From the Ontario election wrap-up post from the editors of The Line:

Newly re-elected Ontario Premier Doug Ford, seen here at the 2014 Good Friday procession in East York, Canada.

Photo via Wikimedia.

Doug Ford and the Ontario Progressive Conservatives obviously feel pretty good this Friday. They really did about as well as they could possibly have hoped to do. Still, we urge our readers and all the analysts and pundits out there not to overreact to Ford’s victory. He’s not a political genius, he’s not some sort of colossus standing astride our politics, and he is not the man who must be immediately beamed into the federal Conservative leadership so that he can slay Trudeau’s government and win 200 seats.

Doug? He’s just a guy who got lucky last night. (Politically, we mean. Get your minds out of the gutter.)

We’re not taking anything away from Ford, or his campaign leadership, or all the people who worked hard for the PCs over the last month. They did a lot of smart things, they did them well, and they are reaping the benefits. It was an effective campaign. It rubbed a lot of people the wrong way, but your Line editors suspect it rubbed people the wrong way precisely because it was an effective campaign. Keeping Ford out of sight, avoiding a lot of questions, keeping things low-key … these weren’t accidents. These were deliberate decisions. You have to start any analysis of the PC campaign by granting that. Yeah, it was well conceived and well executed. A hat tip to the people behind it.

But the point that we want to make, and it shouldn’t take away from anything said above, is that the Progressive Conservatives maxed out the luck-o-meter. If this election had been a year ago, coming off the government’s catastrophic handling of Ontario’s third wave, it probably would have been Doug Ford resigning last night. The government caught an enormous break because factors well beyond its control shifted the public’s focus off its greatest vulnerability, the management of the pandemic, and put it solidly on economic and cost-of-living issues that the PCs are much, much more comfortable talking about.

So yeah, the PCs had a good campaign, but you couldn’t buy that kind of luck. None of it happened in Ontario or even Canada. This was a global trend. After two years of pandemic, people are tired and they’re getting worried about other things. The timing for Ford could not have been better. So we absolutely give full credit to his campaign for a good job, but we also insist on acknowledging the huge role of luck and timing. We don’t know if it’s better to be lucky than good. But we certainly know it’s nice to be both at once.

We raise this as a note of caution before the punditry gets too carried away. This election is undoubtedly a huge victory for the Tories. But it is also a really, really weird election. The circumstances of it are very unique. The combination of low turnout, pandemic fatigue, Ford’s personal political brand in Ontario, bizarrely lacklustre campaigns by the opposition, and a confluence of global trends that all netted out in Ford’s favour don’t tell us anything about the state of the conservative coalition in Canada, who would make a good federal leader, or what’s going to happen at the next federal election. This was a weird campaign during a weird moment in history. Adjust your hot-takes accordingly, friends.

Campaigning from your basement worked very well for Joe Biden, and now it’s done the job for Doug Ford. It probably wouldn’t work for Justin Trudeau — if he’s not performing for the camera, it’s not clear whether he actually exists. Ford certainly benefitted from the small attention his opponents on the right — the New Blue and Ontario parties — although minor parties have pretty much always been a non-factor in Ontario politics. They were summoned into existance by the way Ford and the Progressive Conservatives governed during the pandemic … almost indistinguishable from the federal Liberals under Justin Trudeau. The PCs seemed to rely on their “progressive” urges at the expense of anything remotely “conservative”.

Moving on to the other two major parties … it’s not pretty:

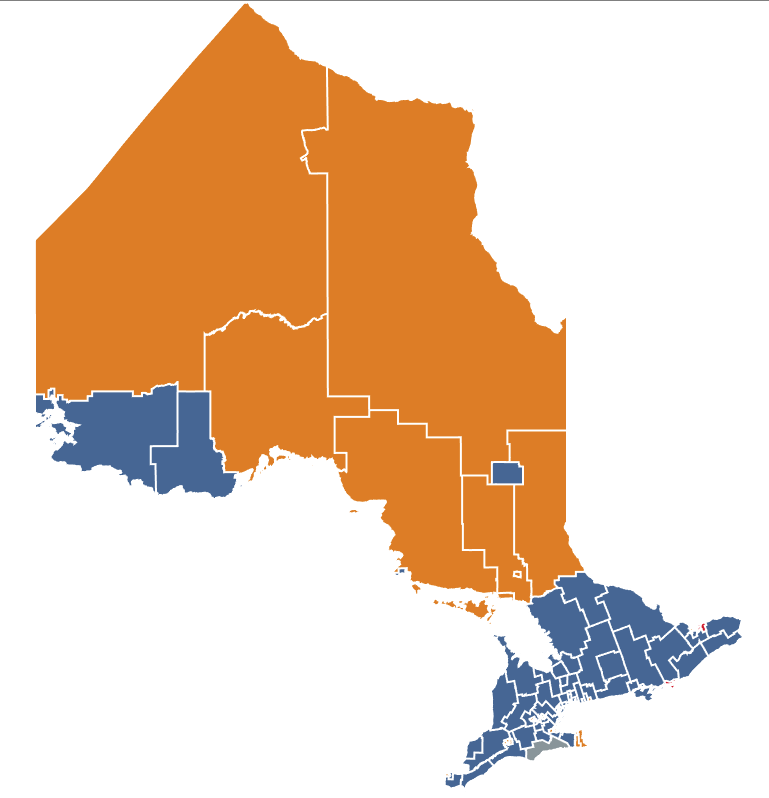

Preliminary riding-by-riding results from the 2022 Ontario election.

Blue – Progressive Conservative, Orange – New Democratic Party, Red – Liberal Party, Green – Green Party

Okay, let’s do the NDP first. The NDP is probably feeling pretty good today. We get it. Even a week or two ago polls were suggesting they were about to lose their hold on official opposition to the Liberals. That would’ve been a disaster for the party. There’s no way around that. They’ve avoided that fate. The NDP has remained in second, although they lost a bunch of seats to the PCs (see above). In the days to come, the party is going to have to take a few cold showers, give their heads a vigorous shake, and realize that warm feeling they’re enjoying right now isn’t the afterglow of victory, it’s the fading adrenaline rush of a near-death experience. Avoiding annihilation shouldn’t be good enough. But that’s all they did.

Andrea Horwath, long-time leader of the party, has already announced that she is stepping down. And rightly so. The Line has some fondness for Andrea. God knows we’ve had the opportunity to get to know her during her tenure as provincial NDP leader, which basically overlaps entirely with our entire careers in journalism. She is a decent person with a better sense of humour than often comes across in public, and she has nothing to be ashamed about. She has taken the party as far as she can, and it’s time for someone else to take over and deal with what might be a changing environment — one that is not obviously changing in the NDP’s favour (again, see above).

[…]

Writing critically about the Liberal campaign today feels a little bit like flogging a dead horse, and then shooting it a bunch of times, and then setting it on fire, and then hunting down all of its little horsey relatives and shooting all of them too. And then peeing on them. But still. It was a really bad campaign by the Liberals. The leader was bad. We’re sorry, but he was. If Steven Del Duca ever encountered charisma we suspect his body would reject it like a donated kidney. The party’s campaign platform was a weird mishmash of stuff that sounded vaguely on point for 2022, but also often read like something copied and pasted directly out of Ontario Liberal campaign platforms going back as far as the 1990s.

Some of the problems the campaign experienced had easy explanations. The party’s 2018 performance was so terrible they lost official party status, and the access to budgets and staff in the legislature that goes along with that status. The party has been trying to rebuild with at least one hand tied behind its back ever since. The campaign team was quite lean, and as a series of ejected candidates show, it was not able to properly vet the full slate of candidates it ran. You can understand how the lack of personnel and money contributed to those problems. But what we can’t understand is why the campaign insisted on making so many weird decisions. Handguns and abortion as campaign issues? In a provincial campaign? Talking up free transit rides, which will only appeal in the deepest downtown cores, where all they could do was hurt the NDP? A mid-campaign pledge to make COVID-19 vaccinations mandatory for school children, which was then never really mentioned again?

The NDP ran a bad campaign, but the Liberals just seemed to be totally disjointed, as if there wasn’t any agreement among the party leadership on what the platform should be so random unrelated items got floated as trial balloons on almost a daily basis, with no follow-up on most of them. Perhaps the party couldn’t afford the cost of proper in-depth pre-election polling or perhaps this was the party leadership’s belated buyer’s remorse over the leader they’d elected.