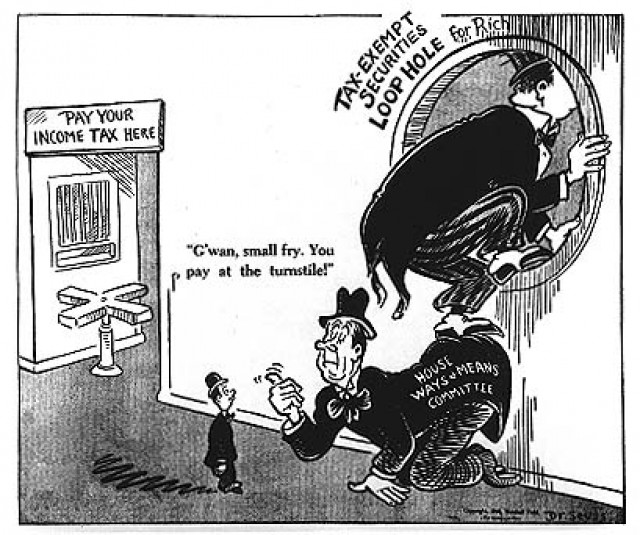

There’s capitalism and there’s crony capitalism: they share a name, but they’re very different creatures. Crony capitalism thrives when government controls a large share of the economy, because then the politicians and bureaucrats have more goodies to share with their “capitalist” cronies. The bigger the slice of the pie controlled by political leaders and unelected regulators, the better the situation for the favoured companies — and that usually means the biggest of the big corporations. In the US government, one of the best examples of institutionalized crony capitalism is the Export-Import Bank (Ex-Im): it exists to allow big corporations like Boeing to sell their products to foreign buyers at highly favourable interest rates, with the taxpayer picking up the risks and the American corporation creaming off the excess profits.

This system works so well — for the businesses being subsidized and the politicians who control the process — that it’s difficult to see it being stopped any time soon. Ex-Im’s enabling legislation is due to be re-authorized later this summer, so this is one of those brief chances to stop it. The problem is that it isn’t just Republicans who support it (because “what’s good for General Motors Boeing is good for America”), but also Democrats … sometimes the very same Democrats who make a lot of speeches about the evils of Wall Street. Jonah Goldberg explains why:

The Left’s anti-big-business populism is very different. It doesn’t want to cut the government’s incestuous relationship with big business; it simply wants to bring business to heel. Big business should do what Washington tells it to do, and when it does, it will get treats. When it doesn’t, it will get the newspaper to the nose. But big business will never be let off its leash, if the Left has its way.

“[Senator Elizabeth] Warren doesn’t have a problem with big banks or corporations,” the Federalist’s David Harsanyi writes. “She has a problem with banks and corporations that make profits in ways that she finds morally intolerable. She is an opponent of dynamism, not cronyism.”

This has always been the central idea behind progressive economics. Bureaucrats and other planners need — or at least want — ever more power to decide how economic resources are arranged and allocated. That doesn’t mean they’re socialists, it just means that corporations need to follow their lead. Indeed, good “corporate citizenship” means acquiescing to the priorities of progressive state planners and whatever their latest idea of “public–private partnerships” might be. The one constant in such partnerships is that business is always the junior partner.

This was the vision behind Woodrow Wilson’s “war socialism,” FDR’s New Deal, LBJ’s Great Society, Bill Clinton’s “Third Way,” and virtually all of Barack Obama’s economic policies. What is Obamacare but an attempt to turn the entire health-care industry into Washington’s well-fed lapdog?

What’s amazing is that people are still capable of shock when it turns out that a policy of treating businesses like dependent lapdogs yields businesses that try to have the government’s lap all to themselves.