My local MP also happens to be the federal Minister of Finance, who got his moment in the spotlight today as he unveiled the government’s 2012 budget. The media folks who were in the budget lock-up are just starting to publish their reports on the “wins” and “losses” as they see them in the new budget.

Initial Tweets concentrated on these headline-friendly moves:

- Old age pension eligibility will rise to 67

- Civil service will shrink by 19,000 positions

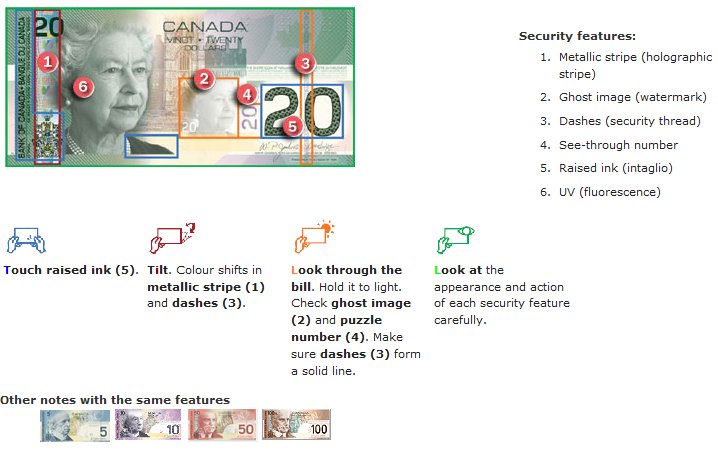

- Coinage change: we’re abandoning the penny (they cost 50% more to make than they’re worth, and we didn’t make it up in volume)

- Return the budget to balance by 2015-2016 and begin running a surplus after that

Pravda The CBC, our government-owned TV/radio network, will see a 10% cut in funding

I’ll update this post as new information gets published.

Update: John Ivison at the National Post calls it “A grand vision of still-big government”:

For a government that has forsworn the vision thing to this point, Budget 2012 is Obama-esque in the audacity of its hope for the future.

“We see Canada for what it is and what it can be… Today we step forward boldly, to realize it fully — hope for our children and grandchildren; opportunity for all Canadians; a prosperous future for our beloved country,” said Jim Flaherty in his speech to the House of Commons, boldly going where no Conservative Finance Minister has gone before — save perhaps Sir George Foster, who served Sir John A. Macdonald.

Mr Flaherty summoned up Sir George in his speech, quoting the need “for long vision, the fine courage of statesmanship and the warm fires of national imagination….Let us climb the heights and take a look forward.”

If the rest of the contents fail to live up to that level of rhetoric, they do at least amount to a serious attempt to move beyond the naked bribery of budgets past.

Paul “Inkless” Wells calls it “Harper’s very political budget”:

Revolution, ladies and gents! Light the torches! In his December year-end interviews, Stephen Harper used the term “major transformations” a half-dozen times. He made fun of earlier majority prime ministers. They let the bureaucrats put them to sleep! For years! No chance of that happening to Harper. Major transformations, coming right up.

Fast forward to this afternoon. “We will eliminate the penny,” Jim Flaherty told the Commons. It was literally the first new policy measure he announced. “Pennies take up too much space on our dressers at home.”

Now you know why Trudeau and Mulroney and Chrétien were such snoozers. It was the pennies. Weighing them down all day. Cluttering their dressers at night. Pennies wear a guy down. Harper, the Interac Prime Minister, will be fleet of foot, full of vim, and ready for —

— major transformations? No. I don’t have a searchable electronic text of Flaherty’s speech, but I do not see the word “transformation” anywhere in it. The rhetoric is altogether more reassuring. “The reforms we present today are substantial, responsible, and necessary,” he said, and “We will stay on course,” and “We will maintain our consistent, pragmatic, and responsible approach to the economy,” and “We will implement moderate restraint in government spending.”

From the Budget overview itself, a welcome change to Canadians who shop in the United States:

Every year, Canadians take some 30 million overnight trips outside of Canada, often returning with goods purchased abroad. Modernization of the rules applied to these purchases is long overdue. Economic Action Plan 2012 proposes the most significant increase in the duty- and tax-free travellers’ exemptions in decades. The travellers’ exemption allows Canadians to bring back goods up to a specified dollar limit without having to pay duties or taxes, including customs duty, Goods and Services Tax/Harmonized Sales Tax, federal excise levies and provincial sales and product taxes.

The Government proposes to increase the value of goods that may be imported duty- and tax-free by Canadian residents returning from abroad after a 24-hour and 48-hour absence to $200 and $800, harmonizing them with U.S. levels. This measure will facilitate cross-border travel by streamlining the processing of returning Canadian travellers who have made purchases while outside Canada. This change will be effective beginning on June 1, 2012. It is estimated that this measure will reduce federal revenues by $13 million in 2012–13 and by $17 million in 2013–14.

Campbell Clark at the Globe and Mail says the budget marks a strong change in the government’s formerly pro-military stance:

The Harper government is slashing spending on Canada’s international presence, with deep cuts to the military, aid and diplomacy.

It marks a reversal to the Conservatives long-ballyhooed policy of beefing up the military: It’s no longer just slowing the growth of Defence spending, but cutting it back, and delaying billions of dollars in capital spending on military hardware for seven years.

[. . .]

In fact, neither the budget nor the host of government officials attending a lockup to explain it provided a figure for the Defence budget for the coming year, and in the years affected by the cuts. Officials said that information was not being presented on budget day.

Still, it was clear that the impact will be deep. Since 2006, the Harper government has touted year-over-year increases for military spending, even when it announced two years ago the growth would be slowed. Now it’s cutting.

By 2014-15, more than $1.1-billion a year will be lopped off the regular Defence budget. But that’s not all. In addition, $3.5-billion in capital spending — the sums the military uses to buy equipment like planes, ships, trucks, tanks and weapons — will be put off until seven years from now, so that the government can save an average of $500-million a year.

Hmmmm. Slowdowns in major equipment purchases? I wonder if we’re about to get a Defence White Paper. We’re probably overdue for one of those…