The late Lester Thurow was quite popular in the 1980s and 1990s for his incessant warnings that America was losing at the game of trade with other countries. Most ominous, Thurow (and others) warned, was our failure to compete effectively against the clever Japanese who, unlike us naive and complacent Americans, had the foresight to practice industrial policy, including the use of tariffs targeted skillfully and with precision. Trade, you see, said Thurow (and others) is indeed a contest in which the gains of the “winners” are the losses of the “losers”. Denials of this alleged reality come only from those who are bewitched by free-market ideology or blinded by economic orthodoxy.

And so – advised Thurow (and others) – we Americans really should step up our game by taking many production and consumption decisions out of the hands of short-sighted and selfish entrepreneurs, businesses, investors, and consumers and putting these decisions into the hands of the Potomac-residing wise and genius-filled faithful stewards of Americans’ interest.

Sound familiar? It should. While some of the details from decades ago of the news-making proponents of protectionism and industrial policy differ from the details harped on by today’s proponents of protectionism and industrial policy, the essence of the hostility to free trade and free markets of decades ago is, in most – maybe all – essential respects identical to the hostility that reigns today.

Markets in which prices, profits, and losses guide the decisions of producers and consumers were then – as they are today – asserted to be stupid, akin to a drunk donkey, while government officials (from the correct party, of course) alone have the knowledge, capacity, willpower, and power to allocate resources efficiently and in the national interest.

Nothing much changes but the names. Three or four decades ago protectionism and industrial policy in the name of the national interest was peddled by people with names such as Lester Thurow, Barry Bluestone, and Felix Rohatyn. Today protectionism and industrial policy in the name of the national interest is peddled by people with different names.

Don Boudreaux, “Quotation of the Day…”, Café Hayek, 2020-03-12.

March 18, 2025

QotD: Lester Thurow and the other cheerleaders for “Industrial Policy” in the 1980s

April 28, 2024

How Britain got out of the Great Depression (and no, it wasn’t WW2)

Tim Worstall, in refuting something being pushed by Willie Hutton, explains how the British government escaped from the Great Depression and set off a nice little boom in the mid- to late-1930s:

Well, yes. Except that’s not actually what did drag Britain out of the Depression. What did was expansionary fiscal austerity. You know, that thing the Tories talked of in 2010 and which everyone laughed at? Somewhat annoyingly I was one of the very few (it’s annoying because I was clearly right in what I was saying) who pointed this out back then.

When we boil this right down it’s an argument about the effectiveness of monetary policy. Absolutely no one thinks that it has no effect. But there’s many who think that it has no effect at the zero lower bound: when interest rates are zero. That’s really the argument that leads to fiscal policy, that idea that government might tax less, or spend more, blow out that deficit and get the economy moving again. We’ve done all we could with monetary policy and we’ve still got to do something so here’s fiscal policy.

To put it as simply as possible. We’ve two major macroeconomic tools, monetary policy and fiscal. The first is interest rates, exchange rates and money printing and so on. The second is the difference between taxes collected and money spent by government — the government deficit or surplus (note, please, for purists, this is being very simple).

OK, either lever or tool can be used to loosen conditions — gee stuff up — or tighten them. Which we use when is somewhere between a matter of taste and necessarily correct given the circumstances. But clearly the total amount of geeing up out of a recession — or tightening to prevent inflation — or depression is the combination of the two sets of policies, applications of levers and tools.

It’s thus theoretically possible to tighten with one, loosen with the other and gain, overall, either tightening or loosening. Depends upon how much of each you do.

Britain in the 30s tightened fiscal policy. The opposite of what the Keynesians said, the opposite of what the US did and so on. Cut — no, really cut, not just slowed the increase in — government spending and thereby cut the government deficit (might, actually, have gone into surplus, not sure). This is, according to the Keynesian line, something that should make the recession/depression worse.

But at the same time they came off the gold standard — Churchill had taken us back in in 1925 at far too high a rate — and lowered interest rates. That’s a loosening of monetary policy.

As it happens, on balance, the monetary was loosened more than the fiscal was tightened and so we have expansionary fiscal austerity. Which set off a very nice little boom in fact. The mid- to late- 30s in Britain were economic good times. Driven, nicely driven, by a housebuilding boom — the last time the private sector built 300 k houses a year in fact (this is before the Town and Country Planning Act stopped all that). Mixed in was that the motor car was becoming a fairly standard bourgeois item and so housing spread out along the roads.

February 28, 2023

QotD: Politicians respond to different economic incentives than the rest of us

Politicians in particular have a problem – in good times, people vote for them, and in tough times … not so much.

The temptation is to delay the tough times until your successor can carry the can.

Poor old Keynes inadvertently gave politicians the answer they were looking for – the idea that during the downturn, the government should spend money into the economy to keep it going along nicely. Making sure that those lifeguards sacked from the Skegness lido can swiftly get jobs working at a government Skegness lido prevents them claiming the dole, and keeps them in the economy earning and spending until the economy washes out all the malinvestment and starts growing again. At which point the government Skegness lido closes and the lifeguards go to work at a lido somewhere where the biting Easterly wind doesn’t sandblast your skin off. The government has bridged the gap.

There’s one problem.

The government has no money of its own, so where will it get the money for their lido?

Well, Keynes said it should run a surplus during the good times and stash that surplus money away so it can be used during the downturn – a national rainy-day fund, if you will.

But guess what? Politicians don’t run surpluses.

Why would they? Every penny spent making lives better for voters today makes it more likely they will vote for you. And every penny saved against a rainy day makes it possible for your rivals to win votes tomorrow, by doing the same once they are in power.

So politicians don’t ever HAVE a rainy day fund. But that doesn’t stop them wanting to bridge the gap.

So they borrow the money.

And now what they are doing is not Keynesian, or even neo-Keynesian, but pseudo-Keynesian

By bridging the current gap with borrowed money, they simply make sure that the next gap will be costlier to bridge. Because the interest on the borrowing means that the gap will be wider.

But that’s not even the biggest problem – the biggest problem is that the gap is intrinsically important. We NEED it, to give us pause.

Whereas bridging it enables us to carry on being silly and prevents the misallocations from being flushed out – a lido remains operating in Skegness despite having no customers, and the lifeguards continue to work. Their lifesaving skills (which should be fruitfully employed elsewhere) stagnate at a lido with no punters. Their customer service skills deteriorate as the customers disappear, and what they learn instead is how to sit in a chair and stare into space. Their skills are degrading. Hysteresis, technically.

And so by delaying the collapse of the Skegness lido in pursuit of benign conditions for the voters, the government destroys the skills of our workforce.

Sowell was right – the problems we battle today were caused by the government’s interventions yesterday.

Surely using government to solve our problems is like a man quenching his thirst with seawater?

Alex Noble, “Drinking Brine”, Continental Telegraph, 2019-06-14.

September 10, 2022

Magical Monetary Theory (MMT) – You’re soaking in it

At the Foundation for Economic Education, Kellen McGovern Jones outlines the rapid rise of MMT as “the answer to everyone’s problems” in the last few years and all the predictable problems it has sown in its wake:

“Inflation & Gold” by Paolo Camera is licensed under CC BY 2.0 .

Modern Monetary Theory (MMT) was the “Mumble Rap” of politics and economics in the late 2010s. The theory was incoherent, unsubstantial, and — before the pandemic, you could not avoid it if you wanted to.

People across the country celebrated MMT. Alexandria Ocasio-Cortez, the Democrat Congresswoman from New York heralded MMT by proclaiming it “absolutely [must be] … a larger part of our conversation [on government spending].” The New York Times and other old-guard news sources authored countless articles raising the profile of MMT, while universities scrambled to hold guest lectures with prominent MMT economists like Dr. L. Randall Wray. Senator Bernie Sanders went as far as to hire MMT economists to his economic advisory team.

The most fundamental principle of MMT is that our government does not have to watch its wallet like everyday Joes. MMT contends that the government can spend as much as it wants on various projects because it can always print more money to pay for its agenda.

Soon after MMT became fashionable in the media, the once dissident economic theory leapt from being the obscure fascination of tweedy professors smoking pipes in universities to the seemingly deliberate policy of the United States government. When the Pandemic Hit, many argued that MMT was the solution to the pandemics problems. Books like The Deficit Myth by Dr. Stephanie Kelton became New York Times bestsellers, and the United States embarked on a massive spending spree without raising taxes or interest rates.

Attempting to stop the spread of Covid, state and federal governments coordinated to shut down nearly every business in the United States. Then, following the model of MMT, the federal government decided to spend, and spend, and spend, to combat the shutdown it had just imposed. Both Republican and Democrat-controlled administrations and congresses enacted trillions of dollars in Covid spending.

It is not hard to see that this spray and pray mentality of shooting bundles of cash into the economy and hoping it does not have any negative consequences was ripe for massive inflation from the beginning. Despite what MMT proponents may want you to believe, there is no way to abolish the laws of supply and demand. When there is a lot of something, it is less valuable. Massively increasing the supply of money in the economy will decrease the value of said money.

MMT economists seemed woefully unaware of this reality prior to the pandemic. Lecturing at Stoney Brook University, Kelton attempted to soothe worries about inflation by explaining that (in the modern economy) the government simply instructs banks to increase the number of dollars in someone’s bank account rather than physically printing the US Dollar and putting it into circulation. Somehow — through means that were never entirely clear — this fact was supposed to make people feel better.

In reality, there is no difference between changing the number in someone’s bank account or printing money. In both cases, the result is the same, the supply of money has increased. Evidence of MMTs inflationary effects are now everywhere.

October 1, 2020

QotD: Even so-called “Keynesians” fail to follow Keynes

The thing about deficit spending is that you should only be doing it when you need to be doing it. No, this isn’t a rejection of that Keynesian idea or ideal, it’s the point of it.

When wages are flatlining, when the economy needs that bolus of extra demand then, OK, go borrow and spend. Or, in the MMT world, print money and spend. But once you’ve delivered that bolus and the economy has recovered then you must be able to stop that spending – whether delivered by borrowing or printing. That is, a permanent increase in spending is not Keynesian demand management, only a temporary one is.

Tim Worstall, “The Guardian‘s Absurd View Of NHS Funding”, Continental Telegraph, 2018-06-15.

August 10, 2020

FDR’s “New Deal” and the Great Depression

The Great Depression began with the collapse of the stock market in 1929 and was made worse by the frantic attempts of President Hoover to fix the problem. Despite the commonly asserted gibe that Hoover tried laissez faire methods to address the economic crisis, he was a dyed-in-the-wool progressive and a life-long control freak (the Smoot-Hawley Tariff Act which devasted world trade was passed in 1930). Franklin D. Roosevelt won the 1932 election by promising to undo Hoover’s economic interventions, yet once in office he turned out to be even more of a control freak than Hoover. His economic and political plans made Hoover’s efforts seem merely a pale shadow.

For newcomers to this issue, “New Deal” is the term used to describe the various policies to expand the size and scope of the federal government adopted by President Franklin Delano Roosevelt (a.k.a., FDR) during the 1930s.

And I’ve previously cited many experts to show that his policies undermined prosperity. Indeed, one of my main complaints is that he doubled down on many of the bad policies adopted by his predecessor, Herbert Hoover.

Let’s revisit the issue today by seeing what some other scholars have written about the New Deal. Let’s start with some analysis from Robert Higgs, a highly regarded economic historian.

… as many observers claimed at the time, the New Deal did prolong the depression. … FDR and Congress, especially during the congressional sessions of 1933 and 1935, embraced interventionist policies on a wide front. With its bewildering, incoherent mass of new expenditures, taxes, subsidies, regulations, and direct government participation in productive activities, the New Deal created so much confusion, fear, uncertainty, and hostility among businessmen and investors that private investment, and hence overall private economic activity, never recovered enough to restore the high levels of production and employment enjoyed in the 1920s. … the American economy between 1930 and 1940 failed to add anything to its capital stock: net private investment for that eleven-year period totaled minus $3.1 billion. Without capital accumulation, no economy can grow. … If demagoguery were a powerful means of creating prosperity, then FDR might have lifted the country out of the depression in short order. But in 1939, ten years after its onset and six years after the commencement of the New Deal, 9.5 million persons, or 17.2 percent of the labor force, remained officially unemployed.

Writing for the American Institute for Economic Research, Professor Vincent Geloso also finds that FDR’s New Deal hurt rather than helped.

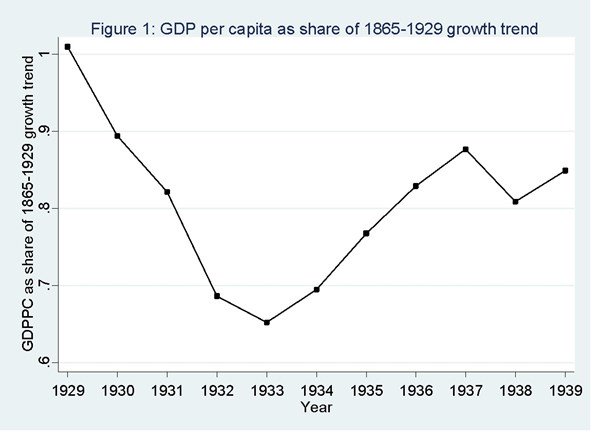

… let us state clearly what is at stake: did the New Deal halt the slump or did it prolong the Great Depression? … The issue that macroeconomists tend to consider is whether the rebound was fast enough to return to the trendline. … The … figure below shows the observed GDP per capita between 1929 and 1939 expressed as the ratio of what GDP per capita would have been like had it continued at the trend of growth between 1865 and 1929. On that graph, a ratio of 1 implies that actual GDP is equal to what the trend line predicts. … As can be seen, by 1939, the United States was nowhere near the trendline. … Most of the economic historians who have written on the topic agree that the recovery was weak by all standards and paled in comparison with what was observed elsewhere. … there is also a wide level of agreement that other policies lengthened the depression. The one to receive the most flak from economic historians is the National Industrial Recovery Act (NIRA). … In essence, it constituted a piece of legislation that encouraged cartelization. By definition, this would reduce output and increase prices. As such, it is often accused of having delayed recovery. … other sets of policies (such as the Agricultural Adjustment Act, the National Labor Relations Act and the National Industrial Recovery Act) … were very probably counterproductive.

Here’s one of the charts from his article, which shows that the economy never recovered lost output during the 1930s.

May 24, 2020

QotD: The “balance of trade”

Joseph Schumpeter [wrote in] History of Economic Analysis (1954):

The first thing to observe about this concept [of the balance of trade] is that it is in fact an analytic tool. The balance of trade is not a concrete thing like a price or a load of merchandise.

Yes (although it is even more accurate to describe the balance of trade as an accounting convention). If, for example, it had been decided to record purchases and sales of real estate on the current account rather than on the capital account, the size of each country’s current-account deficit or surplus would be different even though absolutely nothing real in the national or global economy would be changed. And yet to hear any of the many protectionists bemoan their country’s trade- or current-account deficit is to hear people who typically mistake this accounting convention for a concrete thing. Such complaints almost always reflect utter misunderstanding of so-called “trade balances.”

Don Boudreaux, “Bonus Quotation of the Day…”, Café Hayek, 2018-01-21.

April 15, 2020

When the Fed Does Too Much

Marginal Revolution University

Published 22 Aug 2017In the 2000s, the Fed kept interest rates low to stimulate aggregate demand. But the cheap credit also helped fuel the housing market bubbles. We’ll look at the case of the Great Recession as an example of where the Fed did too much in one area, and perhaps not enough in others.

April 4, 2020

Monetary Policy: The Negative Real Shock Dilemma

Marginal Revolution University

Published 15 Aug 2017Imagine a negative real shock, like an oil crisis, just hit the economy. How should the Fed respond?

Decreasing the money supply will help with inflation, but make growth worse. Increasing the money supply will improve growth, but inflation will climb higher. What’s the Fed to do?!

February 20, 2020

Why the Nazis Weren’t Socialists – ‘The Good Hitler Years’ | BETWEEN 2 WARS I 1937 Part 2 of 2

TimeGhost History

Published 19 Feb 2020The Nazi economy appears to do well during the 1930s. But this is largely myth, as the German economy under Hitler is based on a self destructive, ideologically or selfishly fuelled irrationality driven by conquest and criminal practice.

Join us on Patreon: https://www.patreon.com/TimeGhostHistory

Hosted by: Indy Neidell

Written by: Spartacus Olsson

Directed by: Spartacus Olsson and Astrid Deinhard

Executive Producers: Bodo Rittenauer, Astrid Deinhard, Indy Neidell, Spartacus Olsson

Creative Producer: Joram Appel

Post-Production Director: Wieke Kapteijns

Research by: Spartacus Olsson

Edited by: Daniel Weiss

Sound design: Marek KaminskiSources:

Bundesarchiv_Bild:

192-269, 183-T0706-503, 183-S68029, 183-S68014,

183-S38324, 183-S33516, 183-S07227, 183-R98364,

183-H29131, 183-H25824, 183-H01704, 183-H13192,

183-H06734, 183-H00455, 183-C12671, 183-86686-0008,

183-2008-0826-506, 183-2008-0826-502, 183-2006-1128-504,

183-2004-0729-507, 183-1989-0630-504, 183-1988-0113-500,

146-2005-0191, 146-1990-048-29A, 146-1990-023-06A,

146-1984-040-26, 146-1981-124-32A, 146-1972-025-10,

102-13533, 102-12733, 102-11649, 102-06795, 102-04640,

145_Bild-P046280, 145_Bild-020683,Colorizations by:

Daniel WeissSoundtracks from Epidemic Sound:

– “Document This 1” – Peter Sandberg

– “March Of The Brave 10” – Rannar Sillard – Test

– “Ominous” – Philip Ayers

– “The Inspector 4” – Johannes Bornlöf

– “Disciples of Sun Tzu” – Christian Andersen

– “Guilty Shadows 4” – Andreas Jamsheree

– “Last Point of Safe Return” – Fabien Tell

– “Death And Glory 1” – Johannes Bornlöf

– “Easy Target” – Rannar Sillard

– “Split Decision” – Rannar Sillard

– “First Responders” – Skrya

– “The Charleston 3” – Håkan ErikssonA TimeGhost chronological documentary produced by OnLion Entertainment GmbH.

From the comments:

Spartacus Olsson

1 day ago

From an intellectual viewpoint, this is perhaps the most challenging episode I have written in this series. First of all it’s hard to make economic policy interesting, even when it’s about the Nazis. It tends to get, well … grey. Second of all it’s not that easy to simplify things without completely losing the essence of what was going on. Third of all, I’m fighting an uphill battle against a post truth, political talking point based on … let’s just call it less than ingenious purposes.Obviously that’s the idea that the Nazis were Socialists. And perhaps that is not so far fetched when you think of the name of their party, the way they framed their anti-semitic rhetoric in a way that it would sound friendly to the working class, and their absolute disregard for telling the truth about anything, and everything. But although we have painstakingly showed you the facts, I am painfully aware that it won’t make a difference to stop the nonsense out there and in here — some pundits will religiously stick to their ideas, because if they don’t, they might have to face that some of the ideas they have are mutual with the people they so desperately want to distance themselves from. The same happened with the far left between the 1930s and 1970s, when they tried with cramped desperation to frame Stalinism as a right wing, Fascist movement — Red Fascism was the term — obviously as much nonsense as the alt-right idea that Naziism is Socialism.

And is it important? Well yes and no — the dumbos will probably get worn out at some point, it’s after all quite challenging to look for ways to distort the record over, and over again. I don’t really care if the extremists try to push their mutual garbage in each other’s lap — as a supporter of democracy and humanism, I have no regard for either end. I do however have an incredible amount of respect for conservatives, liberals, and progressives who are equally dedicated to democracy and human rights — and there is where it matters.

When the far left tries to frame Stalinism as right wing, and the far-right tries to frame Naziism is left-wing, they are trying to co-opt a position of less extremism. It’s an invasive attempt for Communists and (real) Socialists to just look like regular Progressives, and Fascists and Nazis to just look like regular Conservatives. And that my friends is dangerous, to all of us, regardless of our nationality, creed, political affiliation, or opinion — because it is specifically our individual rights and democracy that is at stake in this game. That’s what they want to take away, or in some places stop from developing.

October 24, 2019

Monetary Policy: The Best Case Scenario

Marginal Revolution University

Published on 8 Aug 2017Imagine that you’re the Fed and the economy’s been doing fine. GDP growth is good, inflation is low. But then something happens. Consumer confidence drops. The economy shrinks.

What do you do?

October 15, 2019

The Fed as Lender of Last Resort

Marginal Revolution University

Published on 1 Aug 2017If you heard a rumor that your bank was insolvent (in other words, it had more liabilities than assets), what would you do?

A typical reaction is to panic. What if you can’t get your money out? Your next step would likely be to try and get all of your cash in hand.

The rumor could even be false, but if enough people responded as if it were true, it would still spell trouble. Even solvent banks can have illiquid assets. If the bank can’t pay out to its depositors, the panic can spread.

This is where the Federal Reserve System comes into play. The Federal Deposit Insurance Corporation (FDIC) insures deposit accounts. And, if the insurance isn’t enough or the financial institution isn’t covered, the Fed can act as the “lender of last resort” – it can loan enough money to a bank to cover customers who want their cash.

Why does this happen? Well, panics can be a threat to the entire banking system. If one financial institution falls, even if it is insolvent, it can have a domino effect.

If you think through very recent U.S. history, you’ll quickly come up with some examples of the Fed intervening. During the 2008 financial crisis, the Fed, along with U.S. Treasury and FDIC, stepped in to “bail out” insolvent U.S. financial institutions to minimize systemic risk.

But what happens when you know that the government will clean up the mess if you make risky investments? This is certainly a big problem facing the Fed. We’ll discuss the consequences in detail in this video.

September 28, 2019

How the Federal Reserve Works: After the Great Recession

Marginal Revolution University

Published on 3 Apr 2018In response to the Great Recession, the Federal Reserve has implemented some new instruments and policies – including quantitative easing, paying interest on reserves, and conducting repurchase (and reverse repurchase) agreements. In this video we cover how these tools work, and why they matter.

September 27, 2019

How the Federal Reserve Worked: Before the Great Recession

Marginal Revolution University

Published on 13 Mar 2018The Federal Reserve has massive influence over the United States and global economy. But how the Fed uses its tools to stimulate or shrink aggregate demand has changed since the Great Recession. We’ll start by covering how it was done prior to 2008.

September 25, 2019

The Money Multiplier

Marginal Revolution University

Published on 25 Jul 2017When you deposit money into a bank, do you know what happens to it? It doesn’t simply sit there. Banks are actually allowed to loan out up to 90% of their deposits. For every $10 that you deposit, only $1 is required to stay put.

This practice is known as fractional reserve banking. Now, it’s fairly rare for a bank to only have 10% in reserves, and the number fluctuates. Since checkable deposits are part of the U.S. money supplies, fractional reserve banking, as you might have guessed, can have a big impact on these supplies.

This is where the money multiplier comes into play. The money multiplier itself is straightforward: it equals 1 divided by the reserve ratio. If reserves are at 10%, the minimum amount required by the Fed, then the money multiplier is 10. So if a bank has $1 million in checkable deposits, it has $10 million to work with for stuff like loans and reserves.

Now, typically, the money multiplier is more like 3, because banks can always hold more in reserves than the minimum 10%. When the money multiplier is higher, like during a boom, this gives the Fed more leverage to move M1 and M2 with a small change in reserves. But when the multiplier is lower, such as during a recession, the Fed has less leverage and must push harder to wield its indirect influence over M1 and M2.

Next up, we’ll take a closer look at how the Fed controls the money supply and how that has changed since the Great Recession.