July 16, 2011

This week in Guild Wars 2 news

![]() I’ve been accumulating news snippets about the as-yet-to-be-formally-scheduled release of Guild Wars 2 for an email newsletter I send out to my friends and acquaintances in the Guild Wars community. This week was pretty quiet after last week’s release of the new Winds of Change content in Cantha.

I’ve been accumulating news snippets about the as-yet-to-be-formally-scheduled release of Guild Wars 2 for an email newsletter I send out to my friends and acquaintances in the Guild Wars community. This week was pretty quiet after last week’s release of the new Winds of Change content in Cantha.

I got a few comments from non-gaming folks that these posts can get too long to scroll past, so it’s now in the extended post below.

July 15, 2011

The Guild season 5 begins July 26th

A press release provides the details:

Season five of The Guild will return to Xbox LIVE on the Zune video Marketplace and MSN Video on Tuesday, July 26, sponsored by Microsoft and Sprint. Picking up where season four left off, season five takes the Guild members out from behind their computers and throws them into the real world like the show has never seen before, with new locations, guest stars, celebrity cameos and more!

The Guild stars writer/creator Felicia Day (Eureka, Dollhouse, Dr. Horrible’s Sing-A-Long Blog) as Codex, a lovable geek gamer addicted to an online role-playing game. Season five follows the characters of The Guild as they travel to a gaming convention called MEGAGAME-O-RAMACON. “Conventions like San Diego Comic-Con and Penny Arcade Expo have been a part of our experience promoting The Guild and connecting with fans,” says Felicia Day. “I wanted to bring that unique experience of a going to a con to the screen.” In addition to regular cast members Vincent Caso, Jeff Lewis, Amy Okuda, Sandeep Parikh and Robin Thorsen, season five will feature recognizable guest stars from the science fiction and genre community as well as over 200 extras.

The continuing problems of the F-35 Joint Strike Fighter

The Economist titles this piece “The last manned fighter”:

The latest cost estimates from the Government Accountability Office (GAO), published in May to coincide with a Senate Armed Services Committee hearing on the F-35 programme, were shocking. The average price of each plane in “then-year” dollars had risen from $69m in 2001 to $133m today. Adding in $56.4 billion of development costs, the price rises from $81m to $156m. The GAO report concluded that since 2007 development costs had risen by 26% and the timetable had slipped by five years. Mr Gates’s 2010 restructuring helped. But still, “after more than nine years in development and four in production, the JSF programme has not fully demonstrated that the aircraft design is stable, manufacturing processes are mature and the system is reliable”. Apart from the STOVL version’s problems, the biggest issue was integrating and testing the software that runs the aircraft’s electronics and sensors. At the hearing, Senator John McCain described it as “a train wreck” and accused Lockheed Martin of doing “an abysmal job”.

What horrified the senators most was not the cost of buying F-35s but the cost of operating and supporting them: $1 trillion over the plane’s lifetime. Mr McCain described that estimate as “jaw-dropping”. The Pentagon guesses that it will cost a third more to run the F-35 than the aircraft it is replacing. Ashton Carter, the defence-acquisition chief, calls this “unacceptable and unaffordable”, and vows to trim it. A sceptical Mr McCain says he wants the Pentagon to examine alternatives to the F-35, should Mr Carter not succeed.

How worried should Lockheed Martin be? The F-35 is the biggest biscuit in its barrel, by far. And it is not only Mr McCain who is seeking to knock a few chocolate chips out of it. The bipartisan fiscal responsibility and reform commission appointed by Mr Obama last year said that not all military aircraft need to be stealthy. It suggested cancelling the STOVL version of the F-35 and cutting the rest of its order by half, while buying cheaper F-16s and F-18s to keep numbers up. If America decided it could live with such a “high-low” mix, foreign customers might follow suit.

July 14, 2011

The Eurozone crises

That’s right, crises, not crisis. There are three interlinked crises, not just one:

The crisis in the Eurozone has been lurching from one country to another over the past year or so. After bailouts for Greece, Ireland and Portugal, and with a second bailout for Greece in the offing, the financial markets this week turned their attention to Italy, a far larger economy than those previously affected. Spain, another country struggling to pay its way, has also been hit by austerity measures and political turmoil. But while it is easy to get caught up in the specifics of each new stage of the crisis, it is worth taking a step back to understand what is going on and the possibilities for the future.

The Euro crisis, like just about every other economic story these days, has a three-fold character. It is not, in fact, a single crisis; it has three inter-related elements: financial, economic and political.

Of the three, the financial crisis is, paradoxically, the least significant, even though it is the most prominent of the three and the one which threatens to spin out of control with serious broader consequences. Alongside the financial, the economic aspect is the most entrenched and material of the three, while the political crisis — that is, the failure of the political elites to get on top of the other two challenges — is the most critical, as it is, or should have been, the key to the resolution of the other two. The shift in focus to Italy, the Eurozone’s third largest economy, indicates that time may have run out for effective containment. The Euro genie is probably out of the bottle.

Canadian withdrawal from Afghanistan being spun as a Taliban victory

To the surprise of nobody, the Taliban is claiming a clear win in driving the Canadian infidels out of Afghanistan:

During nine years of operations in Afghanistan, 157 Canadian troops died (87 percent because of the Taliban.) For most of that time, Canada suffered, proportionately, twice as many dead in Afghanistan as the United States. During this period, the U.S. had ten times as many troops in Afghanistan. The U.S. also has ten times the population of Canada, so the 3,000 Canadians are making the same scale of effort, but suffering more losses in the process. But most of those losses were not from “fighting the Taliban,” but from mines in the road. Back in early 2007, 81 percent of Canadian deaths were from IEDs (roadside bombs). But that declined as Canadian troops received more bomb resistant armored vehicles.

Since the Taliban couldn’t cope with Canadian troops in head-to-head combat, they devoted much of their roadside bombing effort against the Canadians. But in the last year, the Taliban were only able to kill four Canadian troops. Still, the constant Taliban propaganda about how killing even a few Canadian troops would eventually force the Canadians to withdraw, is believed by most Afghans. Canada decided to withdraw all their troops from Afghanistan back in 2008, and more American troops have moved in to replace them.

It’s ironic that the reason the government of the day originally committed troops to the Afghanistan campaign was that they thought it would be “safer” than being involved in Iraq. Rather than being seen to support George Bush, the Canadian contingent was sent to a “less tainted” operation instead. The party that sent the troops in the first place lost few opportunities to call for them to leave, once the current government was in power.

Never underestimate the Tory ability to pry defeat from the jaws of victory

The headline says “Ontario Tories have 11-point lead over Liberals: poll“, but this is the good old Forward-Backward Party we’re talking about here — if anyone in Canada can pull a defeat out of this, it’s the Progressive Conservatives:

The Progressive Conservative party has blown open the race to form Ontario’s next government, according to a new Ipsos Reid poll which shows the opposition Tories with a commanding, 11-point lead over Premier Dalton McGuinty’s Liberals.

That lead has grown by five percentage points in the last month alone. Tory popularity now stands at 42%, with the Liberals at 31%, according to the survey. The NDP is in third place, at 22% support.

“It’s (PC leader Tim) Hudak’s to lose,” said pollster John Wright, senior vice president of Ipsos.

Mr. Wright says the Liberals, who are besieged on both their left and right flanks, will have a difficult time clawing their way back to level in the polls ahead of the Oct. 6 election.

Between Mr. McGuinty’s teflon coating finally starting to wear out, and the Liberal party’s devout belief that the name “Mike Harris” is the “Avada Kedavra” of Ontario politics, it may still turn out to be a bad October for the current government.

Confused by all this “debt ceiling” talk? Here’s an analogy you’ll understand

Don’t we all understand the debt ceiling situation so much better now?

Yet another twist in the twisty-turny mess that is Ontario liquor law

Michael Pinkus responds to an unfair accusation against Diamond Estates over their ability to open a retail store in Scarborough (most wineries are not legally able to do this):

Upon reading the Fashionable Press’ article I shot back the following (on everybody’s favourite medium these days) the Facebook comment section: “Have you really not been paying attention??? Diamond has a store because they bought a winery that had 1) a pre-1993 license and 2) had a pre-existing store. No mystery here, no cronyism, just smart business sense. In Ontario’s archaic system there are two things that reign supreme: a pre-1993 license (which allows you to blend foreign and domestic wines) and a winery with an outside store attached. Diamond got them both when they acquired DeSousa.”

The reply from Fashionable was quick: “Yes we understand that point the issue remains why no other winery can do the same thing?”

To which I answered, “This comes back to the archaic laws … not cronyism or the fact that Murray Marshall is chairman and CEO of VQA Canada. As many know I am not a huge supporter of the big wineries that can blend (and do) but Murray is working well within the crappy, backward, stink-ass system we call the alcohol laws in Ontario. If another winery wanted to do it they can pony up the 3+ million Cilento will sell their license for (of course I may be off by a few million on the price because that pre-93 piece of paper is a license to print money).”

To understand all this, and all it’s intricacies and complexities is to understand why Ontario’s small wineries are so pissed off (and yes that is the right wording here) when the subject of VQA stores is brought up. But back to Diamond … The moment DeSousa went up for sale Murray saw it as an opportunity to get a store that wasn’t tied to Niagara and a way to get his products into the hands of consumers in the much more lucrative market of Toronto (in this case Scarborough).

Now the astute amongst you (or the Ontario wine history buff) will note that Lakeview also has a pre-1993 license (est. 1991) – but that’s where it gets even wonkier. While Lakeview would be allowed to blend foreign with domestic wines, the original owners never branched out to buy another retail store, so their operation was stuck in Niagara post-1993 when the moratorium on wine store licenses was imposed. DeSousa (est. 1990) on the other hand, did acquire one additional retail licence prior to the cut-off.

The hard part about owning these stores is they are rarely permanent, and here’s why. The rationale behind placing one of these additional retail outlets somewhere is that it is an “under-serviced neighbourhood” … Fashionable asks the following: “Why didn’t the LCBO find this under-serviced gem and plunk one of its outlets there? … Why did they choose in a gentlemanly way to cede over to Diamond?”

To that I say ‘Have No Fear’, if that Diamond store does well then you can bet the farm that the liquor monopoly will parade in like a white knight and announce a store nearby … which will force Diamond to relocate the store to another “under-serviced area” … and how, you may ask, will the LC know that Diamond is doing so well? That my friends is what smells bad in this entire deal: Who do you think gets to look at the sales numbers from these off site stores? Hmm? They’re not called the KGBO by some for nothing.

So the brief and fleeting moment that Diamond has taken advantage of will disappear as soon as the LCBO decides that they need to move into that disadvantaged area and open an LCBO store, which will force the private seller to close their store in the area. Nice.

July 13, 2011

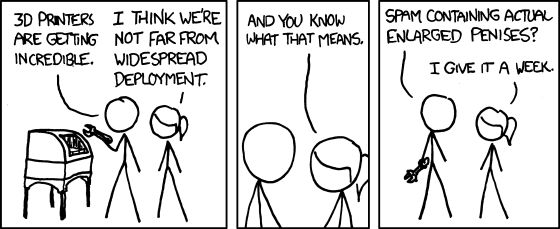

A potential down side to ubiquitous 3D printing

Original at http://xkcd.com/924/

Expanding government-provided flood insurance?

It has always amazed me that the US government is the primary insurer for flood damage, but the idea of putting the few remaining private insurace companies out of business is insane:

The House of Representatives is scheduled this week, as early as today, to consider an extension and “reform” of the National Flood Insurance Program (NFIP), administered by FEMA. Since Hurricane Katrina in 2005, the NFIP has been about $18 billion in the hole. And this is from a program that only collects around $2 billion a year in premiums, which barely covers losses and expenses in a normal year. So make no mistake, the NFIP is still on course to cost the taxpayer billions more in the future.

Even before Katrina, the Congressional Budget Office estimated that the NFIP was receiving a subsidy of close to a billion dollars a year. Under CBO’s optimistic projections, the House’s reform bill would increase NFIP revenues by about $4 billion over the next ten years, making only a small dent in the program’s current deficit.

If private insurers aren’t willing to offer insurance to people and businesses located on flood plains, isn’t that a strong indication that building a house or a plant on that location is a bad idea? Why should people who chose not to locate in risky locations be forced to subsidize the risk-taking of those who do?

A bit more on the Caledonia settlement

The National Post looks at the shameful way the Ontario government has acted through the confrontation in Caledonia:

This week’s settlement of a class-action lawsuit fits right in with the government’s modus operandi. Four years after the suit was filed, Mr. McGuinty’s Liberals will pay a group of residents and business owners $20-million in recompense for the disruption that was caused when the Ontario Provincial Police elected to ignore the rampant violence and lawbreaking that accompanied the aboriginals’ illegal seizure of land. The money will be divided among about 800 claimants, according to a formula related to their proximity to the occupied territory and exposure to acts of violence. As usual, the province has done its best to gag any complaints by insisting that details of the agreement remain confidential.

The class-action suit specified four instances at the height of the dispute in which roads were closed, court injunctions were violated and a hydro-electric transformer was burned. But those were just a sampling of the many episodes in which police, acting under clear instruction, blatantly ignored the aboriginals’ contempt for the law. Families were terrorized, threatened, driven from their homes or forced to show aboriginal “passports” to gain access to their own neighbourhoods. It was like a scene from some balkanized tin-pot regime, in other words — local residents might be inclined to call it the Banana Republic of Ontario.

Donna Reid, a Caledonia resident who has been among the most critical of the government, dismissed the settlement as “hush money” by a Liberal administration that is facing re-election and wants the issue to go away. The amount received by most residents will do little to offset five years worth of disruption that has embittered relations and turned part of the town into a no-go area.

Calling the PM “a limp-wristed, tofu-eating, faux-Tory abomination”

Oddly enough, he’s not talking about Stephen “Liberal-lite” Harper:

Today David Cameron finds himself in the “awkward” position of having to back a Labour motion calling for Murdoch’s News Corporation to drop its bid for BSKyB. Of course in the current climate of almost Death-of-Diana outrage (so brilliantly orchestrated by the BBC and the Guardian), there is probably not much wriggle room for doing otherwise. But in fact it all suits him very nicely for the very last thing our pathologically Heathite prime minister really wants is for the BSkyB to go through.

Why? Because the purpose of Murdoch’s BSkyB bid is essentially so that he can set up a UK version of America’s most popular news channel Fox News. Fox News acts as the conscience of the right in the US: it’s one of the things which made the Tea Party possible. A British version would achieve the same over here, destroying the crushing hegemony enjoyed by the BBC, restoring a balance to the political debate in Britain which for decades has been so sorely lacking – whatever the BBC’s supposed charter to commitment to fairness and balance might pretend.

[. . .]

If the BSkyB deal ever goes through, Cameron will no longer have that option available. Worse still, he will have a new TV news channel explaining to viewers every day of the week what a limp-wristed, tofu-eating, faux-Tory abomination their supposedly Conservative prime minister really is.

I don’t think he wants that. Do you?