British Pathé

Published 13 Apr 2014This archive footage from 1958 depicts British Railways’ journey to modernisation and the transition away from steam-powered trains.

For Archive Licensing Enquiries Visit: https://goo.gl/W4hZBv

#BritishPathé #History #Railway #Trains #BritishRailways

(FILM ID:1549.07)

Full title reads: “Goodbye To Steam”Intertitle reads: “British Railways meet the challenge of the age of abundant power”

Angle shot, railway engine going past camera. GV Outside one of the large London Railway stations showing railway lines and train coming out of station. CU Man in signal box, pan to show him pulling levers. CU Signal going up. GV Train coming towards camera. GV Steam train. GV Aerial shots steam train. CU Man filming from plane. CU man in plane fitting equipment and then giving thumb’s up sign. GV Aerial shot, railway lines. CU Man filming from plane. Steam train going along line. SV Draughtsmen in office. CU Men looking through magnifier at a plan. CU Magnified picture of plan, zoom to show Railway chiefs seated round table with plan, among them is Sir Philip Warter. SV Elevated, railway chiefs looking at plan. CU One of the railway executives. SV Man with model of section of railway line which he places on the table and the railway executives study it. CU Sign reading “Kent Coast Electrification Widening to Provide Four Tracks”, pan to show railway line with only two tracks. GV Kent Coast line with men on bridge. SV Bridge with surveyor. CU Surveyor looking through theodolite. GV Tracking shot of men working. GV Men working at side of railway line with clouds of smoke coming from wood. CU New diesel engine. CU Sir Brian Robertson talking to train driver. CU People watching. CU Sir Brian Robertson blowing whistle. CU Int. diesel engine with driver operating controls. SV Diesel train moving out of station. CU Driver of diesel train. CU. Sir Brian Robertson sitting in carriage. LV Through window of diesel cab as train enters tunnel. SV Three engines on lines. CU Front of one of the engines with plate reading “Cornish Riviera Express”. CU Driver. SV Cornish Riviera Express in station. SV Woman taking in washing because smoke is billowing up from railway lines beside her garden. GV Cornish Riviera Express coming towards camera.

CU Front of steam train “The Bristolian”. SV along top of engine as blows off steam. CU Hand pulling chain. CU valve. GV Platform. CU shovelling coal. GV As train goes along. CU Driver of train. CU Driver. CU Fireman. CU Fire with coal being shovelled. SV Looking over coal tender. SV From driver’s cab of train going under bridge and out the other side. CU Driver. GV From driver’s cab of railway lines with another steam train. SV Int. class for instruction of diesel engine drivers. CU Lecturer talks about metal object. CU Men looking at machinery. SV Royal Scot in station. CU Driver of Royal Scot. GV Activities on platform in which Royal Scot is standing. GV Royal Scot leaving station. GV Building with sign, “English Electric Co. Ltd. Preston”. GV Int. of workshop showing men working on armatures. GV Ext. of building with “Vulcan Locomotives” painted on wall. GV Int. of workshop showing men working on railway engines. CU Man working inside railway engine. GV Workshop. SV Diesel train in station. CU Driver of diesel. GV railway lines in front of train as it moves along. SV Int. dining car in diesel train with attendant pouring coffee. GV Looking through cab window of railway lines in front of train as it goes under bridge and straight past station. CU Glass panel in door with “York Signal Box, Strictly Private”, door opens. SV Man sitting at control panel of box, he reaches over to controls. CU Man’s hands working controls. CU Plan on wall showing different lines and points. CU Hand pushing buttons. CU Signals. CU Point on lines. GV Steam train along lines. CU Train in museum. CU Compartment of old train. SV Ancient train “Locomotion 1828”. SV Diesel Locomotive. CU “Deltic” written on side. GV Deltic. GV Train in station. Various shots in Deltic carriage. SV Coal trucks. SV Railway worker attaching pipe to train. GV Calder Hall Nuclear / Atomic Power station. GV Electrical pylons and cables. GV Diesel train “Sir Brian Robertson” in platform with crowds. GV Crowds. SV “Sir Brian Robertson” unveiled by Mr Grand, General Manager of the Western Region of British Railways. SV Crowd. SV Sir Brian Robertson by train. CU Sign “Sir Brian Robertson”. GV The “Sir Brian Robertson” leaving Paddington Station. SV Steam train letting out smoke. CU Signals. GV Steam train. CU Train over the points. GV steam train leaving clouds of smoke.

BRITISH PATHÉ’S STORY

Before television, people came to movie theatres to watch the news. British Pathé was at the forefront of cinematic journalism, blending information with entertainment.

July 1, 2020

British Railways: Goodbye To Steam aka Railway Modernisation (1958) | British Pathé

March 5, 2020

Chain Your Woman to the Stove – Feminism in the 1930s | BETWEEN 2 WARS I 1938 Part 2 of 4

TimeGhost History

Published 4 Mar 2020Under the yoke of economic depression and more and more authoritarian rulers, Western women face renewed misogyny, patriarchy, and decreasing independence. But not all women think this is such a bad thing.

Join us on Patreon: https://www.patreon.com/TimeGhostHistory

Hosted by: Indy Neidell

Written by: Spartacus Olsson

Directed by: Spartacus Olsson and Astrid Deinhard

Executive Producers: Bodo Rittenauer, Astrid Deinhard, Indy Neidell, Spartacus Olsson

Creative Producer: Joram Appel

Post-Production Director: Wieke Kapteijns

Research by: Spartacus Olsson

Edited by: Daniel Weiss

Sound design: Marek KamińskiSources:

Bundesarchiv_Bild:

101III-Alber-174-14A, 102-04517A, 102-17313, 102-17818,

111-098-069, 137-055879, 146-1973-010-31, 146-1975-069-35,

146-1976-112-03A, 146-2006-205, 146-2008-0271,

183-2000-0110-500, 183-2005-0502-502, 183-2005-0530-500,

183-E10868, 183-E20457, 183-H28245, 183-J02040,

183-S08630, 183-S68014, 183-S68021, 183-S68029,

noun_pipe By Icon Lauk,

noun_company By wardehpillai,

noun_Farmer By Francisca Muñoz Colina.Colorizations by:

– Daniel Weiss

– Norman StewartSoundtracks from Epidemic Sound:

– “Sophisticated Gentlemen” – Golden Age Radio

– “The Inspector 4” – Johannes Bornlöf

– “Magnificent March 3” – Johannes Bornlöf

– “Last Point of Safe Return” – Fabien Tell

– “Step On It 5” – Magnus Ringblom

– “First Responders” – Skrya

– “Step Lightly” – Farrell Wooten

– “Try and Catch Us Now” – David Celeste

– “Not Safe Yet” – Gunnar Johnsen

– “The Dominion” – Bonnie Grace

– “The Charleston 3” – Håkan ErikssonA TimeGhost chronological documentary produced by OnLion Entertainment GmbH.

From the comments:

TimeGhost History

2 days ago (edited)

So, we take a little break from the geopolitical developments in 1938 to look at the situation of women in the Western World in 1938. We’ve received a lot of requests on the WW2 channel to cover the situation on the home fronts. While we do mention it in the weekly episodes, and War Against Humanity covers the horrid parts of it, WWII was so much more. It literally changed the world’s culture in just six years. To do that subject justice we have asked Anna to join us as host for a new monthly WW2 series: On the Homefront.A few years back Anna was a regular feature on German YouTube on her own channel and some of the bigger YouTube entertainment channels. She left YouTube to finish her studies, and because she was searching for more depth than YT entertainment content was offering her. As Astrid’s and my daughter, and having grown up with Indy around all the time, she has a passion for human history form childhood, especially cultural history.

She also has a personal relationship to this time through her grandparents, Herbert and Renate, Astrid’s parents who served in Germany during the war, on the front and at home. Herbert, a career administrator and later NCO in the Wehrmacht engineer corps, went on after the war to work for the British as translator, and then as a public servant supporting the creation of the Bundeswehr, the German defense forces, and eventually Germany’s contribution as NATO member.

Renate’s father, a bank director, died under mysterious circumstance in 1936 after repeatedly refusing to pay out money belonging to Jewish families to the Nazis. Her mother and sisters soldiered on under the Nazis as best they could, When the war broke out they first suffered under the Allied bombing, losing their home three times. When the bombing became a daily occurrence, Renate was drafted to the German flak and only barely survived the war.

Several years after the war Herbert and Renate met and started a family together. They both passed away only a few years ago, late enough so that Anna had a chance to spend countless hours over 23 years listening to their war stories, and what they took away from it: hope for a better world, and the knowledge that what happened in Germany between 1933 and 1945, must never happen again. Please join us to welcome Anna, our daughter to TimeGhost.

Spartacus

March 2, 2020

The unexpected electricity bill for Bitcoin

At the Continental Telegraph, Tim Worstall points out that Bitcoin transactions now consume a huge amount of electricity:

“Bitcoin – from WSJ”by MarkGregory007 is licensed under CC BY-NC-SA 2.0

Some will take this as proof that the system of Bitcoin shouldn’t exist, even that we should attempt to close it down. For it is, according to these calculations, using vast amounts of energy:

Just one Bitcoin transaction uses the same amount of electricity as a British household for nearly two months, new figures have shown.

The amount of energy needed to run the cryptocurrency has soared to record annual highs of 77.78 terawatt hours the same as the entire electrical consumption of Chile.

The carbon footprint of a single transaction is the same as 780,650 Visa transactions or spending 52,043 hours watching YouTube, according to calculations by Alex de Vries, a blockchain specialist, at PWC.

“People react with disbelief, but the figures are true,” said Mr de Vries who founded the Digiconomist blog to highlight the impact.

All those calculations are over here.

February 8, 2020

Switching over from internal combustion vehicles to electric won’t be cheap … it really won’t be cheap!

At Spiked, Rob Lyons looks at the British government’s recent decision to ban sales of internal-combustion cars in 2035 rather than the earlier target date of 2040:

First, at present, electric vehicles cost a lot more than those with internal-combustion engines. For example, one car-buying advice website notes that the Peugeot e-208 is as much as £6,200 more than the standard 208 model. There are government subsidies to help with the cost of electric cars (currently £3,500), but can this be sustained if we all switch? It has already been cut from £4,500 in 2018.

That said, while the purchase price of an electric car may be higher, charging is a lot cheaper than fuelling a regular car. Electric vehicles cost between £4 to £6 per 100 miles to charge at home and £8 to £10 using public charge points, while petrol and diesel cars cost £13 to £16 per 100 miles in fuel (although 60 per cent of the fuel cost is tax).

In theory, maintenance should be cheaper, too, given that electric motors have fewer moving parts than petrol or diesel engines. But to further complicate matters, batteries gradually lose their capacity to hold charge over time. They have to be replaced at the cost of thousands of pounds every few years. (The warranties covering battery replacement varies by manufacturer: Tesla, for instance, offers an eight-year warranty, but the Renault Zoe is covered for just three years.)

Electric cars may be cheaper to own overall, but this is largely down to subsidies and tax breaks, including lower vehicle duties and not having to pay charges in low-emission zones. Still, with the entire car industry throwing its efforts into making electric cars cheaper and increasing battery capacity, costs may well come down somewhat, reducing the need for such breaks. Fingers crossed.

The cost to individual owners will be higher, but the costs to build up the electric charging infrastructure will be distributed among all consumers, not just the owners of vehicles:

This brings us to perhaps the biggest problem: where will the power come from and how will it reach us? Eventually shifting all the energy for cars from oil to electricity means producing much more electricity. Greens are pleased that electricity use is currently decreasing, and a greater proportion of electricity is coming from renewable sources. But the arrival of electric cars en masse would demand a whole lot more electricity, mostly to be used at night.

Unless we want to coat the landscape in wind turbines, which are unreliable in any event, we’ll need other sources of power. More nuclear? Fine by me. But will eco-warriors stand for that? Even if we can produce the juice, having lots of cars charging in the same area may overwhelm the local electricity networks. Who is going to pay for the upgrade?

When all of these factors are considered we have to ask if all this effort will really reduce greenhouse-gas emissions anyway. Digging up the resources required to create all those batteries will be hugely carbon-intensive. Perhaps the most likely outcome of banning sales of new petrol and diesel vehicles is that demand for second-hand vehicles will go up. We could end up like Cubans, nursing venerable old cars for years, way beyond their intended lifespans.

January 23, 2020

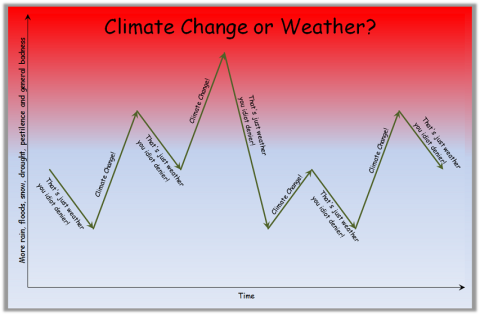

Pascal’s Wager, environmentalists’ version

Hector Drummond indulges in a proper “Fisking” of a recent column in the Telegraph:

We don’t have to buy into the apocalyptic angst of Greta Thunberg, on show again in Davos yesterday, to recognise that something has to be done.

He actually said “Something Has To Be Done”. How about we do a snow dance, Philip? That’s “something”.

Whether or not you are a sceptic about the impact of CO2 on the climate or question man’s involvement in producing the greenhouse gas, our energy future is a non-carbon one, like it or not.

Our energy future involves a lot of talk about non-carbon energy sources, while relying on “carbon” for a long time to come.

Virtually every government has committed to this as an overt aspect of public policy and those that haven’t, like China or the US, have a rapidly growing green energy sector poised to exploit the move to a carbon‑free future.

You mean the China that’s building coal-fired power plants at a rate of knots? That China?

Later on, the column invokes Pascal’s Wager, which Hector finds both amusing and irritating:

Seriously? Pascal’s Wager, which has been long ridiculed by most scientists and philosophers and thinkers, is now the basis for the largest and riskiest economic and political transformation in human history?

Pascal’s Wager justifies any proposed change in response to any possible threat. It’s possible that all the ducks in the world are really super-intelligent and they’re about to launch a takeover, so we need to kill them all. It’s possible that nylon stockings are eventually going to cause a nuclear explosion. Make your own ones up. The consequences of doing nothing, should these claims turns out to be true, are calamitous. In fact, they’re far more calamitous than most of the possible climate change scenarios.

Proper risk analysis, on the other hand, tells us to look at probabilities of the possible bad outcomes, not just how bad some possible bad outcome would be, were it true. The catastrophic climate change scenarios all have tiny probabilities. Even the IPCC admits that.

[…]

Then we have to look at the costs of the proposed action. The real costs, that is, not just vague claims like “Oh, moving everything to solar energy would be, like, you know, cool, my friend went to this talk once and she said that apparently solar works just as well as coal”. The costs – the real costs – are what needs be weighed against alternative courses of action.

The costs of abandoning fossil fuels are not zero. Not even remotely. Changing to renewables will be massively expensive, destroy jobs, and hinder prosperity, because they cannot provide anywhere near the energy we need. “Generate growth and prosperity” is nonsense, and Johnston should be ashamed of himself for falling for this.

January 1, 2020

Let there be LIGHT! – December 31st – TimeGhost of Christmas Day 8

TimeGhost History

Published 31 Dec 2019The electrical age was ushered in by Thomas Edison’s illumination of Menlo Park 140 years ago. For the first time, electrical lighting was demonstrated to a public audience.

Join us on Patreon: https://www.patreon.com/TimeGhostHistory

Hosted by: Indy Neidell

Written by: Tom Maeden and Spartacus Olsson

Directed by: Spartacus Olsson and Astrid Deinhard

Executive Producers: Bodo Rittenauer, Astrid Deinhard, Indy Neidell, Spartacus Olsson

Creative Producer: Joram Appel

Post-Production Director: Wieke Kapteijns

Research by: Tom Maeden

Edited by: Mikołaj Cackowski

Sound design: Marek KamińskiColorization by:

Dememorabilia – https://www.instagram.com/dememorabilia/Soundtracks from Epidemic Sound:

Howard Harper-Barnes – “A Sleigh Ride Into Town”

Traditional – “Carol of the Bells”A TimeGhost chronological documentary produced by OnLion Entertainment GmbH.

From the comments:

TimeGhost History

4 hours ago

On the eighth day of Christmas Thomas Alva Edison said: let there be light. Now, as we say say in the video, we know that Edison was not the only inventor of incandescent light, perhaps not even the inventor at all. But as with so many other things he brought the world, he was the first one to make it practicable, and perhaps more importantly; make it popular.It’s hard to fathom how monumental to humanity this day, 31st of December, 1879 is — the world literally changed forever with the flick of a switch. Our work behavior, or sleeping patterns, our leisure time, socializing, sex, media, industry, cooking, aesthetics … well more or less everything started to change on this day. In 2019 hardly anything we do is possible without it — especially not watching this video, which after all is brought to your eyes by one of many, many derivative innovations of the incandescent light bulb. In fact it’s 140 years later and we are still researching the depths of the change that incandescent light brought upon humanity.

Most of us take it for granted by now, artists celebrate it, entire industries depend on it, Luddites deplore it, environmental studies are showing that it might be harmful to other animals, neurologists are researching the effects of changed sleeping patterns on your brains, the production of energy we need to light our world has contributed to dramatic environmental changes on the entire planet, and the innovations coming from it just keep on pouring out of labs like Menlow Park every day. What do you think?

Happy New Year! May it be enlightening.

November 25, 2019

More frequent car fires, an unintended consequence of wider adoption of electric vehicles

In Quadrant, Tim Blair recounts the story of a friend crossing the Sydney Harbour Bridge only to find his vehicle was on fire:

Most of us manage to scrape through life with no such flame-related driving incidents. Future motorists, however, may find themselves more frequently enjoying the occasional car-b-que. That’s because electric cars — the things Labor ruinously attempted to force upon us as part of their spectacular 2019 election campaign disaster — seem to be impressively prone to burning.

Now, an ordinary car fire is not really that big a deal. Catch it early enough and it can be quickly dealt with. But a fire involving an electric car is a whole different matter. Those things are like four-wheeled infinity candles.

In the manner of all the money given to its manufacturer by various governments, an electric Tesla recently torched itself in Austria. The Tesla’s fifty-seven-year-old driver had slid off the road and struck a tree, prompting a fire emergency.

In ordinary car blaze cases, a single fire engine or even a personal fire extinguisher is sufficient to deal with the problem. Electric cars, or EVs, demand slightly more attention when combustion occurs. Here’s an online news account:

In order to put out the fire, the street had to be closed and fire authorities had to bring in a container user to cool the vehicle.

Some 11,000 litres of water are needed to finally extinguish a burning Tesla but an average fire engine only carries around 2,000 litres of water.

The container used is said to be suitable for all common electric vehicles. It measures 6.8 metres long, 2.4 metres wide and 1.5 metres high, it is (obviously) waterproof and weighs three tons.

Moreover, “fire brigade spokesman Peter Hölzl warned that the car could still catch fire for up to three days after the initial fire”.

I’ve owned one or two cars that were sensibly equipped with fire extinguishers. Future motorists may wish to tow around a lake, just in case their earth-friendly electric cars decide to go the full kaboom.

September 17, 2019

“Clean” alternative energy sources are not free … in fact, they’re quite expensive

Earlier this month in Foreign Policy, Jason Hickel wrote about the requirements for expanding current renewable energy generation (wind and solar):

The phrase “clean energy” normally conjures up happy, innocent images of warm sunshine and fresh wind. But while sunshine and wind is obviously clean, the infrastructure we need to capture it is not. Far from it. The transition to renewables is going to require a dramatic increase in the extraction of metals and rare-earth minerals, with real ecological and social costs.

We need a rapid transition to renewables, yes — but scientists warn that we can’t keep growing energy use at existing rates. No energy is innocent. The only truly clean energy is less energy.

In 2017, the World Bank released a little-noticed report that offered the first comprehensive look at this question. It models the increase in material extraction that would be required to build enough solar and wind utilities to produce an annual output of about 7 terawatts of electricity by 2050. That’s enough to power roughly half of the global economy. By doubling the World Bank figures, we can estimate what it will take to get all the way to zero emissions — and the results are staggering: 34 million metric tons of copper, 40 million tons of lead, 50 million tons of zinc, 162 million tons of aluminum, and no less than 4.8 billion tons of iron.

In some cases, the transition to renewables will require a massive increase over existing levels of extraction. For neodymium — an essential element in wind turbines — extraction will need to rise by nearly 35 percent over current levels. Higher-end estimates reported by the World Bank suggest it could double.

The same is true of silver, which is critical to solar panels. Silver extraction will go up 38 percent and perhaps as much as 105 percent. Demand for indium, also essential to solar technology, will more than triple and could end up skyrocketing by 920 percent.

And then there are all the batteries we’re going to need for power storage. To keep energy flowing when the sun isn’t shining and the wind isn’t blowing will require enormous batteries at the grid level. This means 40 million tons of lithium — an eye-watering 2,700 percent increase over current levels of extraction.

That’s just for electricity. We also need to think about vehicles. This year, a group of leading British scientists submitted a letter to the U.K. Committee on Climate Change outlining their concerns about the ecological impact of electric cars. They agree, of course, that we need to end the sale and use of combustion engines. But they pointed out that unless consumption habits change, replacing the world’s projected fleet of 2 billion vehicles is going to require an explosive increase in mining: Global annual extraction of neodymium and dysprosium will go up by another 70 percent, annual extraction of copper will need to more than double, and cobalt will need to increase by a factor of almost four — all for the entire period from now to 2050.

Wind turbines require a lot of concrete to stabilize them on site (hundreds of tons of it), and that concrete is very carbon-intensive to create in the first place (nearly 930 Kg of CO2 per 1,000 Kg of cement), but even those huge turbine blades have a limited working lifespan and can’t be easily recycled into anything economically, so they generally end up in landfills.

September 10, 2019

We’ve noticed this too…

Sarah Hoyt on the increasing “green-ness” of her appliances — and the increasing uselessness of same:

“A-rated energy appliances” by Tom Raftery is licensed under CC BY-NC-SA 2.0

For years we got expensive front loaders, and yet our clothes kept smelling, there were stains that would not come out, and these things seemed to last only 5 years, on the outside. And I knew it wasn’t our problem, as such, because at the same time we started noticing we couldn’t get our clothes clean, the detergent aisle of the supermarket sprouted an entire section of odor removing things, Febreeze got added to detergents, and, in general, people smelled odd …

Then the washer broke while we were also very, very broke (we were paying mortgage and rent in the run up to buying this. I saw an ad for, I THINK a $300 washer, and we went to look. What we found, instead, was a $200, not advertised washer. As we’re looking at it the saleswoman hurries over and tells us we don’t want it. This washer, she says, uses lots of water. For those who don’t know I suffer from an unusual form of eczema. While it’s triggered mostly by stress with a side of carbs, it can also, out of the blue, take offense at a slight trace of detergent left on the clothes. I’ve found that the eczema got markedly worse the less water the washer used. And it required me to run the washer three times, once with soap and two without to avoid major outbreaks. The idea of using lots and lots of water was great, so I was all excited. Which shocked the poor saleswoman halfway to death. I will point out, though, though that this washer washes well enough I can get away with only one extra rinse cycle and if I forget it it’s usually survivable. Also, our clothes don’t smell. Unfortunately, we’ve not found that [type] of washer any of the times we’ve walked through the appliance aisle, so I think that choice has been eliminated.

Certainly the choice of dishwashers that use “lots” (i.e. what they used 20 years ago) of water and electricity was never offered to us. And since we seemed to have really lousy luck with dishwashers, I found every time we replaced one over the last 20 years, they had less space for dishes (more insulation, to allow for less electricity) to the point that I needed to do 3 or even 4 loads for a family of four. I mean, I cook from scratch, but I really don’t use that much stuff. And it ran slower than before. Right now our dishwasher actually washes (a bonus) but it takes four hours to run a cycle. I rarely do more than one wash a day, though, because it’s just Dan and I, and we … well … the kids used a lot more glasses and little plates, and frankly meals get more complicated for four people.

All the same, there was a time there, for like 10 years, where we were running all this “green” approved stuff, and not only was I running the washer and drier more or less continuously, but to make things more “interesting” I was using MORE water and electricity, in the sense that I was running the appliances a ton more.

This of course is what I also found with the “low flush” toilets. We had them in our previous house, and we found that we spent an inordinate amount of time flushing the toilet. Also, since it took four or five flushes to do the job or one, the fact we were actually only using half the water per flush didn’t save any water. We spent instead twice to three times the amount of water the “high flush” toilets had spent.

All this, btw, to appease Paul Ehrlich — the prophet of wrong. As in, if he foresees something it will be wrong — and his ridiculous idea we’d run out of potable water in 1978. Apparently none of these people have noticed that 1978 has come and gone with no problems. And as for electricity, if they stop their idiocy about nuclear, it’s not even a consideration. (And no, Chernobyl isn’t a caution about nuclear energy. It’s a caution about stupid communist regimes. They can’t run anything — not even a nuclear plant — without destroying it.)

Lightbulbs are another favourite … several years back, our provincial government was pushing us all to get rid of our old incandescent bulbs and replace them with these great new energy-efficient compact fluorescent bulbs. The new CFLs cost roughly ten times as much as the old bulbs, but we were assured up and down that they’d last twenty times longer, so we’d not only save money on electricity, but also have to replace the bulbs so infrequently. Of course, the CFL bulbs were pathetically bad — not only were they expensive, the light they gave was (at best) marginal and they didn’t even last as long as typical incandescent bulbs.

So now, of course, we’re being encouraged to use LED bulbs. Sure, they’re more expensive than the old incandescent bulbs, but they save on electricity and last many times longer! Except, of course, they don’t. The old incandescent bulbs in my office started to fail one after another, so when I was down to only one working bulb, I gave in and bought four replacement LED bulbs … they were on sale for only 2-3 times as much as the old bulbs! That was in March. I’ve already had to replace two of the LED bulbs. This is starting to feel familiar…

On the bright side (pun unintentional), the LED bulbs don’t provide the entertainment of a toxic waste cleanup in your home the way the CFL bulbs did when they were broken.

February 9, 2019

The price tag for Alexandria Ocasio-Cortez’s renewable energy dream

At Reason, Ronald Bailey looks at how much it would cost to implement Alexandria Ocasio-Cortez’s post-fossil-fuel plans:

There’s a lot to consider in this resolution, but let’s for the time being focus on the goal of “meeting 100 percent of the power demand in the United States through clean, renewable, and zero-emission energy sources” by 2030. The resolution is light on fiscal details, so let’s consider the question of how achieving this goal would cost.

As it happens, a team of Stanford engineers led by Mark Jacobson outlined just such a plan back in 2015. Jacobson’s repowering plan would involve installing 335,000 onshore wind turbines; 154,000 offshore wind turbines; 75 million residential photovoltaic systems; 2.75 million commercial photovoltaic systems; 46,000 utility-scale photovoltaic facilities; 3,600 concentrated solar power facilities with onsite heat storage; and an extensive array of underground thermal storage facilities.

Assuming steep declines in the costs of each form of renewable electric power generation, just running the electrical grid using only renewable power would still cost roughly $7 trillion by 2030. The Information Technology and Innovation Foundation calculated that the total cost of an earlier version of Jacobson’s scheme would amount to $13 trillion. And based on how fast it has taken to install energy generation infrastructure in the past, Jacobson’s repowering plan would require a sustained installation rate that is more than 14 times the U.S. average over the last 55 years and more than six times the peak rate.

The cost — $7 trillion — would be spent to save … how much?

..global warming at or above 2 degrees Celsius beyond preindustrialized levels will cause— (A) mass migration from the regions most affected by climate change; (B) more than $500,000,000,000 in lost annual economic output in the United States by the year 2100;

$500 billion a year isn’t a lot in the context of the US economy. It’s currently around $20 trillion in size, so we’re talking about 2.5% of the economy being lost. But of course we’re also predicting that the economy will grow between now and then. Actually, we think the US economy will be about $100 trillion a year by 2100. So we’re talking about 0.5% of that economy. Or about the change in size of the US economy between September and December last year. Think how much richer we did feel over those few months. And how much poorer we’d be if it hadn’t happened, that growth.

Oh, and to avoid that loss AOC is suggesting that we spend $7 trillion now? That just doesn’t pass the cost benefit test. It doesn’t even pass at the Stern Review’s special discount rate.

Which is, of course, what all the economists have been trying to tell us all about dealing with climate change. Don’t do it by central planning, do it by using market incentives. Have a carbon tax. Don’t try and do it too quickly – William Nordhaus gained his Nobel in part for saying this – but do it more gradually over time. Don’t junk what we’ve got that already works, instead when the normal time comes to replace it then make sure it’s non-carbon emitting. Finally, don’t do it the expensive way, do it the cheap way. For the cheaper we make it to solve it then the more of the problem we’ll solve. You know, humans usually doing less of the expensive things and more of the cheap?

The most bizarre passage in the Green New Deal is the admission that after they've junked every car in America, replaced every power plant, and renovated every single building within the space of a decade, they might not get around to slaughtering all the cows by their deadline.

— Megan McArdle (@asymmetricinfo) February 7, 2019

January 27, 2019

Some reasons to be bearish on Tesla’s future

At Coyote Blog, Warren Meyer climbs back onto one of his favourite hobby horses:

Yes, I am like an addict on Tesla but I find the company absolutely fascinating. Books and HBS case studies will be written on this saga some day (a couple are being written right now but seem to be headed for Musk hagiography rather than a real accounting ala business classics like Barbarians at the Gate or Bad Blood).

I still stand by my past thoughts here, where I predicted in advance of results that 3Q2018 was probably going to be Tesla’s high water mark, and explained the reasons why. I won’t go into them all. There are more than one. But I do want to give an update on one of them, which is the growth and investment story.

First, I want to explain that I have nothing against electric vehicles. I actually have solar panels on my roof and a deposit down on an EV, though it is months away from being available. What Tesla bulls don’t really understand about the short position on Tesla is that most of us don’t hate on the concept — I respect them for really bootstrapping the mass EV market into existence. If they were valued in the market at five or even ten billion dollars, you would not hear a peep out of me. But they are valued (depending on the day, it is a volatile stock) between $55 to $65 billion.

The difference in valuation is entirely due to the charisma and relentless promotion by the 21st century’s PT Barnum — Elon Musk. I used to get super excited by Musk as well, until two things happened. One, he committed what I consider outright fraud in bailing out friends and family by getting Tesla to buy out SolarCity when SolarCity was days or weeks from falling apart. And two, he started talking about things I know about and I realized he was totally full of sh*t. That is a common reaction from people I read about Musk — “I found him totally spellbinding until he was discussing something I am an expert in, and I then realized he was a fraud.”

Elon Musk spins great technology visions. Like Popular Mechanics magazine covers from the sixties and seventies (e.g. a flying RV! a mile long blimp will change logging!) he spins exciting visions that geeky males in particular resonate with. Long time readers will know I identify as one of this tribe — my most lamented two lost products in the marketplace are Omni Magazine and the Firefly TV series. So I see his appeal, but I have also seen his BS — something I think a lot more people have caught on to after his embarrassing Boring Company tunnel reveal.

November 4, 2018

That pesky Supreme court ruling on the Churchill Falls deal

I use the term “pesky” in the headline to avoid being slagged by one or possibly even both of my Newfoundland and Labrador readers … to curry favour with them, I’d need to escalate from somewhere between “ethically doubtful” and “outrageous”, and even that might not capture the essence of anger and resentment at Quebec’s amazingly great deal long-term on cheap hydro-electric power from the Churchill Falls facility. It is, as Wikipedia says, “the second largest hydroelectric plant in North America, with an installed capacity of 5,428 MW”, and thanks to Quebec financing and astute negotiations, most of that output is sold to Quebec at a very small proportion of today’s open market price. Colby Cosh arches an eyebrow over a Supreme Court justice’s lone vote of dissent on the case:

It is my solemn duty to perform one of the important functions of a newspaper columnist: raising one questioning eyebrow. On Friday the Supreme Court issued a judgment in the long battle between Churchill Falls (Labrador) Corp., a subsidiary of Newfoundland and Labrador Hydro, and Hydro-Québec. CFLco is the legal owner of the notorious Churchill Falls Generating Station in the deep interior of Labrador, close to the border with Quebec.

The station was built between 1966 and 1971. Hydro-Québec provided backing when the financing proved difficult for the original owner, an energy exploration consortium called Brinco. This led to the signing of Canada’s most famous lopsided contract: a 1969 deal for Hydro-Québec to receive most of the plant’s output for the next 40 years at a quarter of a cent per kilowatt-hour, followed by 25 more years at one-fifth of a cent. The bargain ends in 2041, at which time CFLco will get full use and disposal of the station’s electricity back.

This has been a heck of a deal for Quebec. It took on the risk of financing and building the station in exchange for receiving the electricity at a low fixed price — one that both sides in the court case agree was reasonable at the time. But it meant that Newfoundland saw no benefit from decades of oil price shocks, from the end of nuke-plant construction in the U.S., or from the increasing market advantage hydroelectricity enjoys while dirtier forms of power generation attract eco-taxation.

It has been maddening for Newfoundland to remain poor while Hydro-Québec grows fat on the profits from a Newfoundland river. Quebec, for its part, has never been completely convinced of the legitimacy of its border with Labrador, and it sees its good fortune as a sort of angelic reward for having to be part of Confederation. The Churchill Falls deal is (quite reasonably) regarded as proof that Quebec’s homegrown industrialists were able to beat resource-exploiting Anglo financiers at their own game. There are thus reasons beyond the bottom line that Quebec has never wanted to renegotiate the Churchill Falls contract. But the bottom line is enough.

October 31, 2018

Premier Ford’s promise to lower electricity rates in Ontario

In the Financial Post, Lawrence Solomon says Doug Ford can’t risk abandoning his promises about Ontario electricity costs, despite his cabinet’s worries about provincial reputation damage:

Ford has every reason to return the power system to some semblance of economic sanity. Ontario is now burdened by some of the highest power rates of any jurisdiction in North America, throwing households into energy poverty and forcing industries to close shop or move to the U.S. The biggest reason by far for the power sector’s dysfunction is its renewables, which account for just seven per cent of Ontario’s electricity output but consume 40 per cent of the above-market fees consumers are forced to provide. Cancelling those contracts would lower residential rates by a whopping 24 per cent, making good on Ford’s promise to aid consumers.

[…]

To date, Ford has stopped renewable developments that haven’t been completed, which will prevent things from getting worse, but he has failed to tear up the egregious contracts of completed developments, which will prevent things from getting better. Based on conversations that I and others have had with government officials, it appears that Ford is inclined to cancel the contracts and honour his signature promise, but he is being thwarted by cabinet colleagues who fear that Ontario’s reputation will take a hit in the business community if they don’t play nice.

Except, there’s nothing nice about betraying a promise to the voters who democratically put you in power in order to avoid pressure from lobby groups who think governments are entitled to hand out sweetheart deals to their favoured cronies. There’s also nothing democratic about it. It is an axiom of parliamentary government that “no government can bind another.”

Canadian governments, including Ontario governments, have in the past torn up odious contracts, including those in the energy sector. When they did, upon passing binding legislation, they were able to reset the terms, offering as little or as much compensation as they wished. Outraged business lobbies’ claims that the reputation of governments would be affected were not borne out. Moreover, such rightings of political wrongs serve the interest of small government and free markets, because businesses have always understood that there’s an inherent risk in contracting with governments that are able to unilaterally rewrite contracts. To overcome that inherent risk, businesses add a risk premium when getting in bed with government, helping to explain the rich contracts the renewables developers demanded. That risk premium acts to make business-to-business dealings more economic than business-to-government dealings.

October 5, 2018

A quick way for Doug Ford to reduce Ontario’s electrical rates

Ross McKitrick, Elmira Aliakbari and Ashley Stedman outline one of the fastest ways for the Ontario government to get Ontario electricity rates back down toward the national average:

The Ford government seems to want to repair Ontario’s electricity market. It recently moved to scrap the Green Energy Act and reportedly plans to eliminate or alter the so-called Fair Hydro Plan.

While these moves will mitigate future price increases, they won’t reduce current electricity prices. In fact, according to a Fraser Institute study being released today, to lower existing prices the government must reduce what’s known as the “Global Adjustment” — an extra charge on electricity. It won’t be easy, but reducing the global adjustment could bring down electricity prices by about 24 per cent.

This would be welcome news for Ontarians, as electricity prices increased 71 per cent from 2008 to 2016, far outpacing electricity-price growth in other provinces.

[…]

Between 2008 and 2017, the GA grew from less than one cent per kilowatt-hour (a common billing unit for energy) to about 10 cents, accounting for the entire increase in Ontario electricity commodity costs over that time. Therefore, the key to lowering power prices in Ontario is to reduce the GA.

In our study, we use reports published by the Ontario Energy Board to breakdown the GA to better understand where the money goes and provide specific recommendations on how to lower electricity prices. We found that the largest component of the GA charge — nearly 40 per cent — funds subsidies paid to renewable energy sources (wind, solar, etc.) under feed-in-tariff contracts, yet these sources only provide seven per cent of Ontario’s power output.

And notably, the GA provides almost 90 per cent of revenue earned by renewable generators, with only 10 per cent coming from actual power sales. This overwhelming reliance on government subsidies (paid by ratepayers) rather than actual electricity sales reveals how distorted the pricing structure has become in Ontario.

September 12, 2018

How Do Light Bulbs Work? | Earth Lab

BBC Earth Lab

Published on 1 Nov 2013James May explains one of the most important inventions to modern life: the lightbulb.

“Subscribe to Earth Lab for more fascinating science videos – http://bit.ly/SubscribeToEarthLab

All the best Earth Lab videos http://bit.ly/EarthLabOriginals

Best of BBC Earth videos http://bit.ly/TheBestOfBBCEarthVideosHere at BBC Earth Lab we answer all your curious questions about science in the world around you. If there’s a question you have that we haven’t yet answered or an experiment you’d like us to try let us know in the comments on any of our videos and it could be answered by one of our Earth Lab experts.