Thomas SowellTV

Published 17 Dec 2021

(more…)

August 28, 2023

Why Britain Advanced Before Other European Nations | Thomas Sowell

August 27, 2023

QotD: Getting food to market in pre-modern societies

The most basic kind of transport is often small-scale overland transport, either to and from the nearest city, or in small (compared to what we’ll discuss in a moment) caravans moving up and down a region […]. The Talmud, for instance, seems to suggest that much of the overland grain trade in Palestine under the Romans was performed with itinerant donkey-drivers in small caravans – and I do mean small. Egyptian tax evidence suggests that most caravans were small; Erdkamp notes that 90% of donkey caravans and 75% of camel caravans consisted of three or less animals. These sorts of small caravans don’t usually specialize in any particular good but instead function like land-based cabotage traders, buying whatever seems likely to turn a profit at each stop and stopping in each town and market along the way. Some farmers might even do this during the off season; in Spain, peasants often worked as muleteers during the slow farming season, moving rents and taxes into town or to points of export for their wealthy landlords and neighbors.

Truly long-distance bulk grain transport overland wasn’t viable for reasons we’ve actually already discussed. There is simply nothing available in the pre-modern period to carry the grain overland that doesn’t also eat it. While moving grain short distances (especially to simply fill capacity while the main profit is in other, lower-bulk, higher value goods) can be efficient enough, at long distance, all of the grain ends up eaten by the animals or people moving it.

The seaborne version of this sort of itinerant, short-distance trade is called cabotage. Now today cabotage has a particular, technical legal meaning, but when we use this word in the past, it refers not to the legal status of a ship but a style of shipping using small boats to move mixed cargo up and down the coast. In essence, cabotage works much the same as the small caravans – the merchant buys in each port whatever looks likely to turn a profit and sells whatever [is] in demand. By keeping a mixed cargo of many different sorts of things, he protects against risk – he’s always likely to be able to sell something in his boat for a profit. Such traders generally work on very short distances, often connecting smaller ports which simply cannot accommodate larger, deeper-draft long-distance traders. Such cabotage trading was the background “hum” of commerce on many pre-modern coastlines and might serve to move grain up or down the coast, although not very much of it. Remember that grain is a bulk commodity, and cabotage traders, by definition, are moving small volumes.

But when it comes to moving large volumes, the sea changes everything. The fundamental problem with transporting food on land is that the energy to transport the food must come from food, either processed into muscle power by porters or animals. But at sea, that energy can come from the wind. So while the crew of a ship eats the food, the ship can be scaled up without scaling up the food requirements of the crew or the crew itself. At the same time, sea-transit is much faster than land transit and that speed is obtained from the wind without further inputs of food. It is hard to overstate how tremendous a change in context this is. Using the figures from the Price Edict of Diocletian, we tend to estimate that river transport was five times cheaper than land transport, and sea-transport was twenty times cheaper than land transport. So while the transport of bulk goods like grain on land was limited to fairly small amounts moving over short distances – say from the farm to the nearest town or port – grain could be moved long distances en masse by sea.

Now the scale and character of long-distance transport is heavily impacted by the political realities of the local waterways. If the seas are politically divided, or full of pirates, it is going to be hard to operate big, slow vulnerable grain-freighters and still make a profit after some of them get seized, pirated or sunk. But when we have periods of political unity and relatively safe seas, we see that this sort of transport can reach quite impressive scale. For instance the port regulations of late Hellenistic and Roman Thasos – itself a decent sized, but by no means massive port – divided its harbor into two areas, one for ships carrying 80-130 tons of cargo and one for ships 130+ tons (those regulations are SEG XVII 417). A brief bit of math indicates that the distribution of free grain in the city of Rome – likely less than a third of the total grain demands of the city – required the import, by sea of some 630 tons of grain per day through the sailing season. The scale of grain shipment in the back half of the Middle Ages (post-1000 or so) was also on a vast scale, with trade-oriented Italian cities exploding in population as they imported grain (Genoa being particularly well known for this, but by no means alone in it); with that came the reemergence of truly large grain-freighters.

Bret Devereaux, “Collections: Bread, How Did They Make It? Part IV: Markets, Merchants and the Tax Man”, A Collection of Unmitigated Pedantry, 2020-08-21.

August 11, 2023

The Weirdest Boats on the Great Lakes

Railroad Street

Published 5 May 2023Whalebacks were a type of ship indigenous to the Great Lakes during the late 1890s and mid 1900s. They were invented by Captain Alexander McDougall, and revolutionized the way boats on the Great Lakes handled bulk commodities. Unfortunately, their unique design was one of the many factors which led to their discontinuation.

(more…)

August 8, 2023

Up close with Royal Marines landing craft

Forces News

Published 12 Jul 2022Specialists in small craft operations and amphibious warfare, 47 Commando (Raiding Group) Royal Marines are preparing for overseas training in the Netherlands.

Briohny Williams met up with the marines and found out more about their landing craft.

(more…)

August 2, 2023

How Shipping Containers Took Over the World (then broke it)

Calum

Published 5 Oct 2022The humble shipping container changed our society — it made International shipping cheaper, economies larger and the world much, much smaller. But what did the shipping container replace, how did it take over shipping and where has our dependance on these simple metal boxes led us?

(more…)

July 10, 2023

Echoes of War: Accounts of Operation Husky and the Allied Landings in Sicily

OTD Military History

Published 9 Jul 2023On July 9/10 Allied forces launched Operation Husky, the invasion of Sicily. This video presents accounts from various Allied military personnel who were there that day.

(more…)

June 21, 2023

Scuttling of the German High Seas Fleet at Scapa Flow, Orkney, 21 June 1919 in the Great War

CEFRG (Canadian Expeditionary Force Research Group)

Published 3 Apr 2020The German High Seas Fleet decided to sink as many of its own ships as possible to prevent them from falling into Allied hands. In total, 52 of 74 ships were sabotaged to keep them from Britain, France, Italy and the USA. Most of these nations wanted a share for their navies, and knowing she could not have them all to herself, Britain wanted the ships scrapped to prevent other nations from gaining naval superiority.

On the morning of 21 June 1919, the British fleet left Scapa Flow for exercises, and Rear Admiral Sydney Freemantle, commander of the 1st Battle Squadron guarding the ships, planned to return two days later to board and seize the ships.

Already occupying Germany west of the Rhine, the Allied Powers expected Germany to accept all articles of the Treaty of Versailles by 23 June, and threatened to occupy territory east of the Rhine if all demands were not met. German Rear Admiral Ludwig von Reuter, following orders he had received after the breakdown of negotiations, seized the opportunity with the British fleet having just left the harbour, gave the order to scuttle all ships as his crews opened seacocks, torpedo tubes and portholes to flood them, and once again hoisted the flag of the Imperial German Navy.

The final battle casualties of the Great War occurred on this day, with nine German sailors killed and sixteen wounded by the British during brawls when they refused to help save the ships. For his part, von Reuter was imprisoned along with 1,800 of his men, but was released the following year. Upon his return to Germany, he was praised as the man who had preserved the honour of the German High Seas Fleet (in typical fashion, Freemantle had angrily accused von Reuter of having behaved without honour).

Of the 52 ships scuttled in 1919, seven remain at the bottom of the sea today. They are registered under the Ancient Monuments and Archaeological Areas Act 1979, and provide some of the best shipwreck diving in Europe.

June 14, 2023

The sinking of Norwegian frigate HNoMS Helge Ingstad in 2018

CDR Salamander must follow Norwegian court cases more closely than I do … which is “not at all” in my case. Oddly, I was just thinking about the loss of HNoMS Helge Ingstad last week, and here’s follow-up information from the appeals process:

HNoMS Helge Ingstad, a Fridtjof Nansen-class frigate commissioned in 2009.

Photo detail via Wikimedia Commons.

The court case against the officer of the watch (vaktleder) and its appeals has brought the issue back to the front in Norway.

In yesterday’s Forsvarets Forums article (remember to translate it), retired Norwegian naval officer with multiple command tours, Hans Petter Midttun, outlines a must read wire brushing of the entire “optimal manning” concept.

You will see that his view of what it caused to the Norwegian Navy’s nightmare is a direct parallel of that happened to the US Navy in that horrible month of 2017; too much to do with too little people with too thin training.

Let’s dive in;

The Ministry of Defense (FD), the Defense Staff (FST) and the Norwegian Navy (SST) have, in my opinion, knowingly or unknowingly breached the prerequisites for proper operation of the frigates.

My claim is rooted in 23 years of frigate competence. I have held most of the operational positions in the frigate force. This includes the positions as ship commander at KNM Narvik and KNM Roald Amundsen, as well as a period at the Navy’s competence center and two periods as staff officer for the “shipowner”.

That is the extended way of saying, “I know you because I am you“. He’s raising his voice here because it is personal and he wants to go on the record that there are causes to this mishap much deeper than just the one officer on trial.

In light of the extensive changes that lay before the Armed Forces in 2004, we considered it crucial to describe the assumptions on which the staffing concept was based. It was not a new concept. It just hadn’t been described before. It had been developed as a consequence of continuous efficiency measures in the 90s.

One of our main messages was:

The Lean Manning Concept was not chosen because it was operationally smart. It was chosen because it enabled the Navy to man and sail (at the time) a balanced structure. It was an absolute minimum crew that could only work if all the prerequisites were met.

The last part — here on the Front Porch we describe that as “exquisite“. Everything — and everyone — has to work just right to make the formula work.

It doesn’t work that way outside the briefing room. Never does.

During a five-year period, the crew sailed one year less than what Nato considered necessary to maintain the operational level (for a frigate with a larger crew). But in addition, the crews never reached more than a maximum of 80 percent of their expected combat power. This meant that each year the training activity started at a lower level than the previous year.

You design minimum manning — and you get 80% of the minimum. It might work for awhile in peace — but it unquestionably won’t work in combat. Exactly the stew that contributed to the McCain & Fitzgerald collisions. Senior leaders try to convince everyone that 9-to-11 month deployments are a “new normal” and humans can do 100-hr work weeks for weeks to months on end with no downside. Just sadistic malpractice.

May 24, 2023

The American flagship of Standing NATO Maritime Group 2 (SNMG2)

CDR Salamander has thoughts on the state of the current flagship of Standing NATO Maritime Group 2 (SNMG2), USS James E. Williams … unhappy thoughts:

One of the most high profile alliance units is Standing NATO Maritime Group 2 (SNMG2).

Consisting of a half dozen or so destroyers and frigates from assorted alliance members, it cruises about refining how we work together, conducting exercises, and showing the flag around the Mediterranean and Atlantic as time and livers allow. It is also an opportunity for nations to show their allies their professionalism.

Really, for a Sailor of any nation, it is some of the best duty you can find this side of BALTOPS … but I digress. We’ll return to BALTOPS at the bottom of the post.

Because of its high profile and extended operations with alliance nations, the ships we assign to SNMG2 don’t just represent the USA as any warship that “shows the flag” does, but it imprints on the mind of military and civilian leaders in Europe the quality of the US Navy and by extension, the nation it serves.

Our opponents in the world will also see it as an indication of our general health, morale, and the respect we show our friends.

I had an interesting seat as a junior officer. A little more than a month after reporting to my first sea duty command, I found myself with a front row seat to not just Desert Shield/Storm, but to the last year or so of the Soviet Union. I then watched from the Mediterranean and Atlantic the slow decay of the now Russian naval forces through the 1990s. A common refrain was as we got a close look at them was, “Did you see the condition they’re in?”

Looks matter. With ships, even more than people, the external manifestations of poor condition are a warning of significant problems inside the skin of the ship

The Arleigh Burke-class Flight IIA guided missile destroyer USS James E. Williams (DDG 95) as it was leaving Toulon, France, May 22, 2023. Yes, the ship named after a Boatswain’s Mate First Class looks like that. I am sorry BM1, we tried.

Photo from https://twitter.com/WarshipCam/status/1660740976942501893.

SNMG2 decided to honor the United States Navy by having one of its destroyers be its flagship. That’s right kiddies; that rusting eyesore is the flagship of SNMG2.

The US Navy decided that this was the warship they wanted to represent the US Navy and the nation it serves. This was an act of commission – of intent – as conscious of an act as that which ensured that in the last few years that warship was not manned, trained, equipped, or maintained at a level which would allow for basic maintenance. Even as she got ready to get underway, no one stopped her. No one tried a last minute fix. The whole evolution has an ambiance of, “Who cares. Send her.”

Don’t think the insult isn’t properly understood, if not to Congress and the American people, but to our friends and competitors. Don’t think this isn’t the talk of allied wardrooms.

May 23, 2023

The Diamond Princess – the “worst case virus mill” during the Covid-19 pandemic

Dr. Todd Kenyon looks at the data from the situation onboard the Diamond Princess early in the pandemic:

Diamond Princess is a cruise ship owned and operated by Princess Cruises. She began operation in March 2004 and primarily cruises in Alaska during the summer and Asia in the winter along with Australia cruises. Diamond Princess and Sapphire Princess were both were built in Nagasaki, Japan by Mitsubishi Heavy Industries.

Photo by Bernard Spragg, NZ via Wikimedia Commons.

The Diamond Princess cruise ship departed Japan on January 20, 2020. Five days later a passenger disembarked, later became ill and tested positive for SARS-CoV-2 infection. On board this ship were 3,711 persons, of which 2,666 were passengers (median age of 69) and 1,045 were crew (median age of 36). Nearly half (48%) of the passengers were said to have underlying disease(s). Passengers and crew began testing positive with some becoming ill, but the passengers were not quarantined in their cabins until Feb 5. Until that time they had been engaging in a variety of typical social activities including shows, buffets and dances. Once quarantined (confined to cabins), most passengers shared cabins with 1 to 3 other passengers. Cabins used unfiltered ventilation and the crew continued their duties and mixed with passengers. Evacuation began in mid February and was completed by March 1.

A total of 712 individuals (19%) tested positive via PCR, and as many as 14 passengers were said to have died, though there are differing opinions as to how many of these deaths should be attributed to Covid. Except for one person in their late 60s, all deaths occurred in those over 70. Not one crew member died. Half of the deaths occurred several weeks after leaving the ship, so it is unclear if they actually died from infections caught onboard. Three ill passengers were given an experimental treatment of Remdesivir once hospitalised on shore; apparently all survived.

The Diamond Princess was termed a “virus mill” by one expert while another remarked that cruise ships are perfect environments for the propagation and spread of viruses. The quarantine procedures inflicted much duress on an already frail passenger base and may have done more harm than good. There was panic and confusion both among passengers and crew, and densely packed passengers sharing unfiltered ventilation were only allowed out of cabins every few days for an hour. Meanwhile the crew continued to prepare meals and mix with passengers, but otherwise were kept confined below the waterline in their cramped multi-resident quarters. Some passengers ignored the quarantine entirely. The so-called “Red Dawn” email discussions among government researchers in early 2020 described the DP as a “quarantine nightmare”. The DP was also termed by this group as representative of a large elderly care home (passengers). Based on all these observations, the DP event should provide a nearly worst case scenario for the first wave of Covid. The question is, how did New York City (NYC) fare versus this “worst case”, and what can we learn from the comparison?

We can start by looking at the infection rate on the DP: 25% of those over 60 and 9% of those under 60 were reportedly infected. On the DP, the case fatality rate (CFR) for those over 60 was 2.6%. This assumes that all 14 deaths of passengers were caused by a Covid-19 infection contracted while on the DP. On the other hand, the CFR for those under 60 years of age was 0.0%, since none in this age bracket died.

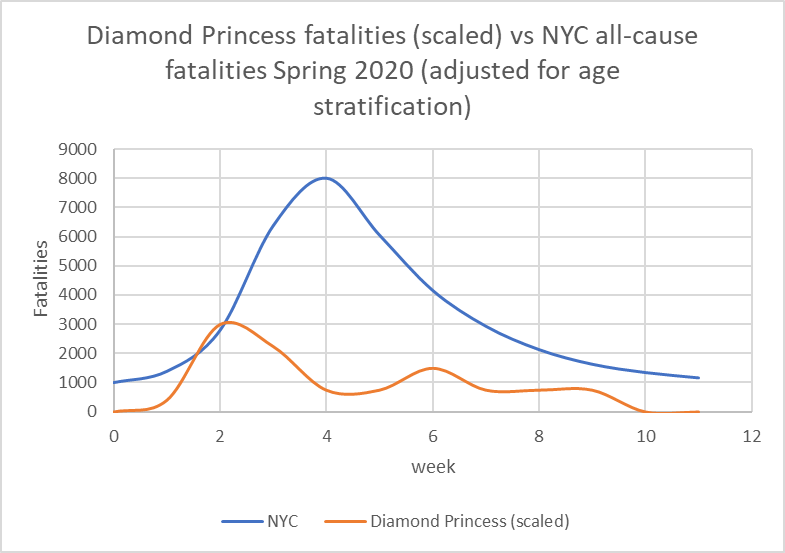

Diamond Princess mortality (scaled) compared to New York City all cause mortality. DP week 1 = first week quarantine imposed while NYC week 1 = first week of lockdown orders (week 12, 2020). DP fatalities are scaled based on relative populations of individuals over 65. It is unclear whether the DP fatalities at the tail end of the curve are attributable to C19 infection contracted months prior on the DP. NYC data: www.mortality.watch

May 8, 2023

Gordon Lightfoot, RIP

Mark Steyn on perhaps the best-known song of the late Gordon Lightfoot:

In November 1975 Lightfoot chanced to be reading Newsweek‘s account of the sinking of a Great Lakes freighter in Canadian waters. He’s a slow and painstaking author, which is one reason he’s given up songwriting – because it takes too much time away from his grandkids. But that day forty-three years ago the story literally struck a chord, and he found himself scribbling away, very quickly:

The legend lives on From the Chippewa on down

Of the big lake they called Gitche Gumee

The lake, it is said Never gives up her dead

When the skies of November turn gloomy …“Gitche gumee” is Ojibwe for “great sea” – ie, Lake Superior – as you’ll know if you’ve read your Longfellow, which I’m not sure anyone does these days. Evidently Hiawatha was on the curriculum back east across Lake Huron in young Gordy’s Orillia schoolhouse. The Gitche Gumee reference may be why, when I first heard “The Wreck of the Edmund Fitzgerald”, I assumed its subject had sunk long before the song was written. In fact, it sank on November 10th 1975 — just a few days before Lightfoot wrote the number. When she’d launched in 1958, the Edmund Fitzgerald was the largest ship on the Great Lakes, and, when she passed through the Soo Locks between Lakes Superior and Huron, her size always drew a crowd and her captain was always happy to entertain them with a running commentary over the loudspeakers about her history and many voyages. For seventeen years she ferried taconite ore from Minnesota to the iron works of Detroit, Toledo and the other Great Lakes ports … until one November evening of severe winds and 35-feet waves […]

That said, human tragedy alone does not make for singable material. The last contact from the SS Edmund Fitzgerald was with another ship, the SS Arthur M Anderson. Yet “The Wreck of the Arthur M Anderson” would have been a far less evocative title. Arthur Marvin Anderson was on the board of US Steel, as Edmund Fitzgerald was on the board of Northwestern Mutual. But there is something pleasingly archaic about the latter name: in fact, as I think of it, I believe the last Edmund I met was one of Gordon Lightfoot’s fellow Canadian singers — the late operetta baritone Edmund Hockridge. Pair “Edmund” to “Fitzgerald”, and you have something redolent of Sir Walter Scott or Robert Louis Stevenson, of shipwrecks off Cornwall or the Hebrides. Perhaps that’s why “The Wreck of the Edmund Fitzgerald” either sounds like an old Scots-Irish folk tune or, alternatively, actually is one. For any IRA members reading this, Bobby Sands, the hunger striker who starved himself to death in a British gaol, wrote in his cell a song called “Back Home in Derry”, about Irish prison deportees en route to Australia and set to a tune remarkably like “The Wreck of the Edmund Fitzgerald”, which it seems unlikely he ever heard.

I see some musicologists claim the tune is in Dorian mode, although it sounds Mixolydian to me (like “The Wexford Carol”). Whichever it is, there is a perfect union between the emphatic melody, the crash of the waves, the antediluvian moniker of Northwestern Mutual’s chairman, and even the obvious filler phrases, so typical of ancient folk songs:

The lake, it is said

Never gives up her dead— which returns far more effectively in the final verse:

Superior, they said

Never gives up her dead— as if Gitchee Gumee is some vast ravening beast. Go back to Orillia, to Fourth Grade in 1947, and the parents listening to Mr and Mrs Lightfoot’s little boy sing “Too-Ra-Loo-Ra-Loo-Ral” as if a bit of synthetic shamrock from an old Tin Pan Alleyman were a genuine Irish lullaby from the mists of Emerald Isle antiquity. That’s the genius of “The Wreck of the Edmund Fitzgerald”: It was born sounding as if it’s a hundred years old. And its agelessness is all the more amazing when you consider that it’s essentially an act of journalism, an adaptation of a news report about something that happened a few days earlier – just the facts, ma’am, with minimal artistic license:

In a musty old hall

In Detroit they prayed

In the maritime sailors’ cathedral …“Maritime sailors” is surely a redundancy, and it’s not a cathedral but the “Mariners’ Church”, which doesn’t quite go the distance syllable-wise. And a parishioner wrote to Lightfoot to say the church isn’t in the least bit “musty”, so these days he finds alternative adjectives.

But that’s all details. The power of the song lies in its storytelling. It immortalized the fate of the freighter not just for the families of the dead, “the wives and the sons and the daughters”, but for everyone, and it made the Edmund Fitzgerald the Titanic of the Great Lakes – except that the Titanic never inspired any song like this. The mournful toll of the lakes in the penultimate stanza is Gordon Lightfoot at his very best:

Lake Huron rolls Superior sings

In the rooms of her ice-water mansion

Old Michigan steams Like a young man’s dreams

The islands and bays are for sportsmen

And farther below Lake Ontario

Takes in what Lake Erie can send her

And the iron boats go As the mariners all know

With the gales of November remembered …The gales of November howl and the waves rise up and devour the ship. And then the gales subside and the placid surface betrays no trace of twenty-nine men, taken deep into the rooms of an ice-water mansion and never to be found.

March 22, 2023

First Class Breakfast on the RMS Titanic

Tasting History with Max Miller

Published 21 Mar 2023

(more…)

March 20, 2023

When 1 Ship Saved 30 others – The Sacrifice of Jervis Bay

Historigraph

Published 25 Nov 2022On the morning of November 5th 1940, the British merchant convoy HX84 was spotted and attacked by a German pocket battleship. Faced with the destruction of 37 merchant ships and a heavy blow against Britain’s survival, it fell to HMS Jervis Bay, the convoy’s only escort, to charge the enemy ship head on and at all costs buy some time for the merchant ships to escape.

(more…)

March 15, 2023

An Aircraft Carrier Without A Deck? | The Remarkable Brodie Landing System

Rex’s Hangar

Published 21 Sept 2022Today we’re taking a look at the remarkable Brodie Launch System. This device could be used on land or aboard ships, and it was designed to provide accessibility for light aircraft in extremely remote locations during WW2.

(more…)

February 19, 2023

Flower-Class Corvettes – WW2 Atlantic Defender

Matsimus

Published 29 Jun 2020The Flower-class corvette (also referred to as the Gladiolus class after the lead ship) was a British class of 294 corvettes used during World War II, specifically with the Allied navies as anti-submarine convoy escorts during the Battle of the Atlantic. Royal Navy ships of this class were named after flowers, hence the name of the class.

The majority served during World War II with the Royal Navy (RN) and Royal Canadian Navy (RCN). Several ships built largely in Canada were transferred from the RN to the United States Navy (USN) under the lend-lease programme, seeing service in both navies. Some corvettes transferred to the USN were manned by the US Coast Guard. The vessels serving with the US Navy were known as Temptress and Action-class patrol gunboats. Other Flower-class corvettes served with the Free French Naval Forces, the Royal Netherlands Navy, the Royal Norwegian Navy, the Royal Indian Navy, the Royal Hellenic Navy, the Royal New Zealand Navy, the Royal Yugoslav Navy, and, immediately post-war, the South African Navy.

After World War II many surplus Flower-class vessels saw worldwide use in other navies, as well as civilian use. HMCS Sackville is the only member of the class to be preserved as a museum ship. Flower Class corvettes were originally intended for coastal escort and mine clearing work. Derived from a whaler design, they were simple, highly seaworthy vessels that could be constructed in secondary yards. The dire lack of ocean escorts early in the war necessitated their being used to screen convoys traversing the North Atlantic between Nova Scotia and the UK. This was a role for which they were ill-designed, and their crews suffered accordingly. The Flowers were wet, highly cramped and impossibly lively. Many sailors could not adjust to the exhausting routine. Compounding the misery was the inexperience of the crews, most of whom had never been to sea. But any escort was better than none at all, so the yards continued to turn out corvettes. 120 were built in Canadian yards, and slightly more in the UK.

(more…)