Williamson Murray posted this review at The Strategy Bridge back in August, but I don’t recall seeing it linked anywhere. He emphasizes the role of tyche both in the small events and the greater flow of history (tyche is a Greek word meaning luck, chance, or random events that change the course of human activity). In his review, he makes it clear that he feels earlier historians have failed to emphasize just how much tyche impacted the Roman world:

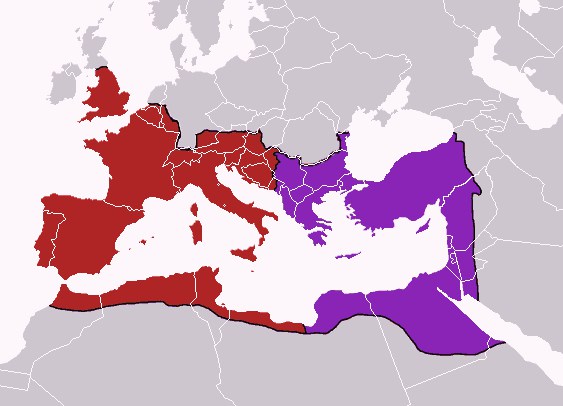

The approximate extent of the Roman empire circa 395AD, when the empire was formally divided into eastern and western zones with joint emperors in Rome and Constantinople.

In The Fate of Rome: Climate, Disease & the End of an Empire, Kyle Harper has presented us with a case study, namely the collapse of the Roman world in the period between the third and sixth centuries CE. Here tyche, in the largest sense, created a perfect storm of disastrous natural events and happenings that brought about the complete collapse of the Western Roman Empire in the fifth century CE, and eventually the ability of the Eastern Roman Empire to control much of the Mediterranean world after the seventh century. These natural events created conditions the Roman world was incapable of understanding, but which nevertheless brought about the collapse of one of the greatest, longest lasting empires in history. What Professor Harper’s book underlines is that the military difficulties that Rome’s generals and soldiers experienced in the period from the third century on were only the surface manifestations of far deeper systemic changes that could not be predicted, but which in combination created a perfect storm. Thus, fate, or more accurately tyche, undermined the best efforts to prevent what turned out to be a disastrous collapse.

The slide to catastrophe began after a period of unparalleled prosperity that had seen the population of Rome grow from approximately 60 million under Emperor Augustus in 33 BC to 75 million in 165 AD. The historian Edward Gibbon would describe the period in the following terms: “If a man were called to fix a period in the history of the world, during which the condition of the human race was most happy and prosperous, he would without hesitation, name” that period. Significantly, archeological and scientific evidence indicates the period from 200 BCE through the mid-point of the second century CE was extraordinarily favorable in terms of its climate for agriculture and the development of an extensive and expansive civilization in the Mediterranean and Western Europe. Combined with the favorable weather was a period of general peace under the empire that, for the most part, removed the generally disastrous role played by war throughout history. Except for one short period of civil wars between the claimants to Nero’s throne (70-71 CE, the year of the three emperors) and the two Jewish rebellions (66-71 CE and 135 CE), Rome fought its wars on the frontiers: the Rhine, the Danube, and Syria.

All that changed in the midst of the rule of the emperor Marcus Aurelius. The traditional narrative suggests that in 165 CE Roman soldiers returning from the campaign against the Parthians in Mesopotamia brought a plague. In fact, the pathogen most probably came through the Red Sea, brought by traders. In the great urban centers of the empire, all closely linked, it found an ideal environment. Given the extent of trade among these urban centers, the smallpox pathogens spread rapidly from urban center to urban center. As Professor Harper points out, “[i]n one sense, the Antonine Plague was a creature of chance, the final unpredictable outcome of countless millennia of evolutionary experimentation. At the same time, the empire — its global connections and fast-moving networks of communications — had created the ecological conditions for the outbreak of history’s first pandemic.” We have no way of knowing how many died, but it was substantial, on the order most probably of what was to occur in the Black Death of the fourteenth century.

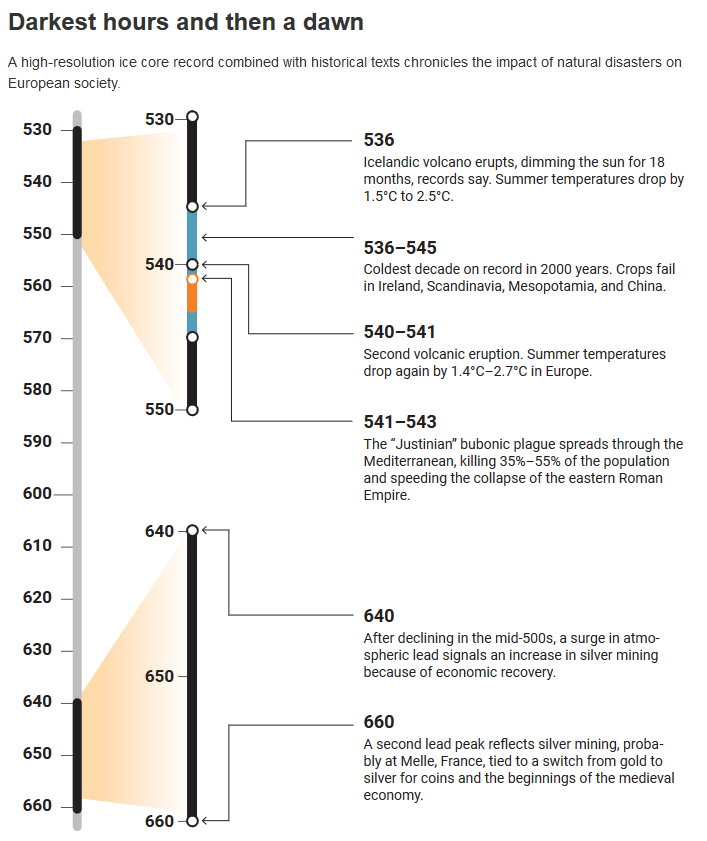

Had the Antonine Plague been the only major problem besetting the Romans, the empire would likely have weathered the initial storm without catastrophic results. It was, however, not the only major factor that would affect the long-term health of the empire, based as it was on the slight surpluses that subsistence agriculture produced. Almost concurrently with the Antonine Plague, the weather patterns across the Mediterranean and Europe, reaching into central Asia, began a slow, steady shift that resulted in an average drop in temperature and rainfall. That decline would continue through to the mid-fifth century, which was to see the beginning of an even colder period, what climatologists are now calling the “Late Antique Little Ice Age” — one that was even less favorable to agriculture.