Lebergott’s historical account – which reinforces the important findings of Robert Higgs about the postbellum economic trajectory of blacks in America – reveals the equalizing powers of economic competition. Contrary to popular myth, even racist southerners put their own economic well-being ahead of their irrational prejudices by competing with offers of higher wages for blacks’ labor and with offers of low prices for blacks’ business. This competition, in turn, increased blacks’ geographic and economic mobility and raised their incomes. The reason southerners – whether racists or rent-seekers (or both) – turned to government to get Jim Crow legislation is that market forces were undermining their racist preferences and competing away their uncompetitively high profits, rents, and wages.

Lebergott’s account also further reveals the utter implausibly of the claims of those who assert that today’s market in America for low-skilled workers is infected with monopsony power. While this market isn’t textbook perfect (no real-world market is), and while this market would be improved by making it even freer (for example, by eliminating occupational-licensing statutes and zoning restrictions), the ability of low-skilled workers today throughout the U.S. to move from job to job is surely better than was the ability of low-skilled blacks 150 years ago throughout the American south to move from job to job. And yet, as Lebergott documents, low-skilled American blacks of 150 years ago in the American south did indeed enjoy such mobility that economic competition raised their wages. Similarly, the ability today of entrepreneurs and business owners to discover and compete for under-priced labor is surely greater than was the ability of employers 150 years ago to do the same – and yet, again as Lebergott documents, such competitive initiative by employers was common 150 years ago and served to increase low-skilled workers’ mobility and wages.

Don Boudreaux, “Quotation of the Day…”, Café Hayek, 2017-05-22.

June 28, 2017

QotD: How “Jim Crow” laws were brought in to suppress competition

June 20, 2017

“Licensing … is now one of the biggest labor problems facing California”

In the Orange County Register, Dick Carpenter outlines how many jobs in California are now closed off to anyone who doesn’t have a license:

Whether it’s brick-and-mortar restaurants fighting to outlaw food trucks, or taxicab associations suing Uber and Lyft, examples abound for this type of anticompetitive lobbying. One of the more blatant instances comes courtesy of the California Landscape Contractors Association. In 2014, the association supported a bill that made it even easier for regulators to crack down on contractors operating without a license. Their stated reasons were revealing: “Unlicensed persons unfairly compete,” because they can “significantly undercut licensed contractors when pricing projects to consumers.” The cost of compliance is quite substantial, as it “typically adds 15 to 20 percent to the cost,” the association estimated. Not only does licensure jack up consumer prices, it also keeps out aspiring entrepreneurs who ask for nothing more than the opportunity to work hard and prove themselves by the sweat of their brow.

Licensing goes well beyond contractors and is now one of the biggest labor problems facing California. In the 1950s, about 5 percent of Americans needed a government-issued license to work. Back then, government-mandated licensing was limited to a handful of trades, such as medicine and the law. But over the years, bottleneckers — often through self-serving professional associations — successfully persuaded governments to adopt new licenses that are difficult or practically impossible to obtain. This restricts opportunities for would-be entrepreneurs trying to break into the marketplace and provide new or better services.

Today, more than one-fifth of California’s workforce is licensed. When it comes to low- and middle-income occupations, which are often a gateway for upward mobility, California is the second-most extensively and onerously licensed state, according to a study by the Institute for Justice. In fact, there are so many licensing bottlenecks that when the bipartisan Little Hoover Commission began examining the issue, it reported that “No one could give the commission a list of all the licensed occupations in California.”

These restrictions are great for the bottleneckers, but they are bad for consumers. A report by the Brookings Institution summarized many of the academic findings on occupational licensing. Licensure can boost wages for licensed workers by as much as 15 percent, while increasing the cost for consumers by anywhere from four to 33 percent. As a result, one study even estimates that pervasive licensing leads to “up to 2.85 million fewer jobs nationwide, with an annual cost to consumers of $203 billion.”

Bottleneckers typically claim the costs of licensing are necessary to protect the public, but the reality is quite different. In California, barbers, cosmetologists, tree trimmers and many construction contractors all must complete far more training for their licenses than is required for emergency medical technicians — who hold people’s lives in their hands. Manicurists need 400 hours of coursework and training for their licenses, which can costs thousands of dollars; EMTs require less than half the amount of training at only a 160 hours.

The introduction of licensing to a previously unregulated field typically benefits the existing workers in that field and severely disadvantages anyone hoping to enter that field — existing workers and businesses restrict competition by keeping out new entrants, and create an artificial shortage which allows them to boost their prices. The consumer generally does not benefit in any measurable way from the introduction of licensing, and ends up paying more for the services offered.

April 6, 2017

QotD: The “real” “synergies” of corporate mergers

There can be a few factors behind consolidation. For example, massive economies of scale. Or … well, I’m afraid this is a bit delicate, but I can’t let it go unmentioned: Industries consolidate to reduce the number of players in the market, giving the remaining players more pricing power. Antitrust regulators tend to put on their big frowny face if companies cite the latter reason, so the public statements made by companies in consolidating industries tend to focus on more superficially attractive reasons like cost savings and “broader industry reach,” or more ethereally vague words like “synergies.”

True to form, Anthem is claiming that nearly $2 billion in synergy savings will be realized by the merged entities. This is probably true, to some extent. But you should keep in mind that mergers are themselves extremely costly. And I don’t just mean the fabulous fees that investment bankers and consultants collect to facilitate them. Joining two entities into one is really difficult: Corporate cultures clash, turf wars damage morale and profits, IT systems never do work right together, key employees leave, customers are alienated. So in general, these sorts of statements should be taken, not just with a grain of salt, but while sitting next to a salt lick with a big bag of Mr. Salty Pretzels and some cocktail peanuts to wash the whole thing down.

Megan McArdle, “No Wonder Insurers Want to Merge”, Bloomberg View, 2015-07-24.

January 5, 2017

Canada’s military-industrial complex

Ted Campbell briefly outlines the three tiers of military logistics then discusses the most controversial tier, the national industrial base, in more detail:

Behind it all, unseen, misunderstood, unloved and, in fact, often actively disliked is the national defence industrial base.

There are a great many people, including many in uniform, who object to the cost ~ fiscal and political ~ of having a defence industrial base. Many people suggest that a free and open market should be sufficient to equip all friendly, and the neutral and even some not so friendly military forces.

They forget, first of all, that the defence industries of e.g. America, Britain, France, Germany and Israel are ALL heavily supported by their government and, equally, heavily regulated. It is not clear that we will always be in full political accord with those upon whom we rely for military hardware? What if one country wanted, just for example, to gain an advantage in a trade negotiation? Do you think they might not “decide” that since the government (a minister of the crown) has threatened to use military force against First Nations who protest against pipelines that they will not sell us certain much needed military hardware or licence its use in Canada?

It is always troubling when we see the costs of military hardware increase at double or even triple the general rate of inflation for, say, cars or TV sets or food and heating fuel, but that is not the fault of the Canadian defence industries … it is, in fact, the “fault” of too little competition in the global defence industry market: too few Australian, Brazilian Canadian and Danish defence producers, too many aerospace and defence contractors merged into too few conglomerates that control too much of the market. A robust Canadian defence industrial base, supported by extensive government R&D programmes and by a steady stream of Canadian contracts would help Canada and our allies.

[…]

I am opposed to government supported featherbedding by Canadian unions and companies but we do need to pay some price for having a functioning defence industrial base … the costs of our new warships, for example, are, without a doubt, higher than they would be if we had bought equivalent ships from certain foreign yards, but we need to be willing to pay some price for having Canadians yards that are ready and able to build modern warships when needed; ditto for aircraft, armoured vehicles, radio and electronics, rifles and machine guns, cargo trucks and boots and bullets and beans, too. AND, we need a government that will, aggressively, support that defence industrial base with well funded R&D programmes and by “selling” Canadian made military equipment around the world.

It’s one thing to accept that you’ll need to pay a premium over market cost for built-in-Canada equipment that can’t also be sold to other customers. What is disturbing is discovering that the premium can be up to 100% of the cost for equivalent non-domestic items. For example, this was reported in a CBC article in 2014:

Britain, for example, opted to build its four new naval supply ships much more cheaply, at the Daewoo shipyard in South Korea. The contract is for roughly $1.1 billion Cdn. That’s for all four. By contrast, Canada plans to build just two ships, in Vancouver, for $1.3 billion each. So Canada’s ships will be roughly five times more costly than the British ones.

But there’s a twist. Canada’s supply ships will also carry less fuel and other supplies, because they’ll be smaller — about 20,000 tonnes. The U.K. ships are nearly twice as big — 37,000 tonnes. Canadians will lay out a lot more cash for a lot less ship.

Everything is more expensive to build domestically if you don’t already have a competitive market for that item. The federal government’s long-standing habit of drawing out the procurement process makes the situation worse, as the costs increase over time (but the budget generally does not), so we end up with fewer ships, planes, tanks or other military hardware items that arrive much later than originally planned.

November 14, 2016

QotD: The relationship between unions and occupational licensing

… this is also known as “licensure”. And the rate in the 50s, at that peak of union power, was around 5% of workers needed such a licence to go to work. And union membership was, at that peak, 35% and is now around 10% or a little above, and licensure has gone from 5% to 30%.

For my point to work we have to consider unionisation and licensure as being the same thing. And they’re obviously not exactly the same thing. But they are sorta, kinda, the same thing. For all the claims that the requirement for a licence is in order to protect consumers (a theory for which the technical economic term is “codswallop”) it’s really a way to protect the wages of the ingroup against competition. As, of course, is being in a union a method of protecting those economic interests of the ingroup.

Actually, licensure is most akin to the medieval and early modern guilds system, out of which the union movement itself grew. So it’s really not surprising at all that they share certain attributes. That aim and desire of protecting the incomes of members of the group against the economic interests of everyone else.

So, my argument is that we’ve not in fact had a fall in the power of organised labour over these recent decades. We’ve just seen a change in the form of it, from unionisation to licensure. The point being that this is absolutely and definitely true in part and may or may not be true entirely. I tend towards the entirely end of that spectrum and I’d be absolutely fascinated to see if there’s been any academic comparisons made of the strengths of the two systems in protecting workers’ wages and conditions. I’d even be willing to believe that licensure works better than unionisation, given that the first is a conspiracy against the consumer, something easier to carry off than the unions’ conspiracy against the employer.

Tim Worstall, “More Union Power Won’t Raise Wages Or Reduce Inequality”, Forbes, 2015-03-07.

August 29, 2016

Debunking “the 1950s as some sort of golden age of progressivism”

James O’Brien selects a few imaginative historical myths for debunking:

Here are a few facts about U.S. life 60 years ago, in 1956:

- The top tax rate was largely irrelevant. The average household income in 1956 was about $4,800. Only 8 percent of families earned more than $10,000 per year. The 91 percent top tax rate (and that really was the top tax rate – a holdover from World War II) kicked in at $400,000 for married couples, or the equivalent of about $3.2 million today). While few individuals made that much money in 1956, people who did earn large sums of money could deduct everything from interest on auto loans to sales taxes, and could – and did – structure things so that their income was funneled through tax shelters at much lower rates.

- There was a lot less money overall. Adjusted for inflation, that $4,800 average household income would be about $42,000 today. That is roughly 20 percent less than current average household income of about $53,000. Even in 1956, when a Harvard education cost $1000 per year, $400 per month hardly afforded a riotous existence for a family of four. One of the most striking things about 1956 was how little people at the top of their professions earned. Yogi Berra – the highest paid player in Major League Baseball that year – received $58,000. That would be a little over $500,000 today, essentially minimum wage by MLB standards.

- Tax revenues as a percentage of GDP were about the same as they are today. Since 1945, tax revenues as a percentage of GDP have fluctuated within a fairly narrow range of 15 to 20 percent. The state of the economy, not tax rates, has determined how much the government takes in. Despite the high marginal rates of the 1950s, the tax intake as a percentage of GDP was just 16.5 percent in 1956. It was 18 percent in 2015, so we are actually taking in more, rather than less money, although we are spending it in many new and different areas.

- Government spent less on everything but defense. The U.S. Federal budget for 1956 might best be described as “Spartan”, not in the sense of being frugal (although it was that) but in the sense of being primarily devoted to preparations for war. In the Cold War climate, defense spending soaked up 60 percent ($47 billion) of the total $76 billion Federal budget – about three times the current percentage — and spending on “social programs” was essentially nonexistent. There was no Department of Education, and total Federal spending on education was just $1.5 billion. Healthcare expenditures were just $1.0 billion; there was no Medicare, (which now represents 15 percent of the total Federal budget), no Medicaid, and certainly no Obamacare. The Interstate Highway Program – so beloved by liberals – was conceived as a defense spending measure and was designed to be self-funding through diesel and gasoline taxes.

- Opportunities were anything but equal. Racial discrimination was rampant and gender bias was everywhere. Many fields were essentially closed to women and to people of color, while quota systems deterred talented Jewish students from pursuing careers in fields such as engineering and law. We can argue all we want about white privilege in 2016 but in 1956 it was endemic, and bred not just economic but social and cultural inequality.

When we look at the United States in 1956 we see a country with high (but largely irrelevant) marginal tax rates, no social programs to speak of, and a massive defense budget. With Europe still recovering from World War II, the economy is strong, and companies are willing to spend and hire. The country’s focus, however, is not on the welfare of its people, but on its survival in a grim ideological and geopolitical struggle with a ruthless and determined opponent. Those who portray the 1950s as some sort of golden age of progressivism are writing historical fiction, not history.

The 1950s for the United States (and for Canada) were, to borrow a notion from John Scalzi, run in “easy mode” — in game terms, the lowest difficulty setting. There was no peer-level competition in manufacturing or even in services and this provided profit levels that allowed both corporations and workers to enjoy unrealistic long-term conditions that finally came to an end in the gas shocks of the 1970s, after the devastated economies of the defeated Axis powers finally were able to compete again. Twenty-five years of minimal competition left the major corporations totally unable to cope with even minimal competitive pressures from overseas … but willing to use whatever political levers were available to try to quash those foreign upstarts.

But as the courtiers of King Canute were finally obliged to accept, even the King can’t order the tide to recede when it’s convenient.

August 8, 2016

QotD: Peace

Almost everyone wants peace, the problem is that we’ve had peace in this country for so long that most people don’t recognize it for the aberration that it is. Because of this, a curiously contradictory mindset holds sway over a large segment of the population, most of them on the left side of the political spectrum. It goes something like this: “Well, we want peace, so we’ll just refuse to fight. If we refuse to fight, the other guy will have no reason to fight us.” If you point out to them that the other guy just might not want peace, you’ll get a predictable response: “Well, since peace is the default state of the world, if we can figure out what we did to make the other guy mad at us and desirous of war, and make it up to him, then he’ll feel comfortable with allowing the default state to resume.”

The problem is, of course, that peace isn’t the default state of the world, war is. Human beings are predators, and we are genetically designed to be in competition with other human beings, either individually or in groups. If group A has something group B wants, the natural instinct of group B is to attack group A and take it. The only way that group A can prevent this from happening is to be stronger than group B. For centuries, the Mongol tribes roamed the countryside of Mongolia, squabbling with and fighting each other. The great neighboring dynasties, the Xia and Jin, had little to fear from the Mongols beyond nuisance raids, because they were stronger. Then Temujin united the tribes, assumed the title Genghis Khan, and swept both empires off the face of the earth. The empires had enjoyed peace for generations — because they were strong. When they ceased to be stronger than their foes, they soon ceased to be entirely.

So what? Primitives. Barbarians. Savages. We’re different now. Civilized. Cultured. Superior.

I hate to break it to you, but we’re not. 13th century man is behaviorally identical to modern man. 8 centuries is nowhere near long enough for that kind of evolutionary change in the human animal. People are … people. Always have been, always will be. The reason that we’ve enjoyed centuries of peace in America (even our wars haven’t been fought here since the 1860s) is because we’ve been strong enough that nobody has had the ability to fight us over here, and we’ve had the ability to go fight them over there when we needed to. There is nothing about this situation that is written in stone. Our homeland is peaceful because we’ve had the military might necessary to make it impossible for foes to make it not peaceful.

But now, with so many believing that peace is the natural order of things, we are in grave danger of finding out that peace is not the natural order of things, it’s a luxury, one that is paid for in blood and the willingness and ability to shed it. Our military is a shell of its former self, hollowed out to buy bread and circuses for the masses. Our diplomacy a joke, conducted insecurely and thus transparent to our foes. Our foreign policy is a hot mess of appeasement and apology. All of this makes us look weaker and weaker to the world, and so now they believe that they can take what they want from us because we can no longer defend it. Bill Clinton gave Ukraine a rock solid guarantee of protection in return for them giving up their nukes to ensure “peace”. That’s gone, along with half that country. Our strongest allies are realizing that they are on their own against genocidal aggressions and prepare to act alone or in concert with new allies. We issue ultimatums and draw red lines and the world laughs at us. This isn’t peace, it’s the prelude to destruction. Our destruction.

Weirddave, “Fundamental Concepts – Weakness Invites Aggression”, Ace of Spades H.Q., 2015-03-07.

July 17, 2016

QotD: Regulating Napa County

… at each tour we typically got the whole backstory of the business. And the consistent theme that ran through all of these discussions was the simply incredible level of regulation of the wine business that goes on in Napa. I have no idea what the public justification of all these rules and laws are, but the consistent theme of them is that they all serve to make it very hard for small competitors or new entrants to do business in the county. There is a board, likely populated by the largest and most powerful entrenched wine makers, that seems to control the whole regulatory structure, making this a classic case of an industry where you have to ask permission of your competitors to compete against them. There are minimum sizes, in acres, one must have to start a new winery, and this size keeps increasing. Recently, large winemakers have started trying to substantially raise this number again to a size greater than the acreage of any possible available parcel of land, effectively ending all new entrants for good. I forget the exact numbers, but one has to have something like 40 acres of land as a minimum to build a structure on the land, and one must have over 300 acres to build a second structure. You want to buy ten acres and build a small house and winery to try your hand at winemaking? — forget it in Napa.

It took a couple of days and a bunch of questions to put this together. Time and again the guide would say that the (wealthy) owners had to look and wait for a long time to find a piece of land with a house on it. I couldn’t figure out why the hell this was a criteria — if you are paying millions for the land, why are you scared to build a house? But it turned out that they couldn’t build a house. We were at this beautiful little place called Gargiulo and they said they bought their land sight-unseen on 3 hours notice for millions of dollars because it had a house AND a separate barn on it grandfathered. Today, it was impossible to get acreage of the size they have and build two structures on it, but since they had the barn, they could add on to it (about 10x the original size of the barn) to build the winery and still have a separate house to live in.

This is why the Napa Valley, to my eye, has become a weird museum of rich people. It seems to be dominated by billionaires who create just fantastically lovely showplaces that produce a few thousand cases of wine that is sold on allocation for 100+ dollars a bottle to other rich people. It is spectacularly beautiful to visit — seriously, each tasting room and vineyard is like a post card, in large part because the owners are rich enough to care nothing about return on capital invested in their vineyards. The vineyards in Napa seem to have some sort of social signalling value which I don’t fully understand, but it is fun to visit for a few days. But in this set-piece, the last thing the folks who control the county want is for grubby little middle-class startups to mess up their carefully crafted stage, so they are effectively excluded.

I know zero about wines, but from other industries this seems to be a recipe for senescence. It would surprise me not at all to see articles get written 10 years from now about how Napa wines have fallen behind other, more innovative areas. I have never been there, but my friends say newer areas like Paso Robles has an entirely different vibe, with working owners on small plots trying to a) actually make a viable business of it and b) innovate and try new approaches.

Warren Meyer, “My Nomination for Corporate State of the Year: Napa County, California”, Coyote Blog, 2016-07-08.

May 13, 2016

QotD: The boring efficiency of North American freight railways

The US rail system, unlike nearly every other system in the world, was built (mostly) by private individuals with private capital. It is operated privately, and runs without taxpayer subsidies. And, it is by far the greatest rail system in the world. It has by far the cheapest rates in the world (1/2 of China’s, 1/8 of Germany’s). But here is the real key: it is almost all freight.

As a percentage, far more freight moves in the US by rail (vs. truck) than almost any other country in the world. Europe and Japan are not even close. Specifically, about 40% of US freight moves by rail, vs. just 10% or so in Europe and less than 5% in Japan. As a result, far more of European and Japanese freight jams up the highways in trucks than in the United States. For example, the percentage of freight that hits the roads in Japan is nearly double that of the US.

You see, passenger rail is sexy and pretty and visible. You can build grand stations and entertain visiting dignitaries on your high-speed trains. This is why statist governments have invested so much in passenger rail — not to be more efficient, but to awe their citizens and foreign observers.

But there is little efficiency improvement in moving passengers by rail vs. other modes. Most of the energy consumed goes into hauling not the passengers themselves, but the weight of increasingly plush rail cars. Trains have to be really, really full all the time to make for a net energy savings for high-speed rail vs. cars or even planes, and they seldom are full. I had a lovely trip on the high speed rail last summer between London and Paris and back through the Chunnel — especially nice because my son and I had the rail car entirely to ourselves both ways.

The real rail efficiency comes from moving freight. As compared to passenger rail, more of the total energy budget is used moving the actual freight rather than the cars themselves. Freight is far more efficient to move by rail than by road, but only the US moves a substantial amount of its freight by rail. One reason for this is that freight and high-speed passenger traffic have a variety of problems sharing the same rails, so systems that are optimized for one tend to struggle serving the other.

Freight is boring and un-sexy. Its not a government function in the US. So intellectuals tend to ignore it, even though it is the far more important, from an energy and environmental standpoint, portion of transport to put on the rails.

Warren Meyer, “The US Has The Best Rail System in the World, and Matt Yglesias Actually Pointed Out the Reason”, Coyote Blog, 2016-05-02.

February 5, 2016

QotD: Chimpanzees, bonobos, and humans

Popular concerns are often weirdly unrelated to actual circumstances. It was only in the 1960s, after the percentage of Americans failing to complete secondary school had been falling for decades and had reached an historic low, that Americans discovered the problem of “high school dropouts.” Political and economic conditions in France steadily improved in the decades leading up to the French Revolution; as Tocqueville explained, expectations rose faster than conditions could improve, so more humane government was accompanied by growing dissatisfaction over “despotism.” A similar process may underlie contemporary hysteria over “intimate partner violence.”

Many have commented on the “irony” that the most pampered women in history are the ones complaining most about oppression. Perhaps we should consider whether this does not represent an irony but a direct causal relation: whether modern woman complains of her lot because — rather than in spite of — its being so favorable.

Writer Jack Donovan has made an ethological argument in favor of such an interpretation. Bonobos, or pygmy chimpanzees, are physically not very different from other chimps, but they are now classed as a separate species because of radical differences in their behavior. Bonobo males are not very aggressive. They compete less for status than do male chimps, and they do not compete at all for mates. Sex is promiscuous, and males are not possessive. Homosexual mating is common. All parenting is done by mothers. Female bonds are stronger and more enduring than male bonds. In short, bonobo society is a feminist paradise.

Chimpanzee behavior is the opposite of bonobo behavior in almost every respect. Male chimps form hierarchical gangs and compete constantly for status and access to females. They are violent and territorial, forming alliances both to defend their own territory and raid that of other chimpanzee bands. They kill stray males from other bands when the opportunity presents itself. They push females around, and females are expected to display submission to males. Homosexuality is uncommon among them. Chimpanzee social behavior is a feminist’s worst nightmare.

Evolutionary theory would lead us to look for a difference in the living environments of bonobos and chimps to which their radically different behavior could represent adaptations. And the primatologists have found such a difference: chimps must compete with other species, especially gorillas, for food. The bonobos live in a food-rich, gorilla-free environment where the living is easy. It is this lack of competitors which makes violence, hierarchy, competition, and male bonding unnecessary for bonobos.

F. Roger Devlin, “The Question of Female Masochism”, Counter-Currents Publishing, 2014-09-17.

December 16, 2015

To lower healthcare costs, increase the competition

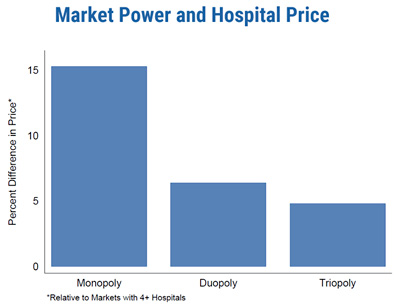

At Mother Jones, Kevin Drum links to an article that explicitly shows the cost of having monopoly providers in healthcare:

Regular readers of this blog should know that when it comes to the price of hospital care, it’s competition that matters, not insurance companies. In areas with only a single hospital, insurance companies have no leverage and have to accept whatever price the hospital charges. If there are lots of hospitals, they have to compete with each other to earn the insurance company’s business.

But in case you’re still skeptical, a team of researchers has analyzed a huge database of health care claims in the US to check this out. They found enormous regional variation in hospital costs for the same procedure, and one of the biggest drivers of this variation was competition:

Hospital market structure stands out as one of the most important factors associated with higher prices, even after controlling for costs and clinical quality. We find that hospitals located in monopoly markets have prices that are about 15.3 percent higher than hospitals located in markets with four or more providers. This result is robust across multiple measures of market structure and is consistent in states where the HCCI data contributors (and/or Blue Cross Blue Shield insurers) have high and low coverage rates.

November 27, 2015

The Balance of Industries and Creative Destruction

Published on 18 Mar 2015

Why are price signals and market competition so important to a market economy? When prices accurately signal costs and benefits and markets are competitive, the Invisible Hand ensures that costs are minimized and production is maximized. If these conditions aren’t met, market inefficiencies arise and the Invisible Hand cannot do its work. In this video, we show how two major processes, creative destruction and the elimination principle, work with the Invisible Hand to create a competitive marketplace that works for producers and consumers.

November 23, 2015

Minimization of Total Industry Costs of Production

Published on 18 Mar 2015

This section connects several ideas covered in previous videos about the price system and profit maximization. In this video, we begin to understand two basic functions of the Invisible Hand. In competitive markets, the market price (with the help of the Invisible Hand) balances production across firms so that total industry costs are minimized. Competitive markets also connect different industries. By balancing production, the Invisible Hand of the market ensures that the total value of production is maximized across different industries. We’ll use the example of minimizing total costs of corn production, and demonstrate our findings through several charts.

November 13, 2015

QotD: To many the very concept of “tax competition” is anathema

I have written a fair bit on this site and elsewhere (I work in the financial/media world) about this subject, and there is no doubt in my mind that the idea that tax competition is harmful is almost always held by politicians and collectivist-minded commentators who want to create a sort of global tax cartel. Cartels are, we learn in our textbooks, harmful although they tend to fracture with time. (The OPEC cartel had a problem in the 80s and 90 sustaining high oil prices, which at one stage went below $10 a barrel). However futile the attempt, however, do not underestimate the harm that is being done in the process of trying to shut down offshore financial centres and the like. The possibility that people can and will take their money elsewhere is one of the few constraints that exist on otherwise rapacious governments. So naturally, governments try to stop this from happening – hence all this talk about shutting down tax “competition”.

When governments claim that tax dodgers are taking food from the mouths of poor babies, treat it with scorn. The money that goes offshore doesn’t disappear down some black hole, never to appear again: that money, if it is to earn a return and outpace inflation, is invested – ie, it is put to work, often far more effectively than would otherwise be the case.

Johnathan Pearce, “The end of tax competition?”, Samizdata, 2014-11-07.

November 12, 2015

Entry, Exit, and Supply Curves: Decreasing Costs

Published on 18 Mar 2015

In this video, we talk about the special case of the decreasing cost industry. As output increases, costs will continue to fall, and more firms will enter which, again, increases output. It’s a virtuous circle! At the end of this video, we review the major points made in this section. If you find that something doesn’t quite make sense, feel free to re-watch videos as many times as you’d like.