An occupation that flips from male to female dominance invariably suffers not only diminished prestige, but also a decline in wages … which, once again, makes sense in the context of sexual psychology. A man’s income is one element (and a big element) of a woman’s attraction to him, but the reverse is not true; if women are paid less, this does not really hurt their value in the sexual marketplace at all, and so they will push back against it much less than men would. This is probably what lies behind the tendency of women to be less forceful when negotiating salaries.

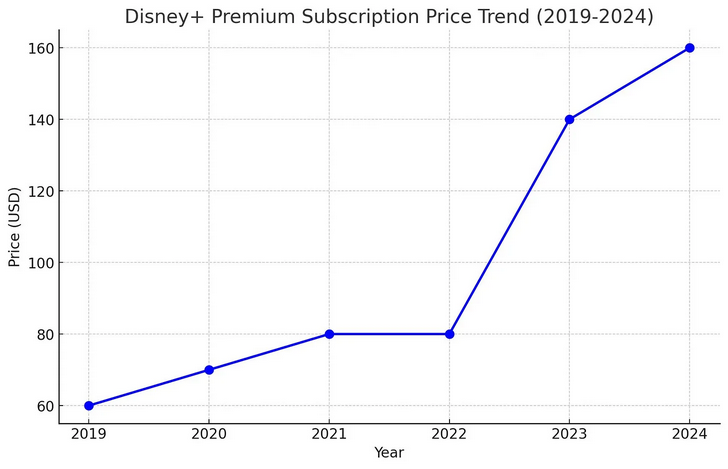

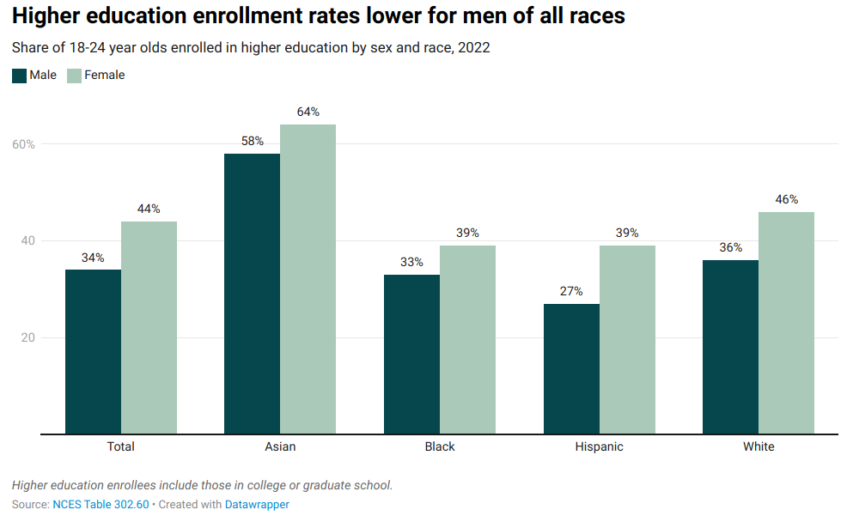

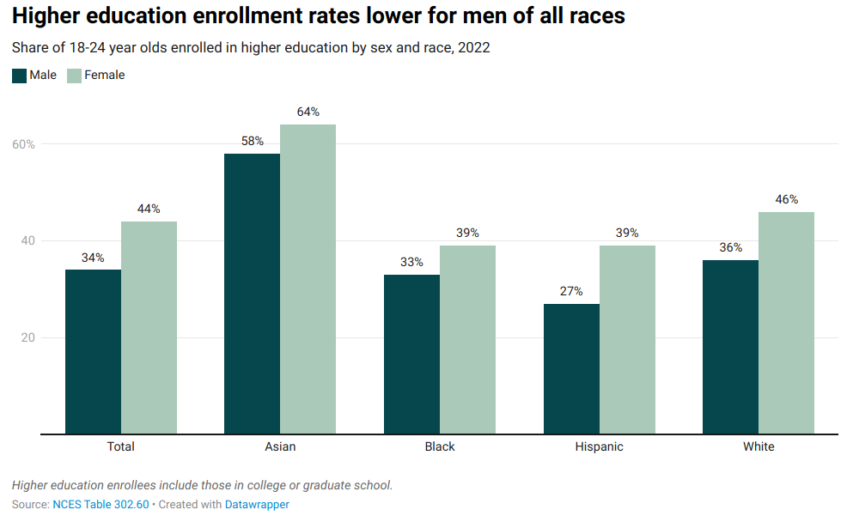

To the point: ever since the 1970s, women have overtaken and gradually eclipsed men within higher education. There is a gap in enrolment, consistent across racial groups:

[…]

Across all programs, at all academic levels, American universities recently reached the threshold of 60% of the student body being female.

This will be a disaster for academia.

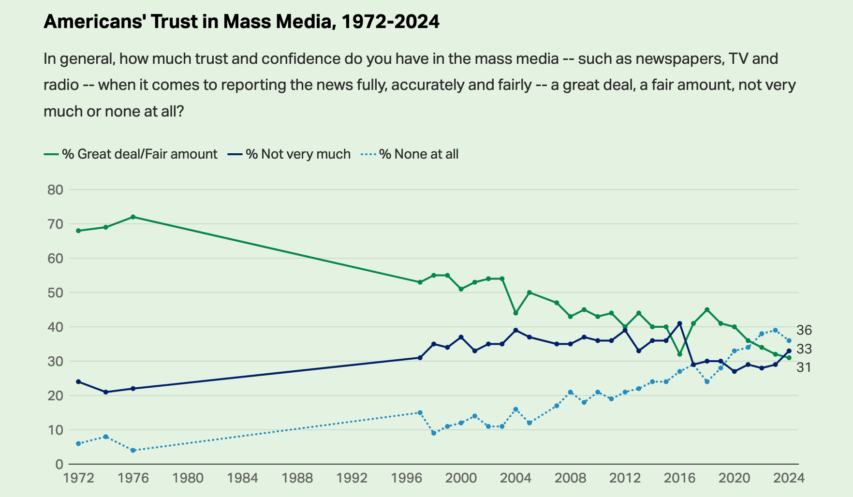

Indeed, it’s already a disaster. About a year ago, I analyzed a Gallup poll which revealed that the confidence of the American public in the trustworthiness and overall value of the academic sector had declined precipitously over the course of the 2010s.

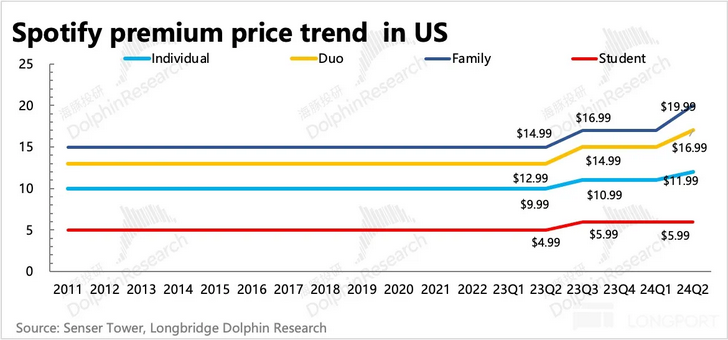

In that article I examined several factors contributing to this DIEing confidence in the academy: the explosive growth in tuition fees, even as continuous relaxation of academic standards dilutes the actual value of a degree; the deplorable state of scholarship, with endless revelations of fraud, a seemingly irresolvable replication crisis, and the torrent of psychotic nonsense that passes for ‘research’; the increasingly frigid social environment enforced by the armies of overpaid, sour-faced administrators. Almost all of these, however, are related in some way or another to the feminization of academia.

And it is probably going to get much worse before it gets better.

As discussed in this recent article by Celeste Davis of Matriarchal Blessing, research on male flight indicates that a 60% female composition represents the tipping point beyond which men perceive an environment as feminine, which then leads to a precipitous decline in male participation. Davis appears to be some sort of feminist3, but I want you to look past that and give her article a read; it is very thorough, well-researched, and thought-provoking (and also the direct inspiration for this article).

[…]

Universities are belatedly starting to notice that male enrolment is dropping fast, particularly among white men (I wonder why…), and are starting to make noises about maybe thinking about perhaps looking into ways of trying to recruit and retain more men (albeit, not specifically white men).

This seems unlikely to succeed.

Even if universities are successful in setting up programs to increase male recruitment, they will be fighting an uphill battle against the sexual perception that has already set in. Once something is coded as being a feminine hobby, it is extremely difficult to change that code. While it’s very easy to list examples of professions that have switched from male to female dominance, off the top of my head I have a hard time coming up with examples of the reverse. This suggests that female dominance tends to be sticky. There’s no reason to expect this will be any different with academia, either within individual programs, or across the sector as a whole.

This is an entirely different problem from the one faced by female entryism. In the initial phases of female entry, the primary difficulty faced by women is that it is simply more difficult to compete with men – in the case of athletics, effectively impossible. Women must therefore either work extremely hard, or the work must be made easier for them. In practice, since the 1970s we’ve seen both of these, with “working twice as hard as the boys” predominating in the early years, and assistance from special programs predominating later on.

By contrast, the central obstacle faced by anyone trying to attract men to a female-dominated environment is that men are deeply reluctant to enter. As a third of young men told Pew when asked why they didn’t attend or complete university: they just didn’t want to. It isn’t because they can’t compete with women. They can, usually with ease, but competition is pointless because it will gain them nothing. Special programs to assist men are beside the point; if anything, they work against you, because the implicit message with any special program for men is that they need help to compete with women … thereby making competition even more pointless. “You beat a girl but you needed help to do it”, is going to impress the girls even less than beating a girl unaided.