James Howard Kunstler looks at Ireland’s plight:

When you’re out of the country, as I was last week, it’s good to know that the home folks are keeping up with the Kardashians and bravely venturing into the blood-splattered chambers of cable TV’s latest hit, Bridal Plasty — where candidates for marriage are transformed from Holstein cows into inflatable sex toys by magic surgical technology — not to mention all those humble guardians of freedom who kept the parking lots of WalMart safe for consumerism in the wee small hours of Black Friday. These are, after all, perilous times.

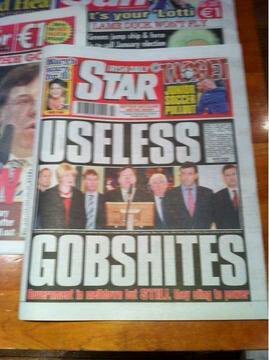

Elsewhere, Ireland and the rest of Europe wore themselves out with soul-searching all week over how to handle national bankruptcy within a currency system that bears only a schematic relation to reality. Does the bankruptee go broke all at once, or is she recruited into permanent debt slavery so that the bond-holders of various banks can keep their loved ones in marzipan and Fauchon’s wonderful marrons glacés for one more holiday season? As of Monday morning, Ireland has been commanded to, er, bend over and pick up the soap, shall we say, for about a hundred billion euros in loans that will not be paid back until a mile-high ice-sheet covers Dublin (something that might happen sooner rather than later if the climate mavens are right).

We’ll see how this bail-out goes down with the French and German voters, too, who have to pay for it, after all, especially as Portugal, Spain, and Italy line up at the cash cage for their cheques (and bars of soap). Of course, a few more basis points in the interest rate spreads could prang the whole Euro soap opera — does anybody really believe this game of kick-the-can will go on after New Years? I’m not even sure it goes on past this Friday, but I am a notoriously nervous fellow.

This is almost as good as the (temporarily discontinued) daily Financial Briefings from Monty.

H/T to Terry Kinder for the link.