J.D. Tuccille welcomes the discussion among the Presidential candidates about lowering the taxes Americans have to pay, and points out that the economic distortions of the current tax code (including “temporary” measures introduced during WW2) make everyone less well-off:

Three months after proposing to end federal taxing of tips — an idea promptly confiscated without compensation by Kamala Harris’s campaign — Donald Trump doubled down by saying “we will end all taxes on overtime” if he’s elected president. Without a doubt, millions of Americans who resent government’s ravenous bite out of their paychecks immediately began contemplating just how much of their income they could shield from the tax man that way.

Tips and Overtime for Everybody!

“Can someone get paid in primarily tips and overtime?” quipped the Cato Institute’s Scott Lincicome. “Asking for a few million friends.”

On a more serious note, the Competitive Enterprise Institute’s Sean Higgins thought exempting overtime pay “wouldn’t necessarily be a bad idea … but, overall, it is not likely to make that much of a difference to most workers because overtime isn’t that common”. He’d been more strongly supportive of exempting tips because that “would put more money directly in the pockets of working Americans without either costing employers more or raising prices for customers”. He also liked that freeing tips from taxation would “keep tipping out of the reach of the regulatory state”.

But what if overtime pay becomes more common precisely because it’s not taxed?

The people at the Tax Foundation expect that’s exactly what will happen, just as Lincicome joked. Thinking through the implications of exempting overtime pay from taxation, Garrett Watson and Erica York warned that “exempting overtime pay from income tax would significantly distort labor market decisions. Employees would be encouraged to take more overtime work, and hourly or salaried non-exempt jobs may become more attractive if the benefit is not extended to salaried employees who are exempt from Fair Labor Standards Act (FLSA) overtime rules.”

The Tax Foundation’s Alex Muresianu had a similar reaction to the proposals to exempt tips from taxes from both Trump and Harris. He thinks “the proposal would make more employees and businesses interested in moving from full wages to a tip-based payment approach”. He foresaw “substantial behavioral responses, such as previously untipped occupations introducing tipping”.

Of course, a world in which more Americans receive their pay beyond the reach of the tax man is a welcome prospect to many of us. If politicians want to phase out income taxes, even unintentionally, who are we to complain? Hang on a minute while I set up my virtual tip jar. In fact, there’s precedent for government policy around wages to cause major unintended consequences. Take, for example, employer-provided healthcare coverage.

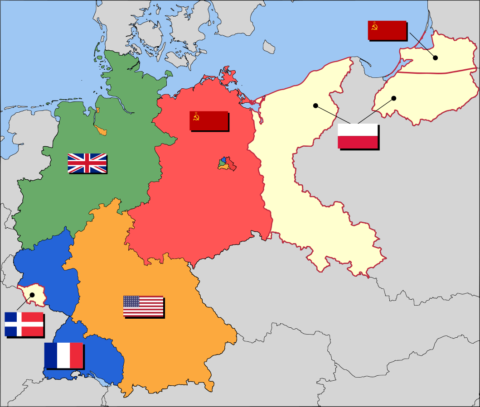

Government Policy Has Distorted Compensation Before

“One of the most important spurs to growth of employment-based health benefits was — like many other innovations — an unintended outgrowth of actions taken for other reasons during World War II,” according to the 1993 book, Employment and Health Benefits: A Connection at Risk. “In 1943 the War Labor Board, which had one year earlier introduced wage and price controls, ruled that contributions to insurance and pension funds did not count as wages. In a war economy with labor shortages, employer contributions for employee health benefits became a means of maneuvering around wage controls. By the end of the war, health coverage had tripled.”

Given that health benefits became a substitute form of compensation to escape a wage freeze, it’s not difficult to imagine the United States moving toward a situation in which a lot more people receive the bulk of their pay from untaxed tips and overtime pay.