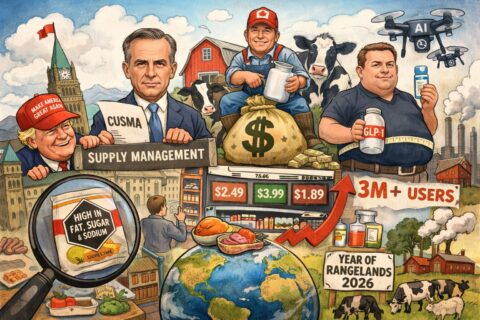

For reasons unknown, Canadian politicians both left and right have been willing to sacrifice almost anything in trade negotiations except the cosy protectionist scheme we call “supply management”, which enriches a tiny number of farmers in Ontario and Quebec by keeping grocery prices significantly higher than the free market price. On his Substack, The Food Professor predicts that Prime Minister Carney will be forced to give up this market-rigging, anti-consumer scheme in the coming year:

As we enter 2026, several forces are converging to reshape Canada’s food economy. Consumer empowerment — amplified by social media — continues to accelerate, while geopolitics, particularly tensions with our southern neighbour, are becoming increasingly disruptive. Together, these dynamics will push food policy issues that once lived in technical silos into the public spotlight.

At the top of that list sits CUSMA and supply management. Prime Minister Carney has signaled firmness on market access, backed by legislation that shields supply management from parliamentary debate. That protection, however, is unlikely to endure. Even if the United States has little genuine interest in exporting more dairy to Canada — and even if Canadian consumers show limited appetite for it — President Trump now understands, far better than during his first term, that supply management is a potent political wedge. The system protects roughly 9,400 dairy farmers who exert disproportionate influence over agricultural policy, while compensation payments continue to flow without any meaningful reduction in production or market share. For a growing number of Canadians, this arrangement increasingly resembles a closed loop rather than a public good. The irony is that global demand for dairy is rising and Canadian milk should be part of that growth story. Instead, the system prioritizes insulation over ambition — a missed opportunity at a time when competitiveness should matter most.

January 1 also marks the formal implementation of new front-of-package nutrition labels. Although these symbols have been appearing on shelves for some time, many consumers either overlook them or misunderstand their purpose. Their real impact has been largely invisible to the public: they have already reshaped how food companies formulate products, invest in research, and redesign portfolios. Whether the labels meaningfully change consumer behaviour remains debatable, but their influence on product development is no longer.

[…]

Finally, 2026 coincides with the United Nations’ International Year of Rangelands and Pastoralists — a timely moment to reset the debate around meat consumption and livestock production. Rangelands underpin global meat systems by converting grasslands — often unsuitable for crops — into high-quality protein. In a world where demand for animal protein continues to grow, portraying livestock as inherently incompatible with sustainability ignores nutritional, economic, and ecological realities. Well-managed grazing supports rural livelihoods, strengthens export economies, and can enhance biodiversity and soil health rather than undermine them. If policymakers are serious about food security, climate resilience, and affordability, 2026 should mark a shift away from apologizing for meat production and toward recognizing livestock as a strategic pillar of resilient food systems — not a sector to be regulated out of existence