The Argentine government has announced it will be increasing spending on their armed forces by a third in the coming year. While this report in the Daily Express takes it seriously, it fails to account for the overall sorry state of the Argentinian economy … it’s not clear if there’s any actual money to be allocated to the military:

Buenos Aires will acquire military hardware including fighter aircraft, anti-aircraft weapons and specialised radar, as well as beefing up its special forces.

The news comes months before drilling for oil begins in earnest off the Falkland Islands, provoking Argentina’s struggling President Cristina Fernandez de Kirchner.

Last month she created a new cabinet post of Secretary for the Malvinas, her country’s name for the Falklands.

Meanwhile, Defence Secretary Philip Hammond has refused to confirm that Britain would retake the Falklands if they were overrun by enemy forces.

The extra cash means Argentina will increase defence spending by 33.4 per cent this year, the biggest rise in its history. It will include £750million for 32 procurement and modernisation programmes.

They will include medium tanks and transport aircraft and the refurbishment of warships and submarines. The shopping list also includes Israeli air defence systems, naval assault craft, rocket systems, helicopters and a drone project.

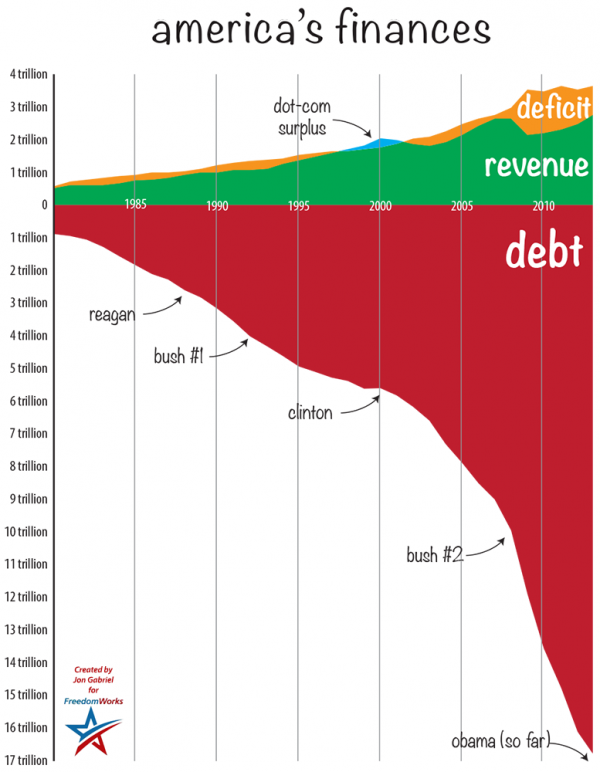

As reported earlier this month, the economy is suffering from an inflation rate estimated to be in the 70% range, the government has expropriated private pensions and foreign-owned companies, and is unable to borrow significant amounts of money internationally due to their 2002 debt default. Announcing extra money for the military may well be the economic version of Baghdad Bob’s sabre-rattling press conferences … just for show.

On the other hand, military adventurism is a hallowed tradition for authoritarian regimes to tamp down domestic criticism and rally public opinion. Being seen to threaten the British in the Falkland Islands still polls well in Buenos Aires.