On his Substack, Glenn Reynolds puts the Somali daycare scandal into its proper perspective: it’s not old-fashioned graft but something far bigger and far more destructive to the pillars of western society:

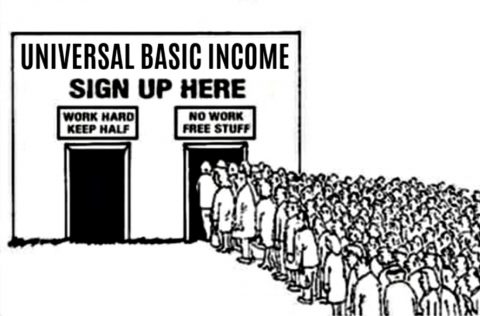

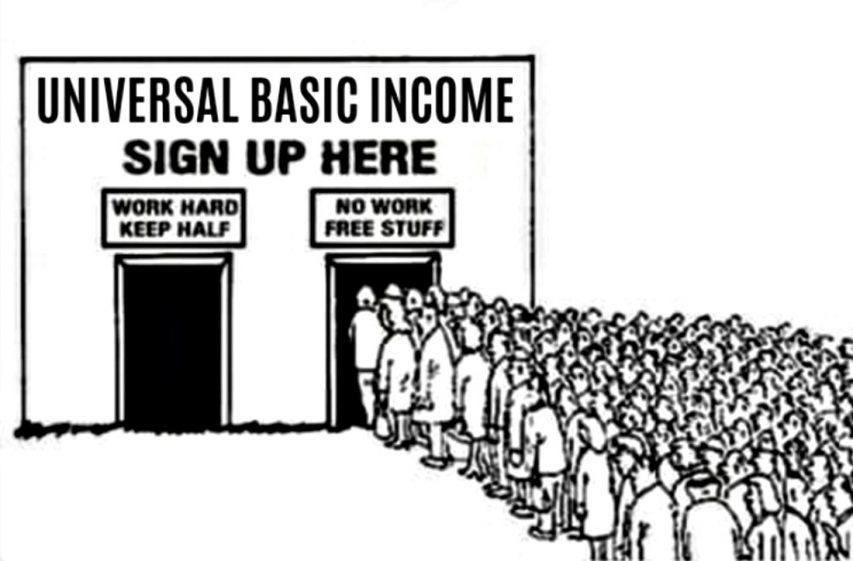

The explosive unveiling of the wildly extensive Somali-run daycare scams in Minnesota has drawn attention to a huge shadow economy, and not just in Minnesota. America, it turns out, is full of people, companies, and organizations that basically live off of fraud. We’re not talking old-fashioned waste, like $600 hammers or $1200 toilet seats. We’re talking about entities whose sole reason for existence consists of being a conduit for taxpayer money to flow directly to the people controlling them, with some of the proceeds being diverted to politicians and political organizations.

People are noticing.

This reverses an old joke told by my Nigerian relatives. A Nigerian visits his rich relative in the United States and is awed by the penthouse apartment, the limo, the private jet and so forth. “How did you make so much money?” he asks. The relative points out the window. “See that bridge? 15%. See that shopping mall? 15%. See that train station? 15%.”

The visitor, inspired, returns home to Nigeria and becomes fabulously wealthy. His rich cousin from America visits and says “How did you make so much money so fast?”

“You see that bridge over there?”

“Nope,” responds the confused relative. The Nigerian cousin points at himself and says “One hundred percent!”

Well, this joke has now been turned around. Leaving aside that we don’t really even build train stations, bridges, or even shopping malls in this country anymore, now it’s America where people are pocketing one hundred percent and not even trying to actually deliver any goods or services. That the people doing this are mostly Africans only adds to the irony.

But what happened?

Well, several things. At base, people defraud the government for the same reason that dogs lick themselves — because they can. One of the things you find in these programs is that there are virtually no controls to ensure that the recipients of the money are legitimate, that the money is spent as promised — in essence, that the bridges get built. (Or, in the case of California, the high speed rail lines.) That lack of controls, of course, is no accident. The systems are designed to promote fraud and to make it hard to catch or punish.

Second, the culture is weaker. In a high trust society, people get angry when there is fraud and move to punish and ostracize the perpetrators. In a low-trust society, people expect it.

Older generations of politicians used to engage more in what George Washington “Boss” Plunkitt called “honest graft”. He defined honest graft as legally exploiting insider knowledge and opportunities from one’s position for personal financial gain, while also benefiting the public or party. A classic example he gave was learning about upcoming public projects (like a new park or bridge) and buying nearby land cheaply before the plans became public, then selling it at a profit to the city. He famously summarized it as: “I seen my opportunities and I took ’em,” comparing it to savvy stock trading on Wall Street. In contrast, dishonest graft involved outright illegal acts, such as blackmail, embezzlement, or extortion (e.g., shaking down gamblers or saloon keepers).

God knows what he would have said about simply taking money for nothing. Would his reaction have been horror? Or admiration?