Rob Henderson reviews The WEIRDest People in the World: How the West Became Psychologically Peculiar and Particularly Prosperous by Joseph Henrich:

The word “WEIRD” stands for “Western, Educated, Industrialized, Rich, Democratic.” It is also a convenient way to communicate that people from such societies are psychologically different from most of the rest of the world and from most humans throughout history.

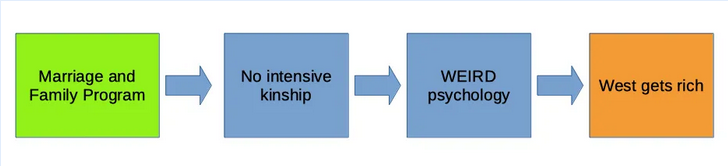

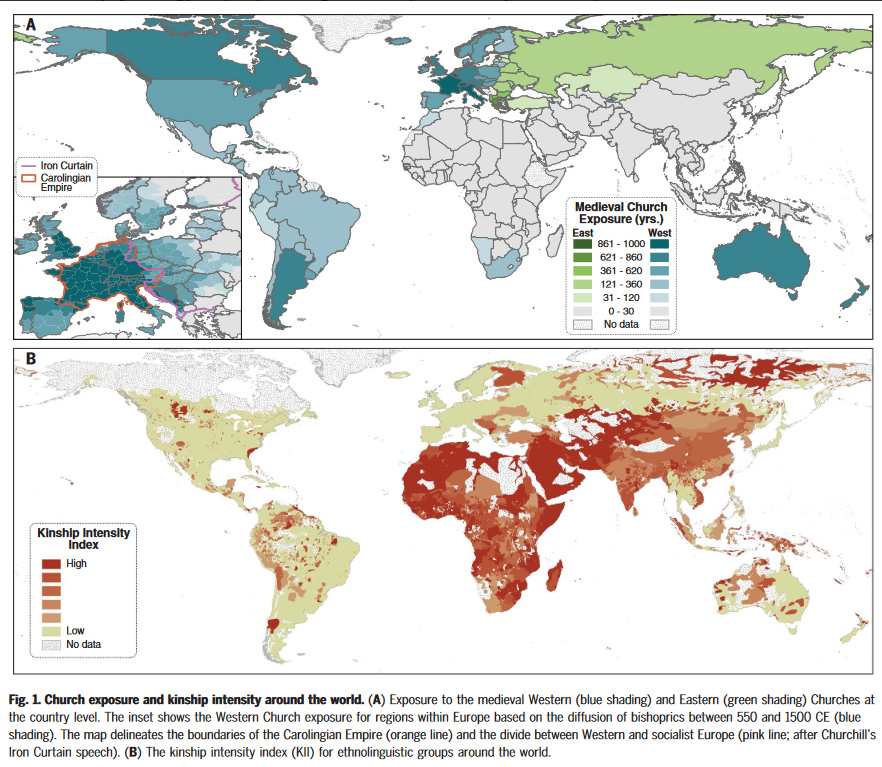

In short, the Western Church (Henrich’s term for the branch of Christianity that rose to power in medieval Europe) enacted a peculiar set of taboos, prohibitions, and prescriptions regarding marriage and family. This dissolved Europe’s kin-based institutions, and gave rise to a more individualistic psychology, which in turn spurred the creation of impersonal markets in which people grew used to interacting with and trusting unrelated strangers, and propelled the development of voluntary institutions, universally applicable laws, and innovation.

Characteristics of WEIRD people

WEIRD people are hyper-individualistic, self-obsessed, nonconformist, analytical, and value consistency. We try to be “ourselves” across social contexts and prize “authenticity”.

The book reviews research indicating that Americans rate those who show behavioral consistency during interactions in different contexts as more “socially skilled” and “likable” compared to those who are more behaviorally flexible. In contrast, non-WEIRD people view personal adjustments as reflecting social awareness and maturity.

In addition to valuing behavioral consistency, WEIRD people are more likely to feel guilt than shame. In contrast, non-WEIRD people are more likely to experience shame as opposed to guilt. Shame is the result of not living up to the expectations of one’s community. Guilt is a private emotion that results from falling short of our own expectations, rather than the community’s.

Relatedly, a recent study found that people can experience shame for being accused of actions they didn’t commit. The accusation alone was enough to elicit this powerful emotion. Shame is a reaction to others believing we did something bad rather than a reaction to actually doing something bad.

Delayed gratification also appears to be more prevalent in WEIRD societies. When researchers offered WEIRD people the choice between a smaller monetary payment up front, or a larger sum later, they tended to choose the larger sum. In contrast, most non-WEIRD people preferred the immediate, smaller, reward.

Interestingly Henrich relays data suggesting that greater patience is most strongly linked to positive economic outcomes in lower-income countries. Put differently, the tendency to defer gratification seems to be especially more important for economic prosperity in countries where formal institutions are less effective. This pattern holds within countries as well, such that patient people obtain higher incomes and more education. Patience is related to success after controlling for IQ and family income, and, even within the same families, more patient siblings obtain more education and higher earnings later in life.

Moreover, WEIRD people are more likely to adhere to rules even in the absence of external sanctions. The book reports that until 2002, U.N. diplomats from other countries were immune from having to pay parking tickets in New York City. Diplomats from the UK, Sweden, Canada, and other countries received a total of zero parking tickets. But diplomats from Bulgaria, Egypt, and Chad, among other non-WEIRD countries accumulated more than 100 tickets per member of their respective delegations. When diplomatic immunity was lifted, parking violations declined, but the gap between countries persisted.

But while they may be patient and rule-following, WEIRD people are more likely to be fair-weather friends. Relative to other populations, WEIRD people assign higher value to impartiality and show less favoritism toward friends, family members, and co-ethnics. We are more likely to abhor nepotism and believe in universally applicable principles.