Money is a symbolic system, the purpose of which is to facilitate exchange and to act as a recordkeeping technology. That money is so very important to our everyday lives and yet has no real connection with physical reality is the source of many apparent paradoxes and contradictions. These are the best of times, these are the worst of times.

Measured by money, things look relatively grim for the American middle class and the poor. Men’s inflation-adjusted average wages peaked in 1973, and inflation-adjusted household incomes for much of the middle class have shown little or no growth in some time. The incomes of those at the top of the distribution (which is not composed of a stable group of individuals, political rhetoric notwithstanding) continue to pull away from those in the middle and those at the bottom. The difference between a CEO’s compensation and the average worker’s compensation continues to grow.

But much of that is written into the code. If, for example, you measure inequality by comparing the number of dollars it takes to land at a certain income percentile, with a hard floor on the low end (that being $0.00 per year in wages) but no ceiling on the top end, and if you have growth in the economy, then it is a mathematical inevitability that incomes at the top will continue to pull away from incomes at the bottom, for the same reason that any point on the surface of a balloon will get farther and farther away from the imaginary fixed point at its center as the balloon is inflated. This will be the case whether you have the public policies of Singapore or Sweden, and indeed it is the case in both Singapore and Sweden.

Purely symbolic systems are easy to manipulate, which is why any two economists can take the same set of well-documented economic data and derive from it diametrically opposed conclusions.

With economic models, we are a little like Neo in The Matrix, before he takes the red pill: We are not in the real world, but in a simulacrum of it, one that has rules, but rules that can be manipulated by those who understand the code. Economic models and analysis are very useful, but it’s worth taking the occasional red-pill tour, leaving behind the world of pure symbolism and taking a look at the physical economy.

Welcome to the paradise of the real.

Kevin D. Williamson, “Welcome to the Paradise of the Real: How to refute progressive fantasies — or, a red-pill economics”, National Review, 2014-04-24

December 3, 2014

QotD: Money in the “paradise of the real”

November 12, 2014

QotD: Europe’s banking trap

Banking is a service, […] and a service has a cost associated with it. Modern banking has all kinds of fees and charges associated with it. But depositors are often charged for keeping too low a balance in their savings or checking accounts, not too large a balance. What’s going on here?

Central banks have created this monster via the regimen of ZIRP (Zero Interest Rate Policy). This is a way of implementing Keynesian stimulus, but central banks have run up against the liquidity-trap wall: interest rates cannot fall below zero. Monetary policy stops working at the zero-interest boundary.

For central banks, the problem is that in a slow-growth economy (or actually a recessive one) a paradox arises where rational behavior on the part of savers leads to bad results: consumers save their money out of concern for the future, but the economy — starved of the cash that fuels it — slows still further. This is the argument behind Keynesian stimulus; inject more (newly-printed) money into the economy until people stop being scared and start spending freely again (with their own money and borrowed money). The danger of inflation looms, however, so central banks try to implement various regimes to keep it under control (with varying degrees of success).

This theory founders on the shoals of reality, alas. It’s rational for people to save money, particularly during bad times, because people believe their currency stock to be an appreciating (or at least a constant-value) asset. But when a sovereign inflates (devalues) its currency to solve a short term economic problem, they run the risk of damaging confidence in the currency itself. Inflation may inject some nitrous oxide into the engine of the economy for a short time, but the outcome may be a blown engine (i.e., a ruined currency, as it was during the Weimar era).

When people lose trust in a fiat currency, it’s nearly impossible to restore confidence in it. Trust is all a fiat currency has — without trust, fiat currency is just worthless paper. This is really the core of the sound-money argument: deflation is bad because it can stall an economy and make debt servicing murderously difficult, but inflation is worse because it wrecks the currency itself. Hard-money currency regimes may be somewhat prone to deflationary cycles, but at least they never go to zero value; they always retain some value. Fiat currencies can go to zero.

Monty, “DOOM: The Wrath of Draghi”, Ace of Spades H.Q., 2014-11-06.

April 5, 2014

Grade inflation at US universities

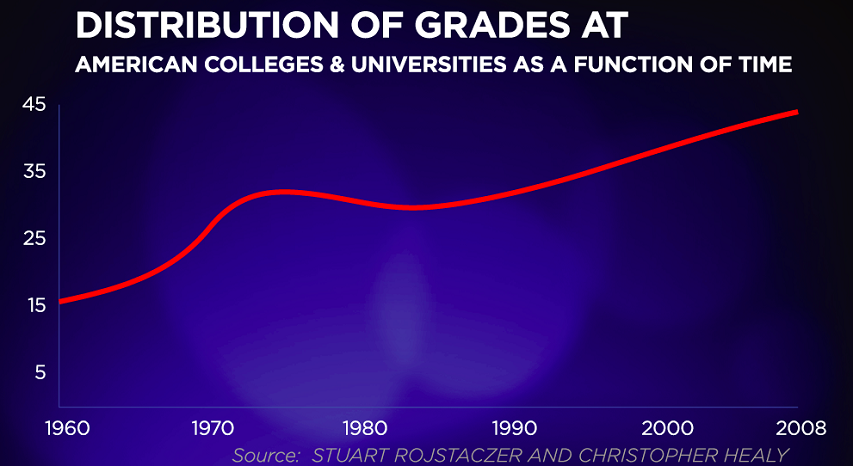

Stu Burguiere looks at the remarkable increase in higher grades handed out at US universities:

I never went to college so I missed out on all the keg parties and, apparently, a surplus of good grades.

Contrary to the concept of school as you knew it growing up, A’s are pretty easy to come by these days. In fact the only thing you have to work really hard to get are D’s and F’s. In college today, an A is over four times as common as a D or an F combined.

It’s a drastic change from the 15% of students who received A’s in 1960.

The pool is a little higher today. Ok, it’s a lot higher. If you look at this chart you’ll see that 43% of all letter grades given today are A’s.

And this sort of makes sense if you think about it. No one wants to pay $40,000 a year to hear that they’re dumb.

College is one of the rare businesses in which you pay them and at the end of the experience they tell you how well they did. If you’re a parent and you send your kids to school and they get A’s you feel good about the purchase. But if your kids get F’s you feel like they wasted your money.

And amazingly these institutions of higher learning, that do little other than indoctrinate kids against the evils of capitalism, sure do understand incentives.

February 24, 2014

Argentina reported to be increasing military spending

The Argentine government has announced it will be increasing spending on their armed forces by a third in the coming year. While this report in the Daily Express takes it seriously, it fails to account for the overall sorry state of the Argentinian economy … it’s not clear if there’s any actual money to be allocated to the military:

Buenos Aires will acquire military hardware including fighter aircraft, anti-aircraft weapons and specialised radar, as well as beefing up its special forces.

The news comes months before drilling for oil begins in earnest off the Falkland Islands, provoking Argentina’s struggling President Cristina Fernandez de Kirchner.

Last month she created a new cabinet post of Secretary for the Malvinas, her country’s name for the Falklands.

Meanwhile, Defence Secretary Philip Hammond has refused to confirm that Britain would retake the Falklands if they were overrun by enemy forces.

The extra cash means Argentina will increase defence spending by 33.4 per cent this year, the biggest rise in its history. It will include £750million for 32 procurement and modernisation programmes.

They will include medium tanks and transport aircraft and the refurbishment of warships and submarines. The shopping list also includes Israeli air defence systems, naval assault craft, rocket systems, helicopters and a drone project.

As reported earlier this month, the economy is suffering from an inflation rate estimated to be in the 70% range, the government has expropriated private pensions and foreign-owned companies, and is unable to borrow significant amounts of money internationally due to their 2002 debt default. Announcing extra money for the military may well be the economic version of Baghdad Bob’s sabre-rattling press conferences … just for show.

On the other hand, military adventurism is a hallowed tradition for authoritarian regimes to tamp down domestic criticism and rally public opinion. Being seen to threaten the British in the Falkland Islands still polls well in Buenos Aires.

February 1, 2014

Argentina’s economic end-game

In Forbes, Ian Vasquez looks at the plight of the Argentine economy:

Argentina’s luck is finally starting to run out. It devalued its currency by 15 percent last week, marking the beginning of a possible economic crisis of the kind Argentina has become known for. Argentina’s problem is that it has followed the logic of populism for more than a decade and President Cristina Kirchner is showing no interest in changing course.

In the 1990s Argentina combined far-reaching but sometimes flawed market-reforms with irresponsible fiscal policies, culminating in its 2002 default on $81 billion in debt — the largest sovereign default in history. The country delinked its currency from the dollar, experienced a severe economic crisis, and initiated its current period of populist politics.

Those policies included price controls on domestic energy, reneging on contracts with foreign companies, export taxes, more pubic sector employment and vastly increased spending. When you don’t pay massive debts, you get temporary breathing room, so growth resumed. High commodity prices and low global interest rates that lifted demand for Argentine exports also helped produce Argentine growth.

But the government’s appetite has consistently grown faster, and, with little ability to borrow abroad, it has turned to other sources of finance. In 2008, Kirchner nationalized private pension funds worth some $30 billion, and has since nationalized an airline and a major oil company. As it drew down reserves, the government turned to printing money to finance itself, falsifying the inflation rate it says is about 11 percent, but which independent analysts put at about 28 percent. Economist Steve Hanke estimates it is much higher at 74 percent

September 17, 2013

A brief history of fifty years of American economic thought

Tyler Cowen wraps up the rise and fall of “right” and “left” economics in the US since the 1960s:

Throughout the 1970s and most of the 1980s, the so-called “right wing” was right about virtually everything on the economic front. Most of all communism, but also inflation, taxes, (most of) deregulation, labor unions, and much more, noting that a big chunk of the right wing blew it on race and some other social issues. The Friedmanite wing of the right nailed it on floating exchange rates.

Arguably the “rightness of the right” peaks around 1989, with the collapse of communism. After that, the right wing starts to lose its way.

Up through that time, market-oriented economists have more interesting research, more innovative journals, and much else to their credit, culminating in the persona and career of Milton Friedman.

I’ve never heard tales of Paul Samuelson’s MIT colleagues mocking him for his pronouncements on Soviet economic growth. I suspect they didn’t.

Starting in the early 1990s, the left wing is better equipped, more scholarly, and also more fun to read. (What exactly turned them around?) In the 1990s, the Quarterly Journal of Economics is suddenly more interesting and ultimately more influential than the Journal of Political Economy, even though the latter retained a higher academic ranking. The right loses track of what its issues ought to be. There is no real heir to the legacy of Milton Friedman.

August 14, 2013

Ignore the inconsistencies in official Chinese statistics at your peril

It’s been a while since I reminded everyone that the official Chinese government statistics can’t be trusted. Here’s Zero Hedge on the same topic:

How Badly Flawed Is Chinese Economic Data? The Opening Bid is $1 Trillion

Baseline Chinese economic data is unreliable. Taking published National Bureau of Statistics China data on the components of consumer price inflation, I attempt to reconcile the official data to third party data. Three problems are apparent in official NBSC data on inflation.

First, the base data on housing price inflation is manipulated. According to the NBSC, urban private housing occupants enjoyed a total price increase of only 6% between 2000 and 2011.

Second, while renters faced cumulative price increases in excess of 50% during the same period, the NBSC classifies most Chinese households has private housing occupants making them subject to the significantly lower inflation rate.

Third, despite beginning in the year 2000 with nearly two-thirds of Chinese households in rural areas, the NSBC applies a straight 80/20 urban/rural private housing weighting throughout our time sample. This further skews the accuracy of the final data.

To correct for these manipulative practices, I use third party and related NBSC data to better estimate the change in consumer prices in China between 2000 and 2011.

I find that using conservative assumptions about price increases the annual CPI in China by approximately 1%.

This reduces real Chinese GDP by 8-12% or more than $1 trillion in PPP terms.

Regular visitors to the blog know that I’ve been rather skeptical about the official statistics reported by Chinese government and media sources.

July 23, 2013

The real aftermath of Iceland’s banking collapse

Simon Black contradicts the media narrative that Iceland has “recovered” from the melt-down of their banking sector:

It was a spectacular collapse. And the first of many. Ireland, Greece, Cyprus, etc. were soon to follow.

Yet unlike the bankrupt countries of southern Europe, Iceland dealt with its economic emergency in a completely different way.

Politicians here are proud that they never resorted to austere budget cuts that are so prevalent in Europe.

They imposed capital controls. They let the banks fail. And, as is so commonly trumpeted in the press, they ‘jailed their bankers and bailed out their people.’

Today, Iceland is held up as the model of recovery. Famous economists like Paul Krugman praise the government for rapidly rebuilding the economy without having to resort to austerity.

This morning’s headline from The Telegraph newspaper sums it up: “Iceland has taken its medicine and is off the critical list”.

It turns out, most of these claims are dead wrong.

[…]

Meanwhile, the government ended up taking on massive amounts of debt in order to bail out the biggest bank of all – Iceland’s CENTRAL BANK.

This was a bit different than the way things played out in the US and Europe.

In the US, the Fed conjures money out of thin air and funnels it to the government.

In Iceland, since the Kronor is not a global reserve currency, the government had to go into debt in order to funnel money to the Central Bank, all so that the currency wouldn’t collapse.

As a result, Iceland’s state debt tripled, almost overnight, in 2008. And from 2007 until now, it has increased nearly 5-fold.

Today, the government is spending a back-breaking 17.3% of its tax revenue just to pay interest on the debt.

And this is real interest, too. Iceland’s central bank owns very little of the government debt. The rest is owed to foreign creditors… putting the country in an extremely difficult financial position.

At the end of the day, the Icelandic people are responsible for this. They were never bailed out. They were stuck with the bill.

Meanwhile, although unemployment in Iceland is low, wages are even lower. And the weak currency has brought on double-digit inflation.

So while people do have jobs, they can hardly afford anything.

This is most prevalent in the housing market, most of which is underwater. Interest rates have jumped so much that many Icelanders are now on negative amortization schedules, i.e. their mortgage balances are actually INCREASING with each payment.

July 13, 2013

What is the real inflation rate?

The official US inflation rate is around 1% annually. That doesn’t seem quite right to a lot of people who seem to be spending more money for the same goods:

… what Bernanke will never admit is that the official inflation rate is a total sham. The way that inflation is calculated has changed more than 20 times since 1978, and each time it has been changed the goal has been to make it appear to be lower than it actually is.

If the rate of inflation was still calculated the way that it was back in 1980, it would be about 8 percent right now and everyone would be screaming about the fact that inflation is way too high.

But instead, Bernanke can get away with claiming that inflation is “too low” because the official government numbers back him up.

Of course many of us already know that inflation is out of control without even looking at any numbers. We are spending a lot more on the things that we buy on a regular basis than we used to.

For example, when Barack Obama first entered the White House, the average price of a gallon of gasoline was $1.84. Today, the average price of a gallon of gasoline has nearly doubled. It is currently sitting at $3.49, but when I filled up my vehicle yesterday I paid nearly $4.00 a gallon.

And of course the price of gasoline influences the price of almost every product in the entire country, since almost everything that we buy has to be transported in some manner.

But that is just one example.

Our monthly bills also seem to keep growing at a very brisk pace.

Electricity bills in the United States have risen faster than the overall rate of inflation for five years in a row, and according to USA Today water bills have actually tripled over the past 12 years in some areas of the country.

No inflation there, eh?

July 9, 2013

NYT writer files classic “First World Problem” article

In yesterday’s “Morning Jolt” email, Jim Geraghty made some sport of a New York Times article by James Atlas:

The comments section underneath the article raises the fairly glaring point that Atlas’s rose-colored memories of flying before these harsh Darwinist times (probably to be blamed on Republicans) ignore the fact that once you adjust for inflation, air travel is a lot more accessible to a lot more people today. In the “golden age” of attractive stewardesses that he romanticizes, flying was too expensive for most of middle-class America.

Come on. Look at the prices (adjusted for inflation) of air travel back in the 60s that you so glorify. In 1972 it cost me about $350 round-trip to fly from Atlanta to Chicago to go to college (so usually I took Greyhound). According to online inflation calculators, that’s the equivalent of $1950 today. If we want the same level of service we got in the 60s and 70s, we’d need to pay equivalent prices. Airline travel in “economy” today is pretty much analogous to what bus travel was in the 70s; cheap enough that many people can afford it but dirty, uncomfortable, crowded, and miserable. Comfortable travel is available now, as it was then, to the more well-to-do — if you can afford to pay for first class, then your flight is far more tolerable than if you’re in economy. In 1972, the one time I flew, it was a lot more enjoyable than taking the bus. But then, as now, one got what one paid for. We expect airfares to be rock-bottom low and accessible to all — but we can’t then expect service levels to match what they would be if the airlines still charged the prices they used to charge.

I would note that higher-end air travel is one of those rare products where a large portion of the consumer base isn’t spending their own money. (How many business class or first-class passengers bought those tickets with personal funds, as opposed to having their employer pay for it?) When it’s somebody else’s money, hey, anything goes, or at least as much as you can get away with. (Of course, that’s at other employers. For the transatlantic flights for the Norway cruise, Jack Fowler has booked me a space in an overhead luggage rack.)

If everyone paid out of his own pocket, those passengers willing to pay $659 to $2,337 for a one-way first-class ticket from D.C. to Los Angeles nonstop would largely disappear. But those folks willing to pay those exorbitant costs — really, those companies willing to pay those costs for their employees — are what make the (relatively) cheap price of $234 for the same flight in coach possible. (I got those figures from plugging in a flight from D.C. to LA with one week’s notice into Expedia.)

Also … did no editor at the Times think it was bad timing to run a column complaining about insufficient legroom and stale ham sandwiches right after the crash at San Francisco airport?

July 4, 2013

“Buenos Aires […] is the headquarters for the central planning bad idea bus”

At the Sovereign Man blog, Simon Black discusses Argentina’s sad history of central planning failures:

The more interesting part about Buenos Aires, though, is that this place is the headquarters for the central planning bad idea bus.

Argentina’s President, Cristina Fernandez, continues to tighten her stranglehold over the nation’s economy and society.

This country is so abundant with natural resources, it should be immensely wealthy. And it was. At the turn of the 20th century, Argentina was one of the richest countries in the world.

Yet rather than adopting the market-oriented approaches taken by, say, Colombia and Chile, Argentina is following the model of Venezuela.

Cristina rules by decree here; there is very little legislative power. She may as well start wearing a crown.

Just in the last few years, she’s imposed capital controls. Media controls. Price controls. Export controls.

She’s seized pension funds. She fired a central banker who didn’t bend to her ‘print more money’ directives. She even filed criminal charges against economists who publish credible inflation figures, as opposed to the lies that her government releases.

Inflation here is completely out of control. The government figures say 10%, but the street level is several times that.

[. . .]

Being here in this laboratory of central planning makes a few things abundantly clear:

1) Printing money does not create wealth. If it did, Argentina would be one of the richest places in the world again.

2) All of these policies that are ‘for the benefit of the people’ almost universally and up screwing the people they claim to help.

Printing money creates nasty inflation. If you’re wealthy, it leads to asset bubbles, which can make you even wealthier. If you’re poor, you just get crushed by rising prices. Or worse – shortages (remember the recent Venezuelan toilet paper crisis?)

3) Desperation leads to even more desperation. The worse things get, the tighter government controls become… which makes things even worse. It’s a classic negative feedback loop.

Both the United States and pan-European governments are varying degrees of this model, with only a flimsy layer of international credibility separating them from the regime of Cristina.

So Argentina is really a perfect case study in things to come.

June 19, 2013

V for Vinegar

The Economist reports on the rising tide of protest in Brazil:

All that changed on June 13th when the state’s unaccountable, ill-trained and brutal military police turned a mostly peaceful demonstration into a terrifying rout. Dozens of videos, some from journalists, others from participants and bystanders, show officers with their name tags removed firing stun grenades and rubber bullets indiscriminately at fleeing protesters and bystanders and hunting stragglers through the streets. Motorists trapped in the mayhem ended up breathing pepper spray and tear gas. Demonstrators found with vinegar (which can be used to lessen the effect of tear gas) were arrested. Several journalists were injured, two shot in the face with rubber bullets at close range. One has been told he is likely to lose his sight in one eye. The following day’s editorials took a markedly different tone.

By June 17th what has become dubbed the “V for Vinegar” movement or “Salad Revolution” had spread to a dozen state capitals as well as the federal capital, Brasília. The aims had also grown more diffuse, with marchers demanding less corruption, better public services and control of inflation. Many banners protested against the disgraceful cost of the stadiums being built for next year’s football World Cup. Brazil has already spent 7 billion reais, three times South Africa’s total four years earlier, and only half the stadiums are finished. “First-world stadiums; third-world schools and hospitals”, ran one placard.

[. . .]

So, why now? One reason is surely a recent spike in inflation, which is starting to eat into the buying power of the great majority of Brazilians who are still getting by on modest incomes, just as a big ramp-up in consumer credit in recent years has left them painfully overstretched. Bus fares have not risen for 30 months (mayors routinely freeze fares in municipal-election years, such as 2012, and in January this year the mayors of Rio and São Paulo agreed to wait until June before hiking in order to help the federal government massage the inflation figures). In fact, the rise in São Paulo’s and Rio’s bus fares comes nowhere close to matching inflation over that 30-month period. But bus fares are under government control, unlike other fast-rising costs such as those for housing and food. Perhaps they were simply chosen as a scapegoat.

More broadly, the very middle class that Brazil has created in the past decade — 40m people have escaped from absolute poverty, but are still only one paycheck from falling back into it, and 2009 was the first year in which more than half the population could be considered middle class — is developing an entirely new relationship with the government. They see further improvements in their living standards as their right and will fight tooth and nail not to fall back into poverty. And rather than being grateful for the occasional crumb thrown from rich Brazilians’ tables, they are waking up to the fact that they pay taxes and deserve something in return. Perhaps their government’s triumphalism over those shiny new stadiums was the final straw.

May 22, 2013

Hyperinflation in Diablo III

At the Ludwig von Mises Institute blog, Peter Earle looks at the “virtual Weimar” economy of Diablo III:

As virtual fantasy worlds go, Blizzard Entertainment’s Diablo 3 is particularly foreboding. In this multiplayer online game played by millions, witch doctors, demon hunters, and other character types duke it out in a war between angels and demons in a dark world called Sanctuary. The world is reminiscent of Judeo-Christian notions of hell: fire and brimstone, with the added fantasy elements of supernatural combat waged with magic and divine weaponry. And within a fairly straightforward gaming framework, virtual “gold” is used as currency for purchasing weapons and repairing battle damage. Over time, virtual gold can be used to purchase ever-more resources for confronting ever-more dangerous foes.

But in the last few months, various outposts in that world — Silver City and New Tristram, to name two — have borne more in common with real world places like Harare, Zimbabwe in 2007 or Berlin in 1923 than with Dante’s Inferno. A culmination of a series of unanticipated circumstances — and, finally, a most unfortunate programming bug — has over the last few weeks produced a new and unforeseen dimension of hellishness within Diablo 3: hyperinflation.

[. . .]

Two obvious solutions for managers of virtual economies include more vigilant bot restrictions and close — indeed, real-time — monitoring of faucet output, sink absorption, prices, and user behaviors. More critically, though, whether structured as auctions or exchanges, markets must be allowed to operate freely, without caps, floors, or other artificialities. Unrestricted (real) cash auctions would for the most part preempt and obviate black markets.

One also surmises, considering the level of planning that goes into designing and maintaining virtual gaming environments, that some measure of statistical monitoring and/or econometric modeling must have been applied to Diablo 3’s game world. The Austrian School has long warned of the arrogance and naïveté intrinsic to applying rigid, quantitative measures to the deductive study of human actions. Indeed; if a small, straightforward economy generating detailed, timely economic data for its managers can careen so completely aslant in a matter of months, should anyone be surprised when the performance of central banks consistently breeds results which are either ineffective or destabilizing?

Update, 24 June: It’s worth examining just who benefits the most from inflationary episodes like this, both in the game and in the real world:

Just as surely as if someone hit “print” on bonds at the U.S. Treasury Department and the Fed made more money of out thin air, the new gold in the game’s economy moved from the hands of its first owners — whose purchasing power was enhanced without contributing anything productive to the economy — to the hands of those who received it for the goods they offered in the “Diablo III” auction house. In so doing, the first holders of the new gold (the cheats) could buy more than they would otherwise have been able to, stimulating demand far outside of their legitimate capacity to do so. By bidding up items simply because they wanted them and could pay more for them, they caused the market to clear artificially high prices.

Reports from the “Diablo III” forums on Battle.net, one of Blizzard’s official sites, include complaints of people selling gems worth 30 million gold for 100–400 million gold; another participant on the forum griped that players “sold garbage for hugely inflated prices.” All told, only 415 out of the estimated three million subscribers who play every month actually exploited the glitch. But all it takes is a few rotten apples to spoil the barrel. In the real economy, the men and women of the Fed and the beneficiaries of their fraudulent money creation comprise a very small percentage of the total number of participants in the real market.

As the second holders of the new gold spent it on goods they desired in the virtual economy, they, too, stimulated demand far out of proportion to their productivity on the market. This raised the prices of what they purchased, just like the cheats who exploited the glitch to begin with. As this gold spread like a ripple on the surface of a body of water, each player’s purchasing power eroded further and further as prices rose higher and higher.

April 8, 2013

The “Winter of Discontent” that brought Margaret Thatcher to power

Megan McArdle explains the temper of the late 1970s in Britain:

To understand the legacy of Margaret Thatcher, you need to understand Britain’s “Winter of Discontent,” in which striking public-sector workers nearly paralyzed the nation. Actually, you have to go back a bit further, to the inflations of the 1970s. Americans remember the “stagflation” of the 1970s as bad, but in Britain it was even worse — the inflation rate peaked in 1975 at over 25 percent.

Governments on both sides of the pond decided that the solution to inflation was to simply declare, by fiat, that prices would not rise so much. In America we got Nixon’s wage and price controls. In Britain, they got the government’s 1978 vow to hold public-sector wage increases to 5 percent — at a time when inflation was running to double digits.

The public-sector workers, as you might imagine, did not like that. And in Britain, the public-sector workers had immense power. Trash piled up in the streets. The truck drivers who ferried goods all over Britain went on strike — and the ones who didn’t, like oil tanker drivers, began feeding their destinations to “flying pickets” — mobile groups of strikers who would go from location to location, blockading them so that workers couldn’t get in and goods couldn’t get out. The BBC called them the “shock troops of industrial action” and that’s an accurate picture; effectively mobilized, flying pickets can grind the wheels of industry to a halt. Which is what they did in the winter of 1978-79.

In Liverpool, the gravediggers went out, leaving bodies unburied for weeks. By the end of January, half the hospitals in Britain were taking only emergency cases. Full of righteous fury, the unions flexed every muscle, demonstrating all the tremendous power that they had amassed by law and custom in the years since the Second World War. Unfortunately, they were pummeling the Labour Party, which had given them most of those powers. And the public, which was also suffering through high inflation and anemic GDP growth, had had enough. They elected Margaret Thatcher, a Conservative grocer’s daughter without roots in the working-class power structure of the labor movement, or the elite power structure of Britain’s famously rigid class system. She systematically went about dismantling the two main sources that gave labor the power to essentially shut down the United Kingdom: lenient strike laws and state ownership of key industrial sectors.

[. . .]

Her detractors should remember that as terrible as it was for the miners when the pits were closed, these mining operations were not sustainable — nor was it even desireable that they be sustained so that further generations could invest their lives in failing coal seams. The work was dreadful. The coal was too dirty for the environment, or the delicate pink tissue of the miners’ lungs. And even if Britain had wanted to keep mining the filthy stuff, it was getting too expensive to dig it out. The mines were playing out, not because Margaret Thatcher was mean, but because the cradle of the Industrial Revolution had burned through much of her coal.

In short, Margaret Thatcher destroyed an industrial system which had yes, provided workers with a secure livelihood, but yes, also done so at an unnacceptable cost. These two things are the same legacy. They cannot be parted.

Her achievement was not inevitable. But looking back at the Winter of Discontent, I’d argue that it was necessary. The alternate future for a United Kingdom where the labor unions hung on was another decade or two of failing state firms and economic decline. By the early 1980s, the UK’s per-capita GDP was lower than that of Italy. You can maybe argue that there was some alternative Social Democratic future, Sweden-style, or perhaps the discovery of an alternative path to capitalism. But it’s hard to look at the convulsions of 1970s Britain and argue that this was a happier past that the nation should pine after. And I find it hard to argue that Britain’s economy could have been modernized without taking on the unions; their veto power made even such obvious steps as shutting down failing mines effectively impossible.

As I wrote a few years back:

My family left Britain in 1967, which was a good time to go: the economy was still in post-war recovery, but opportunities abroad were still open to British workers. My first visit back was in [mid-winter] 1979, which was a terrible shock to my system. I’d left, as a child, before the strikes-every-day era began, and my memories of the place were still golden-hued and happy. Going back to grey, dismal, cold, smelly, strike-bound Britain left me with a case of depression that lasted a long time. It didn’t help that the occasion of the visit was to attend my grandfather’s funeral: it was rather like the land itself had died and the only remaining activity was a form of national decomposition.

March 1, 2013

North Korea’s real inflation rate may have reached 116%

In the Cato@Liberty blog, Steve Hanke looks at North Korea’s offical statistics and makes an educated guess at what they conceal, rather than reveal about the country’s state:

During the past few weeks, North Korea has been the subject of outsized news coverage. The recent peacocking by Supreme Leader Kim Jong Un — from domestic martial law policies to tests of the country’s nuclear weapons capabilities — has successfully distracted the media from North Korea’s continued economic woes. For starters, the country’s plans for agricultural reforms have been deep-sixed, and, to top it off, I estimate that North Korea’s annual inflation rate hit triple digits for 2012: 116%, to be exact.

Unfortunately, the official shroud of secrecy covering North Korea’s official information and statistics remains more or less intact. But, some within North Korea have begun to shed light on this “land of illusions”. For example, a team of “citizen cartographers” helped Google construct its recent Google Maps’ exposition of North Korea’s streets, landmarks, and government facilities. In addition, our friends at DailyNK have successfully been reporting data on black-market exchange rates and the price of rice in North Korea — data which allowed me to conclude that the country experienced an episode of hyperinflation from December 2009 to mid-January 2011.