Brendan O’Neill refutes some of the theories on what underlying causes are motivating the London riots:

Many commentators are on a mission to contextualise the riots that have swept parts of urban London and other British cities. ‘It’s very naive to look at these riots without the context’, says one journalist, who says the reason the violence kicked off in the London suburb of Tottenham is because ‘that area is getting 75% cuts [in public services]’. Others have said that the political context for the rioting is youth unemployment or working-class anger at David Cameron’s cuts agenda. ‘There is a context to London’s riots that can’t be ignored’, said a writer for the Guardian, and it is the ‘backdrop of brutal cuts and enforced austerity measures’. The ‘mass unrest’ is a protest against unhinged capitalism, apparently.

These observers are right that there is a political context to the riots. They are right to argue that while the police shooting of young black man Mark Duggan may ostensibly have been the trigger for the street violence, there is a broader context to the disturbances. But they are wrong about what the political context is. Painting these riots as some kind of action replay of historic political streetfights against capitalist bosses or racist cops might allow armchair radicals to get their intellectual rocks off, as they lift their noses from dusty tomes about the Levellers or the Suffragettes and fantasise that a political upheaval of equal worth is now occurring outside their windows. But such shameless projection misses what is new and peculiar and deeply worrying about these riots. The political context is not the cuts agenda or racist policing — it is the welfare state, which, it is now clear, has nurtured a new generation that has absolutely no sense of community spirit or social solidarity.

What we have on the streets of London and elsewhere are welfare-state mobs. The youth who are ‘rising up’ — actually they are simply shattering their own communities — represent a generation that has been more suckled by the state than any generation before it. They live in those urban territories where the sharp-elbowed intrusion of the welfare state over the past 30 years has pushed aside older ideals of self-reliance and community spirit. The march of the welfare state into every aspect of less well-off urban people’s existences, from their financial wellbeing to their childrearing habits and even into their emotional lives, with the rise of therapeutic welfarism designed to ensure that the poor remain ‘mentally fit’, has helped to undermine such things as individual resourcefulness and social bonding. The anti-social youthful rioters look to me like the end product of such an anti-social system of state intervention.

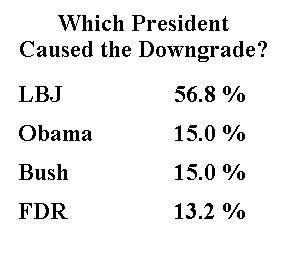

Well, it turns out that Social Security is a relatively minor part of the problem, so even though President Roosevelt’s policies exacerbated and extended the Great Depression, the program he created is only responsible for a small share of the fiscal crisis. To give the illusion of scientific exactitude, let’s assign FDR 13.2 percent of the blame.

Well, it turns out that Social Security is a relatively minor part of the problem, so even though President Roosevelt’s policies exacerbated and extended the Great Depression, the program he created is only responsible for a small share of the fiscal crisis. To give the illusion of scientific exactitude, let’s assign FDR 13.2 percent of the blame.