So many libertarians […] have a simplistic, dare I say dualistic notion about bad-things-done-by-private-business and bad-things-done-by-the-state. One is met with “so start up a rival company” the other with “an outrageous example of state overreach that must be opposed politically.”

And in an ideal world, yes, that makes sense. We do not live in anything resembling an ideal world.

In an era when three (two really) credit card companies and a handful of payment processors have an off-switch for pretty much any on-line business they take a dislike to (unless they are called Apple or Amazon), as more and more of the economy goes virtual, what we have is turn-key tyranny for sale to the highest bidder, and the highest bidder is always going to be a state. I am uncertain what the solution is, but as we do not live in a “free market”, not convinced “so go set up your own global credit card and payment processing network” adds anything meaningful to the discussion. It is a bit like saying when the local electric provider turns off the power in your office (or home) because they disapprove of what you are doing “so go set up your own electric supply company”, as if that would be allowed to happen.

Perry de Havilland, “This is what so many libertarians cannot understand …”, Samizdata, 2021-08-22.

November 25, 2021

QotD: Corporate coercion can be just as dangerous as state coercion

September 23, 2021

QotD: The problem with “free” tech stuff

… I’m baffled by this idea — seemingly everywhere in modern marketing — that they can somehow annoy you into buying their products. Music streaming services like Spotify are all but unlistenable because of it — not only do you get four ads every three songs, but three of the four ads ask “Want a break from the ads? Join premium!!” Or … you know … I could just go back to listening to tunes the old fashioned way. Humanity’s Greatest Genius, when he lays off that shtick for a minute, actually has some good riffs on this. We all must learn to deprogram ourselves from the Cult of Free. If they’re giving away the product, then you are the product. Much like a college degree, “free” tech is actually negative equity — you’re actually worse off for doing it.

It has gotten so bad lately that they don’t just barrage you with ads, they’re now starting to force-feed you content. I used to have Amazon Music — the free one, of course — because it was a good way to listen to The Z Man’s podcasts and my classical library during my commute. I’d download albums to my phone, switch to “offline” mode, and listen that way. Which Amazon obviously considers no good, because they pushed out some “car mode” bullshit that now automatically turns your wifi on, then starts blasting hip hop at you. And that’s not all! A few weeks back, while trying to figure out a way to turn the damn thing off, I noticed that it now has a “your playlist” feature, based on “your” music … which is, of course, the same force-fed rap shit I’ve been trying so desperately to avoid. It has decided that not only shall I listen to Young Jeezy, Big Weezy, and MC Funetik Spelyn, I will also like it, to such a degree that they will start force-feeding me other shit based on my “likes”.

Yeah. Uninstalled. Fuck you, Bezos. I’ve got a CD player. And when Microsoft decides that I’m not listening to the right music on that, and uninstalls the driver, I’ve got a tape deck. And when that breaks, I will sing to myself as I go down the highway. 99 bottles of beer on the wall, motherfucker, just like bus trips back in Boy Scouts. Enough is enough.

Severian, “Mailbag / Grab Bag”, Rotten Chestnuts, 2021-06-18.

July 25, 2021

The Line editors clearly loved crafting their “Dicks in space!” headline

As a fellow space nerd, I welcome the editors of The Line to our number:

You’ve probably noticed by now that your Line editors are space enthusiasts. It’s been an interesting few weeks on that front. Sir Richard Branson flew out of the atmosphere, into free-fall (not zero-G, you scientific illiterates!), on a Virgin Galactic space plane. That said, he didn’t get high enough to cross the Kármán line, which, in the absence of any real international agreement on where the Earth ends and space begins, is as close as we come to a functional definition of the edge of space. (It’s an altitude of 100 km, for those wondering.) Jeff Bezos, of Amazon wealth and fame, did cross that line this week, along with three passengers, including Wally Funk, which was cool, if you’re into that sort of thing. (We are.) Bezos was riding a Blue Origin New Shepard rocket; Blue Origin is a company he founded and funded with his own gigantic wealth.

Look, let’s face facts — your Line editors are into space. We just are. But yeah, we agree that space policy is important enough and complicated enough to warrant debate. Reasonable people can have different views on this stuff. And we also agree that there are important debates to have about the accumulated wealth of billionaires, and the distorting effects that wealth can have on politics and society.

But unlike a bunch of ya’ll, we don’t get confused about a debate over income inequality and a debate over space travel. You can despise Bezos, Amazon and everything he’s done there, and still recognize that what he is doing on the space front is important. Everyone rolling their eyes at Bezos matching space flight capabilities that the Soviets and Americans achieved literally 60 years ago is allowing their desire to rack up some sweet Twitter likes with a snarky dunk blind themselves to the fact that Bezos (and Elon Musk’s SpaceX, which is way ahead of Blue Origin) aren’t just recreating earlier capabilities, they are massively improving on them.

So yeah, Blue Origin can now do what the Soviets and U.S. could do 60 years ago, but they’re doing it more safely, more efficiently and much, much more sustainably than national space agencies did. Reusability isn’t a frill, it’s a massive game-changer. And as much fun as it is to snort when these private-sector companies recreate an existing capability, do you really think they’re going to stop there?

Branson’s company could be written off as a tourism play for the affluent. Fair enough. Except that making space flight economically viable is the first step to ensuring that capability is both sustainable and more broadly accessible in the long run. Further, Bezos and especially Musk are inventing new and transformative space-flight capabilities. They are materially pushing back against the final frontier in ways that we simply have not before. It won’t matter unless we choose to do anything with these new capabilities, and your guess is as good as ours as to whether or not we will. But we could. That’s huge.

As huge as the gigantic dick-shaped rocket Bezos rode up. Yeah, yeah. We snorted, too. But, like, seriously, folks — making penis jokes about the shape of an object dictated by aerodynamic considerations isn’t quite as witty as you think: the rockets are shaped like penises because they literally have to be in order to work. Having a giggle is fine, but if you actually think you’re making a real point about misogyny and fragile male egos when you get snippy (ahem) about a schlong-shaped rocket, well, we’d love to see what happens when your very emotionally vigorous and feminist vagina-shaped space vehicle hits max Q. So long as we aren’t aboard it or in the landing area for its hurtling debris.

Our main point still stands: don’t let your cynicism and even revulsion at these guys blind you to what they’re doing. Bezos isn’t gonna stop at Yuri Gagarin-vintage accomplishments. Musk sure hasn’t. This’ll matter. It’s time to get serious. They are.

March 25, 2020

QotD: The broken feedback mechanism that brought down the chain bookstores

… the push-model of book sales. Long before there was an Amazon, chain bookstores had cozy deals with publishers that sent most indie bookstores (now beloved in effigy by the left) out of business.

And then the left dominated publishing establishment had a brilliant idea. For decades they’d been trying to forecast failure and success, and failings. Books they pushed out the wazzoo (A river in Sundon’tshine) died on the vine when bookstores refused to stock them because the owners had read them. The books they had designated as to be ignored caught someone’s fancy, and suddenly were all over.

This was inefficient. It caused way too much printing that never got distributed, and much last minute rushed reprinting. (Even leaving aside how often people chose to read the WRONG things, something that started to matter more and more in the last two decades.)

So they came up with the push model. It was, from a certain perspective, brilliant.

That perspective is the one where the real world doesn’t really exist, so you don’t need to hear from it.

Because the managers of the big corporate bookstores ALSO didn’t read, they took instruction beautifully. So the publishers could say “you’ll take 100 of x and 2 of y” and they DID.

For a little while it worked beautifully, in the sense that there were no surprise bestsellers, (and publishing houses hated those. I know someone who unexpectedly sold out her print run in a week. The publishing house took the book out of print. No, seriously.) and the books that got seen and talked about were picked by the publisher. (BTW this wasn’t even always or primarily political. Sure, that existed too sometimes, but mostly it was the crazy fads that publishing convinced itself of. For instance, sometime in the mid two thousands they convinced themselves no one wanted historical mysteries — they weren’t selling, true, probably because they were on NO shelves — but everyone wanted “chick-lit mysteries” that had covers with lots of shoes and dresses and whose plots were “Sex in the City with murder.” I remember trying to find something to read, giving up and going to the used bookstore (then a hundred miles away in Denver) for my mystery fix.)

Of course, they sold less. In fact, as time went on and people got out of the habit of going to the bookstore, because there was never anything they could find to read. I mean, I remember being chased from Science Fiction to Mystery to finally History, to at last the sort of “utility” book you find in the discount bins you know “a chart of history” type of thing just to find something to buy on our bookstore night.

Then we gave up.

Eventually the broken feedback mechanism gave us the demise of Borders — and B & N is not feeling so good itself — and a yawning, desperate chasm in customers’ need for books that meant the way was wide open for Indie and Amazon. Even the early badly proofed indie books were like a breath of fresh air because for the first time I could read outside the trends being pushed.

Sarah Hoyt, “Breaking the Gears”, According to Hoyt, 2018-01-03.

February 25, 2019

January 30, 2019

QotD: Political memoirs

We’re told not to judge books by their covers, but faced with these two it’s hard not to. Harman’s is one of those thick, expensive tomes which, understandably, politicians write when they’ve had enough earache and, unbelievably, publishers keep buying for vast sums, despite the fact that a fortnight after publication you can pick them up cheaper than an adult colouring book in a remainder bin. The old saw that ‘all political careers end in failure’ might now better be: ‘All political careers end with a book on Amazon going for less than the price of the postage.’

Julie Burchill, “Harriet Harman and Jess Phillips: poles apart in the sisterhood”, The Spectator, 2017-02-25.

November 21, 2018

Testing The Worst Tools On AMAZON

Wranglerstar

Published on 24 Aug 2017Testing The Worst and Most Ridiculous Tools On AMAZON.

November 15, 2018

Amazon’s HQ$2Bn decision

If you had any doubt that the Amazon HQ2 competition was about anything other than trolling for economic bribes, this should banish the thought:

Amazon is getting some prime real estate.

In exchange for more than $2 billion in economic incentives, the online shopping giant will locate a pair of new corporate headquarters just across the Potomac River from Washington, D.C., and just across the East River from Manhattan. Tuesday’s much-anticipated announcement of the locations for Amazon’s “HQ2” also included details — which had previously been kept from the public — about the economic incentives that successfully lured the Seattle-based firm to the east coast’s political and economic hubs.

Amazon says it will invest $5 billion and create more than 50,000 jobs across the two new locations, with at least 25,000 employees at each of its new corporate campuses, to be located in Virginia’s Crystal City and New York’s Long Island City. Nashville wins a consolation prize: a new supply chain and logistics center that promises 5,000 jobs in exchange for $102 million in economic incentives.

In New York, Amazon will receive $1.2 billion in refundable tax credits through a state-level economic development program and a cash grant of $325 million that’s tied to the construction of new buildings at the Long Island City location over the next 10 years. In Virginia, the state is ponying up $573 million in tax breaks tied to the creation of 25,000 jobs, and the city of Arlington will provide a cash grant of $23 million over 15 years funded by an existing tax on hotel rooms.

Yes, the numbers are staggering — New York state’s pledge of $1.52 billion for 25,000 jobs works out to more than $60,000 in taxpayer support per new job created — but Amazon appears to have selected New York and the D.C. area based on more than just how many zeroes local officials agreed to put on the giant cardboard check.

After all, New Jersey offered Amazon $5 billion (with another $2 billion from Newark), and Maryland offered $8.5 billion. Yet Amazon passed them both over to pick their neighbors.

July 24, 2018

The impact of licensing on previously unlicensed jobs

In the current Libertarian Enterprise, Sean Gabb looks at the recent outrage at Jeff Bezos and Amazon and recounts how at least one job he’d done in the past is now closed off to casual entrants due to the growth of licensing:

Let us imagine a natural order — that is, a world without states, or at least a world without the extended patterns of state-intervention that now exists. In such a world, wage labour would continue to exist. There are benefits in working for someone else. An employee commits to a contract of permanent service, in return for which he receives reasonable certainty of payment. Not everyone is or wants to be an entrepreneur. Not everyone finds it suitable to keep looking for unsatisfied wants and the most rewarding means of satisfying those wants. This being said, there would probably be much less wage labour than there is now.

If the present order of things does little to deter men like Mr Bezos, it does much to deter little people from starting little businesses — little business that sometimes replace, but more often supplement employed income. When I was much younger, the easiest way I found of making extra money was to drive a mini-cab. I went to the nearest cabbing office. I showed my clean driving licence. I showed a certificate of hire and reward insurance. I handed over £25 rent for the week, and was given a two-way radio and a cabbing number. That evening, I was taking prostitutes to their clients and pushing drunks up their garden paths. You cannot do this nowadays. Cabbing is licensed and regulated. It costs thousands to get a licence, and the regulations about age and type of vehicle add tens of thousands more to the costs of entry. You cannot get into cabbing unless you can pay these entry costs, and unless you are able to pay them back by working there full-time and long-term. A casual business has been made into a profession.

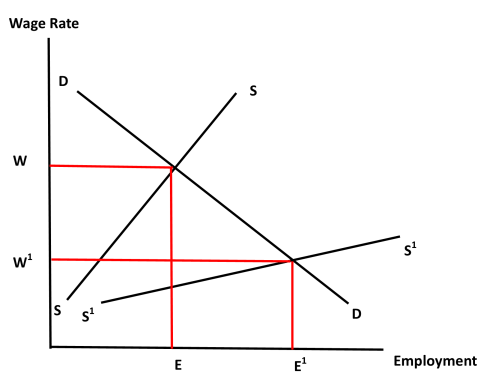

This is an example of which I have personal knowledge. But there is a vast range of little businesses that bring some money to little people. They have nearly all been placed out of reach. The effect is to increase the supply of unskilled labour seeking employment. Think of a supply and demand diagram. Shift the supply curve to the right. Make it more elastic. Money wages will be lower than they would otherwise be. Conditions of work — and these are part of the overall wage — will be worse. Make laws to prevent the market from clearing, and there will be more unemployment.

A further point I mention without choosing to develop is mass-immigration. This is not the kind of movement you would see in a natural order, where virtually the whole cost of entry and adjustment fell on the individual entrant. It is a movement encouraged and subsidised by the State — encouraged by institutional political correctness, and subsidised by laws that amount to forced association. The effect in economic terms is again on the supply curve for labour.

I have no reason to believe that Mr Bezos and Amazon have done anything to bring about this state of affairs. They simply operate in the labour market as they find it. No one is forced to work for Amazon. Amazon is not a legal monopoly, and has no power to force down wages. It pays at least the going rate. It is not a charity, and cannot be expected to behave as a charity. Blaming Amazon for how it pays and treats its workers makes no more sense than blaming a clock for telling the time.

He also touches on the state-created legal situation of limited liability:

I turn to the objection that Amazon is a limited liability company. This is an objection I accept. Limited liability companies exist because of a grant of privilege by the State. They are treated as persons, responsible for their own debts. Their owners have no liability beyond the value of the shares they own. This grant allows companies to gain more investment capital than they otherwise might. It allows them to grow larger and to exist for longer than they otherwise might. It allows even the most entrepreneurial company to turn gradually into a private bureaucracy, trading favours with the various state bureaucracies. Limited liability turns business into the economic arm of a malign ruling class.

So far as Amazon benefits from limited liability, it is an illegitimate enterprise. But this is not the end of the matter. Amazon almost certainly could exist without limited liability. It would instead have raised its investment capital by selling bonds. It would then only be in form what it plainly is in substance — that is, a projection of its owner’s ambition to achieve greatness. It would still have grown large, and it would have grown large by giving its customers what they want.

February 13, 2018

Tulip mania … wasn’t

Tim Harford on bubbles in general and the great seventeenth-century Tulip mania in the Netherlands in particular:

It seems all so much easier with hindsight: looking back, we can all enjoy a laugh at the Extraordinary Popular Delusions and the Madness of Crowds, to borrow the title of Charles Mackay’s famous 1841 book, which chuckles at the South Sea bubble and tulip mania. Yet even with hindsight things are not always clear. For example, I first became aware of the incipient dotcom bubble in the late 1990s, when a senior colleague told me that the upstart online bookseller Amazon.com was valued at more than every bookseller on the planet. A clearer instance of mania could scarcely be imagined.

But Amazon is worth much more today than at the height of the bubble, and comparing it with any number of booksellers now seems quaint. The dotcom bubble was mad and my colleague correctly diagnosed the lunacy, but he should still have bought and held Amazon stock.

Tales of the great tulip mania in 17th-century Holland seem clearer — most notoriously, the Semper Augustus bulb that sold for the price of an Amsterdam mansion. “The population, even to its lowest dregs, embarked in the tulip trade,” sneered Mackay more than 200 years later.

But the tale grows murkier still. The economist Peter Garber, author of “Famous First Bubbles”, points out that a rare tulip bulb could serve as the breeding stock for generations of valuable flowers; as its descendants became numerous, one would expect the price of individual bulbs to fall.

Some of the most spectacular prices seem to have been empty tavern wagers by almost-penniless braggarts, ignored by serious traders but much noticed by moralists. The idea that Holland was economically convulsed is hard to support: the historian Anne Goldgar, author of Tulipmania (US) (UK), has been unable to find anyone who actually went bankrupt as a result.

It is easy to laugh at the follies of the past, especially if they have been exaggerated for the purposes of sermonising or for comic effect. Charles Mackay copied and exaggerated the juiciest reports he could find in order to get his point across.

Update, 15 February: For more detail on the lack-of-bubble in Tulip Mania, you might want to read Anne Goldgar’s post at The Conversation.

Update the second, 30 March: At the Foundation for Economic Education, Douglas French takes issue with Goldgar’s interpretation of Tulip Mania.

Sure, rare bulbs were hard to reproduce and in the greatest demand. However, this does not explain the price history of the common Witte Croonen bulb, which rose in price twenty-six times in January 1637, only to fall to one-twentieth of its peak price a week later.

Peter Garber, tulip mania historian, who, like Goldgar, doesn’t believe tulip mania was a bubble, admitted the “increase and collapse of the relative price of common bulbs is the remarkable feature of this phase of the speculation.” Garber wrote that he “would be hard-pressed to find a market fundamental explanation for these relative price movements.”

Goldgar claims in her latest article that she found no bankruptcies or suicides associated with the bust and that the Dutch economy was not affected by the crash. However, the data I discovered while writing my thesis for Murray Rothbard that is the book Early Speculative Bubbles and Increases in the Supply of Money, was that there was a doubling of bankruptcies in Amsterdam from 1635 to 1637.

Also, Ms. Goldgar must have forgotten the numerous lawsuits she mentioned in her book that were spawned by busted tulip deals. Some of the litigation lasted for years after the bulb price crash in February 1637.

[…]

Ms. Goldgar’s research indicates that only a few hundred people traded tulip bulbs. However, she writes that a few bulbs did sell for 5,000 guilders (the price of a house) and “only 37 people who spent more than 300 guilders on bulbs, around the yearly wage of a master craftsman,” as if this makes her case that this wasn’t a financial bubble.

Readers should note Ms. Goldgar is not interested in prices or market fundamentals. Her research interests are “17th- and 18th-century European social and cultural history; The Netherlands and Francophone culture; Print culture and the culture of collecting; The interaction of society, art, and science.”

In my review of Goldgar’s book in 2007 for History of Economic Ideas, I wrote,

By chronicling the extensive and intertwined network of the real buyers and sellers in the tulip trade, Goldgar puts a human face on tulipmania like no other author has done.”

However, the economics profession will always define tulip mania as Guillermo Calvo does in The New Palgrave: A Dictionary of Economics: “situations in which some prices behave in a way that appears not to be fully explainable by economic ‘fundamentals.'”

Maybe no chimney sweeps were trading in bulbs, but the massive price movements of simple tulip bulbs don’t lie.

November 4, 2017

Desperate Mayors Compete for Amazon HQ2

ReasonTV

Published on 3 Nov 2017Local politicians clash as they try to lure Amazon’s new headquarters to their towns.

——–

Cities across the country want Amazon HQ2 and the 50,000 jobs promised to come with it. Some municipalities are offering big incentives. When New Jersey puts $7 billion in tax credits on the table, how can small-town mayors compete? By really screwing taxpayers.Written and performed by Austin Bragg and Andrew Heaton. Produced and edited by Bragg.

October 1, 2017

The Grand Tour Cast on Amazon vs the BBC, cars, and being recognized in Syria

British GQ

Published on 19 Sep 2017Jeremy Clarkson, James May and Richard Hammond discuss how they feel waking up as cultural icons, where they have (and haven’t) been spotted across the world and what to expect from The Grand Tour season 2. The Grand Tour are GQ’s TV Personalities of the year at the 2017 Men of the Year awards.

August 9, 2017

Lois McMaster Bujold’s latest novella is out in ebook format

Any book by Lois McMaster Bujold is an automatic buy for me, but with her current “Penric” series, I have to wait until it appears in hardcover (the first two were published by Subterranean Press, and I expect they’ll eventually get this one into print as well).

Penric’s Fox: a Penric & Desdemona novella in the World of the Five Gods. Book 3.

Some eight months after the events of Penric and the Shaman, Learned Penric, sorcerer and scholar, travels to Easthome, the capital of the Weald. There he again meets his friends Shaman Inglis and Locator Oswyl. When the body of a sorceress is found in the woods, Oswyl draws him into another investigation; they must all work together to uncover a mystery mixing magic, murder and the strange realities of Temple demons.

Penric and the Shaman was a 2017 Hugo Award nominee in the novella category.

For those of you who are all up-to-date and twenty-first-centurying like there’s no tomorrow, you can get the Kindle version here.

July 6, 2017

Words & Numbers: Let Amazon Play Monopoly

Published on 5 Jul 2017

Amazon’s offer to buy Whole Foods for $13.7 billion sounds pretty great to both parties, but it seems that isn’t good enough. The proposal has a lot of people worried about Amazon becoming an indestructible monopoly, and the government is all too happy to step in and settle the issue. But this concern ignores consumers’ own preferences as well as business and entrepreneurial history. This week in Words and Numbers, Antony Davies and James R. Harrigan discuss the probable future of the Amazon-Whole Foods merger, what it could mean for us, and what it could mean for another once-equally feared corporation: Wal-Mart.

June 17, 2017

“Probably the best example of our carny-barker economy is Tesla”

The Z-Man on the post-modern business models used by Amazon, Facebook, and Tesla:

The key for Amazon making it all these years was to keep people focused on everything but their financials. This is not an exception. Faceberg will never have earnings to justify its share price. In fact, it will never have user rates to justify its ad revenue. It’s not unreasonable to think that everything about the business is fraudulent. That should trigger large scale audits and investigations into its business practices, but Facebook is on the side of angels in the cultural revolution, so its all good.

Probably the best example of our carny-barker economy is Tesla. To his credit, Musk has built a real factory that builds real cars. No one is going to say the Tesla is a work of art or even a practical car, but it is a car and the technology is impressive. The trouble is the company does not exist to make cars. It operates as a tax sink, where government subsidies flow into it and some portion of those subsidies turn into payments to the principles in the form of stock repurchases, debt service and compensation.

This only works if people think the venture will either one day turn a profit or the technology that it creates will result in something good down the road. To that end, Musk is regularly out doing his Lyle Lanley act, making all the beautiful people feel righteous by backing his ventures. He’s also telling Wall Street that he will soon be making and selling enough cars to turn a healthy profit, even without massive tax subsidies. The trouble is, that’s probably never happening, at least not with current management.