Chris Selley somehow seems, I dunno, a bit … cynical about Prime Minister Trudeau and Finance Minister Morneau’s 2019 federal (election) budget:

Ahoy there, relatively young and middle-class Canadian! Did you vote Liberal in 2015? And are you, shall we say, somewhat less enthused about that prospect four years later, for various reasons we needn’t go into here?

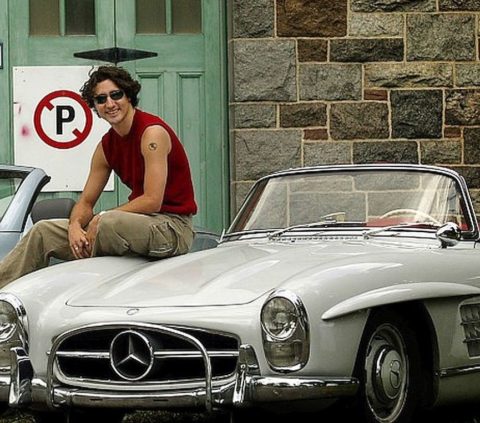

Now, what if Justin Trudeau were to offer you a down payment on a shiny new condominium?

Well, that’s just the kind of guy he is. Starting this year, so long as your household income is below $120,000, the Canada Mortgage and Housing Corporation will pitch in 5 per cent of the price of your first home — 10 per cent if it’s a new home, the construction of which the government hopes to incentivize.

That’s Item One in the 460-page federal budget tabled Tuesday in Ottawa.

On a new $400,000 condo, you could put down your own $20,000; CMHC would chip in another $40,000; and your monthly mortgage payment, on a 25-year term at 3.25 per cent, would drop by a not inconsiderable 12 per cent. You would reimburse CMHC, interest-free, if and when you sell. Cost to the taxpayer: $121 million over six years.

If you’re worried giving home-seekers free money might just push the price of a $400,000 condominium nearer to $440,000, Finance Minister Bill Morneau would first of all like you to stop. (“You’re wrong,” he admonished a reporter who dared suggest it during a press conference in the budget lockup Tuesday.) But if all else fails and you’re forced to rent, the feds also found $10 billion extra over nine years to throw at the Rental Construction Financing Initiative, a CMHC program that offers low-interest loans to qualified builders. The goal is 42,500 new rental units in a decade.

Can’t even think of home ownership until you pay off your student loans? Again, the government is here to help: From now on you’ll pay the Bank of Canada’s prime interest rate, instead of prime plus 2.5 points. And for the first six months after you graduate, you’ll pay nothing. The budget document introduces us to Angela, a recent psychology grad carrying $13,500 in student debt who landed a job at “a medium-sized consumer goods company.” (It doesn’t matter where she works. The writers just wanted to add some colour.) Angela will save something like $2,000 in interest over 10 years.

There’s also the new Canada Training Benefit, which the government intends to help Canadians with “the evolving nature of work.” (Maybe your parents were right, Angela. Maybe that psych degree wasn’t the best idea, Angela.) Starting in 2020, the feds will chip in $250 a year, and you can use the accumulated credit to pay up to half the cost of courses or training. And you can draw on up to four weeks of EI to complete it.