was a FRAUD,” Trump further said in the Truth social post.

The good news is, at least Trump is coming right out and admitting that his “national security” tariffs are really about nothing more than his fragile ego, just in time for the Supreme Court to hear arguments about this very issue.

The bad news is, I think it’s exceptionally naive to think SCOTUS is going to save us from this madness.

Not because I think they’ll rule that what he’s doing is legal. That might be a bridge too far for even Justices Thomas and Alito.

But because this proposition rests on the assumption that Trump considers himself bound by Supreme Court rulings and that anyone else is going to exercise their power to ensure these rulings are followed.

Or, if you think Canadian leaders are deep in a TDS binge:

Trump Derangement Syndrome (TDS) is a widespread and serious issue. When one is afflicted by it, their capacity to sense-make becomes compromised. Emotions are a difficult thing for humans to control, and TDS-sufferers seem for the most part unaware of how much their negative, emotional feelings concerning Trump have hijacked their reason.

TDS types reveal themselves in so many ways. One specifically, which often goes unnoticed, is a general uncharitableness when it comes to interpreting the words and actions of Trump, or a general unwillingness to look beyond words – either Trump’s words or anyone else’s which have been inserted into Trump discourse. A prime example of this is the anti-tariff ad campaign involving a 1987 speech by former president Ronald Reagan which the Ford government paid $75 million to have broadcast to American audiences – key Republican areas – for the purpose of undermining President Trump’s economic policy.

Firstly, the uncharitable analysis does not allow that Trump has any right, or any good argument, or reason to be upset about Canada’s trade practices, such as supply management. The uncharitable analysis sees Canada as an innocent victim and Trump as a bully who is trying to destroy us and/or take us over.

[…]

Returning to reason and reality. Trump has justification for being upset with Canada over both our trade practices and in the under-handed and unfriendly tactics of Doug Ford and other Canadian leaders. The ad was an insult to Trump. His reaction or over-reaction to the ad, does not change the fact that what Ford did was antagonistic and not in the best interests of productive trade negotiations. The charitable analysis understands this, and does not lose sight of it, no matter how outlandish the things Trump does may be.

On the other side of the uncharitable Trump analysis concerning Ford’s Reagan ad blunder, is circulating the idea that Reagan was anti-tariff. Why is this idea believed? Because of Reagan’s rhetoric. You can find hundreds of clips of Reagan speaking about the dangers of high tariffs, or advocating for free trade. But the uncharitable analysis refuses to go beyond words. They ignore words that don’t support their argument, and act as if the words that do support their argument were the only ones spoken. Further, they act like words are the be all and end all, by not bothering to investigate the actions of those who speak the words, they pretend that word-speakers always do and intend exactly what they say. Reagan’s oratory contained lots of anti-tariff rhetoric, but his actions included lots of pro-tariff policy in an effort to deal with unfair trading partners.

None of this is difficult once you mea culpa from TDS. If you remain under the spell of TDS, you will not be rational or reasonable, and I for one, will not take you seriously. You will look increasingly foolish as time goes on and Trump’s policies turn out not to be the disasters you hysterical twits dreamed they would be. And the group of people like me, who shake their heads and roll their eyes at you, will grow and grow, under the weight of inevitable mass mea culpa. But you will remain shrouded from truth as you descend further into darkness and gloom and hate. It doesn’t have to be this way … just mea culpa FFS!

October 17, 2025

Stellantis took the bribe, left Canada anyway

The former American Motors plant in Brampton, now owned by Stellantis, was supposed to be the manufacturing site for a new Jeep vehicle. The federal government under Justin Trudeau handed about $15 billion to Stellantis to build an EV battery complex in Windsor, Ontario. It was apparently just assumed that this meant that Stellantis would keep the Brampton facility open and operating, but that assumption was faulty:

Stellantis has announced they’re leaving Brampton. That’s it. End of story.

Three thousand workers. Gone. A manufacturing base gutted. A city thrown into economic chaos. And a federal government left holding a $15 billion bag it handed over like a drunk tourist at a rigged poker table.

The Jeep Compass — the very vehicle they promised would anchor Ontario’s role in the so-called “EV transition” — will no longer be built in Canada. Production is moving to Belvidere, Illinois. The same company that cashed billions of your tax dollars under the banner of “green jobs” and “economic transformation” has slammed the door and walked out. And no, this isn’t a surprise. This was baked into the cake from day one.

Let’s rewind.

In April 2023, under Justin Trudeau’s government, Chrystia Freeland — then Finance Minister — and François-Philippe Champagne, the Industry Minister, announced what they called a “historic” agreement: a multi-billion-dollar subsidy package to Stellantis and LG Energy Solution to build an EV battery plant in Windsor, Ontario.

It was sold as a turning point. The future. A Green Revolution. Thousands of jobs. A new industrial strategy for Canada. But in reality? It was a Hail Mary pass by a government that had already crippled Canada’s energy sector and needed a shiny new narrative heading into an election cycle.

And here’s what they didn’t tell you: the deal had no enforceable commitment to keep auto production in Brampton. There were performance-based incentives — yes — but only for the battery plant. Not for the Brampton assembly line. Not for the existing workforce. And certainly not for ensuring the long-term health of Canada’s domestic auto industry.

They tied this country’s future to a globalist fantasy. A fantasy that assumed the United States would remain under the control of climate-obsessed technocrats like Joe Biden. A fantasy that required a compliant America pushing carbon neutrality, electric vehicle mandates, and billions in matching subsidies for green infrastructure.

But in November 2024, Americans said no.

Donald Trump was elected president. And just as he promised, he tore Biden’s green agenda to shreds. He pulled out of the Paris Climate Accord — again. He dismantled the EV mandates. He unleashed American oil and gas. But he didn’t stop there. Trump imposed a sweeping America First manufacturing policy, pairing 25% tariffs on imported goods with aggressive incentives to bring factories, jobs, and supply chains back onto U.S. soil.

And, as Conservative deputy leader Melissa Lantsman points out, it’s just the beginning:

You probably heard the news by now: Stellantis is cancelling its opening of a Jeep factory planned in Brampton, taking over 3,000 jobs and USD $600 million of investment out of Canada and moving it to the U.S.

This is the latest development in the growing trend of companies scaling back their operations in our country and choosing instead to grow in the US. Whisky maker Diageo found its name in the headlines last month when they announced they’d move their Crown Royal bottling facility south. GM laid off or cut down shifts for 750 autoworkers in Oshawa and 900 in Ingersoll while sending $4 billion to the U.S. Those are the ones that drew the headlines.

Why is this happening? Well – the reason on everyone’s mind right now is tariffs. And it’s true – tariffs are having a big impact on the Canadian economy and on our trading relationships. But there are other, deeper reasons at play, too.

Companies don’t just make decisions on a whim – especially those related to long-run production and fixed investments totalling hundreds of millions or even billions of dollars. Those decisions are made as part of detailed, multi-year analyses that take into account predicted economic conditions, market forces, and many other factors. A massive move of your production facility isn’t a temporary, six-month decision to be trifled over – it’s a permanent thing and that means they aren’t coming back.

The objective is to decrease uncertainty, cut costs, increase production, etc. etc. all to work in favour of any company’s ultimate goal, which is, of course, to make money.

So let me translate what all these investment and job cuts really mean: they’re not a knee-jerk reaction to the tariffs, although those play a part. They’re a statement about the long-term trajectory of the Canadian economy and the kind of climate that a decade of Liberal government has built for businesses in this country.

If these companies thought the U.S. tariffs would be transitory, a six-month blip, an economic fad – then they’d have no reason to cancel factories that will be producing goods for 20 or 30 years. That wouldn’t make financial sense.

[…]

If things get worse, the government might resort to its favourite strategy of just offering more hand-outs for businesses to try and entice them to stay here, but that only works for so long. That Stellantis plant in Brampton? The one that’s moving to the U.S.? The Ontario government promised them over $500 million just a few years ago – and the feds followed.

Turns out, you can promise to cut somebody a giant cheque and it’s still unprofitable for them to do business here.

As I mentioned, the continued trade uncertainty doesn’t help our situation, and the Prime Minister’s failure to get a deal is costing us big-time – especially as he promises to drive a trillion dollars of investment southbound at the expense of our workers here.

But as long as the Liberals keep the same old approach towards economics and business in this country, as long as the Liberals keep the taxes high, the productivity low, and the red tape piled up high — expect to see more headlines like the one about Stellantis, not fewer.

How many more job losses will it take for our leaders to realize that?

September 4, 2025

Net Zero targets and Britain’s ever-declining car industry

At the Foundation for Economic Education, Jake Scott charts the decline of the British auto manufacturing centres and the government’s allegiance to its Net Zero programs:

Britain was once a giant of car manufacturing. In the 1950s, we were the second-largest producer in the world and the biggest exporter. Coventry, Birmingham, and Oxford built not just cars, but the reputation of an industrial nation; to this day, it is a source of great pride that Jaguar–Land Rover, a global automotive icon, still stands between Coventry and Birmingham. By the 1970s, we were producing more than 1.6 million vehicles a year.

Today? We have fallen back to 1950s levels. Last year, Britain built fewer than half our peak output—800,000 cars, and the lowest outside the pandemic since 1954. Half a year later, by mid-2025, production has slumped a further 12%. The country that once led the automotive revolution is now struggling to stay afloat, and fighting to remain relevant.

This is why the news that BMW will end car production at Oxford’s Mini plant, shifting work to China, is so damning, bringing this decline into sharp focus. The Mini is not only a classic British car; Alec Issigonis’s original design made it an international icon. For decades, the Mini has been the bridge between British design flair and foreign investment. Its departure leaves 1,500 jobs at risk at a time when the government is desperate to fuel growth and convince a wavering consumer market that there is no tension between industrial production and Net Zero goals.

It’s a bitter reminder that we in Britain have been here before: letting an industrial crown jewel slip away.

The usual explanations will be offered: global competition, exchange rates, supply chains. All true, in the midst of a global trade war that is heating up and damaging major British exports. But such a diagnosis is incomplete. The truth is that Britain’s car industry is being squeezed by a mix of geopolitical realignment and government missteps.

The car industry has become the frontline of a new trade war. Washington has already moved aggressively to shield its own firms: the Inflation Reduction Act offers vast subsidies for US-made EVs and batteries, an unapologetic attempt to onshore production, and something that became a flashpoint of tension in Trump’s negotiation with the EU in the latest trade deal. On the production side, the Act has poured billions into US manufacturing: investment in EV and battery plants hit around $11 billion per quarter in 2024.

Ripples have been sent across the world in the US’s wake: Europe, faced with a flood of cheap Chinese EVs, has imposed tariffs of up to 35% after an anti-subsidy investigation. Talks have even turned to a system of minimum import prices instead of tariffs. Unsurprisingly, China has threatened retaliation against European luxury marques, while experts warn the tariffs may slow the EU’s green transition by raising prices.

This is no longer a free market: cars are treated as strategic assets, the 21st-century equivalent of shipbuilding or steel. Whoever controls the supply chains, particularly for EV batteries and the mining of lithium, controls not only the future of the industry but an important lever of national power.

The results are visible. In July 2025, Tesla’s UK sales collapsed nearly 60%, while Chinese giant BYD’s deliveries quadrupled. Europe responded by talking up new tariffs. Britain did nothing. In this asymmetric contest, our market risks becoming a showroom for foreign producers — subsidizing both sides of the trade war without defending our own.

August 23, 2025

“Trump … sees transshipment and nearshoring as sneaky workarounds”

At the Foundation for Economic Education, Jake Scott explains Donald Trump’s latest anti-trade moves:

President Donald Trump’s executive order of July 31st, effective August 7th, has upended global trade dynamics in a single stroke. Slapping a 40% tariff on all “transshipped goods” — products rerouted through third countries to dodge US duties — this is merely the natural development of his evolving protectionist agenda.

Just a week after the order, the move is a clear shot at China’s sprawling manufacturing empire, which has long exploited methods like transshipment and “nearshoring” to skirt American tariffs in general, and Trump’s tariff policies in particular.

While applied globally, China stands to take the biggest hit (and likely already is), with its vast factory networks and knack for rerouting goods through Southeast Asia, Mexico, and beyond. This isn’t just a tariff hike; it’s a calculated escalation in Trump’s ongoing crusade to reshape US trade policy and the global economy in the United States’ favor. But ripple effects that bruise consumers are already visible — and this move is likely to strain relationships with key allies as well.

The new tariffs build on Trump’s first-term strategy — so extensive that it now has a Wikipedia entry — when he wielded America’s economic heft like a sledgehammer to renegotiate or smash trade deals he deemed unfair. Back then, Chinese firms sidestepped US tariffs by setting up shop in countries like Vietnam and Mexico, funneling goods through these hubs to mask their origins.

This nearshoring strategy buoyed many economies that had pre-existing arrangements with the United States or were treated more favorably than China, such as Canada and Latin American nations. It is also seen as a natural part of globalization: shipping parts from where they are constructed (like China), assembling them in developing nations (like Mexico), and then exporting to high-value markets (like the United States). Nearshoring has a long history, but the fragility of extended global supply chains was exposed in the Covid pandemic; since then, manufacturers have sought to mitigate their damage.

The US trade deficit with China (roughly $295 billion) has long been a sore point for Trump, who sees transshipment and nearshoring as sneaky workarounds. The 40% duty on these goods, layered atop existing tariffs, aims to plug this loophole. As Stephen Olson, a former US trade negotiator, noted in the New York Times, China will likely view this as a direct attempt to “box them in”, potentially souring already tense talks.

August 8, 2025

China’s short- to medium-term reaction to Trump’s tariffs

In Reason, Liz Wolfe outlines some of the reasons China has not been suffering under the tariffs President Trump has levied on them over the last few months (unlike, say, Canada):

President Donald Trump and PRC President Xi Jinping at the G20 Japan Summit in Osaka, 29 June, 2019.

Cropped from an official White House photo by Shealah Craighead via Wikimedia Commons.

Total Chinese exports surged in July … but not to us. Compared to July 2024, Chinese exports were up 7.2 percent last month. “Its exports to Southeast Asia and Africa, key regions for reshipment to the United States, rose more than twice as fast as its overall exports”, per The New York Times‘ reading of the data. “China’s exports to the European Union, its main alternative to the American market, were also up very strongly.”

Specifically, “data released Thursday by the customs authorities showed the pickup was driven by strong growth in shipments to the European Union, Southeast Asia, Australia, Hong Kong and other markets, which more than made up for the fourth month of double-digit declines in US purchases”, reports Bloomberg.

Predictably, even the threat of tariffs has been enough to dampen trade. Remember, Washington and Beijing are still operating under a 90-day truce — set to expire on August 12, though it could be extended if a new agreement is reached — that holds off the imposition of higher tariff levels, namely, the tit-for-tat tariff increases that both countries had threatened. The truce also staves off export controls on certain critical rare-earth minerals and items that fall into the technology category. But still, current tariff levels mean a baseline 30 percent tariff on Chinese imports, which has been enough to depress trade.

For those in the Trump administration who are worried about trade deficits in particular, I suppose the good news is that we’ve made progress there: “For the last several decades, China has been selling as much as $4 worth of goods to the United States for each $1 of American goods that it buys”, reports The New York Times. Following China’s admission into the World Trade Organization, the trade deficit rose. Now, “tariffs have begun to reduce the imbalance. The United States announced on Tuesday that its overall trade deficit had narrowed in June to $60.2 billion, the smallest in nearly two years.”

It’s not clear why Trump administration officials, and the president himself, are so worried about trade deficits as something to eliminate for their own sake. We are dependent on Chinese goods to a rather substantial degree, which would pose a problem in the event of war with China (which is why the previous administration focused on improving our semiconductor manufacturing capabilities back in 2022). But you can just as easily make the case that it’s the vast volume of trade between the two countries — the deeply intertwined economies so reliant on each other (despite China’s claims of autarky and, more amusingly, communism) — that are incentivizing continued decent relations.

A few factors are at play that might help to explain why you likely haven’t felt a drastic increase in prices just yet. First, since there’s been a long lead-up to this trade war, many larger importers have stockpiled product over the last few months, so shortages haven’t been felt yet — they’ve just been selling off product they’ve been storing. Second, China has already managed to divert some stages of manufacturing to other countries—namely Vietnam — and some larger companies already have factories up and running in other Southeast Asian countries to avoid the “made in China” or “shipped from China” labeling. Expect more transshipping and manufacturing-locale creativity as a means of throwing customs officials off the scent.

August 5, 2025

Will the courts take away Tariff-master Trump’s favourite toy?

President Donald Trump’s second term in office has been dominated by his capricious and seemingly random deployment of tariffs as a bludgeon to intimidate and coerce America’s allies and enemies alike. In Reason, J.D. Tuccille considers the possibility of the courts taking away the one tool Trump has been using to get his own way in trade negotiations:

Everybody with a brain knows that tariffs are taxes. And they know that tariffs imposed on goods imported to the United States are largely paid by American businesses and consumers. The big question is whether tariffs unilaterally imposed by President Donald Trump under creative interpretations of emergency executive powers will withstand a federal court challenge. So far, the signs are promising for those hoping that a law intended to rein in the power of the presidency will not be read to permit the president to set trade policy of his own accord.

As CBS News reported this week, the U.S. Court of Appeals for the Federal Circuit in Washington, D.C. heard “oral arguments on Thursday in V.O.S. Selections v. Trump, a case brought by five small business owners and 12 states who allege they have been harmed by President Trump’s import taxes. V.O.S., the lead plaintiff in the case, is a New-York based wine importer.”

Representing the plaintiffs is the free-market Liberty Justice Center, along with co-counsel Ilya Somin, a law professor at George Mason University’s Scalia Law School. The plaintiffs are challenging the Trump administration’s invocation of the International Emergency Economic Powers Act (IEEPA) as the basis for the “Liberation Day” tariffs on much of the world as well as related tariffs on Mexico, Canada, and China.

A Law Intended To Trim Presidential Power, Not Expand It

The plaintiffs maintain that “under that law, the President may invoke emergency economic powers only after declaring a national emergency in response to an ‘unusual and extraordinary threat’ to national security, foreign policy, or the U.S. economy originating outside of the United States. The lawsuit argues that the Administration’s justification — a trade deficit in goods — is neither an emergency nor an unusual or extraordinary threat.”

What’s interesting is that Congress passed IEEPA not to expand presidential power, but to restrict it. According to a 2024 Congressional Research Service report, “following committee investigations that discovered that the United States had been in a state of emergency for more than 40 years, Congress passed the National Emergencies Act (NEA) in 1976 and IEEPA in 1977. The pair of statutes placed new limits on presidential emergency powers”. Under these laws, presidents are required to assess emergencies on an annual basis, extend them if necessary, and report on their status to Congress.

“Some experts argue that the renewal process has become pro forma“, the report acknowledges. “History shows that national emergencies invoking IEEPA often last nearly a decade, although some have lasted significantly longer — the first state of emergency declared under the NEA and IEEPA, which was declared in response to the taking of U.S. embassy staff as hostages by Iran in 1979, is in its fifth decade.”

August 2, 2025

July 29, 2025

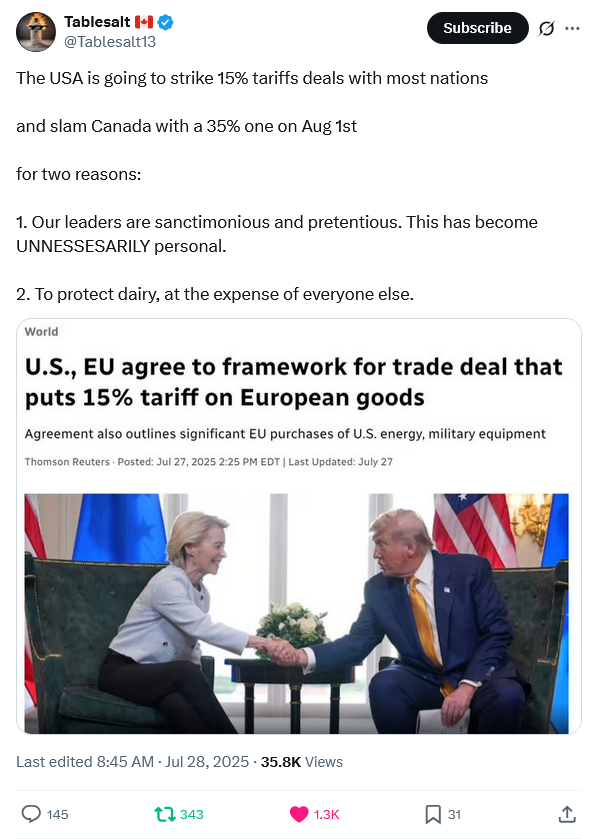

EU Commission President Ursula von der Leyen triumphantly announces EU capitulation to Trump’s demands

The EU and the United States are finalizing negotiations on bilateral trade issues that basically give Trump everything he wanted with very little in return for the EU’s concessions. It’s almost as if Trump has some kind of experience in negotiating lopsided agreements, isn’t it? I guess von der Leyen didn’t get Mark Carney’s memo on the importance of keeping your eLbOwS uP:

EU Commission President Ursula von der Leyen “[learning] in real time that weakness and submission do not in fact invite conciliation”

Donald Trump has shown up the European Union. He’s revealed that the world’s largest single market is a paper tiger to be kicked around, with basically no leverage or strength to resist American demands.

All of these supposedly fierce backroom tariff negotiations have yielded an incredibly one-sided deal – really an unparalleled embarrassment. As announced yesterday, the EU promises to invest $600 billion in the U.S. economy and to make $750 billion worth of “strategic purchases” of oil, gas and the like over the next three years. We also promise to buy a bunch of American military equipment. In return for giving the Americans $1.35 trillion, we earn the privilege of a 15% baseline tariff on all of our exports to America and we drop our own tariffs to zero. At least we don’t have to pay the 30% tariffs Trump threatened!

[…]

While von der Leyen was trying weakly to put a happy face on her total failure, Trump gave her what we might call a softer Zelensky treatment. He twisted the knife in the wound, calling out the idiocy of EU wind energy in an extended soliloquy that will surely keep the fact-checkers and the regime deboonkers up late for weeks to come. I transcribe his remarks in full, because the whole moment was wonderful:

And the other thing I say to Europe, we will not allow a windmill to be built in the United States. They’re killing us. They’re killing the beauty of our scenery, our valleys, our beautiful plains. And I’m not talking about airplanes. I’m talking about beautiful plains, the beautiful areas in the United States. And you look up and you see windmills all over the place. It’s a horrible thing. It’s the most expensive form of energy. It’s no good.

They’re made in China, almost all of them. When they start to rust and rot in eight years, you can’t really turn them off. You can’t bury them. They won’t let you bury the propellers, you know, the props, because they’re a certain type of fiber that doesn’t go well with the land. That’s what they say. The environmentalists say you can’t bury them because the fiber doesn’t go well with the land. In other words, if you bury it, it will harm our soil.

The whole thing is a con job. It’s very expensive. And in all fairness, Germany tried it and, wind doesn’t work. You need subsidy for wind and energy should not need subsidy. With energy, you make money. You don’t lose money.

But more important than that is it ruins the landscape. It kills the birds. They’re noisy. You know, you have a certain place in the Massachusetts area that over the last 20 years had one or two whales wash ashore and over the last short period of time they had 18, okay, because it’s driving them loco, it’s driving them crazy. Now, windmills will not come, it’s not going to happen in the United States, and it’s a very expensive …

I would love to see, I mean, today I’m playing the best course I think in the world, Turnberry, even though I own it, it’s probably the best course in the world, right? And I look over the horizon and I see nine windmills. It’s like right at the end of the 18. I said, “Isn’t that a shame? What a shame.” You have the same thing all over, all over Europe in particular. You have windmills all over the place.

Some of the countries prohibit it. But, people ought to know that these windmills are very destructive. They’re environmentally unsound. Just the exact opposite. Because the environmentalists, they’re not really environmentalists, they’re political hacks. These are people that, they almost want to harm the country. But you look at these beautiful landscapes all over all, over the the world. Many countries have gotten smart. They will not allow it. They will not. It’s the worst form of energy, the most expensive form of energy. But, windmills should not be allowed. Okay?

All the while von der Leyen had to sit there, absolutely frozen except for a curiously accelerated rate of blinking, as she learned in real time that weakness and submission do not in fact invite conciliation.

In Spiked, Jacob Reynolds agrees that the deal is a humiliation for the European Union:

So this is the famous “trade superpower”. After months of tough talk, European Commission president Ursula von der Leyen announced a trade deal with Donald Trump this week which is nothing short of total capitulation. The Commission has accepted a 15 per cent baseline US tariff on most EU goods, agreed to purchase $750 billion worth of American gas and procure billions more of US military kit. What did Queen Ursula get in return? Nothing.

“VDL”, as she is known in the Brussels Bubble, tried desperately to spin this as a win. Sitting anxiously next to Trump in Scotland last weekend, she recited impressive-sounding numbers – such as the EU and US’s combined 800million consumers and the EU’s $1.7 trillion trade volume – like a nervous student. Trump cut through the spin by greeting the deal as fantastic for US cars and agriculture. He didn’t need to say much else – indeed, it was clear for all to see that there was only one winner in this deal.

For decades, even critics of the EU had to concede that whatever its many economic and democratic shortcomings, it still possessed enormous leverage when it came to trade. At the very least, it was more than capable of defending EU interests in trade deals. Evidently, this is no longer the case. When even the hapless government of Keir Starmer can negotiate a better trade deal with Trump, the problems with the EU should be clear to see. (Tariffs on most UK goods are just 10 per cent.)

Even the most ardent Europhiles have found it hard to put a positive spin on the deal. Manfred Weber, leader of the European People’s Party (a coalition of Europe’s legacy centre-right parties) described it as “damage control” and better than not reaching a deal at all. Guy Verhofstadt, former prime minister of Belgium and usually the most maniacal of EU fanboys, slammed the deal as not only “badly negotiated”, but also “scandalous” and a “disaster”, with “not one concession from the American side”. Member states, from Ireland to France, have been similarly unenthusiastic. Yet the brutal truth is that the deal reflects how America views the EU – as strategically weak and politically empty.

Trump has taught the EU a harsh lesson in statecraft. The EU has long relied on its neighbours for energy production. It has long underinvested in defence. And now it throttles its biggest industries with green dogma. This left it with little leverage for the negotiations with the US.

Of course, after Mark Carney being elected on a highly dubious platform of being “the right person to deal with Trump”, this is almost inevitable at this stage: