At Catallaxy Files, Sinclair Davidson explains some of the advantages and disadvantages of both fiat (government-issued) and private currency:

As George Selgin, Larry White and others have shown, many historical societies had systems of private money — free banking — where the institution of money was provided by the market.

But for the most part, private monies have been displaced by fiat currencies, and live on as a historical curiosity.

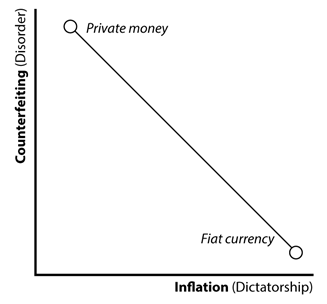

We can explain this with an ‘institutional possibility frontier’; a framework developed first by Harvard economist Andrei Shleifer and his various co-authors. Shleifer and colleagues array social institutions according to how they trade-off the risks of disorder (that is, private fraud and theft) against the risk of dictatorship (that is, government expropriation, oppression, etc.) along the frontier.

As the graph shows, for money these risks are counterfeiting (disorder) and unexpected inflation (dictatorship). The free banking era taught us that private currencies are vulnerable to counterfeiting, but due to competitive market pressure, minimise the risk of inflation.

By contrast, fiat currencies are less susceptible to counterfeiting. Governments are a trusted third party that aggressively prosecutes currency fraud. The tradeoff though is that governments get the power of inflating the currency.

The fact that fiat currencies seem to be widely preferred in the world isn’t only because of fiat currency laws. It’s that citizens seem to be relatively happy with this tradeoff. They would prefer to take the risk of inflation over the risk of counterfeiting.

One reason why this might be the case is because they can both diversify and hedge against the likelihood of inflation by holding assets such as gold, or foreign currency.

The dictatorship costs of fiat currency are apparently not as high as ‘hard money’ theorists imagine.

Introducing cryptocurrencies

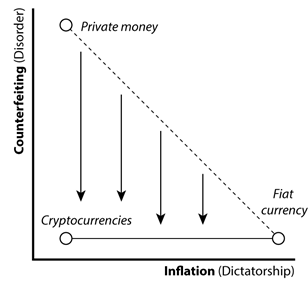

Cryptocurrencies significantly change this dynamic.

Cryptocurrencies are a form of private money that substantially, if not entirely, eliminate the risk of counterfeiting. Blockchains underpin cryptocurrency tokens as a secure, decentralised digital asset.

They’re not just an asset to diversify away from inflationary fiat currency, or a hedge to protect against unwanted dictatorship. Cryptocurrencies are a (near — and increasing) substitute for fiat currency.

This means that the disorder costs of private money drop dramatically.

In fact, the counterfeiting risk for mature cryptocurrencies like Bitcoin is currently less than fiat currency. Fiat currency can still be counterfeited. A stable and secure blockchain eliminates the risk of counterfeiting entirely.