In The Line, Clarke Ries points out the incredibly uncomfortable truth that no matter how the federal government tries to hide it, the carbon tax regime is going to be painful and the pain is going to be absorbed much more by the rural poor than anyone else:

Minister of Environment and Climate Change Steven Guilbeault, 3 February 2020 (when he was Canadian Heritage Minister).

Screencapture from CPAC video.

Consumption taxes are a straightforwardly-effective policy tool. You simply increase the price of the resource you want to see used less and let people adapt to the simulated scarcity via ingenuity, frugality, lifestyle change, repricing their goods and services, etc. The government doesn’t dictate solutions, it lets people find their own. In the process, the consumption tax dispassionately reveals who’s making the most valuable use of that resource.

[…]

So the question remains, who uses a lot of carbon but doesn’t make a lot of money doing it? Who lives in drafty old single-family houses? Who uses archaic methods of keeping those houses warm, like furnaces that run on heating oil? Who has to drive halfway around the world to reach the nearest grocery store and halfway to the moon for the nearest medical clinic? Who’s making that drive in a battered old ride with terrible fuel economy?

The rural poor.

Not the farmers or the ranchers, who mostly make plenty of dough and often know their way around America’s higher-end resort towns, but the rural poor. The kind of people you disproportionately find in Newfoundland outports, eking out a tenuous living as they wait for the cod to return. You know, reliable Liberal voters.

Put another way, a neutrally-applied carbon tax goes after Maritimers first and hardest — forcing them to close shop on their romantic traditional lifestyle and move into apartment blocks in the nearest city, where they’ll earn more for their labour and emit less carbon doing it.

[…]

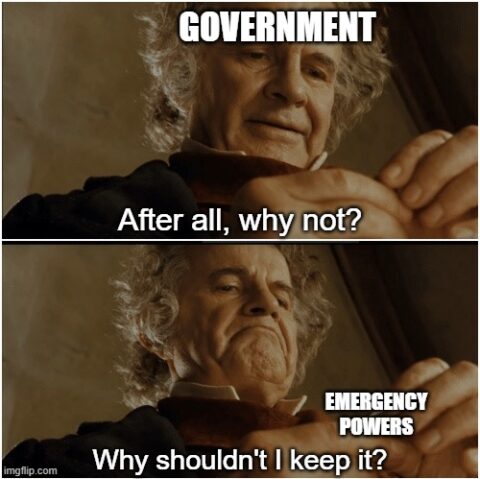

Remember: for the carbon tax to do what it says on the tin, somebody has to lose. For the carbon tax to be anything other than a purposeless pain in the ass, somebody — a lot of somebodies, frankly, if the Liberals are serious about cutting carbon emissions to 40 per cent under 2005 levels — must be forced to make significant and unpleasant lifestyle changes.

So let’s assume the Parliamentary Budget Office is right, and that Atlantic Canadians are now, after a second round of special supplements and exemptions, definitely net beneficiaries of the carbon tax. All it’s bought the Liberals is a reprise of the same question: who’s for dinner?

Who’s going to trade in their beater for bus tickets? Who’s going to raise their kids in a condo tower instead of a single-family home? Who’s going to start taking their midwinter vacation in the province next door instead of Palm Springs or Costa Rica? Who’s going to shiver on a cold night instead of raising the thermostat?

Only the most diehard of optimists could believe that the roster of ritual sacrifices will substantially consist of financially-comfortable Canadians. The people who can afford to make investments that reduce their carbon emissions without materially sacrificing their lifestyles will do so. A handful will start biking to work during the summer. Others will install solar panels on top of their detached houses — which are mostly located in neighbourhoods where you’re not even allowed to build a condo tower — and that’s going to be that.

Beneath all the aspirational language, what an effective carbon tax actually does is throw the government into a cage match with Canada’s working class. The truth behind the Liberals’ woes on this file is that as long as they’re committed to the carbon tax as a tool for fighting climate change, their only real choice is which part of the working class they land on when they come off the top rope.