“How was the mall?” Mom would ask when you got home.

“Eh, it was dead,” you might say.

“What did you do?”

“Nothing.”

Neither was true. Every trip to the mall had a routine. You’d swing by the sausage and cheese store for samples. You’d go to the record store to leaf through the sheaves of albums, nodding at the rock gods’ pictures on the wall, content in the cocoon of your generation’s culture. Head over to Chess King to see if there was something stylish you could wear on a date, if you ever had one; saunter casually into Spencer Gifts to look at the posters in the back, snicker at the naughty gifts, marvel at some electronic thing that cast colored patterns on the wall. Then you’d find a place, maybe by the fountain in the center, and watch the world go past in that agreeably tranquilized state of mall shopping.

Dead? Hardly. Okay, maybe it was the afternoon, low traffic. No movie you really wanted to see, the same stuff in the stores you saw last week. Of course you’d go back tomorrow, because that’s what you did with your friends. You went to the mall.

A dead mall is something else today: a vast dark cavern strewn with trash, stripped of its glitter, its escalators frozen, waiting for the claws to take it apart. The internet abounds with photos taken by surreptitious spelunkers, documenting the last days of once-prosperous malls. We look at these pictures with fascination and sadness. No one said they’d last forever. But there wasn’t any reason to think they wouldn’t. Hanging out as teens, we never thought we’d outlive the mall.

James Lileks, “The Allure of Ruins”, Discourse, 2023-06-12.

September 14, 2023

QotD: Going to “the mall”

September 10, 2023

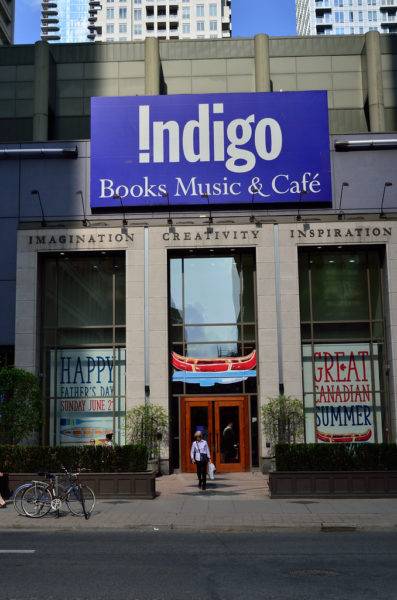

Indigo today … Indigone tomorrow?

In the latest SHuSH newsletter, Ken Whyte discusses the financial woes of Canada’s quasi-monopoly book chain, Indigo after a series of misfortunes:

“Indigo Books and Music” by Open Grid Scheduler / Grid Engine is licensed under CC0 1.0

As we reported in SHuSH 197 and SHuSH 203, Indigo posted a ruinous 2023 (its fiscal year ends March 30), losing $50 million. That came on the heels of more than $270 million in losses the previous four years. The company’s share price, as high as $20 in 2018, has been floating around $1.30 this summer.

That dismal performance spelled the end of founding CEO Heather Reisman’s leadership at the chain. In June, her husband, Onex billionaire Gerry Schwartz, who has been Indigo’s controlling shareholder and chief financial backstop since the company’s launch in 1997, took the reins and elbowed Heather into the ditch along with almost every member of the board of directors who wasn’t beholden to Gerry personally.

The only non-Gerry director to survive was CEO Peter Ruis.

As I said at the time, Peter Ruis, “a career fashion retailer who landed in this jackpot from England two years ago”, is either “polishing his resume as we speak or negotiating a massive retention bonus to stick around and wield an axe on Gerry’s behalf. My money is on polishing.”

[…]

Meanwhile, I’m hearing that everyone in the publishing industry is being slammed with returns. Publishers usually get a lot of books back from retailers in the first quarter of the year as stores send back unsold inventory from the holiday season. This year, the returns were slower to start, probably because of Indigo’s cyberattack last fall, but they have kept coming right through the second and third quarters. This is coupled with lighter than usual buying for the fall.

The firm’s releases continue to claim that Indigo will keep books at its core, even as it loads its shelves with brass cutlery, dildos, and pizza ovens. According to Google, the core of an apple represents 25 percent of its weight. Books are now less than 50% of Indigone, suggesting more returns and light orders to come.

One final note. I corresponded this morning with a giant of Canadian businessman who has no special insight into the Indigo situation although he’s kept up with the news and, like everyone in Toronto commercial circles, he’s familiar with the Schwartz-Reismans.

He wonders just how involved Gerry is with Indigo these days. Apparently his health is not good. And while he’s still the lead shareholder at Onex, he’s no longer CEO and may not have access to the hordes of ultra-bright hirelings and menials that have long surrounded him.

My friend writes: “My guess is that suppliers are going to start to halt shipping and that a financial crisis is imminent, despite [Gerry’s] line of credit. But I don’t know anything.”

June 24, 2023

“… every time I see some fine new supercluster-aspirational buzzword-laden legislative boondoggle coming from our federal government I know that my life is going to get worse in some minor, petty, and yet measurable way”

Jen Gerson is irked by the federal government’s latest petty diktat to “save the planet” from single-use plastic bags that bans the use of bags that are not made of plastic:

Those who follow my work will know that I am an unreformed Calgary evangelist. I like this city for a lot of reasons, but one of them is that I’m a member of the Calgary CO-OP, a chain of local grocery stores. For those who are lucky enough to enjoy something like this, a co-op offers particular advantages over their conventional counterparts; we get a small share of the profits that the chain earns every year, for example. The stores stock local produce, meats, grain, and processed foods from Calgary-based suppliers, and from nearby farms. CO-OP also provides a number of top-notch house brand supplies. National chains are simply not as nimble, nor as local. They can’t be.

But I admit that one of the things I enjoy most about CO-OP is its green grocery bags. When stores across Canada began to phase out the use of single-use plastic bags, I was despondent. The environmental rationale for the ban was thin, but mostly I was annoyed because I’m chronically disorganized and can never remember to bring reusable bags.

So when CO-OP replaced plastic bags with a fully compostable alternative, I was delighted. Granted, we would have to pay a small fee to purchase these bags, but the per-unit cost was actually less than what we would normally spend on a box of Glad compost-bin liners. So it all evened out.

To make matters even better, unlike paper straws, the compostable bags are superior to their plastic alternatives. CO-OP advertises this point on their site: “They are stronger than a plastic checkout bag. You can carry a medium-size turkey or three bottles of wine with no problem.”

I can also attest to this. The bags are an absolute win for everybody involved.

So when I discovered on Thursday that Ottawa plans to ban these items, considering them a “single-use plastic”, I lost my goddamn mind.

Not only will this represent a small inconvenience for me and my family, but it is also one of the laziest, most idiotic decisions issued from this remote, non-responsive federal government I have yet to encounter.

The bags do not contain plastic.

Let me say that again, because apparently the sound of western voices doesn’t quite travel all the way to the the slower bureaucrats in the back: “THE BAGS DO NOT CONTAIN PLASTIC”. You fucking muppets.

[…]

Look, Ottawa, are you there? Are any of you listening, or am I just screaming into the void? For the sake of the entire country, I hope, I pray that there is somebody with an IQ above 92 capable of not just reading this desperate missive, but of really, truly understanding it.

This shit — this, right here.

This. Shit.

This is why we hate you.

This is why we fucking hate you.

Nobody outside the Toronto-Ottawa-Montreal triangle sees a headline like “New Initiative from Ottawa!” and thinks: “Oh, how exciting. I’m so keen to see what grand notion those crafty MPs in Ottawa have cooked up now! Come, Maude, let us settle ourselves before the The National at Six so we can understand how our fine federal government is working to make our lives better.”

Nobody does that. Because every time I see some fine new supercluster-aspirational buzzword-laden legislative boondoggle coming from our federal government I know that my life is going to get worse in some minor, petty, and yet measurable way.

June 12, 2023

“The more recent four or five years at Indigo have been a disastrophe”

In the latest SHuSH newsletter, Ken Whyte outlines the rise and fall of Canada’s biggest bookstore chain that stopped trying to be a bookstore chain and now appears to be looking for a new identity to assume in the wake of several board resignations and the announced resignation of Heather Reisman, the founder and public face of the chain:

“Indigo Books and Music” by Open Grid Scheduler / Grid Engine is licensed under CC0 1.0

Indigo opened its first bookstore in Burlington in 1997 and quickly expanded across the country in competition with the Chapters chain, which it bought in 2001. Heather’s husband, Gerry Schwartz, provided much of the financing in these years. Gerry is the controlling shareholder of Onex, a private equity firm that now has about $50 billion in assets under management.

Influential in Ottawa, the Schwartz-Reismans managed to convince the federal government to approve Indigo’s purchase of Chapters and also keep the US book chain Borders from moving north into Canada — a double play that cleared the field of meaningful competition and wouldn’t have happened in a country with serious antitrust enforcement.

Heather, as Indigo CEO, cast herself as the queen of Canadian literature, making personal selections of books to her customers, hosting book launches, interviewing celebrity authors, etc.

From a financial perspective, Indigo took about five years to get rolling after the Chapters acquisition. It looked steady through the late aughts and into the teens when Amazon showed up in force. Indigo’s share price caved. Unable to convince Ottawa to push Amazon back across the border, Heather adopted a new strategy, backing out of books and recasting Indigo as a general merchandiser selling cheeseboards, candles, blankets, and a lot of other crap to thirtyish women. “We built a wonderful connection with our customers in the book business,” she famously said. “Then, organically, certain products became less relevant and others were opportunities.” This charmed investors, if not the book community, and Indigo’s share price hit a high of $20 a share in 2018. By then, books, as a share of revenue, had fallen from 80 percent of revenue to below 60 percent (they are now 46 percent).

The more recent four or five years at Indigo have been a disastrophe. With its eighty-eight superstores and eighty-five small-format stores, the company lost $37 million in 2019, $185 million in 2020, and $57 million in 2021. Things looked somewhat better in 2022 with a $3 million profit, but its first three quarters of 2023 (Indigo has a March 28 year-end) resulted in an $8 million loss and its fourth quarter featured one of the most spectacular cyberhacks in Canadian commercial history. The company’s website was breached and its employment records held for ransom, resulting in a ten-day blackout for all of the company’s payment systems and a month-long outage in online sales. The share price is now $2.00 or one tenth the 2018 high.

ANALYSIS AND IRRESPONSIBLE SPECULATION

Given everything Indigo has been through over the last several years, and especially the last several months, it’s not surprising that Heather wants to pack it in. She’s seventy-four and super wealthy. There’s nothing but a desperately hard slog ahead for her money-losing company. Why stay?

Still, this has the feel of something that blew up at a board meeting, or in advance of a board meeting. It’s highly irregular for a company to lose almost half its directors in a single day. If these changes had been approached in conventional fashion, there would have been more in the way of messaging and positioning, especially regarding Heather. For all intents and purposes, she is Indigo. It wouldn’t exist without her. They ought to be throwing her a retirement parade and presenting her with a golden cheeseboard. Instead, all she’s getting, for now, are a few cliches in a terse press release.

It’s also weird that this all happened days before we get the company’s year-end results (they were out by this time last year). My guess is that the board got a preview, that the picture is ugly, that there are big changes afoot, and that the directors were nudged out as the start of a major retrenchment or given the option of sticking around for a bloodbath and chose instead to exit.

January 14, 2023

More on the Barnes & Noble turnaround

In the latest SHuSH newsletter, Ken Whyte looks at the Barnes & Noble recovery story (discussed a couple of weeks back):

“Barnes & Noble Book Store” by JeepersMedia is licensed under CC BY 2.0 .

Back in 2018, the bookselling chain was losing $18 million a year. It had just fired 1,800 full-time employees. About 150 stores had been closed, leaving the company with 600. It had lost its fourth CEO in five years, this one to a sexual-harassment charge. The firm’s big digital initiative, the Nook e-reader, was a flop. The share price was down 80 percent.

Not only was the business failing: it was demoralized. As the writer Ted Gioia noted in a recent newsletter, B&N had lost faith in the public’s willingness to buy books from anyone but Amazon. Its leadership “shifted a huge portion of its floorspace to peddling toys, greeting cards, calendars, and various tchotchkes”. It doubled down on in-store cafes and even tried launching freestanding Barnes & Noble restaurants.

Just when it seemed B&N was certain to follow the path of its former competitor, the Borders chain, which closed in 2011, it was purchased for $638 million (US) by Elliott Advisors, a hedge fund.

SHuSH has been skeptical about the record of hedge funds in the cultural space. We are also skeptical of hedge funds in the retail space where they have a well-established record of buying chains, slashing costs, and driving them into the ground: Sears, Toys R Us, Payless Shoes, Radio Shack, Aeropostale, Sports Authority, etc.

Elliott Advisors is an exception.

The UK based-firm has a demonstrated commitment to bookselling (at least in the medium term — more on this later). It bought the Waterstones chain in 2018. Waterstones and its 283 stores had been rescued from near-bankruptcy in 2011 by lifelong bookseller James Daunt and a Russian backer. Elliott kept Daunt at the helm and a year later bought Barnes & Noble and added this second chain to his responsibilities.

Daunt acknowledged that Barnes & Noble was in rough shape when acquired by Elliott. Its stores were “crucifyingly boring”. But he was confident the chain could be turned around. There was no template or magic ingredient, he said. It was a simple matter of “running really nice bookshops”. To that end, he gives his stores unusual autonomy to develop their own personalities and tailor their stock to the interests of their communities.

Barnes & Noble stores have since dropped most of their crap: they no longer look like big-box flea markets. They’ve quit accepting payments from the major publishers to put their books on display, a practice that brought B&N revenue but left publishers in charge of what customers saw when they walked into stores. Local managers now decide how their books are presented based on what they think will appeal to their customers.

The company used the COVID lockdown to freshen up its dowdy stores. Managers were instructed to take every single book off the shelves and “weed out the rubbish”. Walls were painted, aged carpet replaced, furnishings upgraded. The result is a much improved browsing experience. Readers like to browse.

There were hard decisions, too. Daunt cut the B&N head office staff in half and shed about 5,000 of 30,000 employees.

All in all, it worked. Last spring, The New York Times reported that sales were up and costs were down at Barnes & Noble and that “the same people who for decades saw the superchain as a supervillain are celebrating its success. In the past, the book-selling empire, with 600 outposts across all 50 states, was seen by many readers, writers and book lovers as strong-arming publishers and gobbling up independent stores in its quest for market share … Today, virtually the entire publishing industry is rooting for Barnes & Noble — including most independent booksellers. Its unique role in the book ecosystem, where it helps readers discover new titles and publishers stay invested in physical stores, makes it an essential anchor in a world upended by online sales and a much larger player: Amazon.”

There are not a lot of reliable financial numbers available on Barnes & Noble because it is no longer a public company, but it reports that its 2021 sales in were up 3 percent over pre-pandemic times. Most importantly, sales of books were up 14 percent.

December 30, 2022

Barnes & Noble used to be like an even more boring Indigo … but they’ve been turned around

Back when my job required more travel, one of the things I used to look forward to was visiting US bookstores, as they always had a wider and more interesting stock than our staid Canadian equivalents. Over time, the interesting local bookstores got harder and harder to find as the big box stores like Borders and Barnes & Noble took over much of their customer base. Of the two, I much preferred going into a Borders store, as they had better stock than B&N and the staff seemed friendlier and (generally) more helpful to clueless foreigners like me. Borders went under around the same time my business travels to the US tapered off and it looked like it was only a matter of time for B&N to follow it into bankruptcy. Even if it struggled on, surely the pandemic killed off what Amazon left behind? Ted Gioia says not so fast:

“Barnes & Noble Book Store” by JeepersMedia is licensed under CC BY 2.0 .

But Barnes & Noble is flourishing. After a long decline, the company is profitable and growing again — and last week announced plans to open 30 new stores. In some instances, they are taking over locations where Amazon tried (and failed) to operate bookstores.

Amazon seems invincible. So the idea that Barnes & Noble can succeed where its much larger competitor failed is hard to believe. But the turnaround at B&N is real. In many instances they have already re-opened in locations where they previously shut down.

Barnes & Noble tried exactly the same sort of “re-imagining” of their stores that Canada’s Indigo chain is currently floundering with: cutting back on the floorspace devoted to books in favour of throw cushions, candles, decorations, bath salts, scarfs and towels. It worked just as badly for B&N as it is working for Indigo: it chases out the primary customer base (book-buyers) in favour of bored people looking to waste away an hour or two just browsing tchotchkes. (And if you can find an Indigo staff member to ask about a particular book, they almost always assure you that you can find it on their website, which I’m sure helps bring more people into the store …) In desperation, B&N looked to expand into a very different market:

… in a bizarre strategic move, the company decided to launch freestanding restaurants under the name Barnes & Noble Kitchen — no books, just meals. But this was another disaster.

The company chairman Leonard Riggio eventually admitted, in September 2018, that running a restaurant is “a lot harder than you think it is … The bottom line is awful.”

Given the incredibly short and profitless life of most start-up restaurants, that really does qualify as a “No shit, Sherlock” moment. So how did Barnes & Noble turn things around?

It’s amazing how much difference a new boss can make.

I’ve seen that firsthand so many times. I now have a rule of thumb: “There is no substitute for good decisions at the top — and no remedy for stupid ones.”

It’s really that simple. When the CEO makes foolish blunders, all the wisdom and hard work of everyone else in the company is insufficient to compensate. You only fix these problems by starting at the top.

In the case of Barnes & Noble, the new boss was named James Daunt. And he had already turned around Waterstones, a struggling book retailing chain in Britain.

Bringing in fresh blood can be a life-saver for a business, but we also have that expression about deck chairs on the Titanic in common business parlance, so just being “new” isn’t enough … new leaders must also bring new approaches and fresh ideas:

But the most amazing thing Daunt did at Waterstones was this: He refused to take any promotional money from publishers.

This seemed stark raving mad. But Daunt had a reason. Publishers give you promotional money in exchange for purchase commitments and prominent placement — but once you take the cash, you’ve made your deal with the devil. You now must put stacks of the promoted books in the most visible parts of the store, and sell them like they’re the holy script of some new cure-all creed.

Those promoted books are the first things you see when you walk by the window. They welcome you when you step inside the front door. They wink at you again next to the checkout counter.

Leaked emails show ridiculous deals. Publishers give discounts and thousands of dollars in marketing support, but the store must buy a boatload of copies — even if the book sucks and demand is weak — and push them as aggressively as possible.

Publishers do this in order to force-feed a book on to the bestseller list, using the brute force of marketing money to drive sales. If you flog that bad boy ruthlessly enough, it might compensate for the inferiority of the book itself. Booksellers, for their part, sweep up the promo cash, and maybe even get a discount that allows them to under-price Amazon.

Everybody wins. Except maybe the reader.

Daunt refused to play this game. He wanted to put the best books in the window. He wanted to display the most exciting books by the front door. Even more amazing, he let the people working in the stores make these decisions.

This is James Daunt’s super power: He loves books.

“Staff are now in control of their own shops”, he explained. “Hopefully they’re enjoying their work more. They’re creating something very different in each store.”

This crazy strategy proved so successful at Waterstones, that returns fell almost to zero — 97% of the books placed on the shelves were purchased by customers. That’s an amazing figure in the book business.

On the basis of this success, Daunt was put in charge of Barnes & Noble in August 2019. But could he really bring that dinosaur, on the brink of extinction, back to life?

December 12, 2022

The “masher” in US towns and cities

Virginia Postrel wrote an article for the Wall Street Journal on how changes in US retailing in the late 19th century helped women achieve more equal status with men (non-paywalled here). Some interesting parts had to be cut for space reasons, so she’s posted them on her Substack:

As I write in the essay, urban department stores helped to liberate women:

Urban shopping districts were where women claimed the right to dine outside their homes, walk unescorted and take public transportation without loss of reputation. Thousands of female sales clerks flowed out of stores in the evenings, when downtowns had previously been male territory. Department stores provided ladies’ rooms that gave women places to use the toilet and refresh their hair and clothing. They offered female-friendly tearooms. Directly and indirectly, modern shopping enlarged women’s public role.

But as “respectable” women claimed their right to public space, they also attracted unwanted male attention:

It also made sexual harassment a more prominent issue. Men known as “mashers” gathered in shopping districts to ogle and chat up women. Some were no more than well-dressed flirts, violating Victorian norms in ways that few today would find objectionable. Many contented themselves with what an outraged clubwoman termed “merciless glances”. Others followed, catcalled and in some cases fondled women as they strolled between stores, paused to look in windows or waited for trams.

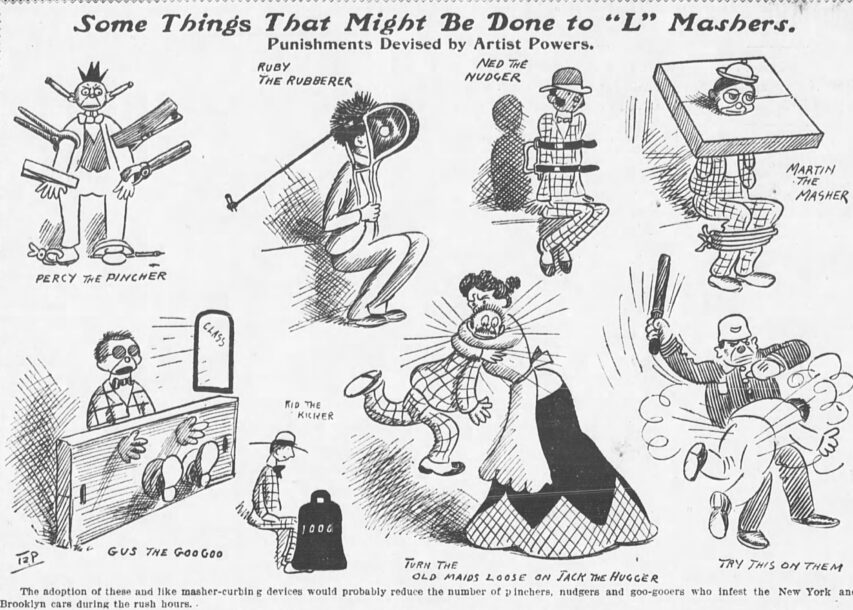

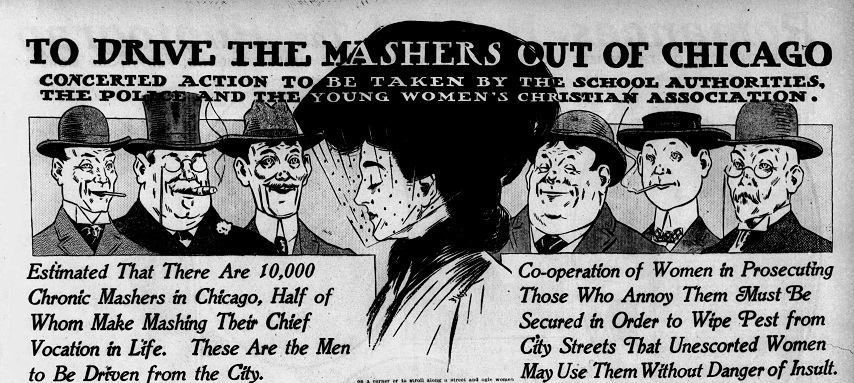

This cartoon from the October 30, 1902 New York Evening World gives some idea of the public outrage toward “mashers”, in this case on streetcars.

Mores were in flux. By old-fashioned standards, everything from a friendly smile or conversation starter to stalking and groping was an insult to a woman’s virtue. Newspapers launched anti-masher crusades and prominent women demanded stricter law enforcement and stern punishment.

“No other feature of city life offers so many opportunities for making life a burden to the woman who for any reason must go about the city alone or with a woman companion,” opined the Chicago Tribune in 1907, leading a crusade against mashers. Outraged society ladies called for hard labor or public flogging as punishment. “Ogling is just as disgusting and offensive to a good woman as any other mode of attack,” declared the president of the Chicago Women’s Club.

When the Chicago police chief suggested that women avoid harassment by staying home and limiting their time in stores, he was roundly denounced by prominent women, business interests and civic leaders. A clergyman declared it “humiliating … that the authorities responsible for the maintenance of public order should feel themselves compelled to refuse the right of the road to any of the city’s citizens.” Americans increasingly assumed that women deserved the same freedom as men to move about in public — a freedom in which retailers and their suppliers had a large economic stake.

But there’s a darker side to the story that didn’t make it into the essay’s published version. The crusade against mashers, while based on a real problem, had a strong element of moral panic.

In Chicago, where the police chief was soon out of office, police won the power to arrest vagrants, including mashers, without warrants and to seek punishment by hard labor rather than fines. Crusading newspapers didn’t give mashers a chance to defend themselves. Nor did they report on the wrongly accused. In the same era that society women were calling for mashers to be publicly whipped, lynching reached its peak — often sparked by the allegation of masher-type offenses that crossed color lines.

Giving police broad powers to arrest men who made shoppers uncomfortable was an extreme solution. (Many women declined to testify in court, so prosecutions were spotty.) It did help to make streets safer for women, but so did a shift in mores that more clearly distinguished between flirtation and assault.

July 5, 2022

Dijon mustard … made from Canadian and Ukrainian mustard seeds

In the New English Review, Theodore Dalrymple explains why Europeans have been experiencing higher shelf prices and shortages for Dijon mustard recently, over and above the ordinary supply chain disruptions of the pandemic years we’ve all had to get used to:

Among myriad smaller consequences of that war is an acute mustard shortage in France. Mustard has all but disappeared from supermarket shelves, having first increased in price dramatically. This has surprised everyone who lazily assumed that Dijon mustard came from Dijon. Why should a war waged in Ukraine lead to the disappearance of mustard throughout France? After all, the famous brands, familiar to everyone, proudly announce on their labels that they are Dijon mustard. Can there be anything more French than Dijon mustard?

Perhaps the mustard is elaborated in Dijon, but the mustard seed, it turns out to everyone’s surprise, is imported from Canada and Ukraine. Apparently, Canada has seen a disastrous harvest of mustard seed, while there is no need to explain the shortage in Ukraine. Dijon mustard is about as local to Dijon as a modern soccer team is local to the city in which it has its stadium.

What is striking about this mustard crisis, unimportant except to those trying to make a proper vinaigrette or lapin à la moutarde, is its revelation of a perennial aspect of social psychology: namely, a resort to conspiracy theory. For some say that there is not really any mustard shortage at all — that mustard has disappeared from supermarket shelves because the supermarket chains are hoarding it, that they have a plentiful supply in their warehouses and will release it little by little, thereby profiteering by the resultant high prices. The war in Ukraine is only a pretext.

This is an old, indeed medieval, trope in times of shortage. There may well have been times, of course, when people really did hoard for the purposes of profiteering, but people rarely hoard something that is in abundant supply.

Yet many people require no evidence or proof to believe in the hoarding story. Does it not, after all, stand to reason? Do not merchants try to maximize their profits, and is hoarding not an easy way to do so? Practically all the mustard in France is sold in supermarkets — themselves a cartel that could easily agree to remove the product from the shelves. Surely no further evidence is needed.

May 12, 2022

Too many cannabis retailers? “… a scrappy band of politicians is coming together to save main street from the excesses of the free market”

Steve Lafleur points out that the temporary surplus of cannabis stores will inevitably self-correct, as most retail situations tend to do on their own without needing the “helpful” hand of government to intervene:

Lately there has been a moral panic brewing in Toronto about the number of marijuana stores in Toronto. Take this New York Times article, for example, which captures the mood with the quotes from various Torontonians. Or this BlogTO piece. And here is a link to a story about two city councilors (including my own) pushing for a moratorium on new pot shops.

At least on its face, the panic hasn’t been about the availability of cannabis products or any kind of (unsupported) claims about pot shops attracting crime. Rather, the concern is that there is simply an unsustainable number of shops that may be cannibalizing other retail opportunities. So a scrappy band of politicians is coming together to save main street from the excesses of the free market.

What could possibly go wrong?

The boom in pot shops is real. Legal marijuana retailing is a new phenomenon, and there has been a gold rush in the sector. This was first evident in financial markets during the 2018-19 weed stock boom (which went bust) as investors sought to capitalize on the rollout of legal marijuana sales in Canada. There are now nearly 2,000 pot shops in Ontario, and it’s not hard to find two on the same block. People aren’t wrong to point out that there has been a rapid buildout of marijuana retailers. Hence the push by City Council and now the Ontario Liberal Party, to restrict clustering of pot shops.

To be sure, new trends can push out old trends. And this can be frustrating. For instance, one insidious trend recently replaced two of my two favourite hole-in-the-wall restaurants: poke bowls. The trendy Hawaiian rice bowls have taken cities by storm. Businesses, understandably, want to capitalize on the trend. If people want it, businesses will sell it.

Trends can create dislocations. No one knows in advance how many poke restaurants — or pot shops — the market will bear, where they should locate, or what their operating hours should be. But through a process of trial and error, retailers and consumers will figure this out. And if it is just a flash in the pan trend, many will fail.

But that’s okay. That’s just the creative destruction of the market at work. It’s not always pretty, but it’s how we get new products and services. It’s a process. Sometimes the market rewards annoying things. But trying any effort to plan these things in a way that avoids over-saturation of short-lived trendy businesses would be rife with unintended consequences.

February 28, 2022

Hunting for books in the age of Amazon

In the latest SHuSH newsletter, Kenneth Whyte remembers book searches before the internet got commercial:

“Beat Ground Zero San Francisco 2014” by Mobilus In Mobili is licensed under

Back in the late twentieth century, I used to build my vacations around book searches. Before going to any new town, I’d make a list of new and used bookstores and hit the best of them during my stay. There was a genuine excitement about entering each store: you never knew what you were going to find, and you were acutely aware that at any moment you might see something you’d never seen before or something you might never see again.

It was especially the fear of blowing that one chance of acquiring something special that turned me into a book hoarder. (I was never disciplined enough to be a collector; I only bought for my own use). Over the years, I accumulated tens of thousands of books. I’d rummage through them, once or twice a decade, and throw out the ones that no longer interested me to make room for new acquisitions. There were always new acquisitions, whether I was traveling or not.

Then came the internet and suddenly the whole concept of book scarcity blew up. Amazon had every new title one could want. I still go to my favorite bookstores when I travel — Daunt’s in London, Prairie Lights in Iowa City, Three Lives & Co. in Manhattan (the world’s most perfect small bookstore), Politics & Prose in DC, City Lights in San Francisco, The Last Bookstore in LA (further below), to name a few. I make the visits (none in the past two years) in part out of a sense of nostalgia for the waning era of brick-and-mortar, and also because well-curated shops often suggest books I might otherwise overlook.

Looking for books on vacation was always one of my habits, and before Amazon came along, I’d carefully search for bookstores along the route we’d be driving during our holiday and I rarely came back without a few armfuls of books. These days, especially since the era of lockdowns began, book stores are mostly just a memory … which is just as well in some sense because I have no disposable cash to spend on fripperies any more.

Of Ken’s list of favourite stores, I’ve only visited City Lights in San Francisco, back in early 1991. It was, bar none, the busiest bookstore I’d ever been in in my life. It rather felt like a record store (remember those?) on a big album release weekend than a staid, stodgy bookstore.

The internet also allowed used bookstores to put their wares online, and Bookfinder.com came along to organize their inventories. Bookfinder.com is a meta-search portal that allows book shoppers to scan the inventories of 100,000 booksellers at once. Type in a title and it will cough up an array of purchasing options: new, used, good condition, poor condition, former library copy, first edition, signed, etc. You compare editions and prices, make your choice, and click through to the bookseller’s site to finalize your purchase.

Bookfinder was launched by a Berkeley student named Anirvan Chatterjee in 1997, just a couple of years after Amazon was born. Chatterjee sold out to AbeBooks in 2005.

AbeBooks is a Canadian tech success story, originally operated out of Victoria by Rick & Vivian Pura and Keith & Cathy Waters. It is a digital marketplace that allows you to search the stock of a wide variety of established retailers. What differentiates it from Bookfinder is that you make your purchase right on the AbeBooks site. AbeBooks also sells the books it represents on other platforms, including eBay, Barnes & Noble, and Amazon. AbeBooks, in short, is a retail business while Bookfinder is a search tool.

AbeBooks was a dangerous discovery for me, and I bought a lot of books through them for a couple of years after discovering the service. Today, of course, not so much, especially as the shipping charges frequently run higher than the initial purchase price of the books themselves. Initially an independent service, AbeBooks is now owned by Amazon.

These days a lot of people want to shop for books anywhere but Amazon or its subsidiaries. For a non-Amazon version of AbeBooks you might try Alibris, founded by Martin Manley in California in 1997 (it’s been passed around to a range of venture capitalists and holding companies and is now in the hands of private investors). Biblio.com is another marketplace, serving mostly collectors. For non-Amazon alternatives to Bookfinder, viaLibri is a slick search tool that I only recently discovered, although it’s not quite as comprehensive as Bookfinder. Bookgilt is a good meta-search site for antiquarian and rare books. For new books, the best alternative to Bezos is your local bookstore, which can get you almost anything you need. See the map at the very bottom of this page or go to Bookshop.org or Indiebound.org. Or you can visit one of the chains, Chapters/Indigo or Barnes & Noble.

I still start most of my used book searches on Bookfinder. It’s old technology, Web 1.0, as hopelessly dated as the Drudge Report, but it works. I find it easy to navigate and it offers far more listings (and more information on each listing) than Amazon. I order from its smaller independents whenever practicable, although it’s often difficult to know exactly who you’re ordering from because the smaller shops are frequently represented on Bookfinder by their resellers, AbeBooks, Alibris, Amazon, and Biblio.

January 30, 2022

“I stand corrected. All retail sucks, not just book retail”

Following up to the issue of book store-to-publisher returns last week (here), Kenneth Whyte discovered that other retailers are not that different from the book business after all:

“Indigo Books and Music” by Open Grid Scheduler / Grid Engine is licensed under CC0 1.0

Last week I wrote about the horrible, wasteful publishing-wide policy of booksellers returning unsold books for full refunds rather than putting them on sale. Some 30 percent of books in stores are sent back to publishers who bury, pulp, or remainder them. I compared this practice to other retail sectors:

If I were in the ugly sweater business, I’d sell 500 ugly sweaters to Saks at $200-a-piece. Saks pays me 500x$200=$100,000, marks the ugly sweaters up to $500, and lays them out on tidy glass shelves under track lighting. Whatever is left after the Christmas season is marked down to half price on crowded sales racks. If Saks still has some ugly sweaters in January, it will ship them to the outlet store where they’re offered at still greater discounts.

Our friend, author and regular SHuSH reader Ken McGoogan, sent my comments to a mature student he teaches. She comes from the fashion industry and says it’s not so simple:

The reality is, if Saks cannot sell that ugly sweater, they will ask for mark-down money from the brand (the wholesaler) who sold them that ugly sweater. If the brand is not willing to give Saks that mark-down money, they will never carry anything from the brand again. Is mark-down money better than returns? Honestly, it’s not that much better. The amount of the mark-down money is an often shocking figure. And this is not just for Saks, all big retailers do it, without exception.

Barnes & Noble or Chapters are just like department stores. The business model is the same. The only thing is, if the readers found out how much waste the book returns are generating every year, it’ll be a big turn off for the customers. They’d rather force themselves to read e-books or audio books than be part of the wasteful culture. Especially for the younger generation, they are buying less garments because of the fashion industry’s wasteful level. Fyi, a lot of new clothes and unsold inventories are burned every year as they are running out of storage spaces.

I stand corrected. All retail sucks, not just book retail. And the book industry had better sort this out before the aforementioned younger generation begins to focus on it.

January 23, 2022

The oddity of the bookselling business

Unlike so many other retail operations, book stores have a different sales cycle because they can generally return unsold books (in good condition) to the publisher for a full refund. This means that 30% or more of the books on the shelf at Christmas will be shipped back to the publisher early in the new year, only to appear again on the discount shelves a year or two later for a fraction of the original retail price (and often in rather worse shape for all the additional handling). In the latest SHuSH newsletter, Kennethy Whyte calls this the worst problem in book publishing:

“Indigo Books and Music” by Open Grid Scheduler / Grid Engine is licensed under CC0 1.0

Book publishing doesn’t work like most other retail businesses. If I were in the ugly sweater business, I’d sell 500 ugly sweaters to Saks at $200-a-piece. Saks pays me 500x$200=$100,000, marks the ugly sweaters up to $500, and lays them out on tidy glass shelves under track lighting. Whatever is left after the Christmas season is marked down to half price on crowded sales racks. If Saks still has some ugly sweaters in January, it will ship them to the outlet store where they’re offered at still greater discounts.

What happens to them if they don’t sell at the outlet doesn’t interest me because I’ve got my $100,000. If Saks ordered far too many ugly sweaters, that’s Saks’ problem.

In the book world, I sell 1,000 copies of a book to a retail chain like Barnes & Indigo for $15-a-piece, half the retail price. Barnes & Indigo pays me 1,000x$15=$15,000 and maybe puts some of the books on a front table, or maybe buries them on a bottom shelf in the darkest corner of the store. I might sell a two hundred, four hundred, or six hundred copies.

Let’s be generous and say 600 sell at Barnes & Indigo through the autumn and over the holidays. Come January, the store doesn’t put the remaining stock on sale: it packs up the unsold 400 and ships them back to me for a full refund. The 400 returns, or at least those of them that aren’t crumpled or coffee-stained, go back into the warehouse, which charges me fees to process the returns and more fees to store them. Sometime later, I get a notice of the returns and regret that extra glass of wine I ordered at dinner the night I thought I sold Barnes & Indigo $15,000 worth of books when, in fact, I only sold $9,000 worth of books, perhaps leaving me under-water on that particular title. I also regret boasting of the $15,000 sale to the author, who probably did some royalty math in his head and thought he was getting 40% more than he’ll actually receive.

Returns at publishing houses run somewhere between 25% and 30% annually, across all titles. That’s despite Amazon with its ruthlessly efficient algorithms seldom buying many more copies than it needs, and despite ebooks and audiobooks (which amount to a quarter of sales for many publishers) having almost zero returns.

Millions of books are returned to publishers at this time of year. Sales are slower in January and February, so bookstores hurriedly return all their remaining holiday-season stock and whatever else hasn’t moved to keep themselves in cash. Some of the returns go back into storage. Eventually, most are remaindered, or pulped, or buried. It’s a colossal waste of paper and ink, a headache in terms of shipping/handling/accounting, and dispiriting as heck. You might think you had a great year, hit all your sales targets, exceeded them, even, and then in about the third week of January begins the drip drip drip of returns, and it continues steadily through March. That’s if you’re lucky and it’s drips, not waves. And while the returns are concentrated in the first quarter, your books are returnable year-round, so even a pleasant summer afternoon can be ruined by the unexpected arrival of a pallet of unwanted stock.

December 26, 2021

QotD: Boxing Week Sales

I’ve done a few tours of duty behind a cash register. The job takes your soul, twists it like a wet chamois and runs it through the shredders they use to turn car hoods into tinfoil strips. […] When I lived out east, the relationship between cashier and customer was the same as that between a German gunner and the troops disembarking at Normandy.

James Lileks, “Backfence: Beyond new store’s hype, genuine smiles”, Minneapolis Star Tribune, 2004-08-03.

August 14, 2021

Great Moments in Unintended Consequences (Vol. 3)

ReasonTV

Published 7 May 2021Good intentions, bad results.

——————

Follow us on Twitter: https://twitter.com/reasonReason is the planet’s leading source of news, politics, and culture from a libertarian perspective. Go to reason.com for a point of view you won’t get from legacy media and old left-right opinion magazines.

—————-Window Wealth

The Year: 1696

The Problem: Britain needs money.The Solution: Tax windows! A residence’s number of windows increases with relative wealth and is easily observed and verified from afar. A perfect revenue generator is born!

Sounds like a great idea! With the best of intentions. What could possibly go wrong?

To avoid higher taxes, houses were built with fewer windows, and existing windows were bricked up. Tenements were charged as single dwellings, putting them in a higher tax bracket, which then led to rising rents or windowless apartments. The lack of ventilation and sunlight led to greater disease prevalence, stunted growth, and one rather irate Charles Dickens.

It took more than 150 years for politicians to see the error of their ways — perhaps because their view was blocked by bricks.

Loonie Ladies

The Year: 1992

The Problem: Nude dancing is degrading to women and ruining the moral fabric of Alberta, Canada.The Solution: Establish a one-meter buffer zone between patrons and dancers.

Sounds like total buzzkill! With puritanical intentions. What could possibly go wrong?

It turns out that dancers earn most of their money in the form of tips, and dollar bills don’t fly through the air very well. Thus, the measure designed to protect dancers from degrading treatment resulted in “the loonie toss” — a creepy ritual where naked women are pelted with Canadian one-dollar coins, which are known as loonies.

Way to make the ladies feel special, Alberta.

Gallant Grocers

The Year: 2021

The Problem: Local bureaucrats need to look like they care.The Solution: Mandate that grocery stores provide “hero pay” to their workers.

Sounds like a great idea! With the best of intentions. What could possibly go wrong?

Besides the fact that these ordinances may preempt federal labor and equal protection laws, a 28 percent pay raise for employees can be catastrophic to grocery stores that traditionally operate on razor-thin margins. As a result, many underperforming stores closed, resulting in a “hero pay” of sudden unemployment.

Don’t spend it all in one place!

Written and produced by Meredith and Austin Bragg; narrated by Austin Bragg

April 29, 2021

QotD: Searching for useful reading lights

The room, in addition to its other drawbacks, was always underlit. But it’s proving a major challenge to find nifty lamps that also give enough light to read by. All the cool Art Nouveau sort of stuff only go up to 60 watts max, which, for a reader, is like switching on the darks. And the lamps in stores are not logically arranged by wattage; one has to wander about turning them upside down and peering at the little sticky labels on the sockets for a clue, for yea verily, the sales staff has none. They are not readers either, sigh.

Lois McMaster Bujold, letter to Baen’s Bar, 2004-10.