Tim Worstall explains not only why your favourite chocolate bar is going to be more expensive, but also why your olive oil will do the same and why it really is the same thing as the Victorian and Edwardian upper class complaints about “the help”:

Upper classes expected maids and other servants to be cheap, eager, and easy to replace. This began to change quickly in the Victorian era, as women found better-paying jobs in commerce and industry that didn’t require bowing and scraping and putting up with constand, casual abuse from oblivious wealthy snobs.

As you might have noticed, cocoa is getting very much more expensive. Futures prices (no, futures are not a good guide to actual market prices but still) have gone from $3,000 a tonne or so (-ish, you understand ) to $12,000 and back to $8,000 or so. According to the usual suspects this is climate change. According to those a little more informed there’s El Nino, there have been a few rusts and plant plagues to deal with. Low prices led to not much planting in recent years — all sorts of little problems that led to that burst of higher prices.

Real prices have changed, the sort of Cadbury’s bar that my wife likes a piece of with her afternoon coffee has gone up by a € a bar in recent weeks (I know, I know, “Send Munnies! Quick!”) and so something must be done.

But there’s a much larger and more significant problem here and one to which there may or may not be a solution. The servant problem.

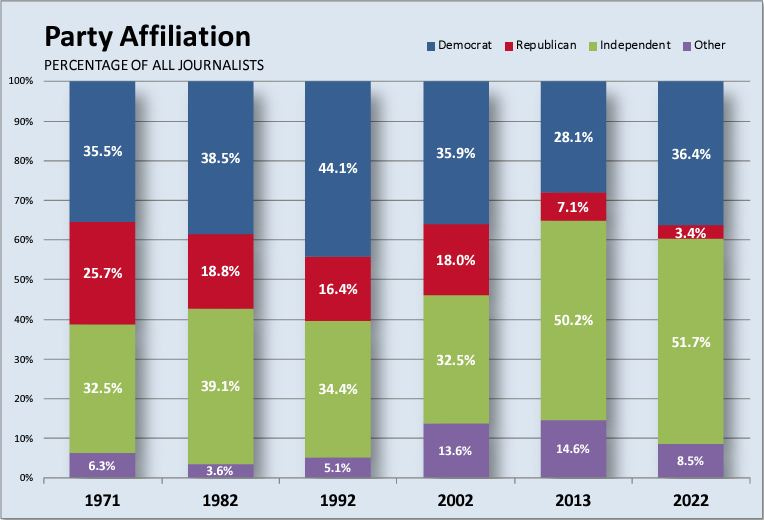

One of those things you learn when living in foreign is that the poorer a country is the easier it is to get a servant and the cheaper a servant is when you get one. This doesn’t wholly make sense to folk until it’s explained. A poor place is one where wages are low — where wages are low is a poor place. They’re the same statement. So, wages for a servant are low in poor countries.

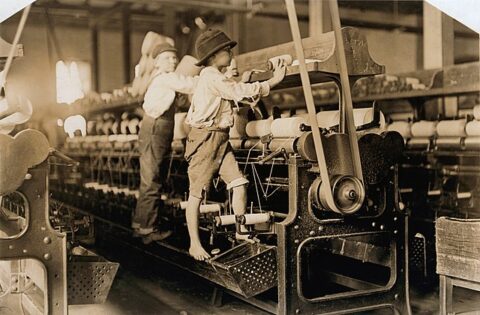

We can up that a little as well. Poor people spend — truly poor people that is — some 80% of their income on food and shelter. So, when you’re in one of those truly poor places you can gain access to a servant — their fulltime, undivided services — for $2 a day plus a bowl of boiled rice and being allowed to sleep in the barn. Because, if they were out there in the cash economy they’d be paid $2 a day (800 million still live at that level out there) and they’d have to buy their own bowl of rice and a tarpaulin to shelter under out of that.

Servants are cheap in poor places because human labour is cheap in poor places because a place with cheap labour is a poor place. QED.

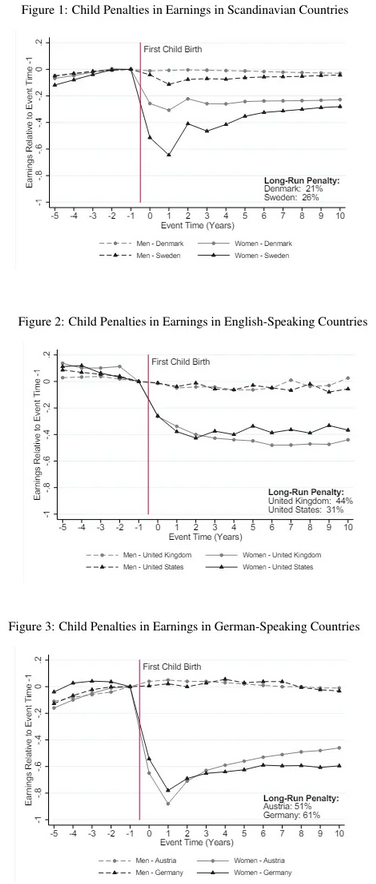

As places become richer human labour costs more. Which is why the letters pages of The Lady started to fill up with complaints about the uppityness and demands of servants from about the 1880s onwards — about the time that British wages at that low and untrained end first started to substantially rise above mere subsistence. This is also one of our major political problems now that middle class women have the vote. They’re using the franchise to insist that government do something about that servant problem. That’s what all that insistence upon child care subsidies and freebies is about. Those middle class women going off to their terribly important power skirt jobs can no longer afford to hire some working class popsie to look after their kids — so government must be forced to do so instead. The correct answer being look after your own damn kids, obviously.

But cheap labour in poor places:

Britain is at risk of olive oil shortages as the industry is wracked by a production crisis.

Fears are growing over the risk of empty shelves as growers across Europe battle a combination of extreme weather, inflation and high interest rates.

Interest rates matter because you plant, wait some number of years, only then do you gain olives. You will then gain them for many decades even centuries, but that wait without income is more painful the higher interest rates get.

There are rusts, plant plagues, afflicting the crop across much of Europe. Of course we’ve those blaming everything on climate change but that’s just the usual bollocks.

However, low wages in poor places. I live in the middle of an oil producing area. Vast waving acres of olive trees in fact. I’ve also lived, until recently, in an historically poorer area of the same country. Where much of the land — little 2 and 4 acre farms (if they were lucky) which might raise a few goats, a sheep (cheese more than anything) and have a couple or four olive trees — has been simply abandoned. The place is getting richer, no one wants to scrape a living on 4 acres of land these days. Rightly so. 4 acres is an adventurous garden, not a living. The absence of those goats is also why the wildfires are getting so much worse — there’s more scrub to burn.

I can take you to places where there are hundreds of acres of such land. Plenty of olive trees in there too, all fruiting and none of them being picked. Because picking olives from the occasional tree is hard bloody work. Spread a net beneath it, hit the tree hard, a lot. Collect up the net with all the olives. Then sort them. By hand. Each single one needs to be checked (for worms and rot) and then nicked. Then you can take them down to the oil mill (every village has at least one) and you hand over the olives and get back the oil, minus a percentage for the mill owner.