On the social media site formerly known as Twitter, @InfantryDort considers the clear evidence that most of the greatest generals of history were, at the very least, eccentric:

Most real post I’ve seen all month.

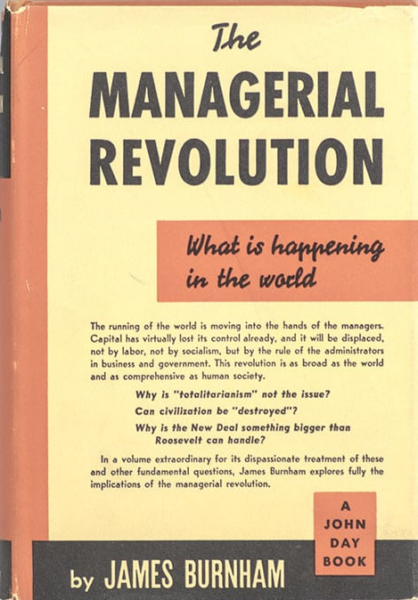

Yes, the process weeds them out.

Until all that remains is some corporatized astroturfed version of … whatever.

Military commanders in the modern era MUST lack personal audacity to some degree. Almost without exception.

Because audacity is “dangerous”. It can be unpredictable. And this is a bad thing in a world obsessed with safety and predictability.

But a military without it, is just one on anti-depressants. You never feel the highest highs or the lowest lows.

You just … exist, in inspirational purgatory.

So you will never see a Napoleon, Patton, Allen, or Sherman ever again.

Their modern equivalents mostly got out as captains because the experience they were promised from history, is now covered in bubble wrap. Wearing a bib and a football helmet.

The modern military is devoid of both victory and defeat. A victory you aren’t allowed to win. A defeat you can explain away. Much of it is due to the American people themselves, and their disdain for violence. At least violence against what sane people classify as enemies.

We have a chance to take it back. A chance to return to glorious and sometimes unhinged leadership. But the rot is thick. And the Empire Strikes Back daily.

My infinite gratitude, and the gratitude of a fawning nation, will rest with those who display the force of will to make it happen.

And crush the corporatization of military leadership once and for all.

The world awaits. And one wonders if our country has the appetite for it all, short of an existential crisis in a war of national survival.

Update, 8 December: Welcome, Instapundit readers! Please do have a look around at some of my other posts you may find of interest. I send out a daily summary of posts here through my Substack – https://substack.com/@nicholasrusson that you can subscribe to if you’d like to be informed of new posts in the future.