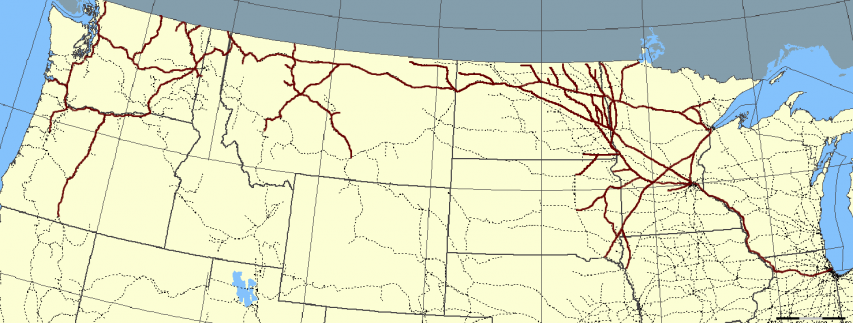

Even during the republican period, state intervention in the economy — usually to “fix” another problem already caused or exacerbated by previous interventions — often made the situation worse. Fortunately there’s a lot of ruin in a nation, but over a long enough run, you do reach the economic end-game:

“The Course of Empire – The Consummation of Empire” by Thomas Cole, one of a series of five paintings created between 1833 and 1836.

Wikimedia Commons.

Debt forgiveness in ancient Rome was a contentious issue that was enacted multiple times. One of the earliest Roman populist reformers, the tribune Licinius Stolo, passed a bill that was essentially a moratorium on debt around 367 BC, a time of economic uncertainty. The legislation enabled debtors to subtract the interest paid from the principal owed if the remainder was paid off within a three-year window. By 352 BC, the financial situation in Rome was still bleak, and the state treasury paid many defaulted private debts owed to the unfortunate lenders. It was assumed that the debtors would eventually repay the state, but if you think they did, then you probably think Greece is a good credit risk today.

In 357 BC, the maximum permissible interest rate on loans was roughly 8 percent. Ten years later, this was considered insufficient, so Roman administrators lowered the cap to 4 percent. By 342, the successive reductions apparently failed to mollify the debtors or satisfactorily ease economic tensions, so interest on loans was abolished altogether. To no one’s surprise, creditors began to refuse to loan money. The law banning interest became completely ignored in time.

The original “dole” was implemented as part of the reforms of the Gracchi brothers, and quickly became a major part of government spending:

Gaius, incidentally, also passed Rome’s first subsidized food program, which provided discounted grain to many citizens. Initially, Romans dedicated to the ideal of self-reliance were shocked at the concept of mandated welfare, but before long, tens of thousands were receiving subsidized food, and not just the needy. Any Roman citizen who stood in the grain lines was entitled to assistance. One rich consul named Piso, who opposed the grain dole, was spotted waiting for the discounted food. He stated that if his wealth was going to be redistributed, then he intended on getting his share of grain.

By the third century AD, the food program had been amended multiple times. Discounted grain was replaced with entirely free grain, and at its peak, a third of Rome took advantage of the program. It became a hereditary privilege, passed down from parent to child. Other foodstuffs, including olive oil, pork, and salt, were regularly incorporated into the dole. The program ballooned until it was the second-largest expenditure in the imperial budget, behind the military. It failed to serve as a temporary safety net; like many government programs, it became perpetual assistance for a permanent constituency who felt entitled to its benefits.

In the imperial government, economic interventions were part and parcel of the role of the emperor:

In 33 AD, half a century after the collapse of the republic, Emperor Tiberius faced a panic in the banking industry. He responded by providing a massive bailout of interest-free loans to bankers in an attempt to stabilize the market. Over 80 years later, Emperor Hadrian unilaterally forgave 225 million denarii in back taxes for many Romans, fostering resentment among others who had painstakingly paid their tax burdens in full.

Emperor Trajan conquered Dacia (modern Romania) early in the second century AD, flooding state coffers with booty. With this treasure trove, he funded a social program, the alimenta, which competed with private banking institutions by providing low-interest loans to landowners while the interest benefited underprivileged children. Trajan’s successors continued this program until the devaluation of the denarius, the Roman currency, rendered the alimenta defunct.

By 301 AD, while Emperor Diocletian was restructuring the government, the military, and the economy, he issued the famous Edict of Maximum Prices. Rome had become a totalitarian state that blamed many of its economic woes on supposed greedy profiteers. The edict defined the maximum prices and wages for goods and services. Failure to obey was punishable by death. Again, to no one’s surprise, many vendors refused to sell their goods at the set prices, and within a few years, Romans were ignoring the edict.

Actually that last sentence rather understates the situation. The Wikipedia entry describes the outcome of the Edict:

The Edict was counterproductive and deepened the existing crisis, jeopardizing the Roman economy even further. Diocletian’s mass minting of coins of low metallic value continued to increase inflation, and the maximum prices in the Edict were apparently too low.

Merchants either stopped producing goods, sold their goods illegally, or used barter. The Edict tended to disrupt trade and commerce, especially among merchants. It is safe to assume that a black market economy evolved out of the edict at least between merchants.

Sometimes entire towns could no longer afford to produce trade goods. Because the Edict also set limits on wages, those who had fixed salaries (especially soldiers) found that their money was increasingly worthless as the artificial prices did not reflect actual costs.