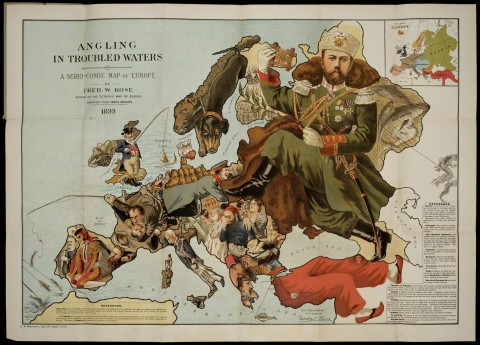

Canada isn’t the only place with rigidly governed agricultural cartels … the European Union has always been a big fan of governing agricultural markets by fiat rather than allowing the markets to sort out how much of which product should be produced. One of the biggest markets actively distorted by EU regulation is the wine industry, where faulty regulations ended up paying for a vast over-supply of wine in the 1980s and 90s. Rather than eliminating the regulatory structures, the EU continues to prefer letting bureaucrats dictate to producers:

When the Common Agricultural Policy was established, it was quickly determined that one of its core objectives would be the protection of farmers, ensuring stable incomes and food security. In the wine sector, this logic translated into strong interventionism aimed at expanding and stabilizing production.

For decades, Brussels subsidized vineyard planting, protected minimum prices, and absorbed producers’ economic risk, disconnecting production decisions from signals of demand. Producing more ceased to be an economic choice and became a politically safe decision.

This approach created a structural market distortion. As wine consumption began to decline across Europe for demographic, cultural, and economic reasons, the artificially incentivized productive structure remained intact and unable to adjust.

It was in this context that, during the 1980s and 1990s, the first major shock occurred, known as the wine lake: massive wine surpluses with no outlet. Even then, Brussels treated this episode as an isolated and temporary phenomenon, ignoring the fact that it was the direct consequence of existing policies. By persisting with the same strategies, the problem ceased to be episodic and became structural.

In the early 2000s, the European Union was finally forced to recognize that the wine crisis was not temporary. However, instead of removing production incentives and restoring the market’s adjustment function, it opted for a new form of intervention: subsidizing the voluntary uprooting of vineyards. The decision to destroy productive capacity ceased to be economic and became administrative, decreed from the European political center, with profound effects across several countries.

This model, presented as temporary, set a dangerous precedent. Rather than allowing less viable producers to exit the market through prices and economic choice, the state began paying for withdrawal, subsidizing the costs of adjustment and normalizing the idea that the correction of public policy errors should be financed with more public money.

This policy did not solve the underlying problem. It merely reduced cultivated area temporarily, while leaving intact the regulatory architecture which had created the initial distortion. The sector became trapped in a cycle of incentivized expansion, predictable crisis, and administrative correction.

It is within this framework that the Wine Package emerges as the European Union’s latest set of measures for the wine sector. The package relies on an administratively planned reduction of supply through financial incentives for vineyard uprooting, complemented by regulatory adjustments, temporary support measures, and crisis management instruments. Instead of allowing the market to adjust to declining consumption, Brussels once again opts for the destruction of productive capacity as a policy tool. Although the package includes support measures and environmental framing, its central axis remains the administrative reduction of supply.

The impact of these decisions is not marginal. The European wine sector represents a significant share of the European Union’s economy, sustaining approximately 2.9 million direct and indirect jobs and contributing more than €130 billion to EU GDP.