Adam Smith Institute

Published 3 Jan 2025In November 2023, Argentina elected Javier Milei, a libertarian economist armed with a chainsaw and a bold plan to rescue the country from decades of decline. Facing 142% inflation, a crumbling peso, and 40% poverty, Milei slashed spending, deregulated markets, and delivered a historic budget surplus — all within a year.

Sam Bidwell dives into Milei’s radical reforms, exploring the challenges that have made them necessary. He traces the country’s rise as a global economic powerhouse in the early 20th century, its decline through years of government intervention and Peronism, and its resurgence under Milei’s leadership.

Discover how this fiery libertarian turned Argentina’s economic fortunes around — and what the world can learn from his audacious blueprint for recovery.

🔗 Subscribe for more insights on global economics, history, and leadership!

🔗 Check out our website for more economics content: https://www.adamsmith.org/TIMESTAMPS

00:00 Start

00:53 Golden Years

02:59 Decline of Argentina

05:20 Peron

08:47 The Legacy of Peronism

11:56 After the Falklands

15:38 Javier Milei

18:17 Challenges

24:31 Lesson for the UK and the wider world

January 4, 2025

December 16, 2024

Winners and losers from free trade

At the Foundation for Economic Education, Patrick Carroll responds to a recent Robert Reich rant about the winners and losers under free trade:

Myth #6 on Robert Reich’s list of economic myths is called “Global Trade Benefits Everyone”.

“Have you heard this lie?” Reich opens. “‘Global trade is good for everyone.'” His pants then light on fire. “Ahh!” he screams. “That’s bunk!”

Watching that opening sequence was an immediate déjà vu moment for me, because I had recently come across an article making the same claim as Reich. The article argued that free market economists are simply wrong to claim that “everyone gains” from free trade, because clearly there are some losers.

The ironic part is, that article was written by none other than Bryan Caplan, one of the world’s leading free market economists.

“What makes me so sure that ‘Everyone gains from X’ is invariably a blatant falsehood? Because every change causes price movements, which are automatically bad for someone or other,” Caplan writes. “The Industrial Revolution was great overall, but hurt traditional craftsmen. The Internet is great overall, but hurt travel agents. Congestion pricing is great overall, but bad for cheapskates with high traffic tolerance. Free trade is great overall, but not for workers and investors in industries that can’t survive at world prices.”

[…]

This would be a rather short article if Reich were simply making the same point as Caplan. “I agree, but Caplan said it better,” would probably be my thesis. But alas, Reich goes in a rather different direction than Caplan does, and that’s where some more rigorous analysis is needed. Here’s how he presents his argument:

Many economists believe in the doctrine of comparative advantage, which posits that trade is good for all nations when each nation specializes in what it does best. But what about costs to workers and the environment? What if a country’s comparative advantage comes from people working under dangerous or exploitative conditions, or from preventing them from forming labor unions, or allowing employers to hire young children? Or from polluting the atmosphere or the ocean, or destroying rainforests and polluting groundwater?

Reich makes a fair point that global trade isn’t all sunshine and roses. Working conditions in some places are atrocious, and environmental damage is also a very real problem. But the fact that working and environmental conditions are far from ideal in many parts of the world does not mean that restricting trade will necessarily make things better. In fact, it’s quite likely that less trade would make things worse, because it would cut off the global poor from opportunities for production and economic growth.

Reich highlights the costs of trade, but there are also immense benefits that the global poor reap from the arrangement. If these benefits outweigh the costs — as they likely do in most cases — then who’s really the advocate of the downtrodden: the ones cheering on mutually beneficial trade, or the ones trying to stop it because they can only see the downsides?

To be fair, Reich doesn’t come out and advocate for cutting off trade. But this raises the question: what exactly is he advocating for? Anyone can point out problems, but the real question is: what solution are you proposing? Maybe he’ll tell us in the next section:

My old boss Bill Clinton called globalization “the economic equivalent of a force of nature, like wind or water”. But globalization is not a force of nature. Global trade is structured by rules negotiated between nations about which assets will be protected and which will not. These rules determine who benefits and who is harmed by trade. Over recent decades, trade deals such as the North American Free Trade Act (NAFTA) and agreements under the World Trade Organization (WTO) have protected the assets of US corporations, including intellectual property.

Reich goes on to list a few ways that these rules have helped large corporations, such as oil companies, financial institutions, Big Pharma, and Big Ag.

Watching this part of the video ushered in a second instance of déjà vu. I remembered reading somewhere, just recently, that NAFTA was rotten to the core, just like Reich was saying.

Yet again, it was a staunch free market economist making this point — Murray Rothbard, in a number of incisive articles that were part of his 1995 anthology Making Economic Sense. The problem, said Rothbard, is that NAFTA was really the opposite of free trade.

November 1, 2024

Canada – 30 protectionist marketing boards wrapped in a flag

In The Line, Greg Quinn points out just how blatantly hypocritical Canada’s politicians and diplomats are in any discussion with other nations when the subject turns to free trade:

Let me say this upfront, and clearly: when it comes to international trade, Canada is protectionist to an astonishing degree whilst at the same time claiming it is a supporter of global free trade. It wants every other country to open up (and complains when they don’t, or when they stand their ground) whilst ensuring access to the Canadian market is more difficult. This is a result of federal policy, inter-provincial restrictions, and vested interests. And it is flagrantly hypocritical.

When it comes to dairy, beef and the mutual recognition of professional qualifications, for example, Canada’s claim to openness is simply a lie. Agricultural groups and businesses dominate and control the local landscape and attempts to either overcome that (or bring external companies in) have failed on many occasions over the years. This could well get worse if the Liberals agree to what the Bloc Québécois has demanded — even more dairy protections — in a desperate attempt to remain in power for a little while longer.

Some of these issues are well known to Canadians — particularly the domestic ones, or the ones that touch on national unity frictions. But I’m not sure Canadians understand how this is perceived globally, including by Canada’s allies. Readers may recall that there was a mild furore a while back when the U.K. dared to pause trade negotiations as Canada refused to move on access for British cheese. There were accusations of the U.K. not playing fair and such like.

It’s bad enough that we “protect” Canadians from lower-priced foreign food, but we even manage to maintain inter-provincial trade barriers that directly harm all Canadian consumers:

Then we have interprovincial trade barriers. According to the Business Council of Alberta in a 2021 report, these barriers are tantamount to a 6.9 per cent tariff on Canadian goods. They also noted that removal of these could boost Canada’s GDP by some 3.8 per cent (or C$80 billion), increase average wages by some C$1,800 per person, and increase government revenues for social programming by some 4.4 per cent.These barriers hinder internal trade between the provinces, including the work of those companies that import goods from other countries.

A freer market, at home or globally, would not solve all the issues that exist with prices, but it would certainly increase competition and give consumers more choice. What exists at the minute is a pretense of choice.

Opening up the Canadian market would certainly benefit other countries, including my own United Kingdom, and there would be some impact on local business and producers. This is true, and acknowledged. But opening itself up to more global trade and dismantling internal trade barriers — and these are things all the politicians insist they like the sound of in theory — would be a win-win for Canadian consumers and Canadian society as a whole. Some big companies and carefully coddled special interests would be upset, but they aren’t supposed to be the ones making decisions in a democracy, or in a free market.

July 25, 2024

David Friedman on the economics of trade

David Friedman discusses how, for example, the US and China manage their trading relationship:

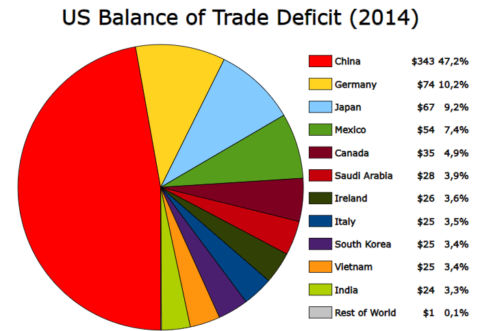

“United States Balance of Trade Deficit-pie chart” by Shirishag75 is marked with CC0 1.0 .

I recently read a thread about US/China trade on a forum occupied mostly by intelligent people. As best I could tell, all participants were taking it for granted that things that make it more expensive to produce in the US, such as regulations or minimum wage laws, make the US “less competitive”, increase the trade deficit, give the Chinese an advantage. Reading Project 2025, the Heritage Foundation’s battle plan for a future conservative president, I observed the same pattern, with only one exception.

It did not seem to have occurred to any of the forum posters that US costs are in dollars, Chinese costs in Yuan, and what determines the exchange rate between them is the cost of producing things. Discussing trade policy in terms of absolute advantage, pre-Ricardian economics, isn’t quite as bad as discussing the space program on the assumption that the Earth is at the center of the universe with sun, moon and planets embedded in a set of nested crystalline spheres surrounding it — Copernicus was about three centuries earlier than Ricardo — but it is close. It is a point that I made here about a year ago, but since the question came up in my most recent post and in a thread on my favorite forum, it is probably worth making again.

The Economics of Trade

It is easiest to start with the simple case of two countries and no capital flows. The only reason Americans want to buy yuan with dollars is to buy Chinese goods, the only reason Chinese want to sell yuan for dollars is to buy American goods. If Americans try to buy more yuan than Chinese want to sell, the price of yuan in dollars goes up, if Chinese want to sell more yuan than Americans want to buy, the price goes down, just as in other markets. The price of yuan in dollars, the exchange rate, ends up at the price at which supply equals demand, which means that Americans are importing the same dollar (and yuan) value of goods that they are exporting.

Suppose the US government, inspired by the mercantilist view that countries get rich by exporting more than they import, tries to produce a “favorable” balance of trade by imposing a tariff on Chinese imports. Chinese goods are now more expensive to Americans. Since they want to buy less from China they don’t need as many yuan so the demand for yuan goes down, the price of yuan in dollars goes down, which reduces the cost of Chinese goods to Americans. Just as before, the exchange rate ends up at a level at which the dollar value of US exports equals the dollar value of US imports. Both imports and exports are now less, since trade is being taxed, but the balance of trade is exactly what it would be without the tariff.

Suppose the US becomes less good at making things due to an increase in government regulation or some other cause. Dollar prices of US goods in the US go up. That makes US goods more expensive to Chinese purchasers so they buy fewer of them, decreasing the demand for dollars on the dollar/yuan market. The exchange rate shifts — dollars are now less valuable so their price falls. Trade still balances. The US is not “less competitive”, merely poorer.

Now add in more countries. One reason Chinese want to buy dollars is to sell them to Germans who want dollars with which to buy American goods. We end up with a trade deficit with China, since some of the dollars they get for their exports are being used to import goods from Germany instead of the US, but a matching trade surplus with Germany, since they are using both the dollars they get by selling things to us and the dollars they get from China to buy goods from us. The same logic applies with more countries.

To explain how it is possible for the US to have a trade deficit we now drop the assumption of no capital movements. One reason Chinese want dollars is to buy goods and ship them to China but another is to buy assets in America — government bonds, shares of stock, real estate. Dollars bought and dollars sold are still equal but exports of goods no longer equal imports of goods. Part of what the US is “exporting”, selling to foreigners, is assets located in the US.

Suppose the US government wants to reduce the trade deficit. One way would be to reduce the budget deficit, since if the US is borrowing less it will not have to pay lenders as high an interest rate, which will make US bonds less attractive to Chinese buyers. Another way would be to block capital movements, make it illegal for foreign buyers to buy US assets. Doing that, however, means less capital investment in the US, hence higher interest rates. With fewer lenders to buy US bonds, the government will have to offer a higher interest rate to sell them.

One argument sometimes offered for restricting foreign investment is that if the Chinese own a lot of US assets that gives them power over us. The same argument was offered in the early 19th century when European investors were paying to build railroads and dig canals in the US. Daniel Webster pointed out that, if there was a conflict with European powers, their assets were sitting on our territory under our control. It wasn’t like they could repossess the Erie canal.

What about imposing a tariff in order to reduce imports? The logic of the previous argument still applies — the exchange rate will shift to make imports more attractive, exports less. Any effect on the deficit will depend on what happens to the attractiveness of US assets to Chinese investors. Figuring out the net effect is complicated, depending in part on what people expect trade policy and exchange rates to be when they collect on their capital investments.

April 11, 2024

All the ways A few of the ways Canada is broken

In The Line, Andrew Potter outlines some of the major political and economic pressures that prompted the formation of the Dominion of Canada in 1867, then gets into all the ways some of the myriad ways that Canada is failing badly:

It is useful to remember all this, if only to appreciate the extent to which Canada has drifted from its founding ambitions. Today, there are significant interprovincial barriers to trade in goods and services, which add an estimated average of seven per cent to the cost of goods. Not only does Canada not have a free internal market in any meaningful sense, but the problem is getting worse, not better. This is in part thanks to the Supreme Court of Canada which continues its habit of giving preposterously narrow interpretations to the clear and unambiguous language in the constitution regarding trade so as to favour the provinces and their protectionist instincts.

On the defence and security front, what is there to say that hasn’t been said a thousand times before. From the state of the military to our commitments to NATO to the defence and protection of our coasts and the Arctic to shouldering our burden in the defence of North America, our response has been to shrug and assume that it doesn’t matter, that there’s no threat, or if there is, that someone else will take care of it for us. We live in a fireproof house, far from the flames, fa la la la la. Monday’s announcement was interesting, but even if fully enacted — a huge if — we will still be a long way from a military that can meet both domestic and international obligations, and still a long way from the two per cent target.

As for politics, only the most delusional observer would pretend that this is even remotely a properly functioning federation. Quebec has for many purposes effectively seceded, and Alberta has been patiently taking notes. Saskatchewan is openly defying the law in refusing to pay the federal carbon tax. Parliament is a dysfunctional and largely pointless clown show. No one is happy, and the federal government is in some quarters bordering on illegitimacy.

All of this is going on while the conditions that motivated Confederation in the first place are reasserting themselves. Global free trade is starting to go in reverse, as states shrink back from the openness that marked the great period of liberalization from the early 1990s to the mid 2010s. The international order is becoming less stable and more dangerous, as the norms and institutions that dominated the post-war order in the second half of the 20th century collapse into obsolescence. And it is no longer clear that we will be able to rely upon the old failsafe, the goodwill and indulgence of the United States. Donald Trump has made it clear he doesn’t have much time for Canada’s pieties on either trade or defence, and he’s going to be gunning for us when he is returned to the presidency later this year.

Ottawa’s response to all of this has been to largely pretend it isn’t happening. Instead, it insists on trying to impose itself on areas of provincial jurisdiction, resulting in a number of ineffective programs — dentistry, pharmacare, daycare, and now, apparently, school lunches — that are anything but national, and which will do little more than annoy the provinces while creating more bureaucracy. Meanwhile, the real problems in areas of clear federal jurisdiction just keep piling up, but the money’s all been spent, so, shrug emoji.

What to do? We could just keep going along like this, and follow the slow-mo train wreck that is Canada to its inevitable end. That is is the most likely scenario.

February 27, 2024

The Company that Broke Canada

BobbyBroccoli

Published Nov 4, 2023For a brief moment, Nortel Networks was on top of the world. Let’s enjoy that moment while we can. Part 1 of 2.

00:00 This is John Roth

02:04 The Elephant and the Mouse

12:47 Pa without Ma

26:27 Made in Amerada

42:15 Right Turns are Hard

57:43 Silicon Valley North

1:07:37 The Toronto Stock Explosion

(more…)

February 20, 2024

QotD: Tariffs and protectionism

The economic case against protectionism is practically invincible. While theoretical curiosities can be described in which an import tariff (or an export subsidy) yields to the people of the home country net economic gains, the conditions that must prevail for these possibilities to have practical merit are absurdly unrealistic.

Yet in their efforts to justify punitive taxes on fellow citizens’ purchases of imports, protectionists regularly trot out these theoretical curiosities. And none is more frequently paraded in public than is the assertion that high tariffs imposed by the home government today will pressure foreign governments to lower their tariffs tomorrow, with the final result being freer trade worldwide.

“Our tariffs are the best means for making trade freer and bringing about what Adam Smith and all free traders have desired: maximum possible expansion of the international division of labor!” protectionists declare with straight faces.

This protectionist apology for tariffs is as believable as is the apology often offered by today’s campus radicals for speech codes and the harassment of certain speakers: “Our insistence on silencing conservatives and libertarians is actually a means of promoting campus diversity and inclusion!”

Both declarations are Orwellian.

Don Boudreaux, “Is Trump’s Ultimate Goal Global Free Trade?”, Catallaxy Files, 2019-06-11.

March 22, 2023

QotD: “[T]he Conservatives were a party whom its enemies need not fear and its friends did not trust”

[Theresa May’s] party is deeply divided on the question of Brexit, and the situation is eerily reminiscent of that which followed Joseph Chamberlain’s sudden conversion from Free Trade to protectionism in 1903. Though the times then were generally prosperous (judged by their own and not by subsequent standards), Chamberlain argued that unfair foreign competition was harming, and even destroying, British agriculture and industry. The solution that he proposed was protectionism within the then extensive British Empire.

The Conservative Party, led (or at least, headed) by the highly intellectual Arthur Balfour, was deeply divided on the question. It appeared not to be able to make up its mind; as one brilliant young Conservative Member of Parliament, Harry Cust put it, “I have nailed my colours to the fence”. Balfour, the Prime Minister, refused to express himself clearly on the subject, for fear of alienating one or other of the factions of his own party, and thereby bringing the government down. Intellectually brilliant as he was, he proved incapable of exercising any leadership.

In the election that followed Chamberlain’s conversion to protectionism, the Conservatives were swept from power. Neither free-traders nor protectionists trusted them, and the opposition Liberal Party, which at least was clear on this question, soon became a government of reforming zeal. For many years, the Conservatives were a party whom its enemies need not fear and its friends did not trust.

Theodore Dalrymple, “On Brexit, Remember that Politics Is Not a Dinner Party”, New English Review, 2018-03-11.

January 21, 2023

When did England become that sneered-at “nation of shopkeepers”?

In the latest Age of Invention newsletter, Anton Howes considers when the English stopped being a “normal” European nation and embraced industry and commerce instead of aristocratic privilege:

England in the late eighteenth century was often complimented or disparaged as a “nation of shopkeepers” — a sign of its thriving industry and commerce, and the influence of those interests on its politics.

But when did England start seeing itself as a primarily commercial nation? When did the interests of its merchants and manufacturers begin to hold sway against the interests of its landed aristocracy? The early nineteenth century certainly saw major battles between these competing camps. When European trade resumed in 1815 after the Napoleonic Wars, an influx of cheap grain threatened the interests of the farmers and the landowners to whom they paid rent. Britain’s parliament responded by severely restricting grain imports, propping up the price of grain in order to keep rents high. These restrictions came to be known as the Corn Laws (grain was then generally referred to as “corn”, nothing to do with maize). The Corn Laws were to become one of the most important dividing lines in British politics for decades, as the opposing interests of the cities — workers and their employers alike, united under the banner of Free Trade — first won greater political representation in the 1830s and then repeal of the Corn Laws in the 1840s.

The Corn Laws are infamous, but I’ve increasingly come to see their introduction as merely the landed gentry’s last gasp — them taking advantage of a brief window, after over two centuries of the declining economic importance of English agriculture, when their political influence was disproportionately large. In fact, I’ve noticed quite a few signs of the rising influence of urban, commercial interests as early as the early seventeenth century. And strangely enough, this week I noticed that in 1621 the English parliament debated a bill that was almost identical to the 1815 Corn Laws — a bill designed to ban the importation of foreign grain below certain prices.

But in this case, it failed. In the 1620s it seems that the interests of the cities — of commerce and manufacturing — had already become powerful enough to stop it.

The bill appeared in the context of a major economic crisis that, for want of a better term, ought to be called the Silver Crisis of 1619-23. Because of the outbreak of the Thirty Years War, the various mints of the states, cities, and princelings of Germany began to outbid one another for silver, debasing their silver currencies in the process. The knock-on effect was to draw the silver coinage — the lifeblood of all trade — out of England, and at a time when the country was already unusually vulnerable to a silver outflow. (For fuller details of the Silver Crisis and why England was so vulnerable to it, I’ve written up how it all worked here.)

The sudden lack of silver currency was a major problem, and all the more confusing because it coincided with a spate of especially bountiful harvests. As one politician put it, “the farmer is not able to pay his rent, not for want of cattle or corn but money”. A good harvest might seem a time for farmers and their landlords to rejoice, but it could also lead to a dramatic drop in the price of grain. Good harvests tended to cause deflation (which the Silver Crisis may have made much worse than usual by disrupting the foreign market for English grain exports). An influential court gossip noted in a letter of November of 1620 that “corn and cattle were never at so low a rate since I can remember … and yet can they get no riddance at that price”. Just a few months later, in February 1621, the already unbelievable prices he quoted had dropped even further.

Despite food being unusually cheap, however, the cities and towns that ought to have benefitted were also struggling. The Silver Crisis, along with the general disruption of trade thanks to the Thirty Years War, had reduced the demand for English cloth exports. And this, in turn, threatened to worsen the general shortage of silver coin — having a trade surplus, from the value of exports exceeding imports, was one of the only known ways to boost the amount of silver coming into the country. England had no major silver mines of its own.

It’s in this context that some MPs proposed a ban on any grain imports below a certain price. They argued that not only were low prices and low rents harming their farming and landowning constituents, but that importing foreign grain was undermining the country’s balance of trade. They argued that it was one of the many causes of silver being drawn abroad and worsening the crisis.

November 9, 2022

The Big Mac’s “peacekeeping magic” is gone

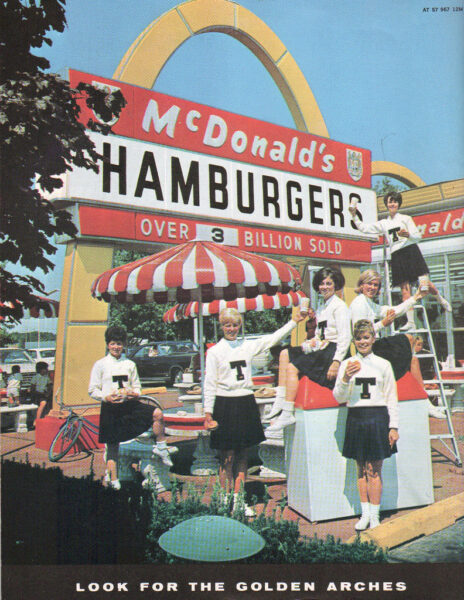

In The Critic, Christopher McCallion illustrates the irrational optimism that countries having McDonald’s restaurants wouldn’t go to war with one another:

“Toledo, McDonald’s, 1967” by DBduo Photography is licensed under CC BY-SA 2.0 .

In 1910, Norman Angell wrote his famous book The Great Illusion, which argued that it would be irrational for the European great powers to go to war with one another when their prosperity was so interconnected by mutual trade and investment. The subsequent outbreak of WWI confirmed for many observers that competition for relative power and security trumped the pacific pursuit of reciprocal gains in wealth.

Following the Cold War, however, the sheer scope and intensity of globalization convinced many that a new era of capitalist peace had arrived. Thomas Friedman famously proposed a “Golden Arches Theory of Conflict Prevention”, which claimed that no two countries with a McDonalds had ever gone to war. There were many propitious augurs for a new era of peace: the lines stretched for blocks when McDonalds first opened in Moscow, and even still-nominally Communist China proclaimed, “to get rich is glorious.”

Simply put, the “capitalist peace theory” says that mutual gains from trade reduce incentives for conflict between economically engaged states, making the prosperity of each dependent on the other and producing high opportunity costs for war.

Realists have long countered this theory by claiming that states prioritize relative gains over absolute gains. State X and State Y may both be made wealthier in absolute terms by trading with one another, but if Y’s wealth grows at a faster pace than X, X may fear that Y’s rapidly growing wealth could be translated into a surplus of military power putting X’s security at risk. Realists contend that states will ultimately prioritize security over all other goals for the simple reason that without security, no other goals can be assured, including the pursuit of prosperity. Realists tend to reverse the logic of interdependence, claiming that low barriers to the cross-border flow of goods and capital are effects, rather than causes, of peace.

It appears that the realists are being proven right. On the eve of the unveiling of the Nordstream-2 pipeline between Russia and Europe, Moscow decided to invade Ukraine, which (literally) blew up the multi-billion-dollar project and all its future returns. Even McDonald’s, the golden harbinger of perpetual peace, shuttered its operations in Russia.

An even more important example is provided in East Asia. The US and China, the two largest economies in the world, are engaged in a rapidly escalating economic, technological, and military rivalry. Not only did the US initiate a trade war against China, it has also launched an increasingly severe series of export restrictions on advanced technology to China, clearly designed to halt China’s economic growth and limit its growing military power. America’s attempts to cut China off at the knees are reminiscent of the measures taken early in the Cold War to contain the Soviet Union and isolate it from the other industrial centers of the world.

September 3, 2022

The impact of the first wave of globalization

In the latest Age of Invention newsletter, Anton Howes considers the world in terms of trade before and after the transportation revolution which changed long-distance trade from primarily luxury goods to commodities for the mass market:

Long-distance trade has of course been common since ancient times. Archaeologists often find Byzantine-made glassware from the sixth century all the way out in India, China, and even Japan. Or beads from seventh-century Southeast Asia all the way out in Libya, Spain, and even Britain. Yet such long-distance trades often involved goods that were entirely unique to particular areas — gems, spices, indigo, coffee, tea — or were sufficiently valuable to make the high costs of transportation worthwhile, such as expert-made glassware, silks, and muslin cloths with impossibly high thread counts. Long-distance trade may have been ancient but was restricted to luxuries. It did not involve the everyday goods of life.

That all changed, however, when the innovations of the sixteenth to the nineteenth centuries caused transportation costs to dramatically fall. With better sailing ships, canals, and navigational techniques, followed by better roads, railways, refrigeration, steam power, and dynamite (which meant railways could cross mountain ranges, canals could link oceans, and new deep-water ports could be dug), it was soon profitable to transport even the cheapest and bulkiest of goods over vast distances — goods like meat, coal, and grain.

The entire world was brought into a single market, in which even the bulkiest commodities of each continent were suddenly in direct competition with one another. The decisions of farmers in Ukraine, for example, in the nineteenth century came to affect the farmers in America, China, India, or even Australia, and all of them vice versa. The prices of commodities all over the world thus converged to similar levels, falling in some places, but rising in the economies that had previously been too distant from the ready markets of the industrialised nations.

The result was what economic historians call a terms-of-trade boom, with the more agrarian economies’ commodity exports becoming more valuable relative to manufactured imports. Thus, their grain, raw fibres, minerals, and ores suddenly bought many more foreign manufactures like textiles. Countries that specialised in commodities thus specialised even further, devoting even more of their workers, resources and capital to extracting them. They were incentivised to extend their frontiers — to put more of the wilderness under pasture or plough, and to dig deeper for the mineral wealth beneath their feet.

Meanwhile, for the industrial economies, the opposite happened. By gaining access to many more and cheaper sources of raw resources and food, they were able to make their own manufactured exports cheaper too. And this, in turn, further exacerbated the terms-of-trade boom among their newly globalised commodity suppliers. As the great Saint-Lucian economist Sir W. Arthur Lewis put it, the world in the late nineteenth century separated into an increasingly industrialised “core”, fed by an increasingly farming- and mining-focused “periphery”.

Much has changed in the century that followed, and some of the old core/periphery distinctions have moved or entirely broken down. But the world has remained globalised. Even in periods of higher tariffs, like between the world wars, no amount of protectionism was able to counteract or undo the effects of the dramatic drop in global transportation costs. With the advent of telegraphs, telephones, fax machines, and now the Internet, even many services are becoming globalised as well — a process likely sped up by the pandemic. Those who can easily work from home will increasingly, like nineteenth-century workers the world over, find themselves either the victims or beneficiaries of global price convergence. (Incidentally, I’m not convinced that the very services-heavy economies of Europe or North America are even remotely prepared for this, to the extent that they can prepare at all for what is the economic equivalent of a planetary-scale force of nature.)

April 12, 2021

QotD: Four lessons on free trade

Here are the main points of the Bank of Canada’s lessons in free trade. It starts off with a bang. “Trade is dominating the news these days. With the barrage of headlines and the talk about protectionism and tariffs, it’s easy to forget that much of our economic growth and prosperity comes from international trade.”

Below are the lessons, taken almost entirely verbatim from the bank’s online lesson (except where I’ve provided a bit of additional description). It’s a terrific lesson and all within a mere 1,400 words and a short video.

Lesson 1: All parties reap the rewards of free trade.

Specialization means focusing on what each country produces most efficiently and trading for the rest. And because specialization is more efficient, it creates more wealth than if each country tried to do it all on its own. International trade is no different from domestic specialization and internal trade — few of us grow our own food or do our own dry cleaning. Instead, we specialize and trade. The lesson includes a short cartoon video featuring “Mark and Lucy” — aimed at kids but worth a presidential view — that explains the concepts of comparative advantage and opportunity costs.

Lesson 2: Trade protectionism makes everyone worse off.

While freer trade — in both exports and imports — makes us better off, the opposite is also true. Barriers to free trade, such as tariffs, have a negative impact on our economic well being.

Lesson 3: The pie isn’t divided equally.

Freer trade has raised incomes across the global economy, but it has not benefited everyone. Countries engaged in free trade are better off overall, but some sectors and communities within countries have suffered. Governments have used policies such as ongoing learning and retraining programs to help affected workers adjust. This a better approach than shrinking the pie through trade protection. That would be worse for everyone.

Lesson 4: Trade deficits and surpluses are not a scorecard.

It’s important to debunk the myth that cheap imports are the cause of all the pain and that a trade deficit with another country is a bad thing. Looking at trade balances between a country and its trade partners, we should expect to see surpluses with some and deficits with others. This is specialization in action.

Terence Corcoran, “Amazing! Canada has one government department that actually comprehends free trade!”, Financial Post, 2018-10-04.

November 24, 2020

QotD: Canada’s economic Stockholm Syndrome

Trade agreements are always about “concessions” in which foreign suppliers are grudgingly given — or, more often, indignantly denied — the right to sell Canadians goods and services at prices lower than what we pay now. Let’s be clear here: lowering the price of consumer goods and services has the exact same effect on household welfare as an increase in incomes. But I defy you to name an elected politician who will list “the ability to buy cheaper stuff” as the most compelling reason to support free trade: more than 200 years since Adam Smith wrote that paragraph, our trade agenda is still written by and for producer interests.

We’re stuck with a system in which producer interests — most notoriously the dairy cartel that operates under the name of “supply management” — hold the rest of us hostage. Dismantling the dairy cartel is an act that would significantly increase consumers’ buying power, but this is a measure that the Conservatives have all but ruled out under any circumstances, and the NDP has made maintaining the cartel a condition for supporting any sort of trade agreement.

Why would the [major parties] stubbornly insist on sticking to a policy that makes consumers worse off at the expense of producers? Because it’s a popular position. It’s one of the marvels of the Canadian electorate. Show Canadians a special interest group that uses its government-granted privileges to fleece consumers, and they’ll embrace it as a “national champion,” a “uniquely Canadian way of life” or some equally vapid catch-phrase.

This is from the Wikipedia entry for Stockholm Syndrome:

Stockholm syndrome, or capture–bonding, is a psychological phenomenon in which hostages express empathy and sympathy and have positive feelings toward their captors, sometimes to the point of defending them.

What we suffer from is the economic policy equivalent. Call it “Canada Syndrome”: a tendency for consumers to identify with the producer interests that are holding them hostage.

Stephen Gordon, “Our Stockholm Syndrome about supply management”, Maclean’s, 2013-03-05.

November 6, 2020

An American Globalist – Cordell Hull – WW2 Biography Special

World War Two

Published 5 Nov 2020Cordell Hull is the face of American diplomacy in 1941 as it navigates the precarious road to war against Imperial Japan.

Join us on Patreon: https://www.patreon.com/TimeGhostHistory

Or join The TimeGhost Army directly at: https://timeghost.tvFollow WW2 day by day on Instagram @ww2_day_by_day – https://www.instagram.com/ww2_day_by_day

Between 2 Wars: https://www.youtube.com/playlist?list…

Source list: http://bit.ly/WW2sourcesHosted by: Indy Neidell

Written by: Francis van Berkel and James Newman

Director: Astrid Deinhard

Producers: Astrid Deinhard and Spartacus Olsson

Executive Producers: Astrid Deinhard, Indy Neidell, Spartacus Olsson, Bodo Rittenauer

Creative Producer: Maria Kyhle

Post-Production Director: Wieke Kapteijns

Research by: James Newman

Edited by: Miki Cackowski

Sound design: Marek Kamiński

Map animations: Eastory (https://www.youtube.com/c/eastory)Colorizations by:

Norman Stewart – https://oldtimesincolor.blogspot.com/

Mikolaj Uchman

Spartacus OlssonSources:

Naval History & Heritage Command

http://maps.bpl.org

FDR Presidential Library & Museum

Picture of MS St. Louis in Hamburg, United States Holocaust Memorial Museum, courtesy of Herbert and Vera Karliner

from the Noun Project: Skull by Muhamad Ulum, Handshake by priyanka, Pickaxe by Luke Anthony Firth, oil barrel by BomSymbolsSoundtracks from the Epidemic Sound:

Howard Harper-Barnes – “London”

Johannes Bornlof – “The Inspector 4”

Farell Wooten – “Blunt Object”

Philip Ayers – “Trapped in a Maze”

Johannes Bornlof – “Deviation In Time”Archive by Screenocean/Reuters https://www.screenocean.com.

A TimeGhost chronological documentary produced by OnLion Entertainment GmbH.

November 5, 2020

QotD: The idiocy of tariffs

The entire point of trade, the very purpose of it, is to gain access to the imports. Those things which Johnny Foreigner makes cheaper or better than we do. To tax ourselves because he makes things cheaper or better than we do is simple idiocy. […] Over and above this stupidity there’s the depressing point that trade and trade protection really is a spiral. Here we’ve got the two largest economies on the planet tripping over themselves to punish their own citizenry for their temerity in buying foreign. And as we can see, it is a tit for tat spiral. A little bit of sabre rattling, a response, a larger amount of shouting, a response, then truly impoverishing levels of rock throwing into own harbours and off we go into making our own people less wealthy.

The true sadness here being that the spiral works the other way too. But hugely, vastly, more slowly. GATT was founded in 1947, it became, the process was transferred to, the WTO and it has taken them since then, that two generations, to reduce tariff levels to where they’re not really all that important in trade matters. Something that is being undone in just a couple of months of foolishness. GATT being something of a response to the economic demolition work done by Smoot Hawley of course.

Trade protection does spiral up and spiral down, the sadness being that here’s an asymmetry to the process. The reductions that make us richer take very much longer than the nonsenses that impoverish.

Tim Worstall, “The China, US, Trade War – It’s All Mutual On The Way Down As Well As Up”, Continental Telegraph, 2018-07-11.