These are the Rules of Fantasy Economics:

Rule 1: Everyone has roughly the exact same amount of money and/or property as everyone else of his or her respective experience-point total. Except at character creation, obviously, where some people totally get the shaft, which sucks … but “being poor” and “staying poor” are two very different things.

Only about 99.9% of all people — specifically those who lack the initiative to spend every dollar they own on studded leather and a knife and to abandon their families for the open road on a mad, bloodthirsty whim — ever really STAY poor.

[. . .]

Rule 2: Money cannot make more money. Investing in businesses is a fool’s bargain: stores burn down, castles crumble, merchants and/or bandits will constantly steal your shit, and you will never, ever make a dime. Ever.

It is far wiser to invest in non-depreciable items like swords, hats and magic boots. Likewise, the things that you need to do your job (boats, armor, weapons, rope and horses, for example) do not depreciate at all and may be used forever unless somehow completely destroyed.

Rule 3: All currencies of all countries are worth almost exactly the same amount — and all currencies of all countries are evenly divisible into platinum, gold, silver and copper pieces by factors of exactly ten. No other non-magical objects have any real value, including land.

The exceptions to this rule are gems, which are randomly & subjectively priced (and therefore effectively useless as trade goods) and ‘art objects’, presumably meaning paintings and such, the value of which are objectively determined, fixed and unchangeable, making them a lot like personal checks.

January 21, 2012

Those aren’t rules of economics. These are rules of economics!

January 10, 2012

When “everyone agrees” about excessive executive pay, something else is being sold

Tim Black on the amazing unanimity of thought that the most pressing problem in the world right now is big pay packets for corporate CEOs:

Occupy London, the Labour Party, the Lib-Con coalition, the Archbishop of York… It doesn’t matter to what or to whom you look, you’ll find the same simple-minded sentiment: the root cause of our economic and social problems is greed. The greed, that is, of bankers, of overpaid CEOs, of those at the top of society who simply have and want too much.

[. . .]

If there was ever a striking indication of the deadening political conformism, the dearth of social imagination, that so characterises our contemporary impasse, it is there in the sheer ubiquity of the Greed-is-Bad argument.

So what is driving this pervy, across-the-board obsession with the pay packets of super execs? It’s certainly not impelled by a desire to get to grips with the economic crisis that holds most of the developed world in its grip. No doubt there are some simple-minded souls in a state of Occupation who believe that blaming and bashing company CEOs or bankers is somehow to understand the economic crisis. But just as the remuneration packages of a few bankers and bosses did not bring about the current crisis, so seeking to limit their wages, to impose a maximum national wage, will not solve the crisis. And while £3million or £4milllion for a CEO’s annual salary does seem huge, such figures amount to very little in the grand economic scheme of things. As the Investor’s Chronicle points out: ‘The average FTSE 100 CEO is paid £3.9million year. But this is only one four-thousandth (0.025 per cent) of the average market capitalisation of a FTSE 100 company.’

The current fashion for attacking large pay packages, then, is economic neither in impulse nor intent. Rather it is driven, in the first instance, by a narrow moralism. For its numerous proponents, either in party offices or in spartan tents, it represents an easy posture, a cheap critical pose. One Guardian columnist virtually gave the game away: ‘Like phone hacking or MPs’ fiddled expenses, this is an issue that only needs to be described to seem reprehensible.’ That is, to the right-thinking types on liberal broadsheets, criticising large salaries is just too good an opportunity to miss. Indeed, like attacking tabloids and MPs, it is a mark of one’s membership of the right-thinking to have a pop at the really, really rich.

But there’s a deeper, darker impulse driving this cheap attack on exorbitant pay packages than just preening self-righteousness. And that’s the belief that the large pay packets pursued by the undeservedly wealthy are a symbol of a society-wide pathology. The cheap attack on top earners is also an attack on the material aspirations of the rest of us. We are, in short, just too greedy now to be left to our own unregulated, uncontrolled devices. A report from the High Pay Commission — a grandiosely monikered body established by centre-left think tank Compass, a few trade unionists and business secretary Vince Cable — makes this clear by drawing the highly questionable link between this putative celebration of ‘greed’ — or ‘an elevation of the concept of the rational self-interested man to unprecedented heights’ — and the August riots. ‘It should not perhaps surprise us’, the report states, ‘that the rioters took the trappings of wealth that they could not afford — the TVs and designer trainers. It reflects a sense of entitlement that pervades society from the very top to the bottom.’

January 8, 2012

George F. Will on big government

Even fans of bigger government should recognize the accuracy of this short summary:

Liberals have a rendezvous with regret. Their largest achievement is today’s redistributionist government. But such government is inherently regressive: It tends to distribute power and money to the strong, including itself.

Government becomes big by having big ambitions for supplanting markets as society’s primary allocator of wealth and opportunity. Therefore it becomes a magnet for factions muscular enough, in money or numbers or both, to bend government to their advantage.

The left’s centuries-old mission is to increase social harmony by decreasing antagonisms arising from disparities of wealth — to decrease inequality by increasing government’s redistributive activities. Such government constantly expands under the unending, indeed intensifying, pressures to correct what it disapproves of — the distribution of wealth produced by consensual market activities. But as government presumes to dictate the correct distribution of social rewards, the maelstrom of contemporary politics demonstrates that social strife, not solidarity, is generated by government transfer payments to preferred groups.

[. . .]

The tax code, government’s favorite instrument for distributing wealth to favored factions, has been tweaked about 4,500 times in 10 years. Generally, the beneficiaries of these changes are interests sufficiently strong and sophisticated to practice rent-seeking.

Not only does redistributionist government direct wealth upward; in asserting a right to do so it siphons power into itself. A puzzling aspect of our politically contentious era is how little contention there is about the ethics of coercive redistribution by progressive taxation and other government “corrections” of social outcomes it considers unethical or unaesthetic.

December 13, 2011

The Zero Sum Fallacy

P.J. O’Rourke on the big economic issue that the Occupy folks always get wrong:

The “Occupy This, That and the Other Place” people are right about the sins of the financial system and right about the evil of government supporting and subsidizing this malfeasance. It’s not fair that 1 percent of Americans are rolling in dough while the rest of us are scrimping to pay for our Internet connection so we can go on Groupon.

But the Occupiers are wrong about something much more important. They believe in the Zero Sum Fallacy — the idea that there is a fixed amount of the good things in life. Anything I get, I’m taking from you. If I have too many slices of pizza, you have to eat the Dominos box. The Zero Sum Fallacy is a bad idea — dangerous to economics, politics, and world peace. It means any time we want good things we have to fight with each other to get them. We don’t. We can make more good things. We can make more pizza — or more tofu, windmills and solar panels, if you like.

The Zero Sum Fallacy is just that, a fallacy. Economic history since the Industrial Revolution proves — be the rich however stinking rich — we ordinary people can make more of the good things in life. But we have to make them ourselves, with our knowledge, skills and hard work. Government can’t give us good things. Government doesn’t make things, it just redistributes them. This brings us back to fighting with each other.

December 10, 2011

December 5, 2011

Debunking memes: the Gini co-efficient as a spark for rioting

Theodore Dalrymple shows that the widespread habit of journalists in Britain to attempt to attribute the root cause of August riots to the Gini co-efficient fails the common-sense test:

An August feature story on the riots in Time offered a particularly striking example. The author suggested that to understand the riots, we should start with “something called the Gini co-efficient, a figure used by economists to indicate how equally (or unequally) income is distributed across a population.” In this traditional measure, the article notes, Britain fares worse than almost every other country in the West.

This little passage is interesting for at least two reasons. First is the unthinking assumption that more equality is better; complete equality would presumably be best. Second is that the author apparently did not think carefully about the table of Gini coefficients printed on the very same page and what it implied about his claim. Portugal headed the list as the most unequal of the countries selected, with a 0.36 coefficient. Next followed the U.K. and Italy, both with a 0.34 coefficient. Toward the bottom of the list, one found France, with a 0.29 coefficient, the same as the Netherlands. Now, it is true that journalists are not historians and that, for professional reasons, their time horizons are often limited to the period between the last edition of their publication and the next. Even so, one might have expected a Time reporter to remember that in 2005 — not exactly a historical epoch ago — similar riots swept France, even though its Gini coefficient was already lower than Britain’s. (Having segregated its welfare dependents geographically, though, France saw none of its town or city centers affected by the disorder.)

As it happened, when I read the Time story, I had an old notebook with me. In it, among miscellaneous scribblings, was the following list, referring to the riots in France and made contemporaneously:

Cities affected 300

Detained 2,921

Imprisoned 590

Burned cars 9,071

Injured 126

Dead 1

Police involved 11,200

Average number of cars burned per day before riots 98And all this with a Gini coefficient of only 0.29! How, then, could it have happened? It might also be worth mentioning that the Netherlands, with its relatively virtuous Gini coefficient, is one of the most crime-ridden countries in Western Europe, as is Sweden, with an even lower Gini coefficient.

November 14, 2011

Beating up on the Boomer generation

Walter Russell Mead has a bit of vitriol to spit at the Baby Boomers:

But at the level of public policy and moral leadership, as a generation we have largely failed. The Boomer Progressive Establishment in particular has been a huge disappointment to itself and to the country. The political class slumbered as the entitlement and pension crisis grew to ominous dimensions. Boomer financial leadership was selfish and shortsighted, by and large. Boomer CEOs accelerated the trend toward unlimited greed among corporate elites, and Boomer members of corporate boards sit by and let it happen. Boomer academics created a profoundly dysfunctional system that systemically shovels resources upward from students and adjuncts to overpaid administrators and professors who by and large have not, to say the least, done an outstanding job of transmitting the cultural heritage of the past to future generations. Boomer Hollywood execs created an amoral morass of sludge — and maybe I’m missing something, but nobody spends a lot of time talking about the towering cultural accomplishments of the world historical art geniuses of the Boomer years. Boomer greens enthusiastically bet their movement on the truly idiotic drive for a global carbon treaty; they are now grieving over their failure to make any measurable progress after decades spent and hundreds of millions of dollars thrown away. On the Boomer watch the American family and the American middle class entered major crises; by the time the Boomers have finished with it the health system will be an unaffordable and dysfunctional tangle — perhaps the most complicated, expensive and poorly designed such system in the history of the world.

All of this was done by a generation that never lost its confidence that it was smarter, better educated and more idealistic than its Depression-surviving, World War-winning, segregation-ending, prosperity-building parents. We didn’t need their stinking faith, their stinking morals, or their pathetically conformist codes of moral behavior. We were better than that; after all, we grokked Jefferson Airplane, achieved nirvana on LSD and had a spiritual wealth and sensitivity that our boorish bourgeois forbears could not grasp. They might be doers, builders and achievers — but we Boomers grooved, man, we had sex in the park, we grew our hair long, and we listened to sexy musical lyrics about drugs that those pathetic old losers could not even understand.

What the Boomers as a generation missed (there were, of course and thankfully, many honorable individual exceptions) was the core set of values that every generation must discover to make a successful transition to real adulthood: maturity. Collectively the Boomers continued to follow ideals they associated with youth and individualism: fulfillment and “creativity” rather than endurance and commitment. Boomer spouses dropped families because relationships with spouses or children or mortgage payments no longer “fulfilled” them; Boomer society tolerated the most selfish and immature behavior in its public and cultural leaders out of the classically youthful and immature belief that intolerance and hypocrisy are greater sins than the dereliction of duty. That the greatest and most effective political leader the Baby Boom produced was William Jefferson Clinton tells you all you need to know.

November 13, 2011

Tyler Cowen on traditional values

In his latest New York Times column, Tyler Cowen looks at the relationship of wealth to traditional values of self-discipline and hard work:

The Occupy Wall Street movement has raised important questions about the respect paid to wealth in our society. There is a good deal of unfairness in the American economy, and by deliberately targeting the “top 1 percent,” the demonstrators have opened up a dialogue that is quite useful.

Nonetheless, as someone from a conservative and libertarian background, I find that I am hearing too much talk about riches and not enough about values. It’s worth recalling why so many Americans have respected the wealthy in the first place.

The United States has always had a culture with a high regard for those able to rise from poverty to riches. It has had a strong work ethic and entrepreneurial spirit and has attracted ambitious immigrants, many of whom were drawn here by the possibility of acquiring wealth. Furthermore, the best approach for fighting poverty is often precisely not to make fighting poverty the highest priority. Instead, it’s better to stress achievement and the pursuit of excellence, like a hero from an Ayn Rand novel. These are still at least the ideals of many conservatives and libertarians.

The egalitarian ideals of the left, which were manifest in a wide variety of 20th-century movements, have been wonderful for driving social and civil rights advances, and in these areas liberals have often made much greater contributions than conservatives have. Still, the left-wing vision does not sufficiently appreciate the power — both as reality and useful mythology — of the meritocratic, virtuous production of wealth through business. Rather, academics on the left, like the Columbia University economists Joseph E. Stiglitz and Jeffrey D. Sachs among many others, seem more comfortable focusing on the very real offenses of plutocrats and selfish elites.

November 2, 2011

QotD: The evolution of the public sector

The public-sector workplace has become a kind of artificial Eden, whose fortunate inhabitants enjoy solid pay and 1950s-style job security and retirement benefits, all of it paid for by their less-fortunate private-sector peers. Some on the left have convinced themselves that this “success” can lay the foundation for a broader middle-class revival. But if a bloated public sector were the blueprint for a thriving middle-class society, then the whole world would be beating a path to Greece’s door.

Our entitlement system, meanwhile, is designed to redistribute wealth. But this redistribution doesn’t go from the idle rich to the working poor; it goes from young to old, working-age savings to retiree consumption, middle-class parents to empty-nest seniors. The Congressional Budget Office’s new report on income inequality points out that growing Medicare costs are part of the reason upper-income retirees receive a larger share of federal spending than they did 30 years ago, while working-age households with children receive “a much smaller and declining share of transfers.” Absent reforms, this mismatch will only grow more pronounced: by the 2030s, Medicare recipients will receive $3 in benefits for every dollar they paid in.

Then there’s the public education system, theoretically the nation’s most important socioeconomic equalizer. Yet even though government spending on K-to-12 education has more than doubled since the 1970s, test scores have flatlined and the United States has fallen behind its developed-world rivals. Meanwhile, federal spending on higher education has been undercut by steadily inflating tuitions, in what increasingly looks like an academic answer to the housing bubble. (If the Occupy Wall Street dream of student loan forgiveness were fulfilled, this cycle would probably just continue.)

The story of the last three decades, in other words, is not the story of a benevolent government starved of funds by selfish rich people and fanatical Republicans. It’s a story of a public sector that has consistently done less with more, and a liberalism that has often defended the interests of narrow constituencies — public-employee unions, affluent seniors, the education bureaucracy — rather than the broader middle class.

Ross Douthat, “What Tax Dollars Can’t Buy”, New York Times, 2011-10-30

November 1, 2011

Niall Ferguson on the West’s “killer applications”

Niall Ferguson points to several key institutional innovations that were key to the rise of the West, compared to the rest of the world:

The West first surged ahead of the Rest after about 1500 thanks to a series of institutional innovations that I call the “killer applications”:

1. Competition. Europe was politically fragmented into multiple monarchies and republics, which were in turn internally divided into competing corporate entities, among them the ancestors of modern business corporations.

2. The Scientific Revolution. All the major 17th-century breakthroughs in mathematics, astronomy, physics, chemistry, and biology happened in Western Europe.

3. The Rule of Law and Representative Government. An optimal system of social and political order emerged in the English-speaking world, based on private-property rights and the representation of property owners in elected legislatures.

4. Modern Medicine. Nearly all the major 19th- and 20th-century breakthroughs in health care were made by Western Europeans and North Americans.

5. The Consumer Society. The Industrial Revolution took place where there was both a supply of productivity-enhancing technologies and a demand for more, better, and cheaper goods, beginning with cotton garments.

6. The Work Ethic. Westerners were the first people in the world to combine more extensive and intensive labor with higher savings rates, permitting sustained capital accumulation.

For hundreds of years, these killer apps were essentially monopolized by Europeans and their cousins who settled in North America and Australasia. They are the best explanation for what economic historians call “the great divergence”: the astonishing gap that arose between Western standards of living and those in the rest of the world.

October 19, 2011

Questioning the “income inequality” argument

James Pethokoukis doesn’t find the income inequality talk particularly convincing, and has a few reasons why:

Sorry, the story just doesn’t hold together. According to left-wing think tanks, columnist and bloggers — and, of course, the Occupy Wall Street radicals — the top 1 percent have been exploiting the 99 percent for decades. The rich have been getting richer at the expense of the middle class and poor.

Really? Just think for a second: If inequality had really exploded during the past 30 to 40 years, why did American politics simultaneously move rightward toward a greater embrace of free-market capitalism? Shouldn’t just the opposite have happened as beleaguered workers united and demanded a vastly expanded social safety net and sharply higher taxes on the rich? What happened to presidents Mondale, Dukakis, Gore, and Kerry? Even Barack Obama ran for president as a market friendly, third-way technocrat.

Nope, the story doesn’t hold together because the financial facts don’t support it. And here’s why:

[. . .]

5. Set all the numbers aside for a moment. If you’ve lived through the past four decades, does it really seem like America is no better off today? It doesn’t to Jason Furman, the deputy director of Obama’s National Economic Council. Here is Furman back in 2006: “Remember when even upper-middle class families worried about staying on a long distance call for too long? When flying was an expensive luxury? When only a minority of the population had central air conditioning, dishwashers, and color televisions? When no one had DVD players, iPods, or digital cameras? And when most Americans owned a car that broke down frequently, guzzled fuel, spewed foul smelling pollution, and didn’t have any of the now virtually standard items like air conditioning or tape/CD players?”

No doubt the past few years have been terrible. But the past few decades have been pretty good—for everybody.

October 16, 2011

The argument for value-added taxes

In an article about the Canadian copy-cat protests, Mike Moffatt addresses some of the demands to increase taxes on the wealthy and explains why value-added taxes (like the much-hated Harmonized Sales Tax) are more efficient:

The Occupy Canada protests which began Saturday took place in over a dozen cities with mostly modest turnouts. They also lacked a cohesive goal or message, as their critics in the media are fond of pointing out. The protests did, however, address a number of important societal issues, such as the growing gap between the rich and the poor. As has been acknowledged by both Bank of Canada governor Mark Carney and Finance Minister Jim Flaherty, rising income inequality in Canada is a real and legitimate concern.

Over the last 30 years, the income gap between the top 1 per cent (or more accurately, the top 0.1 per cent) and the rest of us has increased substantially. Furthermore, this inequality is growing faster in Canada than it is in most other countries, including the United States. The Conference Board of Canada has reported that Canada has fallen to 12th out of 17 countries in its peer group when it comes to income inequal-ity. Between 1980 and 2005, before tax earnings increased by 16 per cent for the top 20 per cent, but fell by over 20 per cent for the bottom 20 per cent. The Occupy Canada protests are the product of a rising tide only lifting a few boats.

[. . .]

So how do we reduce inequality? The obvious place to start would be to borrow solutions from countries where after-tax income inequality is relatively low. Three countries that consistently score well on income inequality measures are Denmark, Finland and Sweden. These three Nordic countries share very similar tax structures, featuring moderate-to-low marginal corporate tax rates, moderate-to-high income tax rates and very high value added sales tax rates (VATs, similar to Ontario’s HST). The average VAT in these three countries is 25 per cent, a rate nearly twice that of the average Canadian federal GST plus provincial sales tax or HST. A onepercentage-point increase in the HST alone would raise $5 billion to $6 billion per year for the federal government, so increases by a few percentage points could adequately fund programs designed to reduce inequality. No country on Earth has been able to find a way to fund the kind of social programs and redistribution needed for “reasonable” levels of inequality without VAT rates significantly higher than Ontario’s HST.

Why are high sales taxes needed to fund social programs rather than higher corporate taxes or higher income taxes? Put simply, VATs are the hardest taxes to avoid paying. Higher income taxes reduce labour effort by the taxed. Higher corporate tax rates reduce investment. Canada’s corporate income tax rate was, not so long ago, twice what it is today. Adjusted for the inflation and the size of the economy, however, the higher corporate tax rates brought in similar levels of revenue then as they do now. There are some ways to avoid the HST, of course, but these are far more limited than they are for other taxes. The HST, as with all VATs, is a cash cow that provides governments with the necessary resources to tackle important societal issues.

September 25, 2011

Mecca is becoming a “playground for the rich”

Jerome Taylor looks at the vast changes being wrought in Mecca and Medina:

Over the past 10 years the holiest site in Islam has undergone a huge transformation, one that has divided opinion among Muslims all over the world.

Once a dusty desert town struggling to cope with the ever-increasing number of pilgrims arriving for the annual Hajj, the city now soars above its surroundings with a glittering array of skyscrapers, shopping malls and luxury hotels.

To the al-Saud monarchy, Mecca is their vision of the future — a steel and concrete metropolis built on the proceeds of enormous oil wealth that showcases their national pride.

Yet growing numbers of citizens, particularly those living in the two holy cities of Mecca and Medina, have looked on aghast as the nation’s archaeological heritage is trampled under a construction mania backed by hardline clerics who preach against the preservation of their own heritage. Mecca, once a place where the Prophet Mohamed insisted all Muslims would be equal, has become a playground for the rich, critics say, where naked capitalism has usurped spirituality as the city’s raison d’être.

Few are willing to discuss their fears openly because of the risks associated with criticising official policy in the authoritarian kingdom. And, with the exceptions of Turkey and Iran, fellow Muslim nations have largely held their tongues for fear of of a diplomatic fallout and restrictions on their citizens’ pilgrimage visas. Western archaeologists are silent out of fear that the few sites they are allowed access to will be closed to them.

But a number of prominent Saudi archaeologists and historians are speaking up in the belief that the opportunity to save Saudi Arabia’s remaining historical sites is closing fast.

September 21, 2011

“Our existing income tax structure is nothing short of crazy”

That’s Kevin Milligan in the Globe and Mail talking about the Canadian tax structure:

Here are five nuggets of information Canadians should keep in mind as the high income taxation discussion unfolds. [. . .]

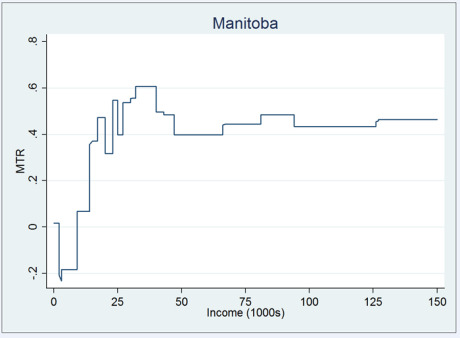

Second, our existing income tax structure is nothing short of crazy. The graph shows the marginal tax rate (the tax owed on the last dollar earned) across different income levels for a two-child family in Manitoba in 2010, the clawback of both federal and provincial refundable tax credits. (Similar graphs for more provinces are here.) What redistributive goal is such a bizarre tax structure designed to achieve? A strong argument can be made that we should improve and reform our existing income tax structure before slapping more confusion on top of it.

Third, the threshold at which one reaches the highest tax bracket is exceedingly low in Canada compared to other countries. In the United Kingdom, one reaches the highest tax bracket of 50 per cent at the Canadian dollar equivalent of $234,000. In the United States, currently the highest federal rate of 35 per cent is reached at incomes of $379,150 (U.S.). In Canada, the highest federal rate is 29 per cent, reached only at $128,800. Just to reach the level of income tax progressivity observed in the United States under President George W. Bush, Canada would need to increase this high income threshold dramatically.

August 25, 2011

Look at what they actually do, not what they say

Tim Worstall peers behind the curtain of those noble, generous French fat-cats who wrote the letter to the French government, insisting that they be taxed more. It’s not a pretty picture:

All very jolly and public-spirited you might think, but applying a little bit of economic theory reveals that they’re somewhere along the “speaking with forked tongues” to “lying toads” continuum.

That bit of economics is the concept of “revealed preferences”: translated out of the jargon it just means don’t look at what people say, look at what they do. For example, Liliane Bettencourt, the L’Oreal heiress, is one signatory calling for higher taxes on herself: it’s also been widely reported that she has received tax refunds under French “fiscal shield” provisions intended to limit taxes on the wealthy to 50 per cent. Madame, if you really want to pay higher taxes, just don’t cash those cheques.

We see the same sort of call everywhere of course. All sorts of people call for higher taxes: it’s just that very few actually pay higher amounts of money. We can see this in both the UK and US.

The US has an account, “Gifts to the United States”, specifically for charitable-minded citizens. Send them a cheque, they’ll cash it and spend the money on government. Last time I checked, the figures they received were $2,671,628.40. Roughly speaking, 1 cent per head of population. OK, so, yes, taxes were too low in the US that year. By exactly that amount.

The UK numbers aren’t even that good. In the same year only five Brits sent in cheques to the Treasury and four of those people were deceased. No, the fifth was not Polly Toynbee, despite the impression one might get from her columns (well, I don’t know it wasn’t her but I’m sure she would have urged the rest of us to do the same if it were).

An FOI request revealed that from 2002 to 2009 actual living people contributed £7,349.90 to the Treasury, over and above their legally due taxation. No, not each or per year… but in total.

There’s literally nothing stopping people from paying more taxes than they actually owe: every jurisdiction appears to allow people to give more money voluntarily. The US government even allows it to be done electronically. So, if you feel you’re not paying “your rightful share”, go right ahead and give it to the government. If you don’t, you’re demonstrating that you really don’t feel under-taxed after all.