This month’s Classic Trains fallen flag feature is the first part of the history of the New York Central System by George Drury. The New York Central was one of the biggest and most economically powerful American railways for over a century before the postwar boom turned into the economic disaster of the 1960s and 70s, as passengers switched from rail to road and plane and the decline of northeastern heavy industry and mining hit the established eastern railroads very hard:

This month’s Classic Trains fallen flag feature is the first part of the history of the New York Central System by George Drury. The New York Central was one of the biggest and most economically powerful American railways for over a century before the postwar boom turned into the economic disaster of the 1960s and 70s, as passengers switched from rail to road and plane and the decline of northeastern heavy industry and mining hit the established eastern railroads very hard:

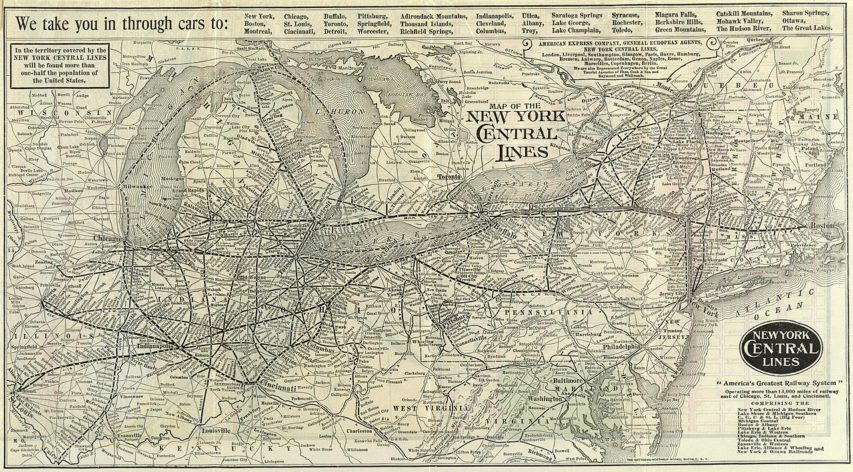

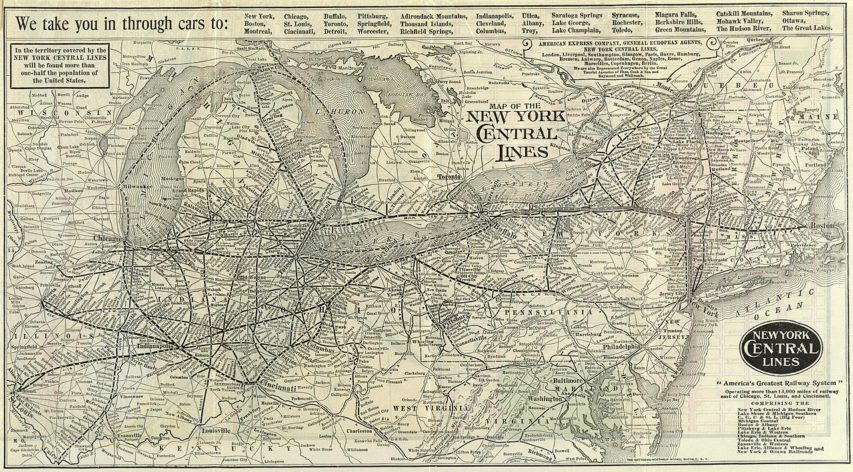

The New York Central was a large railroad, and it had several subsidiaries whose identity remained strong, not so much in cars and locomotives carrying the old name but in local loyalties: If you lived in Detroit, you rode to Chicago on the Michigan Central, not the New York Central; through the Conrail era and even now, the line across Massachusetts is still known as “the Boston & Albany.”

The streamlined steam locomotive New York Central Hudson No.5344 “Commodore Vanderbilt”, leaving Chicago’s LaSalle Street station pulling the NYC’s premier passenger traing, the 20th Century Limited, 22 February 1935.

Photo originally copyrighted International News Photos (copyright not renewed) via Wikimedia Commons

The system’s history is easier to digest in small pieces: first New York Central followed by its two major leased lines, Boston & Albany and Toledo & Ohio Central; then Michigan Central and Big Four (Cleveland, Cincinnati, Chicago & St. Louis). By the mid-1960s NYC owned 99.8 percent of the stock of Michigan Central and more than 97 percent of the stock of the Big Four. NYC leased both on Feb. 1, 1930, but they remained separate companies to avoid the complexities of merger.

In broad geographic terms, the NYC proper was everything east of Buffalo plus a line from Buffalo through Cleveland and Toledo to Chicago (the former Lake Shore & Michigan Southern). NYC included the Ohio Central Lines (Toledo through Columbus to and beyond Charleston, W.Va.) and the Boston & Albany (neatly defined by its name). The Michigan Central was a Buffalo–Detroit–Chicago line and everything in Michigan north of that. The Big Four was everything south of NYC’s Cleveland–Toledo–Chicago line other than the Ohio Central.

The New York Central System included several controlled railroads that did not accompany NYC into the Penn Central merger. The most important of these were (with the proportion of NYC ownership in the mid-1960s):

- Pittsburgh & Lake Erie (80 percent)

- Indiana Harbor Belt (NYC, 30 percent; Michigan Central, 30 percent; Chicago & North Western, 20 percent; and Milwaukee Road, 20 percent)

- Toronto, Hamilton & Buffalo (NYC, 37 percent; MC, 22 percent; Canada Southern, 14 percent; and Canadian Pacific, 27 percent).

[…]

The New York & Harlem Railroad was incorporated in 1831 to build a line in Manhattan from 23rd Street north to 129th Street between Third and Eighth avenues (the railroad chose to follow Fourth Avenue). At first the railroad was primarily a horsecar system, but in 1840 the road’s charter was amended to allow it to build north toward Albany. In 1844 the rails reached White Plains and in January 1852 the New York & Harlem made connection with the Western Railroad (later Boston & Albany) at Chatham, N.Y., creating a New York–Albany rail route.

The towns along the Hudson River felt no need of a railroad, except during the winter when ice prevented navigation. Poughkeepsie interests organized the Hudson River Railroad in 1847. The railroad opened from a terminal on Manhattan’s west side all the way to East Albany. By then the road had leased the Troy & Greenbush, gaining access to a bridge over the Hudson at Troy. (A bridge at Albany was completed in 1866.)

By 1863 Cornelius Vanderbilt controlled the New York & Harlem and had a substantial interest in the Hudson River Railroad. In 1867 he obtained control of the New York Central, consolidating it with the Hudson River in 1869 to form the New York Central & Hudson River Railroad.

Vanderbilt wanted to build a magnificent terminal for the NYC&HR in New York. He chose as its site the corner of 42nd Street and Fourth Avenue on the New York & Harlem, the southerly limit of steam locomotive operation in Manhattan. Construction of Grand Central Depot began in 1869. The new depot was actually three separate stations serving the NYC&HR, the New York & Harlem, and the New Haven. Trains of the Hudson River line reached the New York & Harlem by means of a connecting track completed in 1871 along Spuyten Duyvil Creek and the Harlem River (they have since become a single waterway). That was the first of three Grand Centrals.

The Wikipedia page on the New York Central includes a good overview of the decline of the railway:

The New York Central, like many U.S. railroads, declined after the Second World War. Problems resurfaced that had plagued the railroad industry before the war, such as over-regulation by the Interstate Commerce Commission (ICC), which severely regulated the rates charged by the railroad, along with continuing competition from automobiles. These problems were coupled with even more formidable forms of competition, such as airline service in the 1950s that began to deprive NYC of its long-distance passenger trade. The Interstate Highway Act of 1956 helped create a network of efficient roads for motor vehicle travel through the country, enticing more people to travel by car, as well as haul freight by truck. The 1959 opening of the Saint Lawrence Seaway adversely affected NYC freight business. Container shipments could now be directly shipped to ports along the Great Lakes, eliminating the railroads’ freight hauls between the east and the Midwest.

The NYC also carried a substantial tax burden from governments that saw rail infrastructure as a source of property tax revenues – taxes that were not imposed upon interstate highways. To make matters worse, most railroads, including the NYC, were saddled with a World War II-era tax of 15% on passenger fares, which remained until 1962, 17 years after the end of the war.

Robert R. Young: 1954–1958

In June 1954, management of the New York Central System lost a proxy fight in 1954 to Robert Ralph Young and the Alleghany Corporation he led.

Alleghany Corporation was a real estate and railroad empire built by the Van Sweringen brothers of Cleveland in the 1920s that had controlled the Chesapeake and Ohio Railway (C&O) and the Nickel Plate Road. It fell under the control of Young and financier Allan Price Kirby during the Great Depression.

R.R. Young was considered a railroad visionary, but found the New York Central in worse shape than he had imagined. Unable to keep his promises, Young was forced to suspend dividend payments in January 1958. He committed suicide later that month.

Alfred E. Perlman: 1958–1968

After Young’s suicide, his role in NYC management was assumed by Alfred E. Perlman, who had been working with the NYC under Young since 1954. Despite the dismal financial condition of the railroad, Perlman was able to streamline operations and save the company money. Starting in 1959, Perlman was able to reduce operating deficits by $7.7 million, which nominally raised NYC stock to $1.29 per share, producing dividends of an amount not seen since the end of the war. By 1964 he was able to reduce the NYC long-term debt by nearly $100 million, while reducing passenger deficits from $42 to $24.6 million.

Perlman also enacted several modernization projects throughout the railroad. Notable was the use of Centralized Traffic Control (CTC) systems on many of the NYC lines, which reduced the four-track mainline to two tracks. He oversaw construction and/or modernization of many hump or classification yards, notably the $20-million Selkirk Yard which opened outside of Albany in 1966. Perlman also experimented with jet trains, creating a Budd RDC car (the M-497 Black Beetle) powered by two J47 jet engines stripped from a B-36 Peacemaker bomber as a solution to increasing car and airplane competition. The project did not leave the prototype stage.

Perlman’s cuts resulted in the curtailing of many of the railroad’s services; commuter lines around New York were particularly affected. In 1958–1959, service was suspended on the NYC’s Putnam Division in Westchester and Putnam counties, and the NYC abandoned its ferry service across the Hudson to Weehawken Terminal. This negatively impacted the railroad’s West Shore Line, which ran along the west bank of the Hudson River from Jersey City to Albany, which saw long-distance service to Albany discontinued in 1958 and commuter service between Jersey City and West Haverstraw, New York terminated in 1959. Ridding itself of most of its commuter service proved impossible due to the heavy use of these lines around metro New York, which government mandated the railroad still operate.

Many long-distance and regional-haul passenger trains were either discontinued or downgraded in service, with coaches replacing Pullman, parlor, and sleeping cars on routes in Michigan, Illinois, Indiana, and Ohio. The Empire Corridor between Albany and Buffalo saw service greatly reduced with service beyond Buffalo to Niagara Falls discontinued in 1961. On December 3, 1967, most of the great long-distance trains ended, including the famed Twentieth Century Limited. The railroad’s branch line service off the Empire Corridor in upstate New York was also gradually discontinued, the last being its Utica Branch between Utica and Lake Placid, in 1965. Many of the railroad’s great train stations in Rochester, Schenectady, and Albany were demolished or abandoned. Despite the savings these cuts created, it was apparent that if the railroad was to become solvent again, a more permanent solution was needed.