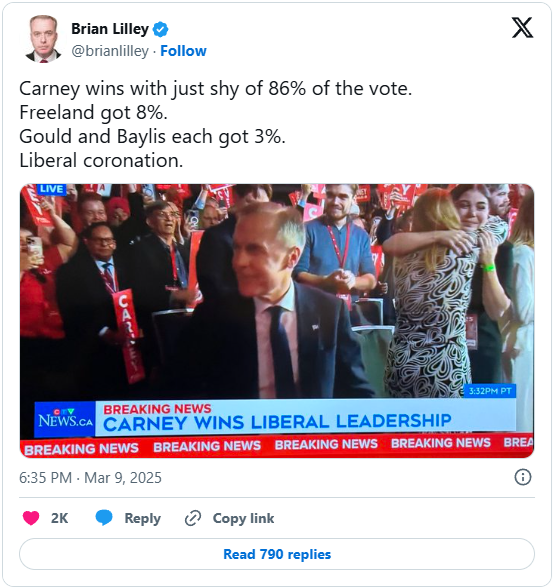

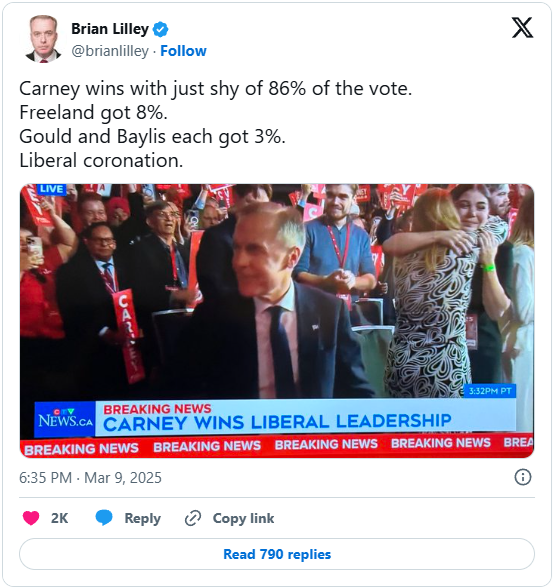

With a resounding 99% 85.9% of the voters whose votes were allowed, Maximum Leader Mark Carney has finally been elected to a position for the first time in his adult life:

With the support of most of Justin Trudeau’s team, Carney has been ushered in to continue on with more of Trudeau’s signature economic policies, the ones Carney has been advising Trudeau on since 2020.

Yes, Carney said that he will scrap the capital gains tax changes that have hurt so many small business owners, but that had to go. He also promised to drop the consumer carbon tax but would also increase the industrial carbon tax, a move that will have the same impact on manufacturing industries like steel as Donald Trump’s tariffs.

Few Canadians will know about the discrepancy in Carney’s plan or any others because there has never been a leader in this country elected to such high office with so little vetting. Carney preferred speeches and rallies over news conferences and interviews with U.S. media outlets over Canadian ones because the interviewer would know little about Canadian politics.

When he wasn’t appearing on The Daily Show or the podcast of Trump’s short-lived spokesman Anthony Scaramucci, Carney preferred to speak to friendly liberal media outlets like CBC. While the media narrative is that Carney has reinvigorated the Liberal party and closed the polling gap with Pierre Poilievre’s Conservatives, neither claim is demonstrably true.

While more than 400,000 people signed up as “registered Liberals” to vote in this nomination process, just over 151,000 actually took the time to vote. This is a chance to pick the next prime minister of our country at a time when we are facing a threat to our sovereignty and a threat to our economic future, yet our next PM was chosen by so few people.

By comparison, the last Conservative leadership race saw more than 400,000 people vote with 295,285 ballots cast for Poilievre alone. Sure, it might have been a longer timeline, but the stakes – becoming leader of the official Opposition with no election in sight – were much smaller.

In the National Post Chris Selley doesn’t seem to be a fan of the new unelected leader of the federal government (assuming that Justin Trudeau will actually step down, of course):

Every speaker of note [at the Liberal leadership hootnanny], from the four leadership candidates to outgoing leader Justin Trudeau to former prime minister Jean Chrétien, who held the room in the palm of his hand for what felt like a day and a half, mentioned the need for Canadians to stand together, united and altogether resolute against the threat of Donald Trump’s tariffs.

At the same time, of course, Liberals were insisting that the Conservatives — who have as much or more support nationwide, and until recently had a lot more — are bent on destroying all that’s good and holy about this country. That isn’t really a unifying message.

“Pierre Poilievre just doesn’t get it,” Carney averred in his victory speech. “He is the type of life-long politician … who worships at the altar of the free market without having made a payroll himself. And now … at a time of immense economic insecurity, he would undermine the Bank of Canada. Poilievre has called for the shutting down of CBC at a time when disinformation and foreign interference are on the march. He insults our mayors and ignores our First Nations.”

“A person who worships at the altar of Donald Trump will kneel before him, not stand up to him,” Carney said of Poilievre, who has been raining invective on Trump just as fast as he can in recent days — and indeed someone whom Trump himself denigrated in recent days as “not a MAGA guy”.

Oh, and Carney said “Pierre Poilievre would let our planet burn” — on the same night he promised to axe the consumer carbon tax as a first order of business.

Other than all that, though, we’re in it together. Okey-dokey.

Dan Knight is even less impressed:

And here’s where it gets even better. The polling — oh, the polling. For months, the Liberals have been sinking. Before Trudeau resigned, they were floundering at 24% support. Then, magically, within days of picking a new leader, they skyrocket to 33%? A 9-point jump in the blink of an eye? Wow, what a coincidence! You mean to tell me that the same Canadians who couldn’t be bothered to sign up for a free membership, the same Canadians who have overwhelmingly turned against this party, suddenly decided they’re on board again — just because the party swapped one out-of-touch elitist for another?

No. That’s not how this works. That’s not how enthusiasm works.

This isn’t some grand Liberal resurgence. This is the Liberal-friendly media manufacturing a comeback narrative because their government subsidies depend on it. The same journalists who screamed for years about the Conservative “far-right” threat are now bending over backwards to convince you that Mark Carney is a fresh outside

And you know what? Maybe if they had actually let Ruby Dhalla into this race, they would’ve stood a chance. Seriously. I had to do a double-take when I looked at her policies — supporting small business, tough on crime, actual immigration regulation — I mean, that’s how you win the center. That’s how you stop a Conservative majority and turn it into a minority government. If they had let her run, we’d be having a very different conversation right now.

But what did the Liberals do? Oh, they disqualified her over — get this — campaign finance irregularities. But guess what? They kept the money. That’s right. The party flagged “violations”, kicked her out, and then conveniently pocketed the cash. If that’s not the most Liberal Party thing I’ve ever heard, I don’t know what is.

Can you feel the Carneymentum? It’s supposed to sweep the land from sea to sea to sea … any minute now.