As Lynn acknowledges, “the tariffs are a tax”. Because they are a tax, they are going to be paid by someone in some form. You can’t have money flowing into the Treasury without someone paying that extra money in some way. Broadly speaking, we can divide the potential payors of American-imposed tariffs into three camps: American consumers, American importers, and foreigners.

One of the oft-cited effects of a tariff is to reduce the amount of imports coming into America. This makes sense and is in fact one of the numerous goals administration officials have pointed to. Insofar as American consumers and importers end up paying the tariff, they will buy less of the now-more-expensive foreign products. We’re already seeing this happen in the US, which Lynn alludes to throughout his article.

If foreigners pay the tariff, they’ll sell less of the now-tariffed goods to the US. This will, as President Trump and others have correctly identified, hurt their bottom line. To offset at least some of this, these countries will try to sell more of their products to their domestic consumers or consumers in countries other than the US. This is exactly what we have seen and what we are seeing, as other countries around the world are securing new trade deals with one another and deliberately excluding the United States from said deals.

So, Lynn is correct to point out that foreign corporations have incurred costs because of the Trump tariffs. However, despite his repeated implication to the contrary, this is not money that goes to the US Treasury. Volkswagen, for example, has raised the price of its 2026 models by up to 6.5 percent, largely due to tariffs, and has indicated that this is just the beginning. That’s more money coming out of American consumers’ pockets. At these higher prices, American consumers are purchasing fewer Volkswagens than last year. Volkswagen’s losses from the tariffs include an almost 30 percent decline in profits from auto sales. Importantly, sales that do not happen count toward the reduced profit that Volkswagen reported but generate no tariff revenue for the Treasury to collect. That Lynn, a financial commentator, does not understand this distinction is deeply troubling.

Who Really Pays the Tariff?

Lynn’s central argument rests on a fundamental confusion between what economists refer to as the “legal incidence” and the “economic incidence” of a tax. Legally, because tariffs are a tax on imports, it is the US importers who must write the check to Customs and Border Protection. But this says nothing about who actually pays the tariff.

For example, when landlords’ property taxes go up, who pays? The landlord will obviously write the check to the county assessor, but unless Lynn thinks that landlords are running charities, that cost gets passed on to tenants in the form of higher rent, less frequent maintenance, or fewer included benefits (utilities or access to designated parking, for example). The legal incidence falls on the landlord, but the economic incidence falls disproportionately on renters, i.e., young Americans already besieged by high housing costs.

Tariffs work the same way. US Customs and Border Protection bills the American importer directly, which is the legal incidence of the tariff. But the economic burden gets distributed among American consumers, American importers, and foreign exporters, depending on the particulars of the individual markets.

Lynn cites the Harvard Pricing Lab finding an approximately 20 percent “pass-through rate,” meaning that American consumers are only paying about one-fifth of the tariff costs. He treats this as a permanent feature of the tariff regime and as proof that foreigners are footing the bill. But the question isn’t who writes the check today, it’s who bears the cost over time. And here, the evidence directly contradicts Lynn’s fables.

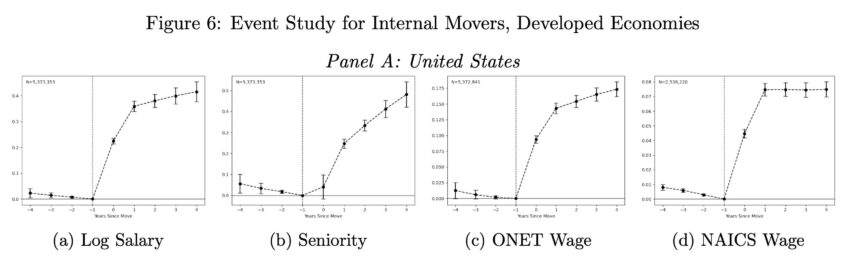

As we have seen, pass-through rates are not static, but evolve over time as markets adjust. And every piece of evidence suggests that the pass-through rate has been and is continuing to rise rapidly. Goldman Sachs and the Council on Foreign Relations tracked the evolution over just this administration. Their findings are stunning: In June, US businesses absorbed about 64 percent of the tariff costs, American consumers about 22 percent, and foreign exporters about 14 percent in the form of reduced profits. Just four months later, American businesses absorbed just 27 percent, while American consumers absorbed 55 percent and exporters absorbed 18 percent. Projections for 2026 continue the trend with consumers absorbing 67 percent, exporters 25 percent, and importers just 8 percent.

The logic behind this is simple and has been echoed by President Trump and Scott Bessent themselves. In the initial months following Liberation Day, American importers could not quickly shift to alternative suppliers, giving them little leverage to demand price cuts from existing foreign vendors. Many American importers also believed (or hoped?) that the tariffs were simply a negotiating tool that would be bargained away. Having built up inventories before April, they were able to avoid raising consumer prices, with the belief that the “temporary pains would be worth the long term gains.”

That’s no longer the case. As the BLS notes in its latest import price index report, the price of imports has barely changed. This matters because US importers, not foreign sellers, are legally required to write the tariff check. American buyers pay the foreign company’s price, then pay the tariff on top of it. If foreigners were truly absorbing the tariffs, they’d have to lower their prices to compensate, and we would see a decrease in the import price index. We haven’t. The index is flat, which is evidence that the burden of the tariff is, as economists warned, being paid disproportionately by Americans in one form or another. As the Council on Foreign Relations analysis points out, by October, importers have “had time to seek alternative suppliers, giving them a bit more negotiating leverage.” More importantly, the “trade deals” that the administration has inked have made it clear that substantially higher tariffs are here to stay. All of this gives importers and retailers good reason to continue passing more of the costs along to consumers.

We are already seeing evidence of this happening. The Federal Reserve Bank of Boston’s survey of small and medium-sized businesses, for example, confirms this dynamic. Firms expecting tariffs to persist for a year or longer plan to pass through three times more of their cost increases to consumers than firms expecting short-lived tariffs. As of August, over 45 percent of affected businesses expected their costs to be impacted for longer than a year.

But how does all of this compare to the pass-through rate felt during the 2018–2019 tariffs? The Harvard Pricing Lab — the same data that Lynn cites — actually undermines his entire argument. After just six months, the 2025 tariff pass-through rate is indeed around 20 percent. But if we compare this to the 2018 tariffs, the difference is night and day. After Trump’s first-term tariffs, the pass-through rate stayed under 5 percent after a full year. This isn’t evidence that these tariffs are working. It’s evidence that these tariffs are hitting consumers harder and faster than the previous round.