Marginal Revolution University

Published on 25 Apr 2017The long-run aggregate supply curve is actually pretty simple: it’s a vertical line showing an economy’s potential growth rates. Combining the long-run aggregate supply curve with the aggregate demand curve can help us understand business fluctuations.

For example, while the U.S. economy grows at about 3% per year on average, it does tend to fluctuate quite a bit. What causes these fluctuations? One cause is “real shocks” that affect the fundamental factors of production. Droughts, changes to the oil supply, hurricanes, wars, technological changes, etc. can all have big and potentially far-reaching consequences.

Next week, we’ll dig into why wages are considered “sticky,” or slow to change.

December 30, 2018

The Long-Run Aggregate Supply Curve

November 23, 2018

The Aggregate Demand Curve

Marginal Revolution University

Published on 18 Apr 2017This wk: Put your quantity theory of money knowledge to use in understanding the aggregate demand curve.

Next wk: Use your knowledge of the AD curve to dig into the long-run aggregate supply curve.

The aggregate demand-aggregate supply model, or AD-AS model, can help us understand business fluctuations. In this video, we’ll focus on the aggregate demand curve.

The aggregate demand curve shows us all of the possible combinations of inflation and real growth that are consistent with a specified rate of spending growth. The dynamic quantity theory of money (M + v = P + Y), which we covered in a previous video, can help us understand this concept.

We’ll walk you through an example by plotting inflation on the y-axis and real growth on the x-axis — helping us draw an aggregate demand curve!

Next week, we’ll combine our new knowledge on the AD curve with the long-run aggregate supply curve. Stay tuned!

August 20, 2018

Causes of Inflation

Marginal Revolution University

Published on 24 Jan 2017In the last video, we learned the quantity theory of money and its corresponding identity equation: M x V = P x Y

For a quick refresher:

•M is the money supply.

•V is the velocity of money.

•P is the price level.

•And Y is the real GDP.

In this video, we’re rewriting the equation slightly to divide both sides by Y and explore the causes behind inflation. What we discover is that a change in P has three possible causes – changes in M, V, or Y.

You probably know that prices can change a lot, even over a short period of time.

Y, or real GDP, tends to change rather slowly. Even a seemingly small jump or fall in Y, such as 10% in a year, would signal astonishing economic growth or a great depression. Y probably isn’t our usual culprit for inflation.

V, or the velocity of money, also tends to be rather stable for an economy. The average dollar in the United States has a velocity of about 7. That may fall or rise slightly, but not enough to influence prices.

That leaves us with M. Changes in the money supply are the driving factor behind inflation. Put simply, when more money chases the same amount of goods and services, prices must rise.

Can we put this theory to the test? Let’s look at some real-world examples and see if the quantity theory of money holds up.

In Peru in 1990, hyperinflation came into full swing. If we track the growth rate of the money supply to the growth rate of prices, we can see that they align almost perfectly on a graph with both clocking in around 6,000% that year.

If we plot the growth rates of the money supply along with the growth rates of prices for a many countries over a long stretch of time, we can see the same relationship.

We’ll wrap-up the causes of inflation with three principles to keep in mind as we continue exploring this topic:

•Money is neutral in the long run: a doubling of the money supply will eventually mean a doubling of the price level.

•“Inflation is always and everywhere a monetary phenomena.” – Milton Friedman

•Central banks have significant control over a nation’s money supply and inflation rate.

August 12, 2018

Misunderstanding what the trade deficit represents

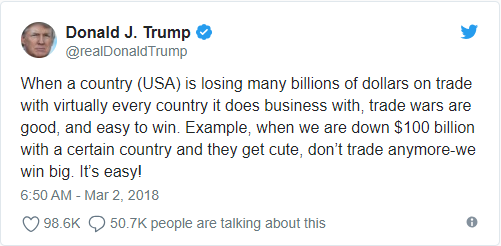

In a post from last week, Tim Worstall explains why Donald Trump is wrong about the economic impact of a trade deficit:

I should note here that I didn’t, because as a foreigner I can’t, support The Donald at the last election. But I didn’t support Hillary even more. So this is more about really, actually, insisting that Trump is wrong on trade issues rather than just the more general he’s wrong about everything common in the US press.

[…]

What Trump, DiMicco and Navarro are getting wrong is this, the GDP equation.

Y = C+I+G+(X-M)GDP is consumption plus investment plus government spending plus the trade balance – and minus it if there’s a trade deficit. So people look at this and think yep, if there’s a trade deficit than that makes Y, GDP, smaller!

But this is a mistake, an error. For, as the textbook immediately goes on to explain, what is it that we do with imports? Well, we either consume them, use them in investments or government buys them. So all imports are already in C and I and G. Meaning that if we don’t deduct them we’ll be double counting them. So, to avoid double counting we subtract them.

Trump and his advisers are simply wrong on this. The trade deficit doesn’t reduce the size of the economy. They’re getting it wrong simply because they’re not reading the second page of the explanation of the GDP equation.

June 30, 2018

Enriching the public in ways that do not show up in the GDP calculations

Tim Worstall looks at the calls to regulate the big tech firms and points out that we already get a very good deal on “free stuff” that isn’t reflected in standard economic statistics:

It won’t have escaped your attention that rather large numbers of people are calling for the regulation of the tech companies. The Amazon, Google, Facebook (Apple and Microsoft often added, just because they’re large) nexus have lots of power over markets and thus therefore – well, therefore something. My own prejudice here is that certain people just cannot look at centres of power and or money without insisting that they, the complainers, should be the ones exercising that power and determining the disposition of that money. Thus much of the drive for “democratic” regulation of the economy more generally, the self proclaimed democrats being the ones who would end up with the power. The advantage of this analysis being that it does describe reality, the same people do end up making the same arguments about different companies over time. Mere prominence brings the demand for control.

The economist on this subject is Jean Tirole. His Nobel was for exploring this very subject, tech companies and the two sided market. Google, for example, sells the search engine to us and us to the advertisers. The tech here is different, obviously, but the underlying economics is the same as that of the free newspaper.

Tirole’s a new book out and there are a number of interesting points to be had from it:

Yes, on the whole consumers tend to get a good deal, because we use wonderful services — like Google’s search engine, Gmail, YouTube, and Waze — for free. To be certain, we are not paid for the valuable data we provide to the platforms, as for example Eric Posner and Glen Weyl remind us in their recent book Radical Markets. But on the whole, our living standards have substantially improved thanks to the digital revolution.

From which we can extract a few points. We’re richer, we really are. Substantially richer and yet in a manner that normal economic statistics entirely fail to capture. As Hal Varian has pointed out, GDP doesn’t deal well with free. Near all of those benefits of the digital revolution are coming to us for free and so aren’t recorded in that GDP. So, we’re richer yet the numbers say we’re not. In that is much of the explanation of slow economic growth these days, even of slow real wage growth. We’re just not counting what is happening to our living standards.

But we can and should go further than that. If the above is true then we’re very much less unequal than we’re recording. Stuff that’s free is, obviously enough, distributed rather more evenly among the population than extant monetary incomes. You, me and Bill Gates all have access to exactly the same amount of Facebook at the same price. We’re entirely equal in that sense. Bill’s actually poorer concerning search engines, stuck for emotional reasons with Bing as he is while we get to use Google or DuckDuckGo. Our standard measures of inequality are wrong both because of the undermeasurement of new wealth and also the extremely equitable pattern of the distribution of that new wealth.

May 2, 2018

Uses and misuses of the Baltic Dry Index

At the Continental Telegraph, Tim Worstall explains why, for example, Zero Hedge‘s witterings about the changes in the Baltic Dry Index are not actually predictive of boom or bust in the global economy:

As background, the volume of such shipping – dry is referring to dry bulk cargoes, wheat, grains, cement, that is, not container stuff and not oils – is an important indicator of global growth. Trade tends to, tends to note, increase faster than growth itself. If the volume of trade falls off a cliff then we would indeed think that there’s going to be a kablooie in our global GDP figures.

The Baltic Dry is an index of the prices of shipping these cargoes. It’s thus the interaction of the supply of shipping as against the demand for it. That’s rather more than subtly different to the volume of world trade.

The basic background here is that there are reasonably long lead times to get more shipping afloat. And once it is afloat then it tends to stick around for a decade or two. Building the boat is a sunk cost (sorry) so you keep trying to use it as long as income from doing so is above marginal costs, of maintenance and fuel (and maintenance will be skipped in some circumstances) and bugger the mortgage. The supply of shipping is near entirely inelastic on an annual basis, near entirely elastic on a two decade basis.

Demand for shipping is much more elastic in that shorter term. As is usual when we’ve an inelastic supply meeting an elastic demand in a marketplace we get wild price swings. They being what causes that longer term elasticity – as with, say, oil from conventional reservoirs.

The Baltic Dry can drop because more ships are being launched, it can rise because more are scrapped. Not because – note the can here – the volume of trade has changed at all.

What has actually been happening in shipping in general is that the ship owners all looked at how trade was growing before 2008. So, they thought, aha! 5% volume growth! (Numbers here are made up but indicative of the major points) Let’s order more spanking new ships! Which then start arriving in 2010, 2011. Flooding the market with new supply. And shipping volume didn’t grow at 5%. It grew at 2% instead. (Again, these numbers are made up, reflecting memory and thus not accurate, but the relationships between them are about right) So, prices plunge.

But it’s those prices which plunge, not the volume of world trade.

April 19, 2018

The mis-measurement of the digital economy

In the Continental Telegraph, Tim Worstall explains why our current statistical model does not adequately reflect the online world’s contribution to our economy:

To give my favourite current example. WhatsApp is used by some billion people around the world for some to all of their telecoms needs. It turns up in economic statistics as a reduction in productivity.

That’s mad.

In more detail, WhatsApp is free to use and carries no advertising. That means there’s no sale associated with it. We measure consumption at market prices – a price of $0 means no consumption. Consumption is one of the three ways we measure GDP – each of the three should be the same as the other two but isn’t because lying about taxes.

The other two calculations are all incomes, or all production. Things that are sold at no price do not add to production given that we measure it at market prices.

Income, well, there’re 200 or so engineers at Facebook who work on it (I checked with Facebook itself). Say their salary is $250k a year each. Probably too low but we’ve got to use some number or other. $50 million then. That’s incomes added to GDP.

So, in our three methods of calculating GDP – they should all be the same but that doesn’t matter here – we’ve value of WhatsApp (more accurately, WhatsApp adds value of $x each year to the global economy) of $50 million. Or $0 or $0.

September 11, 2017

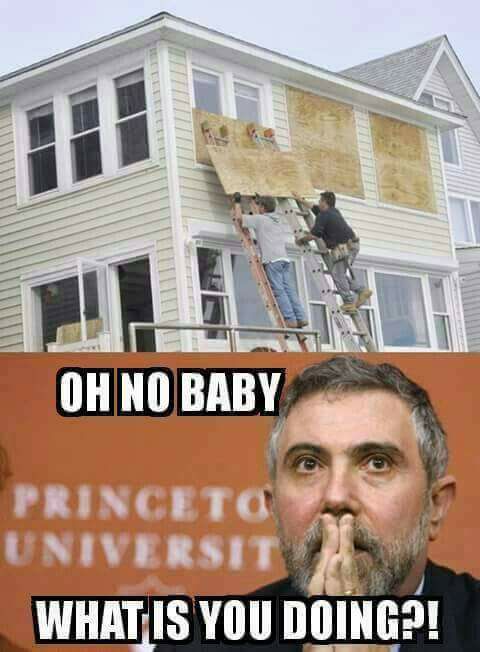

Harvey, Irma, and Frédéric – the “Broken Window Fallacy” returns

Jon Gabriel tries to set the record straight on what a natural disaster means for the economy (hint, ignore anyone who says the GDP will rise due to the recovery efforts):

Ever since Hurricane Harvey slammed into Texas two weeks ago, we’ve seen countless images of heroic rescues, flooded interstates and damaged buildings.

As awful as the human toll was, it was not as bad as many of us feared. But it will take months to repair the homes, businesses and infrastructure of Houston and the surrounding area. The same will be true in Florida after Hurricane Irma.

The economic impact could be felt for years, but many economists and financial experts think there’s a silver lining.

The Los Angeles Times crowed that Harvey’s destruction is expected to boost auto sales. CNBC reported that Harvey “could be a slight negative for U.S. growth in the third quarter, but economists say it may ultimately provide a tiny boost to the national economy because of the rebuilding in the Houston area.”

Even Goldman Sachs is looking at the bright side, noting that there could be an increase in economic activity, “reflecting a boost from rebuilding efforts and a catchup in economic activity displaced during the hurricane.”

Economically speaking, it’s great news that all this damage in Texas and Florida needs to be fixed, right? Not only does this mean big bucks for cleanup crews, but think of all the money that street sweepers, construction workers and Home Depots will rake in.

And what about all those windows broken by the high winds? This will be the Golden Age of Texas Glaziery!

Not so fast.

All of this is based on a misunderstanding of what the GDP actually measures. It’s a statistic that often gets mentioned in the newspapers and on TV, but it is almost always used in a way that misleads people about what is happening in the economy. GDP — Gross Domestic Product — is intended to show the approximate total of goods and services produced in a national economy. Thus, when the GDP goes up, it means that the current period being measured recorded more goods and services produced than in the previous period.

When a natural disaster like a hurricane, earthquake, flood, or tornado strikes a city, state or region, all the work required to fix the damage will artificially boost the recorded GDP for that year. But the affected area isn’t that much richer than it was before, despite the GDP going up, because the GDP does not measure the losses suffered during the natural disaster.

This is where Frédéric comes in. I’m referring to the French economist and author Frédéric Bastiat, who brilliantly illustrated the GDP misunderstanding in his essay “What Is Seen and What Is Not Seen“:

In the economic sphere an act, a habit, an institution, a law produces not only one effect, but a series of effects. Of these effects, the first alone is immediate; it appears simultaneously with its cause; it is seen. The other effects emerge only subsequently; they are not seen; we are fortunate if we foresee them.

There is only one difference between a bad economist and a good one: the bad economist confines himself to the visible effect; the good economist takes into account both the effect that can be seen and those effects that must be foreseen.

Yet this difference is tremendous; for it almost always happens that when the immediate consequence is favorable, the later consequences are disastrous, and vice versa. Whence it follows that the bad economist pursues a small present good that will be followed by a great evil to come, while the good economist pursues a great good to come, at the risk of a small present evil.

The GDP problem I identified at the start of this post is a general case of what Bastiat called the “Broken Window Fallacy”:

Have you ever been witness to the fury of that solid citizen, James Goodfellow, when his incorrigible son has happened to break a pane of glass? If you have been present at this spectacle, certainly you must also have observed that the onlookers, even if there are as many as thirty of them, seem with one accord to offer the unfortunate owner the selfsame consolation: “It’s an ill wind that blows nobody some good. Such accidents keep industry going. Everybody has to make a living. What would become of the glaziers if no one ever broke a window?”

Now, this formula of condolence contains a whole theory that it is a good idea for us to expose, flagrante delicto, in this very simple case, since it is exactly the same as that which, unfortunately, underlies most of our economic institutions.

Suppose that it will cost six francs to repair the damage. If you mean that the accident gives six francs’ worth of encouragement to the aforesaid industry, I agree. I do not contest it in any way; your reasoning is correct. The glazier will come, do his job, receive six francs, congratulate himself, and bless in his heart the careless child. That is what is seen.

But if, by way of deduction, you conclude, as happens only too often, that it is good to break windows, that it helps to circulate money, that it results in encouraging industry in general, I am obliged to cry out: That will never do! Your theory stops at what is seen. It does not take account of what is not seen.

It is not seen that, since our citizen has spent six francs for one thing, he will not be able to spend them for another. It is not seen that if he had not had a windowpane to replace, he would have replaced, for example, his worn-out shoes or added another book to his library. In brief, he would have put his six francs to some use or other for which he will not now have them.

Let us next consider industry in general. The window having been broken, the glass industry gets six francs’ worth of encouragement; that is what is seen.

If the window had not been broken, the shoe industry (or some other) would have received six francs’ worth of encouragement; that is what is not seen.

And if we were to take into consideration what is not seen, because it is a negative factor, as well as what is seen, because it is a positive factor, we should understand that there is no benefit to industry in general or to national employment as a whole, whether windows are broken or not broken.

Now let us consider James Goodfellow.

On the first hypothesis, that of the broken window, he spends six francs and has, neither more nor less than before, the enjoyment of one window.

On the second, that in which the accident did not happen, he would have spent six francs for new shoes and would have had the enjoyment of a pair of shoes as well as of a window.

Now, if James Goodfellow is part of society, we must conclude that society, considering its labors and its enjoyments, has lost the value of the broken window.

From which, by generalizing, we arrive at this unexpected conclusion: “Society loses the value of objects unnecessarily destroyed,” and at this aphorism, which will make the hair of the protectionists stand on end: “To break, to destroy, to dissipate is not to encourage national employment,” or more briefly: “Destruction is not profitable.”

Related: Shared by Thomas Forsyth on Facebook:

August 3, 2017

QotD: Improved quality of life doesn’t always show up in GDP figures

We economists marvel, too, but we also wonder how free apps fit into GDP. They do have their long-run downside, as we forget how to read maps and plot routes ourselves. (Anybody out there remember how to work a slide rule? No? That’s not a loss for computation but it does mean lower average numeracy.) But in the short run they save billions of hours in wrong turns not taken and trillions of cells of stomach lining no longer eaten up by travel anxiety. Not to mention their entertainment value.

But hardly any of that very big upside shows up in GDP. In one respect, in fact, GDP goes down. I used to buy maps, including travel atlases. I’m unlikely to do that anymore. Maps purchased by consumers are a “final good or service” and thus do enter into GDP. Maps I interact with online but don’t pay for aren’t GDP. So well-being has gone up — a lot — as a result of Google Maps. But GDP may well have gone down.

In fact, apps do produce some GDP. Google sustains itself in part by selling ads, including to retailers and restaurants looking to pay for prominent mention on its map display. Its ad revenue is an intermediate input into GDP. Many of the entities buying Google ads are in the business of selling “final goods or services” and if they’re money-making, the prices of their goods have to cover the cost of their ads. So by that circuitous route the “value” of the apps does end up in GDP.

But what’s the relationship between what advertisers pay for my eyeballs and the value of the app to me? The two are not completely unrelated. The more I use the app the more I’m likely to buy the advertised products, presumably. But in practice, the probability of my buying is pretty small while my benefit from the app is pretty big. How strange that miracle apps can change our lives but not our GDP.

William Watson, “How using Google Maps on your summer road trip messes with the GDP”, Financial Post, 2017-07-18.

June 19, 2017

Office Hours: The Solow Model

Published on 20 Apr 2016

In last week’s Principles of Macroeconomics video, you learned about the steady state level of capital and the Solow model of economic growth. Here are two of the practice questions from that video:

Country A has K=10,000 and produces GDP according to the following equation: GDP=5√K.

1) If the country devotes 25% of its GDP to making investment goods, how much is the country investing?

2) If 1% of all machines become worthless every year (they depreciate, in other words) in Country A, GDP is…?

June 4, 2017

Intro to the Solow Model of Economic Growth

Published on 28 Mar 2016

Here’s a quick growth conundrum, to get you thinking.

Consider two countries at the close of World War II — Germany and Japan. At that point, they’ve both suffered heavy population losses. Both countries have had their infrastructure devastated. So logically, the losing countries should’ve been in a post-war economic quagmire.

So why wasn’t that the case at all?

Following WWII, Germany and Japan were growing twice, sometimes three times, the rate of the winning countries, such as the United States.

Similarly, think of this quandary: in past videos, we explained to you that one of the keys to economic growth is a country’s institutions. With that in mind, think of China’s growth rate. China’s been growing at a breakneck pace — reported at 7 to 10% per year.

On the other hand, countries like the United States, Canada, and France have been growing at about 2% per year. Aside from their advantages in physical and human capital, there’s no question that the institutions in these countries are better than those in China.

So, just as we said about Germany and Japan — why the growth?

To answer that, we turn to today’s video on the Solow model of economic growth.

The Solow model was named after Robert Solow, the 1987 winner of the Nobel Prize in Economics. Among other things, the Solow model helps us understand the nuances and dynamics of growth. The model also lets us distinguish between two types of growth: catching up growth and cutting edge growth. As you’ll soon see, a country can grow much faster when it’s catching up, as opposed to when it’s already growing at the cutting edge.

That said, this video will allow you to see a simplified version of the model. It’ll describe growth as a function of a few specific variables: labor, education, physical capital, and ideas.

So watch this new installment, get your feet wet with the Solow model, and next time, we’ll drill down into one of its variables: physical capital.

Helpful links:

Puzzle of Growth: http://bit.ly/1T5yq18

Importance of Institutions: http://bit.ly/25kbzne

Rise and Fall of the Chinese Economy: http://bit.ly/1SfRpDL

April 17, 2017

Office Hours: Rule of 70

Published on 23 Feb 2016

One of the of the practice questions from our “Growth Rates Are Crucial” video asks you to compare real GDP per capita for two countries that start at the same place, but grow at different rates. It’s a little tricky:

Suppose two countries start with the same real GDP per capita, but country A is growing at 2% per year and country B is growing at 3% per year. After 140 years, country B will have a real GDP per capita that is roughly ________ times higher than country A. (Hint- you may want to review the “Rule of 70” to answer this question.)

We asked our Instructional Designer, Mary Clare Peate, to hold virtual “office hours” to guide you through how to solve this problem. Join her as she discusses your questions!

April 7, 2017

Growth Rates Are Crucial

Published on 12 Jan 2016

In the first video in this section on The Wealth of Nations and Economic Growth, you learned a basic fact of economic wealth — that countries can vary widely in standard of living. Specifically, you learned how variations in real GDP per capita can set countries leagues apart from one another.

Today, we’ll continue on that road of differences, and ask yet another question.

How can we explain wealth disparities between countries?

The answer? Growth rates.

And in this video, you’ll learn all about the ins-and-outs of measuring growth rates.

For one, you’ll learn how to visualize growth properly — examining growth in real GDP per capita on a ratio scale.

Then, here comes the fun part: you’ll also take a dive into the growth of the US economy over time. It’s a little bit like time travel. You’ll transport yourself to different periods in the country’s economic history: 1845, 1880, the Roaring Twenties, and much more.

As you transport yourself to those times, you’ll also see how the economies of other countries stack up in comparison. You’ll see why the Indian economy now is like a trip back to the US of 1880. You’ll see why China today is like the America of the Jazz Age. (You’ll even see why living in Italy today is related to a time when Atari was popular in the US!)

In keeping with our theme, though, we won’t just offer you a trip through ages past.

Because by the end of this video, you’ll also have the answer to one vital question: if the US had grown at an even higher rate, where would we be by now?

The magnitude of the answer will surprise you, we’re sure.

But then, that surprise is in the video. So, go on and watch, and we’ll see you on the other side.

March 20, 2017

Basic Facts of Wealth

Published on 5 Jan 2016

We know that there are rich countries, poor countries, and countries somewhere in between. Economically speaking, Japan isn’t Denmark. Denmark isn’t Madagascar, and Madagascar isn’t Argentina. These countries are all different.

But how different are they?

That question is answered through real GDP per capita—a country’s gross domestic product, divided by its population.

In previous videos, we used real GDP per capita as a quick measure for a country’s standard of living. But real GDP per capita also measures an average citizen’s command over goods and services. It can be a handy benchmark for how much an average person can buy in a year — that is, his or her purchasing power. And across different countries, purchasing power isn’t the same.

Here comes that word again: it’s different.

How different? That’s another question this video will answer.

In this section of Marginal Revolution University’s course on Principles of Macroeconomics, you’ll find out just how staggering the economic differences are for three countries — the Central African Republic, Mexico, and the United States.

You’ll see why variations in real GDP per capita can be 10 times, 50 times, or sometimes a hundred times as different between one country and another. You’ll also learn why the countries we traditionally lump together as rich, or poor, might sometimes be in leagues all their own.

The whole point of this? We can learn a lot about a country’s wealth and standard of living by looking at real GDP per capita.

But before we give too much away, check out this video — the first in our section on The Wealth of Nations and Economic Growth.

March 5, 2017

Splitting GDP

Published on 21 Nov 2015

In the last three videos, you learned the basics of GDP: how to compute it, and how to account for inflation and population increases. You also learned how real GDP per capita is useful as a quick measure for standard of living.

This time round, we’ll get into specifics on how GDP is analyzed and used to study a country’s economy. You’ll learn two approaches for analysis: national spending and factor income.

You’ll see GDP from both sides of the ledger: the spending and the receiving side.

With the national spending approach, you’ll see how gross domestic product is split into three categories: consumption goods bought by the public, investment goods bought by the public, and government purchases.

You’ll also learn how to avoid double counting in GDP calculation, by understanding how government purchases differ from government spending, in terms of GDP.

After that, you’ll learn the other approach for GDP splitting: factor income.

Here, you’ll view GDP as the total sum of employee compensation, rents, interest, and profit. You’ll understand how GDP looks from the other side — from the receiving end of the ledger, instead of the spending end.

Finally, you’ll pay a visit to FRED (the Federal Reserve Economic Data website) again.

FRED will help you understand how GDP and GDI (the name for GDP when you use the factor income approach) are used by economists in times of economic downturn.

So, buckle in again. It’s time to hit the last stop on our GDP journey.